Click here to register!

Microfinance Institutions - Financing Renewable Energy

World Bank Group

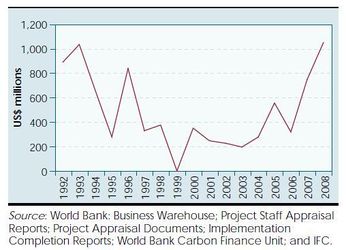

The World Banks investments in hydropower projects reflects international trends and demands. In the 1990 hydropower projects were strongly criticised throughout the world since social domains and investments in environmental protection were neglected and human rights have been infringed. Therefore lendings in hydropower during the 1990s significantly decreased accompanied by a shift to projects with fewer environmental and social impacts.By the early 2000s, however, several policies repositioned the World

Bank Group in terms of infrastructure and risk, and established a renewed framework for hydropower.

Thus lending increased over the last five years. In the years from 2002 to 2004 avergae new lending per year amounted to less than $250 million; between 2005 and 2007 avergae new lending increased to $500 million per year. In 2008, new lending exceeded

$1 billion, with an increase in larger, standalone projects (see Figure)

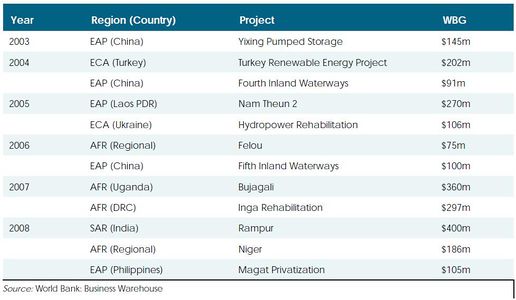

Since 2003 67 hydropower projects have been approved amounting to 3.7 billion USD in WBG contributions (US$3.2 billion for hydropower components) to support almost 9700 MW in project investments.

The majority of the projects have been approved in Africa (Senegal, Democratic Republic of Congo, Sierra Leone, and Uganda) and Asia (People’s Democratic Republic of Laos, India), as well as several rehabilitation projects in Eastern Europe (Ukraine, Macedonia, and Georgia).

Over the time the WBG has adapted product lines and financial instruments. Over the period 1992–2002, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) accounted for 99% of the lending portfolio, and International Financial Corporation (IFC) the remaining 1%. During 2003–08, IBRD/IDA’s lending decreased significantly,to 58%—mainly because of an absolute decrease in IBRD lending. At the same time, IFC increased support (to 20%), as did carbon finance (to 5%), and guarantees (to 17%), reflecting increased private sector involvement.

The WBG’s assistance extends beyond lending—to technical support, knowledge sharing, policy dialogue, economic and sector

work, and support during project preparation and implementation. In these roles, the WBG draws on a range of products and services which were developed after the fall of lending in the 1990s. These products in form of operational directives and safeguards, coupled with the ongoing development of tools such as Strategic Environmental Assessment and payments for environmental services offer the Bank opportunities to add imputs to hydropower efforts.

Source: Water Working Notes No 21, June 2009. Direction in Hydropower: Scaling Up for Development. Water Sector Board of the Sustainable Development Network of the World Bank Group

Reconstruction Loan Corporation (German Kreditanstalt für Wiederaufbau KfW)

Detailed infomation about the total amount of KfW lendings in hydropower projects in the last years could not be found in the literature. However, the Gloabal Status Report of Renewables 2011 (REN21) stated that the KfW is one of the three leading development banks, in terms of financing of renewables projects in 2010 (with 1.5 billion USD).

Infomation about small and large hydropower projects which are financed by the KfW can be found at the country portal at the KfW website: http://www.kfw-entwicklungsbank.de/ebank/DE_Home/Laender_und_Programme/index.jsp

Countries where small and large hydropower projects have been / are supported are e.g.:

- Albania (small hydropower plants)

- Agypt (rehabilitation of the generators of the Assuan High Dam)

- India (small hydropower plants)

- Macedonia (rehabilitation and modernisation of six hydropower plants)

- Mongolia (rehabilitation of Bogdyn HPP in 2007)

- Montenegro with 16 million € (rehabilitation of existing hydropower plants)

- Morocco with 87 million € (Tanafnit and El Borj Run of River HPP and modernisation of 20 old HPP)

- Pakistan with 97 million € over 6 years (construction of the HPP Keyal Khwar 122 MW)

- Serbia with 30 million € (rehabilitation of Bajina Basta HPP)

- Turkey (support of the construction of five hydropower plants)

- Uganda with 15 million USD for Bujagali HPP 250 MW (after support of small hydropower plants)

Source: Renewables 2011 Global Status Report, REN21 (Paris), 115 pp. (Lead author Janet Sawin)

Regional Development Banks

European Investment Bank (EIB)

EIBs lending for renewable energies grew almost fivefold between 2007 and 2010. In 2008 lendings account for 2.2 billion €, in 2009 lendings were 4.2 billion € and in 2010 lending reached 6.2 billion €. However, the proportion of lendings for small and large hydropower projects is unclear.

In 2011 the EIB provided a loan of 70 million € for the construction of the 80MW Budharhals hydroplant on the Kaldakvisl River in southern Iceland. Furthermore a 300 million € loan for the upgrade of the Alqueva and Venda Nova pump storage projects in Portugal. In addition, EIB is lending €20 million to the Republic of Georgia to finance the completion of rehabilitation of the 1,250 MW Enguri plant and Vardnili hydro cascade.

Source:

REN 21 Global Status report 2009 and 2010