Albania Energy Situation

Capital:

Tirana

Region:

Coordinates:

41.0000° N, 20.0000° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Albania is a country in Southeastern Europe, bordered by Montenegro to the northwest, Kosovo to the northeast, North Macedonia to the east, and Greece to the south and southeast.[1]

Albania is classified as a middle-income country and became an official candidate for accession to the European Union in 2014.[2]

About 60% of Albanian energy demand is met through the fossil fuels. In terms of electricity generation, about 90% of the electricity is generated from hydropower. With the ongoing climate change, energy security could become a critical concern in Albania.[3]

Country Overview

Albania like the rest of the Western Balkan has continued encourage foreign capital to enter the energy sector. In 2018, the net inflows of foreign direct investment amounted to 8% of the national GDP (IMF, 2018).[4] Investments that have already reached above $ 1 billion in 2019.[4]

A considerable interest that has made that electricity produced by private sector reached 43% of net domestic production in 2019. Notwithstanding which the country remains a net importer on average for around one-third of its needs. Notably, in 2019, drought-triggered electricity imports cost by € 209 million and put the power utility KESH and distribution operator into severe financial difficulty.

The development the energy sector has been a vital priority of any government, and a fundamental part of the economic development plans from the decades, which has been materialized, in government facilities and subsidies to support investments, accompanied with the creation of high quality technical and experienced workforce. The all have been materialised, in one of the long proven track records of successful foreign investment from countries in Europe's with the oldest tradition in the energy industry.[5]

Energy Situation

Albania has been working to diversify its energy sources and increase the share of renewable energy in its overall energy mix. Key renewable energy sources in Albania include hydropower, wind, and solar energy. Here are some key points regarding Albania's renewable energy situation:

Albania has set renewable energy targets as part of its commitment to the European Union and its efforts to enhance sustainability. These targets aim to increase the share of renewable energy in the overall energy mix.

Like many countries, Albania faces challenges in terms of regulatory frameworks, financing, and infrastructure development. Overcoming these challenges is crucial for the successful deployment of renewable energy projects.

Installed electricity capacity (MW) by Technology, Grid connection and Year

| Technology | Grid Connection | Year | Capacity (MW) |

|---|---|---|---|

| Solar photovoltaic | On-grid | 2022 | 28.6 |

| Renewable hydropower | On-grid | 2022 | 2507 |

| Renewable municipal waste | On-grid | 2022 | 1.43 |

| Oil | On-grid | 2022 | 97* |

Energy Generation and Consumption

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity production [GWh] | 5.313 | 8.962 |

| Gross electricity consumption [GWh] | 7.589 | 8.484 |

| Consumption structure [GWh] / industrial, transport, services and other | 3.002 | 3.02 |

| Consumption structure [GWh] / households (residential customers) | 2.957 | 3.68 |

Net Import & Net Export

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Net imports [GWh] | 3.239 | 2.252 |

| Net exports [GWh] | 963 | 2.8 |

Energy Loses

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Losses in transmission [%] | 2.12% | 2.54% |

| Losses in distribution [%] | 21% | 17% |

Transmission network

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Horizontal transmission network [km] | 3.389 | 3.397 |

| Horizontal transmission network [km] / substation capacity [MVA] | 4.501 | 4.501 |

No of consummers

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity customers / total | 1,270,591 | 1,278,259 |

| Electricity customers / non-households | 143.017 | 176.783 |

| Eligible customers under national legislation | 81 | 83 |

Internal Market

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Internal market / electricity supplied to active eligible customers [MWh] | 877.291 | 1.049.953 |

| Internal market / share of final consumption [%] | 15% | 16% |

Technical potential and practical developments

Considering, that the point of reference for any investment decision has to do with the rate of return it directly makes fundamental the focus on the analyse of the technical potential of different resources.

