Albania Energy Situation

Capital:

Tirana

Region:

Coordinates:

41.0000° N, 20.0000° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Albania is a country in Southeast Europe, bordered by Montenegro to the northwest, Kosovo to the northeast, North Macedonia to the east and Greece to the south. With an area of 28,748 km2, it has a varied range of climatic, geological, hydrological and morphological conditions. Albania's landscapes range from rugged snow-capped mountains to fertile lowland plains extending from the Adriatic and Ionian seacoasts. Tirana is the capital and largest city in the country.[1]

Albania is classified as a middle-income country and became an official candidate for accession to the European Union in 2014.[1]

Energy Situation

Almost 60% of the Albanian total energy supply is met through fossil fuels, mostly by oil. The share of modern renewables in final energy consumption in Albania is 42%. In terms of electricity generation, 98% of the electricity is generated from hydropower (2022), the remaining 2% come from Solar PV.[2]

Albania has been working to diversify its energy sources and increase the share of renewable energy in its overall energy mix. Key renewable energy sources in Albania include hydropower, wind, and solar energy. Here are some key points regarding Albania's renewable energy situation:

Albania has set renewable energy targets as part of its commitment to the European Union and its efforts to enhance sustainability. These targets aim to increase the share of renewable energy in the overall energy mix.

Like many countries, Albania faces challenges in terms of regulatory frameworks, financing, and infrastructure development. Overcoming these challenges is crucial for the successful deployment of renewable energy projects.

Installed Electricity Capacity (MW) by Technology, Grid Connection and Year

| Technology | Grid Connection | Year | Capacity (MW) |

|---|---|---|---|

| Solar photovoltaic | On-grid | 2022 | 28.6 |

| Renewable hydropower | On-grid | 2022 | 2507 |

| Renewable municipal waste | On-grid | 2022 | 1.43 |

| Oil | On-grid | 2022 | 97* |

Energy Generation and Consumption

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity production [GWh] | 5.313 | 8.962 |

| Gross electricity consumption [GWh] | 7.589 | 8.484 |

| Consumption structure [GWh] / industrial, transport, services and other | 3.002 | 3.02 |

| Consumption structure [GWh] / households (residential customers) | 2.957 | 3.68 |

Net Import & Net Export

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Net imports [GWh] | 3.239 | 2.252 |

| Net exports [GWh] | 963 | 2.8 |

Energy Losses

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Losses in transmission [%] | 2.12% | 2.54% |

| Losses in distribution [%] | 21% | 17% |

Transmission Network

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Horizontal transmission network [km] | 3.389 | 3.397 |

| Horizontal transmission network [km] / substation capacity [MVA] | 4.501 | 4.501 |

No of Consumers

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity customers / total | 1,270,591 | 1,278,259 |

| Electricity customers / non-households | 143.017 | 176.783 |

| Eligible customers under national legislation | 81 | 83 |

Internal Market

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Internal market / electricity supplied to active eligible customers [MWh] | 877.291 | 1.049.953 |

| Internal market / share of final consumption [%] | 15% | 16% |

Renewable Energy Potential

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Total installed power generation capacity | MW | 2947 | 4476 |

| Renewable capacity | MW | 2397 | 3926 |

| Hydropower | MW | 2150 | 2150 |

| Wind on shoore | MW | 0 | 536 |

| Wind off fshoore | MW | 80 | 80 |

| Biofuels so( lid, iqluid, agseous) | MW | 47 | 86 |

| Solar VP | MW | 120 | 1074 |

| Non-renewable capacity | MW | 550 | 550 |

| Gas | MW | 550 | 550 |

| Technologies | Technical Potential MW |

|---|---|

| Solar PV | 2,378.2 |

| Wind | 7,483.1 |

| Hydro | 4,813.0 |

| ≤ 10 MW | 938.0 |

| > 10 MW | 3,875.0 |

| Pumping | |

| Biomass | 1,832.0 |

| Biogas | 416.6 |

| Solid Biomass | 663.0 |

| Biowaste | 755.1 |

| Geothermal el. | 1.4 |

| Total | 16,507.7 |

As we can see, if Albania would use its entire technical potential,it would increase the generating power by 527%, and would become one of the key net exporter of the WB6 .

