Country Profile of Nigeria

Introduction

Nigeria is a vibrant and diverse nation with a population of approximately 226.2 million people, located in West Africa. This makes it the highest populated country with the largest economy across Africa. Nigeria is a federation of 36 autonomous states and the Federal Capital Territory [1].

Currently, around 90 million people in Nigeria are without access to grid electricity. The country only has 6GW operational grid capacity for the whole population. Therefore, 80% of the population are reliant on electricity from off-grid diesel/petrol generators that are expensive and polluting[2]. One of the primary development goals of the Federal Government of Nigeria is to increase electricity access to 75% and 90% by 2020 and 2030 respectively, and at least 10% of renewable energy mix by 2025 [3]. To achieve these goals, Nigeria requires rapid expansion of electricity generation capacity and production.

Off-grid solar sector in Nigeria

Under the Net Zero Vision, the decentralized electricity production capacity is expected to rise to 16GW until 2050, comprising a mix of Solar Home Systems (SHS), Minigrids, and solar PV + battery. SHS are preferred for low-density areas (e.g. villages of less than 20 people), while Minigrids are preferred for larger communities [2]. The potential annual market opportunity for providing off-grid clean energy technologies to customers in Nigeria is estimated at US$8 billion for mini-grids and US$2 billion for SHS. The growth of the off-grid sector to date can be attributed to several factors, including an increase in the number of local and foreign private off-grid companies operating in Nigeria and increased government support through the activities of the Rural Electrification Agency (REA) and the Central Bank of Nigeria [4]. REA majorly supports off-grid development through the deployment of mini grids and solar home systems under the following programmes: the Nigeria Electrification Project (NEP), the Rural Electrification Fund (REF), and the Energizing Economies Initiative (EEI).

Policy and regulatory framework

Nigerian developers working on decentralized renewable electricity solutions should consider several key aspects of regulations and policies to ensure compliance and the successful implementation of their projects. Existing regulations address various aspects of the market, such as consumer payments, customs and importation, and setting up of an off-grid business[4].

Please consult the specific page Comply with Policies and Regulations to gain detailed information.

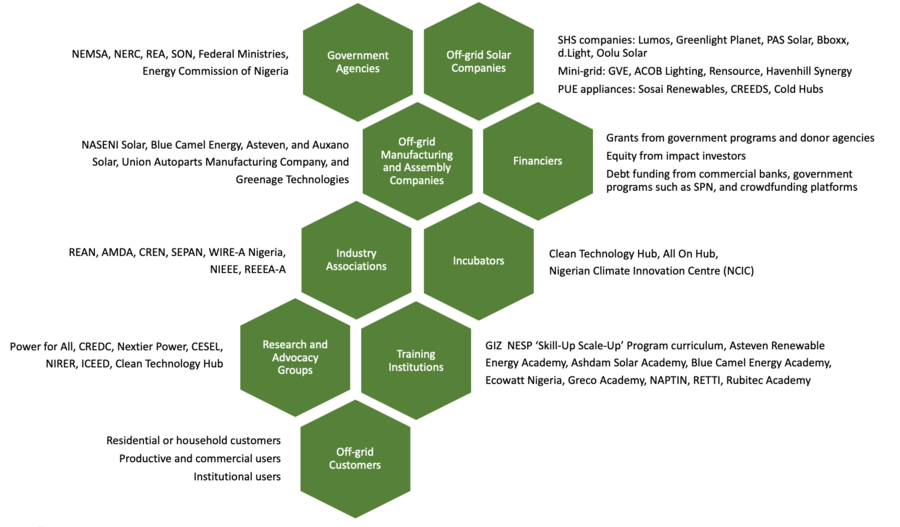

Stakeholder landscape of the Nigerian off-grid solar sector

The illustration is based on the Power Africa Nigeria Power Sector Program Off-grid Market Intelligence Report [4].

State-specific information

Please click on the respective state for specific information.

- ↑ World Bank (2023). Nigeria At-A-Glance. https://www.worldbank.org/en/country/nigeria/overview

- ↑ 2.0 2.1 ETP (2022). Nigeria Energy Transition Plan.https://www.energytransition.gov.ng/power/

- ↑ REA. Rural electrification goal. https://rea.gov.ng/theagency/rural-electrification-goal/

- ↑ 4.0 4.1 4.2 USAID (2022). Off-grid Market Intelligence Report. https://pdf.usaid.gov/pdf_docs/PA00ZB5X.pdf