The country is predominantly mountainous, with eight major rivers crossing a basin with over 57% of its current administrative extension, with an average height by 700 m above sea level and a perennial flow by 1245 m3/s, for a combined water supply by 40 billion cubic meters yearly. Then, by first, the traditional sources developed in Albanian have been based on its hydroelectric potential.<[4]

On regard, it can be said that today the total installed capacity has reached at 2400 MW. However, projects granted, but yet not developed, at 1485 MW (33%) and the hydropower potential studied still unexploited remains at around 615 MW (14%). Therefore, in a synthesis, considering the theoretical potential by 4500 MW, today, only 53% are exploited. As it is worth noting that the country can offer one of the lower cost of production (LCOE) of hydropower in the region starting from an average by 30 Euro/MWh.

Passing to alternative renewable, Albania has outstanding sun irradiation within most of its territory. The country has the highest number of sunshine hours per year in Europe. On average, there are around 286 days, with up to 2700 hours of sunshine per year. Therefore, it is an ideal place, where every hectare of land used can generate up to a quarter of a million euros yearly.

A vast possibility opens in PV considering that up to now less than 1% of total energy production came from solar generation. Until today have been installed only seven photovoltaic power plants up to 2 MW, covered by Feed-in Tariff of 100 Euro/MWh, and plenty of self-generation small installation estimated to around 45-50 MW.[4]

Besides the above, according to preliminary zoned studies, currently, there is untapped technical potential for the deployment of solar PV of up to 2378 MW available with low cost of capital.[4]

The wind potential as an energy resource is distributed throughout the territory, with an average annual wind speed among 6-8 m/s. Then, the huge amount of licenses are given calculated up to approximately 4200 MW. However, yet, no wind farm projects have been completed, but there is currently some project in the pipeline. In regard, at the begin of June, Prime minister has made public the preparation of the huge investment in a wind power plant (estimate to be among 150 MW). Even Tirana Water Supply and Sewerage (UKT) has opened a tender of wind feasibility project.

Passing to the natural gas it has some kind of historical tradition in Albania, and in last, the new development of the hydrocarbon sector has led to further associate reserves with oil. However, more important is that Albania is one of the transit countries for the Trans Adriatic Pipeline, carrying Azeri gas across Greece, to Italy and the rest of the EU. In January 2020, the Ministry of Infrastructure and Energy (MIE) has intensified the meeting with the highest represents of the sector in the US, discussing about the plans to make Albanian one of the main gates of the US LNG port projects in Europe.

In meanwhile, the country has an oil-fuelled power plant of capacity of 98 MW, representing 4% of the total installed capacity, which has not been put into use since its construction in 2011, (due to a failure in its cooling system). In January 2019, the MIE issued a tender inviting for a public-private partnership (PPP), to revive the power plant converting to a natural gas-fuelled plant. Failure of the first attempt of which will make possible in short the released of a new one. In the same time, particular interest presents the project in pipeline CCGT Korça by 480 MW proposed by Austrian company of IVICOM Holding, with feasibility financed by WB/IFC.[4]

However, the Albania Gas Master Plan (GMP) 2017 sees the rising up to 2.4 bill/m3 within 2030. The current gas pipeline network of 498 km is mostly not operational. Nevertheless, a sector will have a great chance of developing due to the first quantities of natural gas (already introduced to the commissioning test of the new TAP gas pipeline). In regard, in parallel is going ahead with the Ionian Adriatic Pipeline (IAP) interconnectors and there is a possibility of the constructing of natural gas pipeline between Albania-Kosovo (AlKoGaz).[6]

Renewable Energy Potential

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Total installed power generation capacity | MW | 2947 | 4476 |

| Renewable capacity | MW | 2397 | 3926 |

| Hydropower | MW | 2150 | 2150 |

| Wind on shoore | MW | 0 | 536 |

| Wind off fshoore | MW | 80 | 80 |

| Biofuels so( lid, iqluid, agseous) | MW | 47 | 86 |

| Solar VP | MW | 120 | 1074 |

| Non-renewable capacity | MW | 550 | 550 |

| Gas | MW | 550 | 550 |

| Technologies | Technical Potential MW |

|---|---|

| Solar PV | 2,378.2 |

| Wind | 7,483.1 |

| Hydro | 4,813.0 |

| ≤ 10 MW | 938.0 |

| > 10 MW | 3,875.0 |

| Pumping | |

| Biomass | 1,832.0 |

| Biogas | 416.6 |

| Solid Biomass | 663.0 |

| Biowaste | 755.1 |

| Geothermal el. | 1.4 |

| Total | 16,507.7 |

As we can see, if Albania would use its entire technical potential,ti would increase the generating power by 527%, and would become one of the key net exporter of the WB6 .

