Difference between revisions of "Microfinance Institutions - Financing Renewable Energy"

***** (***** | *****) m (Fungai Cecilia Sandamu moved page Involvement of Microfinance Institutions (MFIs) to Microfinance Institutions - Financing Renewable Energy without leaving a redirect) |

***** (***** | *****) m |

||

| Line 1: | Line 1: | ||

| + | |||

| + | = <span class="mw-headline" id="Overview">Overview<br/></span> = | ||

| + | |||

| + | Acces to energy for poor housholds, especially in Africa and Asia, is one of challenges in the 21st century. The question is which role can play Green '''Microfinance (MFI)''' in this process? Many MFIs aren´t aware about the importance of financing'''renewable energy (RE)''' / '''energy efficient (EE)''' products. A reason might be the lack of knowledge about best practices and success stories.<br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

= World Bank Group = | = World Bank Group = | ||

| Line 7: | Line 14: | ||

1. Construction of new hydropower projects<br/>2. Rehabilitation of existing hydropower projects<br/>3. Other lending, capacity building, DPL<br/>4. Analytical work | 1. Construction of new hydropower projects<br/>2. Rehabilitation of existing hydropower projects<br/>3. Other lending, capacity building, DPL<br/>4. Analytical work | ||

| − | The World Banks investments in hydropower projects reflects international trends and demands. In the 1990 hydropower projects were strongly criticised throughout the world since social domains and investments in | + | The World Banks investments in hydropower projects reflects international trends and demands. In the 1990 hydropower projects were strongly criticised throughout the world since social domains and investments in environmental protection were neglected and human rights have been infringed. Therefore lendings in hydropower during the 1990s significantly decreased accompanied by a shift to projects with fewer environmental and social impacts.By the early 2000s, however, several policies repositioned the World<br/>Bank Group in terms of infrastructure and risk, and established a renewed framework for hydropower. |

Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded<br/>$1 billion, with an increase in larger, standalone projects (see Figure) | Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded<br/>$1 billion, with an increase in larger, standalone projects (see Figure) | ||

| − | [[File:WBG hydropower investment.JPG|center| | + | [[File:WBG hydropower investment.JPG|center|Value of WBG Contribution to Multipurpose Hydropower Components|alt=Value of WBG Contribution to Multipurpose Hydropower Components]] |

Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments. | Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments. | ||

| Line 17: | Line 24: | ||

The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia). | The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia). | ||

| − | [[File:WBG major hpp investments2003-08.JPG|center| | + | [[File:WBG major hpp investments2003-08.JPG|center|WBG major hpp investments2003-08.JPG|alt=WBG major hpp investments2003-08.JPG]] |

Over the time the WBG has adapted product lines and financial instruments. Over the period 1992–2002, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) accounted for 99% of the lending portfolio, and International Financial Corporation (IFC) the remaining 1%. During 2003–08, IBRD/IDA’s lending decreased significantly,to 58%—mainly because of an absolute decrease in IBRD lending. At the same time, IFC increased support (to 20%), as did carbon finance (to 5%), and guarantees (to 17%), reflecting increased private sector involvement. | Over the time the WBG has adapted product lines and financial instruments. Over the period 1992–2002, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) accounted for 99% of the lending portfolio, and International Financial Corporation (IFC) the remaining 1%. During 2003–08, IBRD/IDA’s lending decreased significantly,to 58%—mainly because of an absolute decrease in IBRD lending. At the same time, IFC increased support (to 20%), as did carbon finance (to 5%), and guarantees (to 17%), reflecting increased private sector involvement. | ||

| Line 23: | Line 30: | ||

The WBG’s assistance extends beyond lending—to technical support, knowledge sharing, policy dialogue, economic and sector<br/>work, and support during project preparation and implementation. In these roles, the WBG draws on a range of products and services which were developed after the fall of lending in the 1990s. These products in form of operational directives and safeguards, coupled with the ongoing development of tools such as Strategic Environmental Assessment and payments for environmental services offer the Bank opportunities to add imputs to hydropower efforts. | The WBG’s assistance extends beyond lending—to technical support, knowledge sharing, policy dialogue, economic and sector<br/>work, and support during project preparation and implementation. In these roles, the WBG draws on a range of products and services which were developed after the fall of lending in the 1990s. These products in form of operational directives and safeguards, coupled with the ongoing development of tools such as Strategic Environmental Assessment and payments for environmental services offer the Bank opportunities to add imputs to hydropower efforts. | ||

