Innovative Approaches to End-User Financing

Purpose of the thematic knowledge products

About 600 million people in Sub-Saharan Africa (SSA) lack access to electricity. Electrification is particularly low in rural areas, where less than 20% of the population has access to electricity[1]. For people living far from the national grid in rural areas with low population density, access to electricity through grid extension is rarely economically viable. Although access to electricity and productive technologies can promote economic development of local enterprises and improve livelihoods, stand-alone off-grid electricity systems based on renewable energies remain unaffordable to many. As a result, households, social institutions, and micro, small and medium-sized enterprises (MSMEs) generally use energy-inefficient and outdated technologies, such as diesel generators, which have high running costs and are usually harmful to the environment and human health.

Against this background, the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) programme for “Green People‘s Energy” (Grüne Bürgerenergie, GBE) aims to improve access to electricity with decentralised renewable energy (DRE) in rural SSA. It applies market-based approaches involving local key stakeholders, including the population, authorities, agricultural cooperatives, financial institutions and solar companies. GBE promotes DRE systems in rural areas in nine African countries: Benin, Côte d’Ivoire, Ethiopia, Ghana, Mozambique, Namibia, Senegal, Uganda and Zambia. Particular attention is paid to promoting local value added through productive use of energy (PUE).

GBE intends to give impulses for German and international development cooperation in the short term. The results and lessons learned are relevant for other programmes. Against this background, five thematic knowledge products look into the intermediate impacts and lessons learned from selected GBE interventions and identify key success factors for why and how which technologies, support measures and funding approaches work.

This knowledge product focuses on innovative approaches to promote end-user financing, particularly for solar PUE appliances for farmers and small businesses, such as solar water pumps/solar-powered irrigation systems (SPIS) and solar cooling. Sector-specific challenges and intervention approaches are first described before GBE programme findings are presented to enrich the sector discussion.

End-user financing for PUE

Solar PUE technologies typically have higher investment costs than fossil fuel alternatives. This is even more the case in rural areas, as it takes a lot of effort for suppliers to serve remote regions. For example, a solar water pump (SWP) costs about three to four times as much as a diesel-powered pump. However, the higher investment cost is usually quickly made up for through saved fuel costs. Depending on usage and fuel costs, this can be done in two to four years.[ST1] Solar PUE technologies can therefore reduce overall energy costs when replacing older fossil fuel solutions. When providing first-time access to energy, they can increase productivity or enable business development. This makes them a crucial investment, but one that low-income rural smallholder farmers and other MSMEs often have issues affording. Not only do they often lack the necessary financial resources to make significant investments on their own, but external funds such as bank loans are usually too expensive, with nominal interest rates typically above 20% in SSA countries. Furthermore, microfinance institutions (MFIs) perceive smallholder farmers in rural areas as high-risk borrowers, mainly due to a lack of data on creditworthiness or credit collaterals[2]. When targeting these groups, innovative end-user financing schemes are a critical success factor in promoting PUE.

The following approaches for providing and supporting end-user financing for PUE appliances are commonly used and described in the relevant literature:

Approach 1: Supporting PUE suppliers to offer PAYGO and other financing modalities

An obvious solution to address the high capital costs of solar PUE appliances is to offer pay-as-you-go (PAYGO) mechanisms that allow low-income households to purchase products with one down payment and several monthly, weekly, or even daily instalments. Offering PAYGO has proven to be a successful financing approach in the off-grid solar industry.[3][4]

While much can be learnt from PAYGO for solar stand-alone products, PUE suppliers need advice on how to set up PAYGO schemes that can accommodate the specifics of PUE products: for example, income from PUE used in agriculture is often seasonal, so PAYGO schemes should be adapted accordingly. PUE suppliers also need advice on how to manage credit risk internally without jeopardising their core business[5]. In addition, suppliers require sufficient capital to be able to offer supplier credit as a PAYGO scheme to their customers. This approach is therefore often not an option for MSMEs.

