End-user finance in payment Systems in displacement settings

Background

Some of the biggest obstacles to a market-based energy supply and demand in communities in Ethiopia, Kenya and Uganda - whether real or just perceived - are the low and seasonal purchasing power of the customers, market risk due to the perception and narrative of the temporary nature of the camps, regulatory incertitude, and cultural barriers. All these factors concur with very low penetration of energy and financial service providers (respectively energy- and financial-service-providers) in displacement settings targeted by ESDS.

End-User-Financing

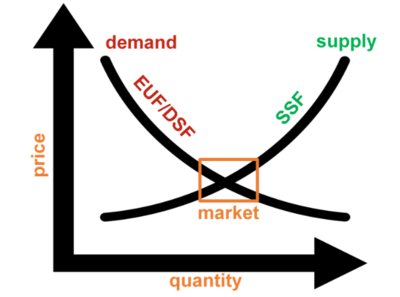

End-user financing (also “demand-side financing”) as a type of financing addresses end-users of a specific service or product with the aim to facilitate the meeting between demand and supply by intervening mostly on the “affordability” issue.

It is a form of financing mostly dealing with inelastic demand, such as the one of more vulnerable populations in the refugee camps, and it is usually complementary and/or alternative to more traditional “supply-side financing” (SSF). It should be noted that while SSF usually intervenes directly both at “price” (e.g. subsidies on products) and “quantity” levels (e.g. financing to increase imports), EUF financing usually focuses on the “price” axis only (making products and services cheaper), consequently having indirect benefits in terms of quantities that are made available on the market.

The most common use of EUF is through end-user subsidies, which are largely used in the development sector, especially in the humanitarian environment. However, end-user subsidies represent only one available mechanism of EUF, and many others exist.

EUF in ESDS Regions

The three countries of intervention vary widely in terms of market readiness, regulation, and financing environment, with Kenya and Uganda showing an overall higher level of market maturity than Ethiopia. End-user-financing (EUF) can support higher uptake of energy products and services in the displacement settings, provided that market-based activities are already present and in need of a boost. In situations where markets are extremely fragile or even non-existent, supply-side financing should also be provided.

The intermediation through financial service providers is possible but challenging. Larger formal institutions cannot easily be found in displacement settings, while smaller and more informal structures often do not have the capacity to operate at medium scale and meet the financing needs of large groups. Hence, unless there is a clear mandate for GIZ and UNHCR to boost and support market entry of financial institutions into the target areas, it is rather proposed that the energy provider itself provides EUF whenever possible, both in terms of financial capability and regulation. In those markets where Pay-as-you-Go (PAYGO) through mobile money is well developed, such as Kenya and partially Uganda, this is considered to be an effective, relatively low-cost tool for EUF.

For further information about EUF in the above mentioned ESDS regions, please check the latest country specific EUF-studies about Uganda, Kenya and Ethiopia.

Advantages and Disadvantages of EUF

Advantages

- Allows final users to increase choice over products and services available on the local markets, as long as they are eligible for support

- EUF is demand-driven, and final users themselves can approach different ESP or FSP based on their specific needs and preferences

- Due to the strong fragmentation of users, even small interventions and budgets can make a difference in terms of impact, as EUF can be targeted to very small groups of users, often the most vulnerable ones

- EUF is much more flexible to accommodate the needs of different types of users, by leaving them more choice and being more targeted in terms of user groups

Disadvantages

- Dealing with a heavily fragmented customers base, when compared to a limited number of players involved in the supply chain, is expensive both at transactional level and at interest level, due to the lack of collaterals of most final users

- EUF mainly addresses issues related to affordability, but it often fails to address other issues such as supply chain and logistical constraints, for which SSF is generally more effective

Conclusion

EUF was found to be extremely valuable to increase market choice, rather than limiting it, as it is often the case with SSF, and it is suitable for smaller interventions targeting specific groups, such as women; on the other hand, EUF only works on existing markets, and it is little useful to create new markets challenged by a variety of constraints, mostly on the supply chain.

The report can be downloaded here:

Partners

GIZ's Energy Solutions for Displacement Settings (ESDS) project cooperate with UNHCR to enhance the access to sustainable energy in displacement contexts, and the Energypedia page has been created to share learnings across various practitioners to spur the development of clean energy solutions.