Fossil Fuels

Almost 60% of the Albanian total energy supply is met through fossil fuels, mostly by oil.[2]

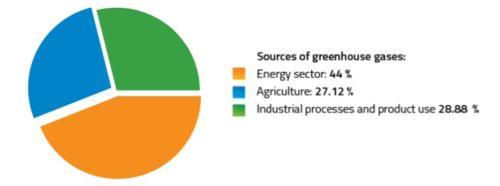

Greenhouse Gas Emissions

Greenhouse gas emissions in Albania are around 5.20 MtCO2e (2016). Albania has calculated a potential emission reduction of 11.5% by 2030.

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Energy related CO2 emissions | [Mt CO2 /yr] | 7 | 4.9 |

Key Problems of the Energy Sector

While Albania has significant renewable energy potential, there are challenges associated with increasing the share of renewable energy in the country's energy mix. Some of the challenges include:

| Reliance on Hydropower: | Albania has historically relied heavily on hydropower for its renewable energy generation. This dependence makes the energy sector vulnerable to variations in water availability and climate change. |

| Intermittency and Grid Integration: | Many renewable energy sources, such as solar and wind, are intermittent and can be challenging to integrate into the grid seamlessly. Grid upgrades and energy storage solutions are needed to manage fluctuations in supply and demand. |

| Regulatory and Policy Framework: | Inconsistent or unclear regulatory frameworks and policies may hinder the development of renewable energy projects. A stable and supportive regulatory environment is crucial for attracting investments. |

| Technological Readiness: | The adoption of new and innovative renewable energy technologies may face resistance due to factors such as unfamiliarity, perceived risks, and concerns about reliability. |

| Lack of Energy Storage: | The intermittent nature of some renewable sources necessitates the development of energy storage systems. The absence of efficient and cost-effective energy storage solutions can limit the ability to store excess energy for later use. |

| Political and Economic Stability: | Political and economic stability are crucial for creating an environment conducive to long-term investments in renewable energy projects. Uncertainty and instability can deter investors. |

| Energy Market Design: | The design of energy markets can impact the competitiveness of renewable energy. Ensuring fair market conditions and removing barriers to entry for renewable energy providers is essential. |

Policy Framework, Laws and Regulations

Renewable energy sources in Albania are promoted through customs and excise tax exemptions. Furthermore, a feed-in tariff for small renewable energy power plants as well as a premium tariff for larger ones are in place and have a duration of 15 years. The latter is determined in a public auction. The public energy supplier is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. Small producers are also entitled to benefit from a net-metering scheme.

The grid operator is obliged to connect to the system any renewable energy generating plant meeting the conditions for connection. Renewable energy is given priority with regard to grid connection and enjoys the priority of dispatch

Support Schemes

The main supporting instrument for renewable energy sources in Albania is a feed-in tariff. Currently, the feed-in tariff has only been adopted for hydro-power plants.

| Feed-in tariff | Renewable power plants not exceeding a certain capacity are supported by a feed- in tariff. |

| Tender | A competitive bidding process sets a premium tariff, which is set between the energy supplier and the electricity producer, generating from renewable energy sources. |

| Net-metering | Private households as well as small and medium-sized companies are entitled to net-meter their production from renewable energy sources with their electricity consumption. |

| Tax exemptions | The machineries and equipment used for construction of new power plants including renewable energy are exempted from the custom duties. The fuels used by electricity producers including renewable energy sources are exempted from the excise tax. |

The following policies are listed on th IEA homepage[3]:

- Albania First Solar PV Auction (July 2018)

- National Energy Policy 2013

- Order IET/1882/2014 of 14 October. Electricity generated by means of non-renewable fuels in STE and hybrid installations