Approach 2: Partnerships between PUE suppliers and MFIs to jointly develop financing models for PUE products

Partnerships between PUE suppliers and MFIs to jointly develop financing models for PUE products aim to make PUE appliances affordable for end-users by building on the strengths of each partner. MFIs are often unsure about the viability of PUE loans due to a lack of experience in conducting due diligence on PUE business plans, and have concerns, for instance, about the ability of PUE assets to generate sufficient income for repay loans. The technical expertise of PUE suppliers helps MFIs assess the viability of PUE business cases. On the other hand, MFIs’ local staff structures and existing client portfolios help suppliers reach new PUE customers quickly. Partners of successful collaborations appreciate MFIs’ expertise in conducting rigorous client screening and educating farmers about credit risks involved[6]. However, the majority of these partnerships are not (yet) successful, as credit conditions do not meet customers’ repayment abilities, for example, when interest rates are too high in most cases[6][7].

Approach 3: Supporting MFIs in developing a new credit line for PUE products

Lending for PUE is rarely a business case for MFIs due to the low value of PUE assets (compared to other assets), the unsuitability of PUE appliances as collateral, and the lack of credit history of smallholder farmers and the associated high risk of default[8][9]. For instance, while a lot of research has focused on solar irrigation, cooling and drying, assumed to be viable PUE appliances[10][11][12], the economic viability of other PUE applications such as processing or transport is only given in specific contexts[10][13]. Despite these perceived barriers, much can be learned from financing agricultural production facilities and over-the-counter solar products[4][14]. Despite this prevailing PUE risk adversity, development partners are assisting MFIs in developing PUE loan products tailored to the local context, the target group, and asset type. In addition, new digital tools such as mobile money promise to lower transaction costs by reducing the necessity to have MFI field staff.

Approach 4: Access to credit for user groups

When lending to individuals is too risky due to their lack of credit history, collateral, and steady income, lending to groups can be an alternative. Members of groups such as producer cooperatives, credit unions, and savings and cooperatives (SAACOs), guarantee each other’s loans and thereby gain creditworthiness. For the lender, a group can be more attractive because of its combined purchasing power, lower default risk and lower transaction costs than lending to all the individual members of the group. For group members, group purchasing has the advantage of sharing the investment risk of buying a high-cost product[15]. Providing a costly PUE asset to a group promises positive socio-economic impacts at the community level that would not otherwise have occurred[16][17].

Approach 5: Demand-side subsidies

Demand-side subsidies are becoming an increasingly popular intervention option, especially for providing energy access to very poor populations who cannot afford market prices, considering SDG7 (access to energy for all) and the Leave No One Behind (LNOB) principle (UN 2021). For example, India is known for heavily promoting use of solar water pumps through demand-side subsidies, and has had success in uptake[18]. Demand-side subsidies consist of grants passed on to end-users to enable them to purchase energy access products they could not otherwise afford[19][20][21][22]. There are various delivery mechanisms to channel grants to end-users. They can be disbursed through national funds, vouchers or mobile money accounts.

Demand-side subsidies can also be channelled through intermediaries, such as suppliers, who have to pass on the grants to end-users by reducing their retail prices. When this type of subsidy is results-based, i.e. paid when PUE equipment is sold to end-users, it is generally referred to as demand-side Results-Based Financing (RBF), as opposed to supply-side RBF, which is discussed in the PUE Knowledge Product. RBF offers financial incentives for pre-defined results and does not cover the full cost of implementing the service. Instead of hiring a company to buy and install a solar water pump at a cooperative, for example, the company receives a smaller financial incentive to identify customers, sell and install pumps. The main challenge with demand-side subsidies is to avoid market distortions. Ideally, subsidies are provided only on a temporary basis, with a clear phase-out plan, and are targeted at vulnerable customer groups otherwise not able to participate in the market[23][24].

GBE approaches to end-user financing

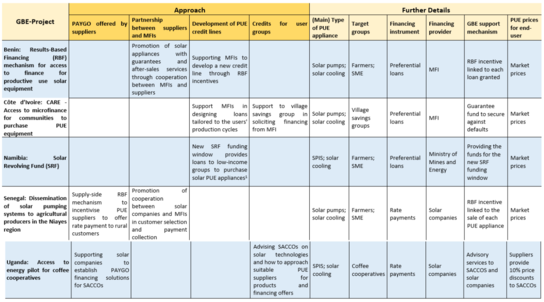

GBE has promoted several end-user financing schemes. These GBE projects are innovative in that they are new to the sector or country context, either in terms of funding or new technology. The financing approaches applied vary considerably from project to project, most as combinations or adaptations of the financing approaches described above. In some cases, the approaches used have been complemented by technical assistance activities, such as capacity building and awareness raising. The GBE interventions, their respective approaches, target groups and promoted types of PUE appliances are shown in Table 1 below.

