Difference between revisions of "EEP in Mongolia Capacity Building & Finance"

***** (***** | *****) m Tag: 2017 source edit |

***** (***** | *****) m Tag: 2017 source edit |

||

| Line 30: | Line 30: | ||

The association brought together seven of the 12 banks in Mongolia to design a new financial product which offered mortgages with verified energy efficiency, for low-income households living in the ger districts. Through this project, households in off-grid areas were enabled to switch from burning coal, to living in energy efficient standalone houses with up to 80% less (heat) energy consumption. | The association brought together seven of the 12 banks in Mongolia to design a new financial product which offered mortgages with verified energy efficiency, for low-income households living in the ger districts. Through this project, households in off-grid areas were enabled to switch from burning coal, to living in energy efficient standalone houses with up to 80% less (heat) energy consumption. | ||

| − | |||

| − | |||

= How does it work = | = How does it work = | ||

#Interested customer: A ger area family decides that they want to live in an energy efficient house, that is warm without burning coal and polluting the environment. | #Interested customer: A ger area family decides that they want to live in an energy efficient house, that is warm without burning coal and polluting the environment. | ||

| Line 41: | Line 39: | ||

#Energy efficiency auditing: Once the house is built, it is audited by an EE audit to assure that 20% energy savings can be achieved. | #Energy efficiency auditing: Once the house is built, it is audited by an EE audit to assure that 20% energy savings can be achieved. | ||

#Happy family: The customer moves into the new energy efficient house and enjoys the new comfort of a warm and comfortable home without emitting smoke. | #Happy family: The customer moves into the new energy efficient house and enjoys the new comfort of a warm and comfortable home without emitting smoke. | ||

| − | |||

<br> | <br> | ||

[[File:EEP Energy Efficient Housing Financing.PNG|800px|center]] | [[File:EEP Energy Efficient Housing Financing.PNG|800px|center]] | ||

| + | |||

| + | <div class="box box-green"> | ||

| + | = Interview with M. Nomindari CEO of the Mongolian Sustainable Finance Association (MSFA) and L. Amar Executive director and Secretary General of the Mongolian Bankers Association (MBA) = | ||

| + | '''Good afternoon, Ms. Nomindari and Mr. Amar. We want to talk about financing energy efficiency in Mongolia today. Mortgage loans for housing were already available in Mongolia. Tell us why there was a need to develop a new scheme for energy efficient (EE) houses?''' | ||

| + | |||

| + | Nomindari: ''We saw that there is a high demand for affordable housing loans. Most previous housing projects supported the relocation of ger district residents to apartment buildings. However, the existing loan programmes did not often meet their financial situation and their preferences for individual open spaces where they have more freedom to plant trees or have a safe playground for their children. On the supply side, there is a strong interest from financial institutions to explore new financial products as a way to tackle new markets, progress on their sustainable finance commitments, make contributions to solving the air pollution crisis, and eventually also be able to access alternative, lower-cost green funds from outside of Mongolia.'' | ||

| + | |||

| + | '''What was the objective of the pilot?''' | ||

| + | |||

| + | Amar: ''MBA, together with MSFA and GIZ, initiated this pilot project in order to improve the energy efficiency in the “ger” areas of Ulaanbaatar city. The objective was to establish a ‘buy-down facility’ to provide grants to residents'' | ||

</div> | </div> | ||

Revision as of 12:39, 15 June 2022

Capacities for Building Efficiency

Reaching Energy Efficiency in the building sector is a challenge, that requires the integration of know-how in many different areas that must come together. Therefore, the building of capacities in institutions of the public and private sector has to be strengthened on different levels. The project had its main focus on the city level and therefore worked closely with the Municipality of Ulaanbaatar (MUB). Nevertheless, the intention of working with the MUB as the biggest city in Mongolia was also to set examples that could then be transferred to the national level as well. This target was reached as different national entities were able to include the know-how developed, into national institutions and regulations.

To sustain knowledge in a system it is important to not only train its stakeholders once, but to continue the process of passing it onto the next generation of employees and civil servants. This is especially important in the public sector, where a high frequency of job turnover takes place. As a result of this, the project trained a large number of stakeholders from different institutions, and focused on establishing long term implementability by training the trainers of academies and training centres. This included the Municipal Research and Training Center, the National Academy of Governance, and the Mongolian Construction and Designers Association. Basic trainings, tools and databases were also developed to allow interested stakeholders to freely access the information online.

