Difference between revisions of "SPIS Toolbox - Finance - Annex"

***** (***** | *****) m |

***** (***** | *****) |

||

| (26 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| − | {{SPIS | + | {{SPIS Finance}}{{Back to SPIS Toolbox}} |

| + | == '''<span style="color:#879637">Annex - Collection of Formulae (Finances)</span>''' == | ||

| − | + | '''<span style="color:#879637">AVERAGE CASH FLOW*</span>''' | |

| − | |||

| − | |||

| − | |||

| − | '''<span style="color:#879637"> | ||

{| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | {| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | ||

|- | |- | ||

| − | | style="background-color: rgb( | + | | style="background-color: rgb(225, 229, 205)" | |

''*Definition: The “cash flow” is the incoming and outgoing cash of a business. Expenses (costs) are considered as negative cash flows and revenues as positive ones.'' | ''*Definition: The “cash flow” is the incoming and outgoing cash of a business. Expenses (costs) are considered as negative cash flows and revenues as positive ones.'' | ||

| + | |||

|} | |} | ||

| − | '''''Formula:'''''<i>(Revenue-R –Operating Expenses-C) = Cf. = Cash flow</i> | + | '''''Formula: '''''<i>(Revenue-R –Operating Expenses-C) = Cf. = Cash flow</i> |

| − | + | <br/> | |

| + | '''<span style="color:#879637">PAYBACK PERIOD* (PP)</span>''' | ||

{| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | {| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | ||

|- | |- | ||

| − | | style="background-color: rgb( | + | | style="background-color: rgb(225, 229, 205)" | |

''*Definition: The payback period is the length of time required to recover the cost of an investment.'' | ''*Definition: The payback period is the length of time required to recover the cost of an investment.'' | ||

| + | |||

|} | |} | ||

| − | |||

| − | |||

'''Formula''': I/(R-C) = PP = Payback Period | '''Formula''': I/(R-C) = PP = Payback Period | ||

| Line 37: | Line 35: | ||

(R-C) = Cf. = Cash flow | (R-C) = Cf. = Cash flow | ||

| − | '''<span style="color:#879637"> | + | <br/>'''<span style="color:#879637">NET PRESENT VALUE* (NPV)</span>''' |

| − | |||

{| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | {| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | ||

|- | |- | ||

| − | | style="background-color: rgb( | + | | style="background-color: rgb(225, 229, 205)" | |

''*Definition: The “Net Present Value” or NPV determines the present worth of an investment by discounting the cash inflows and cash outflows generated by this investment over its life span. For the determination of the NPV you need to define the expected life span of the investment as well as a discount factor, which might be near to the interest rate on deposits. You could also use the NPV for comparison of alternative investment options.'' | ''*Definition: The “Net Present Value” or NPV determines the present worth of an investment by discounting the cash inflows and cash outflows generated by this investment over its life span. For the determination of the NPV you need to define the expected life span of the investment as well as a discount factor, which might be near to the interest rate on deposits. You could also use the NPV for comparison of alternative investment options.'' | ||

| + | |||

|} | |} | ||

| + | '''Formula'''<br/>[[File:Formul1.jpg|border|left|200px|Formula|alt=Formula]] | ||

| − | + | {| style="width:100%;" cellspacing="5" cellpadding="1" border="0" | |

| + | |- | ||

| + | | r= Discount factor <br/>S= Salvage Value<br/>I= Initial investment cost<br/>t= years counting from base year<br/>n= lifetime of project (panels)<br/><br/> | ||

| + | |} | ||

| + | {| style="width: 100%" cellspacing="1" cellpadding="1" border="0" | ||

| + | |- | ||

| + | | '''<span style="color:#879637">INTERNAL RATE OF RETURN* (IRR)</span>''' | ||

| + | |} | ||

| − | + | {| style="width: 800px" cellspacing="1" cellpadding="1" border="0" | |

| + | |- | ||

| + | | style="background-color: rgb(225, 229, 205)" | | ||

| + | ''*Definition: The “Internal Rate of Return” or IRR gives the discount rate over the lifespan of a capital investment; i.e. the profit rate generated by a certain investment (amount) over its lifespan. By calculating IRR of a project you can answer the question whether the money is well spent or if less risky investment alternatives might be more profitable in the long run, e.g. putting the money on a bank account to get interest on it.'' | ||

| + | |} | ||

| + | '''Formula''' | ||

| + | [[File:Formul22.jpg|border|left|200px|Formula|alt=Formula]] | ||

| + | <div style="clear: both"></div> | ||

| − | + | {{SPIS Reference}} | |

| − | |||

| − | |||

| − | |||

| − | { | ||

| − | |||

| − | |||

| − | |||

| − | |||

Latest revision as of 15:29, 12 July 2018

Annex - Collection of Formulae (Finances)

AVERAGE CASH FLOW*

|

*Definition: The “cash flow” is the incoming and outgoing cash of a business. Expenses (costs) are considered as negative cash flows and revenues as positive ones. |

Formula: (Revenue-R –Operating Expenses-C) = Cf. = Cash flow

PAYBACK PERIOD* (PP)

|

*Definition: The payback period is the length of time required to recover the cost of an investment. |

Formula: I/(R-C) = PP = Payback Period

I=Initial investment (CAPEX)

C=Average annual operating expenses (OPEX), excluding depreciation

R=Average annual revenue

(R-C) = Cf. = Cash flow

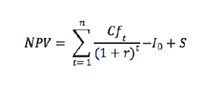

NET PRESENT VALUE* (NPV)

|

*Definition: The “Net Present Value” or NPV determines the present worth of an investment by discounting the cash inflows and cash outflows generated by this investment over its life span. For the determination of the NPV you need to define the expected life span of the investment as well as a discount factor, which might be near to the interest rate on deposits. You could also use the NPV for comparison of alternative investment options. |

Formula

| r= Discount factor S= Salvage Value I= Initial investment cost t= years counting from base year n= lifetime of project (panels) |

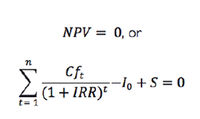

| INTERNAL RATE OF RETURN* (IRR) |

|

*Definition: The “Internal Rate of Return” or IRR gives the discount rate over the lifespan of a capital investment; i.e. the profit rate generated by a certain investment (amount) over its lifespan. By calculating IRR of a project you can answer the question whether the money is well spent or if less risky investment alternatives might be more profitable in the long run, e.g. putting the money on a bank account to get interest on it. |

Formula