Five case studies were conducted to provide a comparative analysis of these different GBE interventions. For the case studies, target groups were approached with a quantitative survey and central key project stakeholders were interviewed qualitatively. The main lessons learned and recommendations that can be drawn from the case studies are presented in the following section. All GBE interventions referred to in the section on lessons learned and recommendations are those listed in Table 1 below.

Lessons learned and recommendations

1. Financing instruments often need to be accompanied by awareness raising

First and foremost, it is clear that for financing approaches to increase use of solar PUE appliances to work, targeted end-users need to be informed about solar technologies themselves. It is not enough to simply design an attractive financing offer, but a demand for solar PUE appliances needs to be created for financing solutions to actually be used. For instance, GBE interventions in Benin and Senegal combined support for creating innovative financing approaches with awareness-raising activities for farmers and business owners about the possibilities of integrating solar appliances into their activities. Further details on how measures can be implemented can be found in the knowledge product on PUE.

However, end-users must also be aware of the availability and conditions of funding opportunities, as they will only take advantage of what they are aware exists. In the GBE intervention in Namibia, the main reason why productive users did not use a new financing window of the Solar Revolving Fund was the limited number of targeted awareness campaigns.

2. Facilitating partnerships between MFIs and suppliers proved to be very effective in improving end-user financing

Two of the GBE projects analysed for this knowledge product integrated partnerships between MFIs and solar companies as an important element in establishing new financing instruments, and were very successful in doing so.

In Benin, GBE provided RBF incentives to MFIs to encourage them to grant micro-loans to potential end-users. However, the MFIs needed support in assessing the benefits and risks of PUE appliances to set adequate terms and conditions for loans. GIZ facilitated partnerships between four MFIs and solar companies, specifically to ensure the quality of the solar appliances and installations and to reduce risks for the MFIs. Jointly agreeing on conditions for functional guarantees and after-sales services for PUE appliances ensures that financial products offered by MFIs are not jeopardised by low-quality products or inadequate maintenance and repair. At the same time, this contributes to development of a commercial market for solar PUE appliances and creates links between solar companies and MFIs which could lead to further collaboration in the future.

In Senegal, GBE also provided RBF incentives; this time to encourage PUE suppliers to offer rate payments to rural customers. Again, this was combined with encouraging collaboration between solar companies and MFIs, with the latter assisting suppliers in selecting clients and collecting payments. The difficult logistics required to reach customers in remote areas can present a major obstacle for solar companies entering this market. By working closely with MFIs, solar companies can benefit from their network and experience in providing financial services to rural populations and outsourcing tasks, such as operational monitoring. In addition, MFIs, with their large network of agents and experience in providing financial services to rural populations, offer potential for massive scaling-up and replicating intervention results.

These examples demonstrate how complementing the respective strengths of PUE appliance suppliers and MFIs can create synergies which increase the effectiveness of support schemes, such as RBF incentives.

3. Capacity building and further support for MFIs are needed to improve financial service provision in the long term

As MFIs often lack technology-specific knowledge related to solar energy and PUE appliances, it is recommended to provide accompanying capacity building to strengthen them as effective implementation partners. This was the case in the GBE intervention in Benin, for example, where capacity development has provided MFIs with relevant knowledge and has initiated developing in-house expertise on solar energy.

In addition, MFIs (as well as other financial institutions in developing countries) often have lengthy and complicated application procedures, which can discourage users from applying for funding or which delay approvals of funds. In the case of the Solar Revolving Fund in Namibia, this was found to be another reason for limited demand from productive users. Development partners can address this issue by supporting applicants in preparing the required application documents. However, this is unlikely to be a sustainable solution as it can only be provided selectively and for a limited period of time. Digitising and simplifying the application process can also contribute to making loans more accessible to a wider range of people in a more sustainable way.

