Solar Energy Country Analysis Vietnam

Introduction

Worldwide, solar energy has an enormous theoretical potential for energy and power supply. However, technology and generation costs are mostly higher than those from conventional energy sources. The worldwide market for solar energy applications and the installed capacity is growing. The Vietnamese market is currently very small, but PV power is foreseen to make a contribution to Vietnam's power supply in 2030.

A general overview about Viet Nam's energy situation is given: Vietnam Energy Situation.

Information about solar energy applications, solar financing, business models and solar related topics can be found at Solar Portal.

Solar Energy Potential and Databases

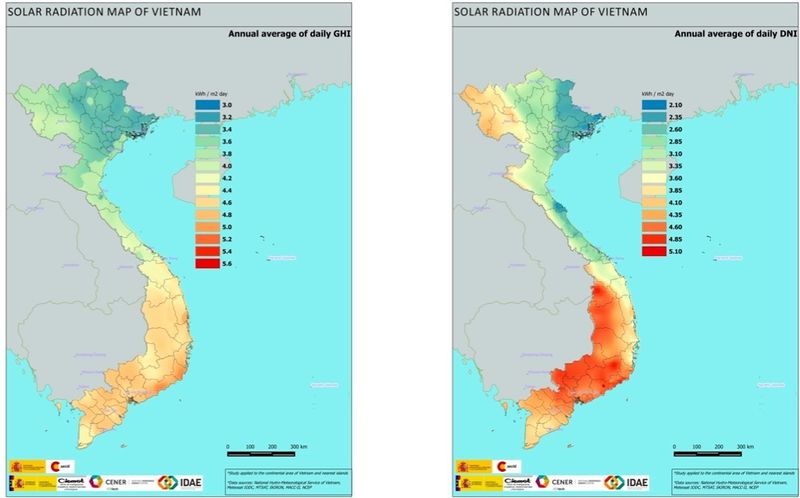

In general, Viet Nam can be considered as a country with high solar energy potential. The solar resources are comparable to countries like Italy, Spain, and California or – staying in the region – China or Thailand. According to a very recent mapping project by a Spanish research consortium estimations of overall solar resources in Viet Nam show an average GHI of 4-5 kWh/m2/day in most regions of southern, central and partially even northern Viet Nam (corresponding to 1,460-1,825 Wh/m2/year) and peak irradiation levels of up to 5.5 kWh/m2/day on average in some southern regions (corresponding to about 2,000 kWh/m2/year).[1]

Fig. 1: Solar Irradiation Maps of Viet Nam - Annual Average of Daily GHI and DNI (CINEMAT et. al. 2015)[2]

The most up-to-date and scientifically comprehensive estimation of solar resources in Viet Nam was undertaken by a Spanish research consortium led by the Spanish Research Centre for Energy, Environment and Technology, CIEMAT, with support of the Spanish government and in collaboration with the Vietnamese Ministry of Industry and Trade. As a result of these efforts very detailed maps of solar resources in Viet Nam are now available for policy makers, investors and researchers.[1] The data is supposed to be published by MoIT in 2015.

Since there is no publicly accessible database on solar PV projects, available information on existing projects are based on individual private or institutional monitoring efforts. The most comprehensive overview has been published by Mr Thrinh Quang Dung, former director of the Solar Laboratory of the Institute of Physics in Ho Chi Minh City (Solarlab) under the Vietnamese Academy of Science and Technology (VAST). The following project overview (Solar Projects in Viet Nam) is mainly based on his publications.[3]