- National Energy Efficiency Action Plan 2010-2018

- Albanian Law of Energy Efficiency 2005

- Albanian National Strategy of Energy 2003

- Law on creating facilitating conditions for the construction of new sources of electricity generation (Law No. 8987)Albania 2002

Institutional Set up and Key Actors in the Energy Sector

The following key actors work together within the regulatory framework to ensure the efficient functioning, sustainability, and development of the energy market in Albania. Collaboration among these stakeholders is essential for achieving energy security, promoting renewable energy, and meeting the country's energy goals.

| 1. Ministry of Infrastructure and Energy (MIE): | The Ministry of Infrastructure and Energy is responsible for formulating and implementing energy policies in Albania. It plays a key role in shaping the regulatory framework, energy development plans, and strategies for the sector. |

| 2. Regulatory Authority for Energy (ERE): | The Regulatory Authority for Energy is an independent regulatory body overseeing the energy sector in Albania. ERE is responsible for regulating and overseeing electricity and natural gas markets, ensuring fair competition, and protecting the interests of consumers. |

| 3. Transmission System Operator (OST): | The Transmission System Operator manages the high-voltage electricity transmission system in Albania. It is responsible for the operation, maintenance, and development of the transmission infrastructure, ensuring the reliable and secure transport of electricity. |

| 4. Distribution System Operator (OSHEE): | The Distribution System Operator manages the low and medium-voltage electricity distribution network in Albania. OSHEE is responsible for distributing electricity to end-users, maintaining the distribution infrastructure, and ensuring the continuity of electricity supply. |

| 5. Albanian Power Corporation (KESH): | The Albanian Power Corporation is the state-owned company responsible for electricity generation. KESH operates hydropower plants and contributes significantly to Albania's electricity production. |

| 6. Albanian Transmission System Operator (OST SH.A.): | The Albanian Transmission System Operator is a company responsible for operating and developing the electricity transmission system. It works in coordination with the Transmission System Operator to ensure the stability and efficiency of the transmission network. |

| 7. Albanian Distribution System Operator (OSHEE Distribution): | OSHEE Distribution is a subsidiary of OSHEE responsible for managing the distribution network and delivering electricity to end-users at the local level. |

| 8. Market Operator (OPC-Albania): | The Market Operator plays a role in facilitating the electricity market by managing market transactions, ensuring fair competition, and promoting market efficiency. It operates in accordance with the regulatory framework and market rules. |

| 9. Independent Power Producers (IPPs): | Independent Power Producers are private entities involved in electricity generation. They contribute to the diversification of the generation mix and may operate renewable or conventional power plants. |

| 10. Consumers and Industrial Users: | End-users, including residential, commercial, and industrial consumers, are essential actors in the energy market. Their energy consumption patterns and demand influence market dynamics. |

| 11. Investors and Financing Institutions: | Investors, both domestic and foreign, play a crucial role in funding and developing energy projects. Financing institutions, such as banks and international financial organizations, provide funding and support for energy infrastructure projects. |

| 12. Government Agencies and Local Authorities: | Various government agencies and local authorities are involved in permitting, land-use planning, and environmental assessments for energy projects. They also play a role in setting policies that impact the energy sector. |

| 13. International Organizations and Donors: | International organizations and donor agencies may provide support, technical assistance, and funding for energy sector development projects, especially those focused on sustainability, renewable energy, and regulatory reforms. |

Further Information

- Open EI:Albania

- IEA: Albania

- NDC Partnership Albania

- World Bank Climate Change Knowledge Portal - Albania

References

Further sources:

- IRENA, Renewables Readiness Assessment: Albania, 2021

- IRENA, Renewable Energy Prospects for Central and South-Eastern Europe Energy Connectivity (CESEC), 2020

- IRENA, Cost-competitive renewable power generation: Potential across South East Europe, 2017

- LEGAL SOURCES ON RENEWABLE ENERGY res-legal.eu

- Second and Third National Action Plan for Energy Efficiency for Albania, 2017-2020

- Energy Community, Albania