End-user finance in payment Systems in displacement settings

Background

Some of the biggest obstacles to a market-based energy supply and demand in communities in Ethiopia, Kenya and Uganda - whether real or just perceived - are the low and seasonal purchasing power of the customers, market risk due to the perception and narrative of the temporary nature of the camps, regulatory incertitude, and cultural barriers. All these factors concur with very low penetration of energy and financial service providers (respectively energy- and financial-service-providers) in displacement settings targeted by ESDS.

End-User-Financing

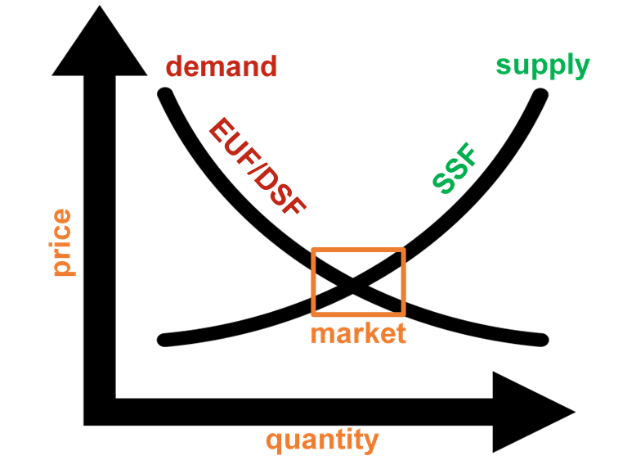

End-user financing (also “demand-side financing”) as a type of financing addresses end-users of a specific service or product with the aim to facilitate the meeting between demand and supply by intervening mostly on the “affordability” issue.

It is a form of financing mostly dealing with inelastic demand, such as the one of more vulnerable populations in the refugee camps, and it is usually complementary and/or alternative to more traditional “supply-side financing” (SSF). It should be noted that while SSF usually intervenes directly both at “price” (e.g. subsidies on products) and “quantity” levels (e.g. financing to increase imports), EUF financing usually focuses on the “price” axis only (making products and services cheaper), consequently having indirect benefits in terms of quantities that are made available on the market.

The most common use of EUF is through end-user subsidies, which are largely used in the development sector, especially in the humanitarian environment. However, end-user subsidies represent only one available mechanism of EUF, and many others exist.