| − | + | ||

Source: Water Working Notes No 21, June 2009. Direction in Hydropower: Scaling Up for Development. Water Sector Board of the Sustainable Development Network of the World Bank Group | Source: Water Working Notes No 21, June 2009. Direction in Hydropower: Scaling Up for Development. Water Sector Board of the Sustainable Development Network of the World Bank Group | ||

| − | + | <br/> | |

= Reconstruction Loan Corporation (German Kreditanstalt für Wiederaufbau KfW) = | = Reconstruction Loan Corporation (German Kreditanstalt für Wiederaufbau KfW) = | ||

| Line 33: | Line 40: | ||

website: [http://www.kfw.de/kfw/en/Development_Finance/index.jsp http://www.kfw.de/kfw/en/Development_Finance/index.jsp] | website: [http://www.kfw.de/kfw/en/Development_Finance/index.jsp http://www.kfw.de/kfw/en/Development_Finance/index.jsp] | ||

| − | Detailed infomation about the total amount of | + | Detailed infomation about the total amount of KfW lendings in hydropower projects in the last years could not be found in the literature. However, the Gloabal Status Report of Renewables 2011 (REN21) stated that the KfW is one of the three leading development banks, in terms of financing of renewables projects in 2010 (with 1.5 billion USD). |

Infomation about small and large hydropower projects which are financed by the KfW can be found at the country portal at the KfW website: [http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp] | Infomation about small and large hydropower projects which are financed by the KfW can be found at the country portal at the KfW website: [http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp] | ||

Countries where small and large hydropower projects have been / are supported are e.g.: | Countries where small and large hydropower projects have been / are supported are e.g.: | ||

| − | |||

*Albania (small hydropower plants) | *Albania (small hydropower plants) | ||

*Agypt (rehabilitation of the generators of the Assuan High Dam) | *Agypt (rehabilitation of the generators of the Assuan High Dam) | ||

| Line 45: | Line 51: | ||

*Mongolia (rehabilitation of Bogdyn HPP in 2007) | *Mongolia (rehabilitation of Bogdyn HPP in 2007) | ||

*Montenegro with 16 million € (rehabilitation of existing hydropower plants) | *Montenegro with 16 million € (rehabilitation of existing hydropower plants) | ||

| − | *Morocco with 87 million € (Tanafnit and El Borj Run of River HPP and modernisation of | + | *Morocco with 87 million € (Tanafnit and El Borj Run of River HPP and modernisation of 20 old HPP) |

| − | *Pakistan with 97 million € | + | *Pakistan with 97 million € over 6 years (construction of the HPP Keyal Khwar 122 MW) |

*Serbia with 30 million € (rehabilitation of Bajina Basta HPP) | *Serbia with 30 million € (rehabilitation of Bajina Basta HPP) | ||

*Turkey (support of the construction of five hydropower plants) | *Turkey (support of the construction of five hydropower plants) | ||

*Uganda with 15 million USD for Bujagali HPP 250 MW (after support of small hydropower plants) | *Uganda with 15 million USD for Bujagali HPP 250 MW (after support of small hydropower plants) | ||

| + | <br/> | ||

| + | Source: Renewables 2011 Global Status Report, REN21 (Paris), 115 pp. (Lead author Janet Sawin) | ||

| − | |||

| − | |||

= Regional Development Banks = | = Regional Development Banks = | ||

| Line 63: | Line 69: | ||

website: [http://www.eib.org/projects/ http://www.eib.org/projects/] | website: [http://www.eib.org/projects/ http://www.eib.org/projects/] | ||

| − | The European Investment Bank is the EU's financing institution. Its shareholders are the 27 member states of the EU. In 2010, about 88% of total EIB financing of €72 billion ($99.5 billion) went to projects in the EU. Outside the EU, EIB is active in more than 150 countries.<br/>EIBs lending for renewable energies grew almost fivefold between 2007 and 2010. In | + | The European Investment Bank is the EU's financing institution. Its shareholders are the 27 member states of the EU. In 2010, about 88% of total EIB financing of €72 billion ($99.5 billion) went to projects in the EU. Outside the EU, EIB is active in more than 150 countries.<br/>EIBs lending for renewable energies grew almost fivefold between 2007 and 2010. In 2008 lendings account for 2.2 billion €, in 2009 lendings were 4.2 billion € and in 2010 lending reached 6.2 billion €. However, the proportion of lendings for small and large hydropower projects is unclear. |