Technologies and Applications

The Vietnamese solar PV market is currently very small with only around 4.5 MWp installed capacity at the end of 2014. Around 80% of that capacity was deployed off-grid and 20% is grid-connected. For off-grid uses, applications can be divided into two main categories. First, there are small-scale applications for domestic (lighting, home appliances etc.) or non-domestic (telecommunication, BTU etc.) uses. And second, there are larger PV off-grid systems that either include additional infrastructure for local power distribution or management (mini-grids) or additional sources of power such as diesel generators or wind turbines (hybrid systems). The former can be subdivided into Pico PV applications such as solar lanterns or solar battery chargers, Solar Home Systems (SHS) for mostly domestic appliances and larger stand-alone PV systems for mostly institutional uses such as community or medical centers. Power capacities of these systems range from less than 1 Wp for Pico PV applications to 1 kWp and more for larger stand-alone systems. Regarding larger-scale off-grid applications there are different technologies and system configurations in operation including stand-alone off-grid PV systems, hybrid systems (PV with diesel, wind and/or batteries) and PV mini-grids with a substantial part of grid infrastructure included.

Grid-connected systems are mainly based on crystalline-cell module types of different sizes. They can be clustered in residential PV rooftop units (approx. 1-50 kWp), commercial/industrial PV rooftop units (>40kWp) and ground-mounted PV systems. Almost all grid-connected systems are in inception phase and projects are usually for demonstration or pilot purposes. The main market barrier seems to be the low electricity tariff.

Following the available data, roughly 60-70% of the off-grid installed capacity in Viet Nam is dominated by smaller applications such as Solar Home Systems (SHS), small base transceiver stations for telecommunications (BTS), solar public lighting systems and likewise applications. Around 30-40% of off-grid installations are bigger systems such as solar local network stations and off-grid hybrid systems in remote areas or on islands.

►Go to Top

Policy Framework

Currently there are no solar PV development targets implemented within the relevant energy strategies such as the Master Plan for Power Development. The PDP VII from 2011 is currently under revision and expected to be finalized and published until mid of 2015. A first draft became public end of October 2014 showing raised targets for renewable energies in general and, for the first time, a specific target for solar PV.

According to this draft, solar PV capacities are supposed to increase to around 7 MWp until 2020 and 1,500 MWp until 2030 with a respective share in renewable power generation capacity of 1.2% (by 2020) and 12.8% (by 2030).

Policy Framework for PV On-Grid Applications

Currently, there has not been any specific regulation for solar PV implemented so far. This applies in particular to the following aspects of the regulatory energy framework:

- There are no financial incentives (such as Feed-in-Tariffs or net-metering schemes) to promote the deployment of solar PV. PV is not yet included in the existing FIT scheme for renewable energies.

- There is no standardized interconnection code (grid code) for PV systems. However, an ongoing project involving EVN, the energy authorities of Da Nang City and the International Copper Association Southeast Asia (ICA-SEA) has now made first steps in this direction and developed a proposal for an interconnection standard for PV as well as a general net-metering scheme.

- There is no effective regulation on the sale of excess solar electricity generated by private or commercial PV systems. As interviews and consultations with private sector stakeholders have shown, this constitutes a significant barrier to investments in commercial PV applications.

- There are some tax-related incentives in place that can be applied to renewable energy investments and technologies in general, such as an import tax exemption, a corporate tax exemption and an environmental protection fee exemption. It is yet unclear whether these incentives can also be applied to solar energy applications.

- Furthermore, there are incentives for infrastructure and land use regarding investments in major power stations that could also be applied to solar energy investments. In addition, the local People’s Committees are responsible for providing available land to wind power projects.

Policy Framework for PV Off-Grid and Rural Electrification

The prospects of further PV off-grid development in Viet Nam are mainly framed by the national electrification strategy and related political targets and measures. This strategy has its main foundation in the Power Development Plan (PDP), which indicates the strategy to develop and create rural power until 2020. Here government stimulates EVN to develop the national power grid to supply power to 100% households by 2020.

