Click here to register!

Difference between revisions of "The Economics of Renewable Energy"

***** (***** | *****) m |

***** (***** | *****) m |

||

| Line 6: | Line 6: | ||

In order to assess how private investment in renewables can be increased, it is necessary to understand the economics of renewable energy. | In order to assess how private investment in renewables can be increased, it is necessary to understand the economics of renewable energy. | ||

| − | Worldwide more energy is required to enable economic development. Fossil fuels are a finite resource that contribute to climate change and cause other problems like smog, extended supply lines and vulnerable power grids. Utilizing renewables would help to avoid these problems, create new job opportunities and reduce the drain on hard currency for poorer countries. Because conventional fuels have received long-term subsidies in the past, it is vital that governments support the development of renewables in the form of financial incentives that can create a level playing field | + | Worldwide more energy is required to enable economic development. Fossil fuels are a finite resource that contribute to climate change and cause other problems like smog, extended supply lines and vulnerable power grids. Utilizing renewables would help to avoid these problems, create new job opportunities and reduce the drain on hard currency for poorer countries. Because conventional fuels have received long-term subsidies in the past, it is vital that governments support the development of renewables in the form of financial incentives that can create a level playing field <ref>United Nations Environment Programme Finance Initiative (UNEP FI), 2004. CEO briefing - Renewable Energy, Geneva, Switzerland: United Nations Environment Programme Finance Initiative (UNEP FI).</ref>. |

| − | According to REN-21’s Renewables Global Futures Report 2013, the future of renewable energy is uncertain as finance remains a key challenge. The future of the renewables industry depends on finance, risk-return profiles, business models, investment lifetimes and a host of other economic, policy and social factors. Many new sources of finance are possible such as insurance funds, pension funds and sovereign wealth funds along with new mechanisms for financial risk mitigation. Many new business models are also possible for local energy services, utility services, transport, community and cooperative ownership, and rural energy services. | + | According to REN-21’s Renewables Global Futures Report 2013, the future of renewable energy is uncertain as finance remains a key challenge. The future of the renewables industry depends on finance, risk-return profiles, business models, investment lifetimes and a host of other economic, policy and social factors. Many new sources of finance are possible such as insurance funds, pension funds and sovereign wealth funds along with new mechanisms for financial risk mitigation. Many new business models are also possible for local energy services, utility services, transport, community and cooperative ownership, and rural energy services <ref>Appleyard, D., March 2013. The Future of Renewables: Economic, Policy and Social Impications - Renewable Energy World International. [Online] |

| + | Available at: http://www.renewableenergyworld.com/rea/news/article/2013/03/from-the-editor20</ref>. | ||

| − | In 2011, the global investment in renewable power and fuels increased by 17% to a new record of $257 billion dollars. Significantly, developing economies made up 35% of this total investment. | + | In 2011, the global investment in renewable power and fuels increased by 17% to a new record of $257 billion dollars. Significantly, developing economies made up 35% of this total investment <ref>Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance, 2012. Global Trends in Renewable Energy Investment 2012, Frankfurt am Main, Germany: Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance.</ref>.<br/> |

| + | |||

| + | <span style="line-height: 1.5em; font-size: 0.85em;">Despite these trends, RETs continue to face a number of barriers</span><ref>These barriers can be financial and economically such as, higher upfront costs, political and regulatory (generally policies do not favour renewable technologies), environmental and social (e.g. planning objections), technical (e.g. intermittent nature of renewable technologies), or related to the scale of the projects, mainly higher transaction costs. To create a level playing field for renewable technologies, all the barriers mentioned above need to be addressed, but the crucial starting point is a supportive and stable policy and regulatory framework. This will encourage greater investment on the part of financial institutions. (United Nations Environment Programme Finance Initiative (UNEP FI), 2004)</ref><span style="line-height: 1.5em; font-size: 0.85em;">.</span>[[File:Economics of RE 1.PNG|thumb|right|250px|Investments in Renewables in 2012. Source: Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance]] | ||