Some hydropower projects which are/have been financed are listed below: | Some hydropower projects which are/have been financed are listed below: | ||

| − | + | *Gilgel Gibe II HPP with a capacity of 428 MW and 385 km of overhead transmission lines and substations was financed with 50 million €. The project is cascaded with the Gilgel Gibe I project, commissioned and co-funded by the EIB, too. (2005) | |

| − | *Gilgel Gibe II HPP with a capacity of 428 MW and 385 km of overhead transmission lines and substations was financed with 50 million €. The project is cascaded with the Gilgel Gibe I project, commissioned and co-funded by the EIB, too. (2005) | + | *EIB has signed a loan agreement of 45 million € with the Laos Government to help finance the "Nam Theun 2" (NT2) hydroelectric power project in Laos (Nov 2005) |

| − | *EIB has signed a loan agreement of | + | *EIB financed the construction of the Felou HPP a 60MW Run of River project in Mali which forms part of the Organisation de Mise en valeur du Fleuve Sénégal (OMVS’s) power supply strategy for Mali, Mauritania and Senegal with 33 million € (2006) |

| − | *EIB financed the construction of | ||

*Bujagali 250MW HPP Uganda was funded with 92 million € (2007) | *Bujagali 250MW HPP Uganda was funded with 92 million € (2007) | ||

| − | *funding of the rahabilitation project of the Inga HPP | + | *funding of the rahabilitation project of the Inga HPP in the DRC with 110 million € (2008) |

| − | *EIB provided a loan up to 44 million € for the design, construction and operation of 10 small scale hydropowr plants with a total capacity of 62MW, | + | *EIB provided a loan up to 44 million € for the design, construction and operation of 10 small scale hydropowr plants with a total capacity of 62MW, located in the Yichang prefecture (Hubei province), China (2009) |

*EIB has granted Iberdrola SA a 300 million € loan to finance the expansion of three of the company’s hydropower plants in Galicia and Valencia (2009) | *EIB has granted Iberdrola SA a 300 million € loan to finance the expansion of three of the company’s hydropower plants in Galicia and Valencia (2009) | ||

| − | *EIB provided a loan of 70 million € | + | *EIB provided a loan of 70 million € for the construction of the 80MW Budharhals hydroplant on the Kaldakvisl River in southern Iceland (2011) |

*a 300 million € loan for the upgrade of the Alqueva and Venda Nova pump storage projects in Portugal (2011) | *a 300 million € loan for the upgrade of the Alqueva and Venda Nova pump storage projects in Portugal (2011) | ||

*EIB is lending €20 million to the Republic of Georgia to finance the completion of rehabilitation of the 1,250 MW Enguri plant and Vardnili hydro cascade (2011) | *EIB is lending €20 million to the Republic of Georgia to finance the completion of rehabilitation of the 1,250 MW Enguri plant and Vardnili hydro cascade (2011) | ||

| − | *Itezhi - Tezhi 120MW Hydro Project in Zambia is approved and financed | + | *Itezhi - Tezhi 120MW Hydro Project in Zambia is approved and financed with 50 million € from the EIB<br/>the EIB confirms commitment to the 147 MW Ruzizi III HPP on the Ruzizi River, a natural border between Rwanda and the Dem. Republic of Congo |

*the EIB also confirms commitment to the construction and operation of 305 MW hydropower plant with associated dam and reservoir, located on the Reventazon river in Costa Rica. The project is funfed with up to 200 million €. | *the EIB also confirms commitment to the construction and operation of 305 MW hydropower plant with associated dam and reservoir, located on the Reventazon river in Costa Rica. The project is funfed with up to 200 million €. | ||

| − | *a project currently under appraisal and partly fianced with 30 million € by the EIB is the Lom Pangar 30MW HPP on the Sanaga river and a 110 km transmission line in Cameroon | + | *a project currently under appraisal and partly fianced with 30 million € by the EIB is the Lom Pangar 30MW HPP on the Sanaga river and a 110 km transmission line in Cameroon |

| + | |||

| − | |||

Source: | Source: | ||

| Line 89: | Line 94: | ||

REN 21 Global Status Report 2009 and 2010 | REN 21 Global Status Report 2009 and 2010 | ||

| − | + | <br/> | |

== Inter-American Development Bank (IDB) == | == Inter-American Development Bank (IDB) == | ||

| Line 95: | Line 100: | ||

Website: [http://www.iadb.org/en/about-us/about-the-inter-american-development-bank,5995.html http://www.iadb.org/en/about-us/about-the-inter-american-development-bank,5995.html] | Website: [http://www.iadb.org/en/about-us/about-the-inter-american-development-bank,5995.html http://www.iadb.org/en/about-us/about-the-inter-american-development-bank,5995.html] | ||