It was also important to include the new ways for implementation into the standard processes of public institutions, such as how to select the buildings to be renovated by public investment, and which planning procedures and blueprints are to be used to calculate such investments.

First Energy Efficient Housing Financing Scheme for Ger Area Established

Saving heat through energy efficiency (EE) is a top priority investment for local communities as it benefits not only the environment but also the quality of living and public health, especially that of children. Despite the demand for housing improvements, banks offered no financial product to insulate existing housing or build EE homes. This was due to a lack of sectoral standards and quality assurance systems, as well as a general dearth of affordable, long-term funding suitable for developing economies.

As part of the project, the first ever energy efficient housing mortgage programme was developed and tested in Mongolia in 2020/2021. The housing financing scheme was piloted in cooperation with the Mongolian Bankers Association (MBA) and the Mongolian Sustainable Finance Association (MSFA/ ToC).

The association brought together seven of the 12 banks in Mongolia to design a new financial product which offered mortgages with verified energy efficiency, for low-income households living in the ger districts. Through this project, households in off-grid areas were enabled to switch from burning coal, to living in energy efficient standalone houses with up to 80% less (heat) energy consumption.

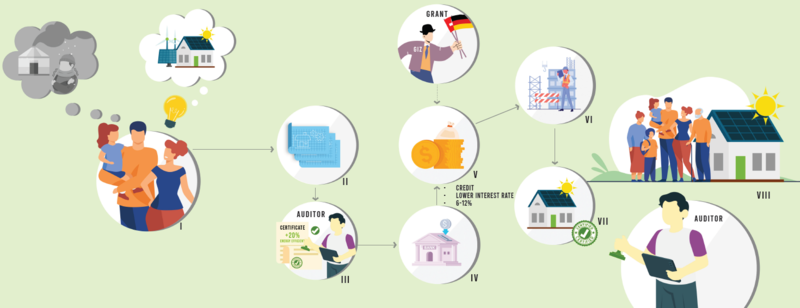

How does it work

- Interested customer: A ger area family decides that they want to live in an energy efficient house, that is warm without burning coal and polluting the environment.

- Selection of design with construction company: The interested customer reaches out to a) eligible construction companies that have already approved energy efficient building designs, or b) a bank that provides information about eligible companies and designs.

- Certification of design: The construction company applies for a certification of their building design. Newly developed and certified design provides the planning documents for a family house that consumes a minimum of 20% less energy compared to the Mongolian standard.

- At the bank: The staff at the bank are aware of the EE housing scheme and know that certain EE houses were and can be certified. Given the customers wish to buy one of the 24 certified designs, they receive a mortgage loan at a special rate.

- Finances: The customer pays 10% of the building prices upfront. 30% of the building price (30% or up to 18 Mio. MNT) was covered by GIZ during the pilot project. For the remaining 60% the customer receives a loan with a special low interest rate of between 6% and 12% that needs to be repaid in 15 years.

- Construction: With the signed contract between customer and construction company, and the financing of the bank in place, the construction of the house starts. The contracted energy auditor visits the construction site to inspect EE relevant issues such as insulation work, and materials and to advise.

- Energy efficiency auditing: Once the house is built, it is audited by an EE audit to assure that 20% energy savings can be achieved.

- Happy family: The customer moves into the new energy efficient house and enjoys the new comfort of a warm and comfortable home without emitting smoke.

Interview with M. Nomindari CEO of the Mongolian Sustainable Finance Association (MSFA) and L. Amar Executive director and Secretary General of the Mongolian Bankers Association (MBA)

Good afternoon, Ms. Nomindari and Mr. Amar. We want to talk about financing energy efficiency in Mongolia today. Mortgage loans for housing were already available in Mongolia. Tell us why there was a need to develop a new scheme for energy efficient (EE) houses?

Nomindari: We saw that there is a high demand for affordable housing loans. Most previous housing projects supported the relocation of ger district residents to apartment buildings. However, the existing loan programmes did not often meet their financial situation and their preferences for individual open spaces where they have more freedom to plant trees or have a safe playground for their children. On the supply side, there is a strong interest from financial institutions to explore new financial products as a way to tackle new markets, progress on their sustainable finance commitments, make contributions to solving the air pollution crisis, and eventually also be able to access alternative, lower-cost green funds from outside of Mongolia.

What was the objective of the pilot?

Amar: MBA, together with MSFA and GIZ, initiated this pilot project in order to improve the energy efficiency in the “ger” areas of Ulaanbaatar city. The objective was to establish a ‘buy-down facility’ to provide grants to residents

For more information about the project please contact: XYZ