Key Actors Energy Sector

These key actors work together within the regulatory framework to ensure the efficient functioning, sustainability, and development of the energy market in Albania. Collaboration among these stakeholders is essential for achieving energy security, promoting renewable energy, and meeting the country's energy goals.

| 1. Ministry of Infrastructure and Energy (MIE): | The Ministry of Infrastructure and Energy is responsible for formulating and implementing energy policies in Albania. It plays a key role in shaping the regulatory framework, energy development plans, and strategies for the sector. |

| 2. Regulatory Authority for Energy (ERE): | The Regulatory Authority for Energy is an independent regulatory body overseeing the energy sector in Albania. ERE is responsible for regulating and overseeing electricity and natural gas markets, ensuring fair competition, and protecting the interests of consumers. |

| 3. Transmission System Operator (OST): | The Transmission System Operator manages the high-voltage electricity transmission system in Albania. It is responsible for the operation, maintenance, and development of the transmission infrastructure, ensuring the reliable and secure transport of electricity. |

| 4. Distribution System Operator (OSHEE): | The Distribution System Operator manages the low and medium-voltage electricity distribution network in Albania. OSHEE is responsible for distributing electricity to end-users, maintaining the distribution infrastructure, and ensuring the continuity of electricity supply. |

| 5. Albanian Power Corporation (KESH): | The Albanian Power Corporation is the state-owned company responsible for electricity generation. KESH operates hydropower plants and contributes significantly to Albania's electricity production. |

| 6. Albanian Transmission System Operator (OST SH.A.): | The Albanian Transmission System Operator is a company responsible for operating and developing the electricity transmission system. It works in coordination with the Transmission System Operator to ensure the stability and efficiency of the transmission network. |

| 7. Albanian Distribution System Operator (OSHEE Distribution): | OSHEE Distribution is a subsidiary of OSHEE responsible for managing the distribution network and delivering electricity to end-users at the local level. |

| 8. Market Operator (OPC-Albania): | The Market Operator plays a role in facilitating the electricity market by managing market transactions, ensuring fair competition, and promoting market efficiency. It operates in accordance with the regulatory framework and market rules. |

| 9. Independent Power Producers (IPPs): | Independent Power Producers are private entities involved in electricity generation. They contribute to the diversification of the generation mix and may operate renewable or conventional power plants. |

| 10. Consumers and Industrial Users: | End-users, including residential, commercial, and industrial consumers, are essential actors in the energy market. Their energy consumption patterns and demand influence market dynamics. |

| 11. Investors and Financing Institutions: | Investors, both domestic and foreign, play a crucial role in funding and developing energy projects. Financing institutions, such as banks and international financial organizations, provide funding and support for energy infrastructure projects. |

| 12. Government Agencies and Local Authorities: | Various government agencies and local authorities are involved in permitting, land-use planning, and environmental assessments for energy projects. They also play a role in setting policies that impact the energy sector. |

| 13. International Organizations and Donors: | International organizations and donor agencies may provide support, technical assistance, and funding for energy sector development projects, especially those focused on sustainability, renewable energy, and regulatory reforms. |

Valorisation of the small local particularities

In more, the energy market deep renovation on the renewable energies sees even the turning attention toward the regional peculiarities. A tendency that was finalised in the ambitious Consolidated National Action Plan on Renewable Energy Sources 2019-2020 (NREAP) 2020 that see to rise the use of biomass from 8 MW to 41 MW within 2020.[4]

As well as in energy efficiency, there is a huge potential complete untouched. Then, in last period it starts with the approve the first troupe of auditors and manager of energy that will kick-off with the audit of around 10000 public building and the audit and managing of big consumers above the 3 mil/kWh (a threshold to be decrease at the 1 mil/kWh). Then, in regard, there are a huge of investments planned to be taken and more than 7 commercial banks that have prepared packages of support, based to incentive and grant offered by developing international banks.