| − | The IDB supports efforts by Latin America and the Caribbean countries to reduce poverty and inequality.In the hydroelectric sector, IDB | + | The IDB supports efforts by Latin America and the Caribbean countries to reduce poverty and inequality.In the hydroelectric sector, IDB supports the rehabilitation of facilities and helps to examine the social, financial and environmental sustainability of new dam projects. In 2009 the IDB committed more than $1 billion in loans for renewable energy, including $941 million for hydropower. |

| − | + | *IDB's hydro-related investments in 2011: | |

| − | *IDB's | + | *20 million USD for the restoration of the 54-MW Peligre HPP (Haiti) |

| − | *20 million USD for the restoration of the 54-MW Peligre HPP | + | *426,830 USD for the construction of a bypass of the 50-MW Centroamerica HPP (Nicaragua) |

| − | *426,830 USD for the | ||

*IDB will provide a loan of 128 million USD to Brazilian energy utility Furnas Centrais Eletricas S.A. to partly finance the rehabilitation and modernization of the Furnas and Luiz Carlos Barreto de Carvalho hydro plants (Brazil) | *IDB will provide a loan of 128 million USD to Brazilian energy utility Furnas Centrais Eletricas S.A. to partly finance the rehabilitation and modernization of the Furnas and Luiz Carlos Barreto de Carvalho hydro plants (Brazil) | ||

*150 million USD for the 306-MW Reventazon (Costa Rica)- Status: in preparation | *150 million USD for the 306-MW Reventazon (Costa Rica)- Status: in preparation | ||

| − | + | <br/> | |

== Asian Development Bank (ADB) == | == Asian Development Bank (ADB) == | ||

| Line 109: | Line 113: | ||

website: [http://www2.adb.org/Projects/ http://www2.adb.org/Projects/] | website: [http://www2.adb.org/Projects/ http://www2.adb.org/Projects/] | ||

| − | In 2009 the Asian Development Bank invested approximately | + | In 2009 the Asian Development Bank invested approximately 933 million USD in renewables, including 238 million USD in large hydropower. |

Approved hydropower related projects funded by the ADB are e.g.: | Approved hydropower related projects funded by the ADB are e.g.: | ||

| − | + | *the detailed Engineering Study for the Upper Seti Hydropower Project in Nepal with 2,8 million USD (2010) | |

| − | *the detailed Engineering Study for the Upper Seti Hydropower Project in Nepal | ||

*the Greater Mekong Subregion Nam Ngum 3 Hydropower Project, Laos with 115,5 million USD (2011) | *the Greater Mekong Subregion Nam Ngum 3 Hydropower Project, Laos with 115,5 million USD (2011) | ||

*GMS Nam Theun 2 Hydropower Development Project + Social Safeguards Monitoring, Laos with total 22,3 million USD (2003-2010) | *GMS Nam Theun 2 Hydropower Development Project + Social Safeguards Monitoring, Laos with total 22,3 million USD (2003-2010) | ||

| Line 123: | Line 126: | ||

*PATRIND Hydropower Project in Pakistan with 97 million USD (2011) | *PATRIND Hydropower Project in Pakistan with 97 million USD (2011) | ||

| + | <br/> | ||

| − | + | == African Development Bank (AfDB) == | |

| − | == African | ||

website: [http://www.afdb.org/en/projects-and-operations/ http://www.afdb.org/en/projects-and-operations/] | website: [http://www.afdb.org/en/projects-and-operations/ http://www.afdb.org/en/projects-and-operations/] | ||

[[Category:Hydro]] | [[Category:Hydro]] | ||

| + | [[Category:Financing_and_Funding]] | ||

| + | [[Category:Financing_Hydropower]] | ||

Revision as of 11:18, 12 July 2013

Overview

Acces to energy for poor housholds, especially in Africa and Asia, is one of challenges in the 21st century. The question is which role can play Green Microfinance (MFI) in this process? Many MFIs aren´t aware about the importance of financingrenewable energy (RE) / energy efficient (EE) products. A reason might be the lack of knowledge about best practices and success stories.