<br/> | <br/> | ||

| − | + | When assessing decisions to support RET’s, policy-makers need to answers to whether renewables are more expensive that fossil fuels, and whether renewables can be made available on a scale large enough to replace fossil fuels. | |

<br/> | <br/> | ||

| − | + | Economics of RE<br/>Generally the economics of renewable energy are not competitive, as production costs per unit of energy are usually higher than those for fossil fuels as depicted in the figure below, which shows the relative costs for renewable energy technologies compared with each other, and with non-renewable energy<ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | [[File:Economics of RE 2.PNG|thumb|right|500px|Relative costs for renewable energy technologies compared with each other, and with non-renewable energy. Source: Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011.]] | |

| − | + | The figure shows that while non-renewable costs are in the range of US$0.3–US$0.10/KwH, most renewable forms are actually more expensive and have a far greater cost range. This reflects the relative maturity of technologies and also the key significant cost difference of renewable energy production (which is dependent on factors such as wind speed and degrees of solar intensity.) The issue of scale is also a factor as fossil-fuel technologies have been developed, improved and manufactured on an increasing scale for a century, which is not the case for the renewable sector<ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | Thus combined, these factors suggest that there is scope to reduce renewable production costs, which vary considerably by sector as shown in the Figure 1 above. The most expensive is ocean/tidal electricity, which, even at the bottom of the potential cost range, remains uncompetitive with fossil fuels. The next is solar power. At its cheapest, it is potentially competitive with fossil fuels, but midrange costs are well above fossil fuels. For solar power, the wide range reflects the cost implications of different technologies. For example, large-scale Concentrated Solar Power (CSP) techniques employed in a desert environment could produce electricity at a far lower cost than small solar panels fitted to residential properties. Wind power is potentially cheaper still, but remains more expensive than fossil fuels in most instances. Again, the range reflects differing scales of energy generation, but also the different cost structures of onshore and offshore wind. Finally, biomass, geothermal and hydropower in particular are already competitive with fossil fuels in some circumstances (IPCC, 2011) <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | In addition to the absolute costs of renewable energy production, costs relative to fossil fuels are also important. Three points should be stressed. First, fossil-fuel energy does not reflect its full social costs. In 2006, the Stern Review described climate change as the ‘biggest market failure in history’ as the environmental costs associated with carbon emissions are not included in market prices (Stern, 2006). Not only are these externalities not reflected in prices, but fossil fuels are actually subsidised to the tune of US$300 billion per year. Removing these subsidies and incorporating external costs into non-renewable energy costs would dramatically change relative costs. For the latter, carbon taxes would be ideal, but if that is not feasible politically, it may be desirable to add a shadow price of carbon to evaluations of energy projects by public agencies (see below, and also Griffith-Jones and Tyson, 2011 for European Investment Bank (EIB) experience on this) <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | Second, it is more expensive to deliver non-renewable energy in some places than others. For example, rural communities in developing countries are often not connected to grids, so that localised, ‘off-grid’ energy production – particularly solar power – is more competitive than in a fully networked context <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | Third, as shown in the Figure 1.2, there is no shortage of renewable energy potential at the global level. In terms of primary energy, it is already technically possible to generate many multiples of global energy supply using solar energy. Similarly, there is ample wind or geothermal power to meet all of today’s global electricity demand<ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | [[File:Economics of RE 3.PNG|thumb|right|500px|Ranges of global technical potentials of RE sources]]<br/> | |

| − | + | <br/><br/> | |

| − | + | Perhaps more importantly, much of this global solar power potential is concentrated in developing countries, but there is also high potential in other areas. | |

| − | + | Table 1.1 Top ten countries globally in terms of renewable energy potential relative to energy use Table 1.1 lists the top ten countries globally in terms of renewable energy potential relative to energy use. That they are all developing countries is partly a reflection of their relatively low energy use at present, but also the relative abundance of solar, wind, hydro and geothermal energy <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] | |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | + | [[File:Economics of RE 4.PNG|thumb|right|250px|Top ten countries globally in terms of renewable energy potential relative to energy use]] | |