Last but not least important, regard the transport, there is a new law approved that establishes 10% of the amount of fuel consumed for transportation in-country should consist of biofuels by 2020. Other initiatives have to do with the smart cities, and electrical taxis or busses considers of the huge benefit that this has in Albania base to the high price of oil and low of the electricity as well as the target of 10% posted by consolidated NREAP 2019-2020.

Fossil Fuel

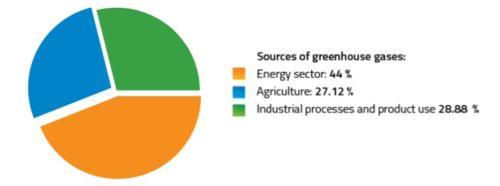

Greenhouse gas emissions

Greenhouse gas emissions in Albania are around 5.20 MtCO2e (2016). Albania has calculated a potential emission reduction of 11.5% by 2030.

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Energy related CO2 emissions | [Mt CO2 /yr] | 7 | 4.9 |

Key Problems of the Energy Sector

While Albania has significant renewable energy potential, there are challenges associated with increasing the share of renewable energy in the country's energy mix. Some of the challenges include:

| Reliance on Hydropower: | Albania has historically relied heavily on hydropower for its renewable energy generation. This dependence makes the energy sector vulnerable to variations in water availability and climate change. |

| Intermittency and Grid Integration: | Many renewable energy sources, such as solar and wind, are intermittent and can be challenging to integrate into the grid seamlessly. Grid upgrades and energy storage solutions are needed to manage fluctuations in supply and demand. |

| Regulatory and Policy Framework: | Inconsistent or unclear regulatory frameworks and policies may hinder the development of renewable energy projects. A stable and supportive regulatory environment is crucial for attracting investments. |

| Technological Readiness: | The adoption of new and innovative renewable energy technologies may face resistance due to factors such as unfamiliarity, perceived risks, and concerns about reliability. |

| Lack of Energy Storage: | The intermittent nature of some renewable sources necessitates the development of energy storage systems. The absence of efficient and cost-effective energy storage solutions can limit the ability to store excess energy for later use. |

| Political and Economic Stability: | Political and economic stability are crucial for creating an environment conducive to long-term investments in renewable energy projects. Uncertainty and instability can deter investors. |

| Energy Market Design: | The design of energy markets can impact the competitiveness of renewable energy. Ensuring fair market conditions and removing barriers to entry for renewable energy providers is essential. |

Policy Framework, Laws and Regulations

Renewable energy sources in Albania are promoted through customs and excise tax exemptions. Furthermore, a feed-in tariff for small renewable energy power plants as well as a premium tariff for larger ones are in place and have a duration of 15 years. The latter is determined in a public auction. The public energy supplier is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. Small producers are also entitled to benefit from a net-metering scheme.

The grid operator is obliged to connect to the system any renewable energy generating plant meeting the conditions for connection. Renewable energy is given priority with regard to grid connection and enjoys the priority of dispatch

Support schemes

The main supporting instrument for renewable energy sources in Albania is a feed-in tariff. Currently, the feed-in tariff has only been adopted for hydro-power plants.

| Feed-in tariff | Renewable power plants not exceeding a certain capacity are supported by a feed- in tariff. |

| Tender | A competitive bidding process sets a premium tariff, which is set between the energy supplier and the electricity producer, generating from renewable energy sources. |

| Net-metering | Private households as well as small and medium-sized companies are entitled to net-meter their production from renewable energy sources with their electricity consumption. |

| Tax exemptions | The machineries and equipment used for construction of new power plants including renewable energy are exempted from the custom duties. The fuels used by electricity producers including renewable energy sources are exempted from the excise tax. |

The following policies are listed on th IEA homepage[7]:

- Revised/Updated NDC of Albania (2021)

Legal Instruments

Now, as far as the future is concerned, new opportunities unfold from the transformations. Referring to the new strategy by 2030, it is planned to continue on the integration of two main pillars: which regard the completing the reforms of market liberalization in the context of regional integration, and the promotion of sustainable development, within five analytical scenarios, built to pave the way to the pursuit of the priorities that will be defined by concrete action plans prepared and presented by the interested private players.