World Bank Group

website: http://www.worldbank.org/projects

Currently, the World Bank Group is engaged in hydropower projects in all its regions. These efforts can be divided into four main points:

1. Construction of new hydropower projects

2. Rehabilitation of existing hydropower projects

3. Other lending, capacity building, DPL

4. Analytical work

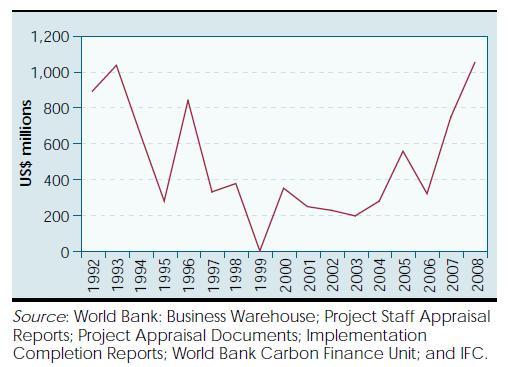

The World Banks investments in hydropower projects reflects international trends and demands. In the 1990 hydropower projects were strongly criticised throughout the world since social domains and investments in environmental protection were neglected and human rights have been infringed. Therefore lendings in hydropower during the 1990s significantly decreased accompanied by a shift to projects with fewer environmental and social impacts.By the early 2000s, however, several policies repositioned the World

Bank Group in terms of infrastructure and risk, and established a renewed framework for hydropower.

Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded

$1 billion, with an increase in larger, standalone projects (see Figure)

Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments.

The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia).

Over the time the WBG has adapted product lines and financial instruments. Over the period 1992–2002, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) accounted for 99% of the lending portfolio, and International Financial Corporation (IFC) the remaining 1%. During 2003–08, IBRD/IDA’s lending decreased significantly,to 58%—mainly because of an absolute decrease in IBRD lending. At the same time, IFC increased support (to 20%), as did carbon finance (to 5%), and guarantees (to 17%), reflecting increased private sector involvement.

The WBG’s assistance extends beyond lending—to technical support, knowledge sharing, policy dialogue, economic and sector

work, and support during project preparation and implementation. In these roles, the WBG draws on a range of products and services which were developed after the fall of lending in the 1990s. These products in form of operational directives and safeguards, coupled with the ongoing development of tools such as Strategic Environmental Assessment and payments for environmental services offer the Bank opportunities to add imputs to hydropower efforts.

Source: Water Working Notes No 21, June 2009. Direction in Hydropower: Scaling Up for Development. Water Sector Board of the Sustainable Development Network of the World Bank Group

Reconstruction Loan Corporation (German Kreditanstalt für Wiederaufbau KfW)

website: http://www.kfw.de/kfw/en/Development_Finance/index.jsp

Detailed infomation about the total amount of KfW lendings in hydropower projects in the last years could not be found in the literature. However, the Gloabal Status Report of Renewables 2011 (REN21) stated that the KfW is one of the three leading development banks, in terms of financing of renewables projects in 2010 (with 1.5 billion USD).

Infomation about small and large hydropower projects which are financed by the KfW can be found at the country portal at the KfW website: http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp

Countries where small and large hydropower projects have been / are supported are e.g.:

- Albania (small hydropower plants)

- Agypt (rehabilitation of the generators of the Assuan High Dam)

- India (small hydropower plants)

- Macedonia (rehabilitation and modernisation of six hydropower plants)

- Mongolia (rehabilitation of Bogdyn HPP in 2007)

- Montenegro with 16 million € (rehabilitation of existing hydropower plants)

- Morocco with 87 million € (Tanafnit and El Borj Run of River HPP and modernisation of 20 old HPP)

- Pakistan with 97 million € over 6 years (construction of the HPP Keyal Khwar 122 MW)

- Serbia with 30 million € (rehabilitation of Bajina Basta HPP)

- Turkey (support of the construction of five hydropower plants)

- Uganda with 15 million USD for Bujagali HPP 250 MW (after support of small hydropower plants)

Source: Renewables 2011 Global Status Report, REN21 (Paris), 115 pp. (Lead author Janet Sawin)

Regional Development Banks

European Investment Bank (EIB)

website: http://www.eib.org/projects/

The European Investment Bank is the EU's financing institution. Its shareholders are the 27 member states of the EU. In 2010, about 88% of total EIB financing of €72 billion ($99.5 billion) went to projects in the EU. Outside the EU, EIB is active in more than 150 countries.

EIBs lending for renewable energies grew almost fivefold between 2007 and 2010. In 2008 lendings account for 2.2 billion €, in 2009 lendings were 4.2 billion € and in 2010 lending reached 6.2 billion €. However, the proportion of lendings for small and large hydropower projects is unclear.