| − | + | <br/> | |

| − | It is therefore clear that there is significant scope to increase the use of renewable energy in developing countries. This is not limitless, however. Although we can expect the costs of renewable energy to continue to fall relative to fossil fuels, particularly in countries with high renewable energy potential, fossil fuels are likely to retain a cost advantage in most cases | + | It is therefore clear that there is significant scope to increase the use of renewable energy in developing countries. This is not limitless, however. Although we can expect the costs of renewable energy to continue to fall relative to fossil fuels, particularly in countries with high renewable energy potential, fossil fuels are likely to retain a cost advantage in most cases<ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | Two important conclusions can be drawn from this. First, the basic economics of renewable energy need to be artificially altered, either by increasing the cost of fossil fuel-based energy (e.g. through taxes or equivalent mechanisms), or by reducing the costs of renewable energy (e.g. subsidies), or by boosting the returns to renewable energies (e.g. through paying a premium for this form of energy) | + | Two important conclusions can be drawn from this. First, the basic economics of renewable energy need to be artificially altered, either by increasing the cost of fossil fuel-based energy (e.g. through taxes or equivalent mechanisms), or by reducing the costs of renewable energy (e.g. subsidies), or by boosting the returns to renewable energies (e.g. through paying a premium for this form of energy) <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | Second, it does not follow that developing countries should be required to meet these costs. <br/>Where it is the case that employing renewable technologies makes economic sense, this is not an issue – only limited incentives are needed and it is reasonable to expect them to be met domestically because of the benefits that will accrue to the country. However, where the development of renewable energy capacity could place countries at a competitive disadvantage and/or these countries bear no responsibility for climate change, the costs should be met by countries that do bear such a responsibility. This case is even stronger while developed countries are subsidising fossil-fuel energy | + | Second, it does not follow that developing countries should be required to meet these costs.<br/>Where it is the case that employing renewable technologies makes economic sense, this is not an issue – only limited incentives are needed and it is reasonable to expect them to be met domestically because of the benefits that will accrue to the country. However, where the development of renewable energy capacity could place countries at a competitive disadvantage and/or these countries bear no responsibility for climate change, the costs should be met by countries that do bear such a responsibility. This case is even stronger while developed countries are subsidising fossil-fuel energy <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>. | ||

| − | This suggests that, in most cases, low-income countries (LICs) should generally not be expected to subsidise the development of a renewable energy sector. Significant implications result from this, which we shall return to throughout this paper | + | This suggests that, in most cases, low-income countries (LICs) should generally not be expected to subsidise the development of a renewable energy sector. Significant implications result from this, which we shall return to throughout this paper <ref>Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] |

| + | Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf</ref>.<br/> | ||

<br/> | <br/> | ||

= Further Information = | = Further Information = | ||

| + | |||

| + | *<br/> | ||

<br/> | <br/> | ||

| Line 61: | Line 77: | ||

= References = | = References = | ||

| + | |||

| + | <references /><br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | <br/> | ||

<br/> | <br/> | ||

[[Category:Financing_and_Funding]] | [[Category:Financing_and_Funding]] | ||

Revision as of 13:27, 8 July 2013

► Back to Financing & Funding Portal

Introduction

In order to assess how private investment in renewables can be increased, it is necessary to understand the economics of renewable energy.

Worldwide more energy is required to enable economic development. Fossil fuels are a finite resource that contribute to climate change and cause other problems like smog, extended supply lines and vulnerable power grids. Utilizing renewables would help to avoid these problems, create new job opportunities and reduce the drain on hard currency for poorer countries. Because conventional fuels have received long-term subsidies in the past, it is vital that governments support the development of renewables in the form of financial incentives that can create a level playing field [1].