On above, regarding the sustainability component, the last NREAP 2019-2020, confirm that renewable investments could continue to rely on incentives, fiscal and non-tax facilitations. In terms of target setting for renewable energy, it foresees a 38% of Albania’s gross final energy consumption by 2020. Further, according to the National Energy Strategy 2030, renewable energy share aims to raise at least 42% by 2030.[4]

Enabling Frameworks

Until recently, Albania had a limited supportive regulatory framework for the deployment of renewable energy sources, other than hydropower since 2007. A change of game came with approving of the new RES law of the second generation in 2017. A legal framework that enables the feed-in tariff available for new and existing small hydropower plants with a capacity of up to 15 MW, but also the solar PV plants up to 2 MW and wind power plants of up to 3 MW.

A new framework that was followed by first with the agreement between the MIE and the European Bank for Reconstruction and Development (Ebrd) on May 6, 2017, and then the one of the Ebrd - Energy Community Secretariat (EnC) on June 9, 2017. The agreements that see the engagement to accompany the process bringing expertise, and overseeing the approval of competitions with transparency and full integrity to attract the interest of big international actors for the developing of 700 MW capacity in the PV worth half a billion euros by 2020.

A feed-in tariff support system

The above was finalised in Albania with the approve the new NREAP 2019-2020 that rises the PV capacity planned form 120 MW to 490 MW, the wind from 70 MW to 150 MW, and the biomass from 8 MW to 41 MW. Further, on, the mentioned strategy provides a solid framework that will also serve as a basis for the development of an integrated National Energy and Climate Plan (NECP) as the other union members within the end of 2020, which will serve as the base for the NREAP 2030.

Premium tariff/Contract for Difference

The larger renewable energy power plants are eligible for a Premium Tariff by a Contract for Difference (CfD). The tariff is determined in a competitive bidding auction process. The CfD, according to the RES Law 2017, is foreseen to have a duration of 15 years.[8]

Institutional Set up in the Energy Sector

Further Information

Reference

- ↑ http://en.openei.org/wiki/Albania

- ↑ https://climateknowledgeportal.worldbank.org/country/albania?_gl=1*heudrz*_gcl_au*MTE3OTM5MjUyMC4xNzI2NDc5OTcz

- ↑ Albania Energy Sector. Retrieved from :http://bit.ly/1xE4dar

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 4.7 Reference missing

- ↑ https://adviser.albaniaenergy.org/en/2020/08/10/advlorencgordani/albania-toward-large-and-sustainable-developments-by-lorenc-gordani/

- ↑ https://adviser.albaniaenergy.org/en/2020/08/10/advlorencgordani/albania-toward-large-and-sustainable-developments-by-lorenc-gordani/

- ↑ IEA homepage https://www.iea.org/countries/albania

- ↑ https://adviser.albaniaenergy.org/en/2020/08/10/advlorencgordani/albania-toward-large-and-sustainable-developments-by-lorenc-gordani/

Further sources:

- IRENA, Renewables Readiness Assessment: Albania, 2021

- IRENA, Renewable Energy Prospects for Central and South-Eastern Europe Energy Connectivity (CESEC), 2020

- IRENA, Cost-competitive renewable power generation: Potential across South East Europe, 2017

- LEGAL SOURCES ON RENEWABLE ENERGY res-legal.eu

- Second and Third National Action Plan for Energy Efficiency for Albania, 2016-2020

- Energy Community, Albania