Some hydropower projects which are/have been financed are listed below:

- Gilgel Gibe II HPP with a capacity of 428 MW and 385 km of overhead transmission lines and substations was financed with 50 million €. The project is cascaded with the Gilgel Gibe I project, commissioned and co-funded by the EIB, too. (2005)

- EIB has signed a loan agreement of 45 million € with the Laos Government to help finance the "Nam Theun 2" (NT2) hydroelectric power project in Laos (Nov 2005)

- EIB financed the construction of the Felou HPP a 60MW Run of River project in Mali which forms part of the Organisation de Mise en valeur du Fleuve Sénégal (OMVS’s) power supply strategy for Mali, Mauritania and Senegal with 33 million € (2006)

- Bujagali 250MW HPP Uganda was funded with 92 million € (2007)

- funding of the rahabilitation project of the Inga HPP in the DRC with 110 million € (2008)

- EIB provided a loan up to 44 million € for the design, construction and operation of 10 small scale hydropowr plants with a total capacity of 62MW, located in the Yichang prefecture (Hubei province), China (2009)

- EIB has granted Iberdrola SA a 300 million € loan to finance the expansion of three of the company’s hydropower plants in Galicia and Valencia (2009)

- EIB provided a loan of 70 million € for the construction of the 80MW Budharhals hydroplant on the Kaldakvisl River in southern Iceland (2011)

- a 300 million € loan for the upgrade of the Alqueva and Venda Nova pump storage projects in Portugal (2011)

- EIB is lending €20 million to the Republic of Georgia to finance the completion of rehabilitation of the 1,250 MW Enguri plant and Vardnili hydro cascade (2011)

- Itezhi - Tezhi 120MW Hydro Project in Zambia is approved and financed with 50 million € from the EIB

the EIB confirms commitment to the 147 MW Ruzizi III HPP on the Ruzizi River, a natural border between Rwanda and the Dem. Republic of Congo - the EIB also confirms commitment to the construction and operation of 305 MW hydropower plant with associated dam and reservoir, located on the Reventazon river in Costa Rica. The project is funfed with up to 200 million €.

- a project currently under appraisal and partly fianced with 30 million € by the EIB is the Lom Pangar 30MW HPP on the Sanaga river and a 110 km transmission line in Cameroon

Source:

REN 21 Global Status Report 2009 and 2010

Inter-American Development Bank (IDB)

Website: http://www.iadb.org/en/about-us/about-the-inter-american-development-bank,5995.html

The IDB supports efforts by Latin America and the Caribbean countries to reduce poverty and inequality.In the hydroelectric sector, IDB supports the rehabilitation of facilities and helps to examine the social, financial and environmental sustainability of new dam projects. In 2009 the IDB committed more than $1 billion in loans for renewable energy, including $941 million for hydropower.

- IDB's hydro-related investments in 2011:

- 20 million USD for the restoration of the 54-MW Peligre HPP (Haiti)

- 426,830 USD for the construction of a bypass of the 50-MW Centroamerica HPP (Nicaragua)

- IDB will provide a loan of 128 million USD to Brazilian energy utility Furnas Centrais Eletricas S.A. to partly finance the rehabilitation and modernization of the Furnas and Luiz Carlos Barreto de Carvalho hydro plants (Brazil)

- 150 million USD for the 306-MW Reventazon (Costa Rica)- Status: in preparation

Asian Development Bank (ADB)

website: http://www2.adb.org/Projects/

In 2009 the Asian Development Bank invested approximately 933 million USD in renewables, including 238 million USD in large hydropower.

Approved hydropower related projects funded by the ADB are e.g.:

- the detailed Engineering Study for the Upper Seti Hydropower Project in Nepal with 2,8 million USD (2010)

- the Greater Mekong Subregion Nam Ngum 3 Hydropower Project, Laos with 115,5 million USD (2011)

- GMS Nam Theun 2 Hydropower Development Project + Social Safeguards Monitoring, Laos with total 22,3 million USD (2003-2010)

- Song Bung 4 Hydropower Project Vietnam with 950,000 USD (2004-2008)

- Implementation and Monitoring of Song Bung 4 Hydropower Project Resettlement and Ethnic Minority Development Plan with 225,000 USD (2011)

- Gansu Heihe Hydropower Development China with 78,5 million USD (2006)

- Dagushan Hydropower Project, China 22 million USD (2008)

- Development of Mini Hydropower Plants in Badakhshan and Bamyan Provinces in Afghanistan with 12 million USD (2008)

- PATRIND Hydropower Project in Pakistan with 97 million USD (2011)