According to REN-21’s Renewables Global Futures Report 2013, the future of renewable energy is uncertain as finance remains a key challenge. The future of the renewables industry depends on finance, risk-return profiles, business models, investment lifetimes and a host of other economic, policy and social factors. Many new sources of finance are possible such as insurance funds, pension funds and sovereign wealth funds along with new mechanisms for financial risk mitigation. Many new business models are also possible for local energy services, utility services, transport, community and cooperative ownership, and rural energy services [2].

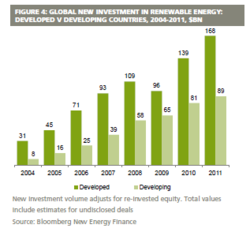

In 2011, the global investment in renewable power and fuels increased by 17% to a new record of $257 billion dollars. Significantly, developing economies made up 35% of this total investment [3].

Despite these trends, RETs continue to face a number of barriers[4].

When assessing decisions to support RET’s, policy-makers need to answers to whether renewables are more expensive that fossil fuels, and whether renewables can be made available on a scale large enough to replace fossil fuels.

Economics of RE

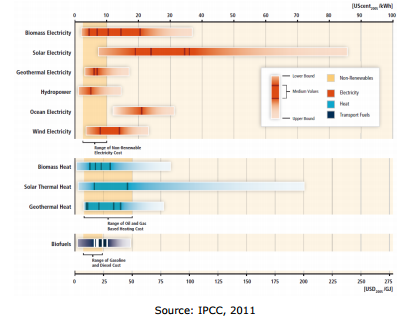

Generally the economics of renewable energy are not competitive, as production costs per unit of energy are usually higher than those for fossil fuels as depicted in the figure below, which shows the relative costs for renewable energy technologies compared with each other, and with non-renewable energy[5].

The figure shows that while non-renewable costs are in the range of US$0.3–US$0.10/KwH, most renewable forms are actually more expensive and have a far greater cost range. This reflects the relative maturity of technologies and also the key significant cost difference of renewable energy production (which is dependent on factors such as wind speed and degrees of solar intensity.) The issue of scale is also a factor as fossil-fuel technologies have been developed, improved and manufactured on an increasing scale for a century, which is not the case for the renewable sector[6].

Thus combined, these factors suggest that there is scope to reduce renewable production costs, which vary considerably by sector as shown in the Figure 1 above. The most expensive is ocean/tidal electricity, which, even at the bottom of the potential cost range, remains uncompetitive with fossil fuels. The next is solar power. At its cheapest, it is potentially competitive with fossil fuels, but midrange costs are well above fossil fuels. For solar power, the wide range reflects the cost implications of different technologies. For example, large-scale Concentrated Solar Power (CSP) techniques employed in a desert environment could produce electricity at a far lower cost than small solar panels fitted to residential properties. Wind power is potentially cheaper still, but remains more expensive than fossil fuels in most instances. Again, the range reflects differing scales of energy generation, but also the different cost structures of onshore and offshore wind. Finally, biomass, geothermal and hydropower in particular are already competitive with fossil fuels in some circumstances (IPCC, 2011) [7].

In addition to the absolute costs of renewable energy production, costs relative to fossil fuels are also important. Three points should be stressed. First, fossil-fuel energy does not reflect its full social costs. In 2006, the Stern Review described climate change as the ‘biggest market failure in history’ as the environmental costs associated with carbon emissions are not included in market prices (Stern, 2006). Not only are these externalities not reflected in prices, but fossil fuels are actually subsidised to the tune of US$300 billion per year. Removing these subsidies and incorporating external costs into non-renewable energy costs would dramatically change relative costs. For the latter, carbon taxes would be ideal, but if that is not feasible politically, it may be desirable to add a shadow price of carbon to evaluations of energy projects by public agencies (see below, and also Griffith-Jones and Tyson, 2011 for European Investment Bank (EIB) experience on this) [8].

Second, it is more expensive to deliver non-renewable energy in some places than others. For example, rural communities in developing countries are often not connected to grids, so that localised, ‘off-grid’ energy production – particularly solar power – is more competitive than in a fully networked context [9].