The second rural electrification project (REPII) is providing funds for this process. The objective of the REPII, which became effective in 2005, is to improve access to good, affordable electricity services to rural communities in an efficient and sustainable manner, financed with a US$200 million IDA credit and US$5.25 million GEF grant, the project included a major upgrading and expansion of rural power networks in about 1,200 communes, the conversion of the existing ad hoc local electricity management systems to the local distribution utilities (LDUs) as legal entities recognized under Vietnamese law, to improve management of power distribution in rural areas and capacity building assistance for LDUs, provincial authorities, participating regional PCs, and national authorities involved in the planning and regulation of rural electrification. Additional financing for the Second Rural Electrification Project (US$200 million IDA credit) was approved in May 2009 and is supposed to increase the outcome to 1,500 communes with 1.5 million households.[4]

►Go to Top

Solar Projects in Viet Nam

By the end of 2014, roughly 15,000 small scale PV off-grid applications with a total capacity of 3,600 kWp, the vast majority being <200 Wp of size only a few with more than 1kWp, have been installed in Viet Nam. Of those, around 5,000 were solar home systems (SHS) with a size of 20-200Wp, 2,100 were telecommunication and BTS systems (300-4,000 Wp) and more than 1,000 were small size PV systems for public use such as in community centers, schools or medical centers (up to 3,000 Wp), which were deployed in rural and mountainous areas or on islands. Furthermore, around 5,000 solar signal lights (20-100 Wp) and 2,000 public lighting systems (50-250 Wp) were installed alongside streets and highways throughout the country.

There are also a number of larger-scale PV off-grid systems in operation, including hybrid systems (PV-wind, PV-diesel, PV-wind-diesel) that often include grid and grid management infrastructure as well (mini grids). There is for example one project in Bai Huong village on Cu Lao Cham island (28 kWp PV plus 20 kW diesel generator) and one at Mang Yang in central highland Gia Lai province with 100 kWp PV combined with a 24 kWp mini hydro plant. Further projects are in development for several islands including PV-wind hybrid systems. In addition to these hybrid systems installed in the rural areas of Viet Nam’s mountain regions, there have been more than 50 PV hybrid projects realized on islands and naval outposts. All of these projects were put into operation together with EVN and the Vietnamese Navy as the main investors and off-takers for the energy provided by the systems.

The grid-connected share of installed capacity is dominated by a rather small number of bigger roof-top systems such as the installations of Intel Corporation (220 kWp), Big C (200 kWp), the National Conference Hall in Hanoi (154 kWp), the UNDP building in Hanoi (119 kWp) or the new National Assembly in Hanoi (50 kWp). So far, there are no larger ground-mounted PV systems in operation yet. However, there have been some announcements for investments in utility size PV power plants very recently. Following media reports from January 2015, there is 30 MWp PV plant under development and planned to be grid-connected in Quang Ngai province by end of this year. The investment of 60 million USD is supposed to be made by a joint-stock company. Another announcement relates to a planned 100 MWp PV plant in central Viet Nams Quang Nam province. Following media reports from March 2015, a Russian energy company with Singaporean and Vietnamese investment partners is planning to invest 140 million USD but negotiations with EVN about “market prices” are still ongoing.

References

- ↑ 1.0 1.1 CIEMAT et al. (2015). Maps of Solar Resource and Potential in Vietnam. Ha Noi: CIEMAT, CENER & IDAE with support from AECER in collaboration with GDE/MoIT.

- ↑ Publication of Solar Resource Potential Maps for Vietnam Results of a study analysing the solar radiation and solar energy potential in Vietnam, conducted by a consortium of CIEMAT, CENER and IDAE with support of AECID and MOIT. http://www.tcnl.gov.vn/userfile/files/Maps of Solar Resource and Potential in Vietnam REPORT FOR PUBLISHING.pdf

- ↑ Dung Trinh Quang (2015). Potentiality, Development and Challenge of Solar PV of Vietnam. Presentation held at the Seminar „Towards Sustainable Energy in Mekong Delta“, 27 January 2015 in Ho Chi Minh City.

- ↑ USAID/Winrock/SVN (2014). Off-Grid Opportunities and Challenges in Vietnam. Final Report. Ha Noi: United States Agency for International Development and Winrock International Institute for Agricultural Development in partnership with SVN Netherlands Development Organisation.