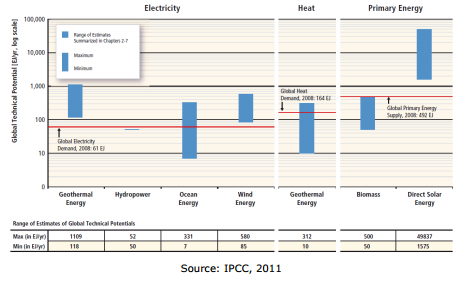

Third, as shown in the Figure 1.2, there is no shortage of renewable energy potential at the global level. In terms of primary energy, it is already technically possible to generate many multiples of global energy supply using solar energy. Similarly, there is ample wind or geothermal power to meet all of today’s global electricity demand[10].

Perhaps more importantly, much of this global solar power potential is concentrated in developing countries, but there is also high potential in other areas.

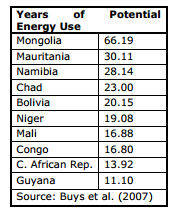

Table 1.1 Top ten countries globally in terms of renewable energy potential relative to energy use Table 1.1 lists the top ten countries globally in terms of renewable energy potential relative to energy use. That they are all developing countries is partly a reflection of their relatively low energy use at present, but also the relative abundance of solar, wind, hydro and geothermal energy [11].

It is therefore clear that there is significant scope to increase the use of renewable energy in developing countries. This is not limitless, however. Although we can expect the costs of renewable energy to continue to fall relative to fossil fuels, particularly in countries with high renewable energy potential, fossil fuels are likely to retain a cost advantage in most cases[12].

Two important conclusions can be drawn from this. First, the basic economics of renewable energy need to be artificially altered, either by increasing the cost of fossil fuel-based energy (e.g. through taxes or equivalent mechanisms), or by reducing the costs of renewable energy (e.g. subsidies), or by boosting the returns to renewable energies (e.g. through paying a premium for this form of energy) [13].

Second, it does not follow that developing countries should be required to meet these costs.

Where it is the case that employing renewable technologies makes economic sense, this is not an issue – only limited incentives are needed and it is reasonable to expect them to be met domestically because of the benefits that will accrue to the country. However, where the development of renewable energy capacity could place countries at a competitive disadvantage and/or these countries bear no responsibility for climate change, the costs should be met by countries that do bear such a responsibility. This case is even stronger while developed countries are subsidising fossil-fuel energy [14].

This suggests that, in most cases, low-income countries (LICs) should generally not be expected to subsidise the development of a renewable energy sector. Significant implications result from this, which we shall return to throughout this paper [15].

Further Information

References

- ↑ United Nations Environment Programme Finance Initiative (UNEP FI), 2004. CEO briefing - Renewable Energy, Geneva, Switzerland: United Nations Environment Programme Finance Initiative (UNEP FI).

- ↑ Appleyard, D., March 2013. The Future of Renewables: Economic, Policy and Social Impications - Renewable Energy World International. [Online] Available at: http://www.renewableenergyworld.com/rea/news/article/2013/03/from-the-editor20

- ↑ Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance, 2012. Global Trends in Renewable Energy Investment 2012, Frankfurt am Main, Germany: Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance.

- ↑ These barriers can be financial and economically such as, higher upfront costs, political and regulatory (generally policies do not favour renewable technologies), environmental and social (e.g. planning objections), technical (e.g. intermittent nature of renewable technologies), or related to the scale of the projects, mainly higher transaction costs. To create a level playing field for renewable technologies, all the barriers mentioned above need to be addressed, but the crucial starting point is a supportive and stable policy and regulatory framework. This will encourage greater investment on the part of financial institutions. (United Nations Environment Programme Finance Initiative (UNEP FI), 2004)

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf

- ↑ Griffith-Jones, S., Ocampo, J. A. & Spratt, S., 2011. Financing Renewable Energy in Developing Countries: Mechanisms and Responsibilities. [Online] Available at: http://erd-report.eu/erd/report_2011/documents/dev-11-001-11researchpapers_griffith-jones-ocampo-spratt.pdf