Nevertheless, not only is the application process often cumbersome, but also the procedures for assessing loan applications are often time-consuming and can sometimes take up to several years. In the case of the GBE project in Benin, these sorts of delays in the loan approval process led to dissatisfaction on the part of the applying farmers and SMEs, as well as the participating suppliers of solar PUE appliances. Supporting MFIs and other local financial institutions to improve their internal procedures can therefore be a valuable complement to building the knowledge needed to properly assess technology-specific risks.

Finally, MFIs in particular, can be constrained in their ability to provide financing to end-users by limited access to refinancing possibilities. One of the MFIs involved in Benin expressed the need for tailor-made credit lines that they themselves could access to significantly increase their financing offerings for solar PUE appliances. However, this issue is better addressed by financial cooperation institutions (rather than technical cooperation organisations such as GIZ) due to their corresponding mandate and financial capacity.

4. Financial products need to be tailored directly to the needs and capabilities of their target groups

Existing financial offerings are often not suitable for low-income rural farmers and enterprises to be able to purchase and use PUE appliances. In the case of loans to farmers, for instance, repayment schedules often need to be aligned with harvest cycles, as these are times when farmers' incomes and ability to repay loans are highest. Another option is to offer loans with longer maturities, which reduces individual repayment rates and the risk of default. The ability to provide collateral, make advance payments and repay loans or pay in instalments varies greatly depending on the target end-users. This underlines the importance of investing adequate time and resources in diligently assessing the target groups to tailor financing offers specifically to their needs and financial capabilities.

Co-creating financial approaches with the participation of the target group can be an effective and successful means of achieving this goal, as was the case in the GBE intervention in Uganda, which focused on providing financing to coffee farmers to purchase solar pumps for irrigation and solar fridges for storing their produce. This brings together SACCOs of coffee cooperatives with suppliers of solar appliances, who offer PAYGO financing to the SACCOs. The SACCOs pass these on to their members at adapted conditions, which have been defined in direct cooperation with the coffee farmers to match them with their financial abilities, contributing to acceptance of the financing approach by the target group and reducing the risk of default.

Finally, it is important to note that providing bank loans or supplier credits (instalment plans) does not immediately lead to financial stability or economic growth. In fact, it can even lead to precarious financial situations if end-users' repayment capacities are not properly assessed. Therefore, tailoring financing products to the financial ability of end-users not only makes life better for lenders but, more importantly, can prevent potential economic hardship for borrowers.

5. Financing should be channelled through user groups, where such established structures exist, to increase trust and reduce risk of default

Projects aiming to introduce or improve financing options for solar PUE appliances often face problems of lack of trust among stakeholders. Quantitative data from Uganda shows that 10% of end-users do not trust financial institutions. On the other hand, financial institutions (and the same applies to companies providing PAYGO or other solutions) often do not trust that borrowers, especially low-income rural groups, can (re)pay loans or instalments. Trust-building measures can be an effective way of unlocking existing financing potential, and working with user groups is good approach.

The success of the GBE intervention in Uganda, described in the previous section, is largely because solar companies offering instalment payments linked with coffee farmers through SACCOs. As companies are more likely to trust larger groups than individuals, and individual farmers are more likely to trust familiar cooperatives than unknown companies, the cooperative can leverage trust from both sides to build a better platform for communication and business.

The GBE project in Côte d’Ivoire worked with similar end-user groups, called Village Savings and Loan Associations (VSLAs), and encouraged MFIs to provide them with credit. Trust on the side of MFIs increases through the simple fact that groups have greater financial capacity and lower risks of default than individuals. This is also confirmed by quantitative survey data. Of the end-users who took out loans to finance PUE appliances, 87% state that they are either sure (68%) or rather sure (19%) that they will be able to repay their loan. This figure is highest for cooperatives (100%), while individual farmers (90%) and MSMEs (75%) are less confident.

6. Ensuring proper use and functioning of solar PUE appliances reduces the default risk

The quantitative survey results show that an unexpectedly low return from solar-powered appliances is also a common reason for default risks. Only when solar PUE appliances are correctly installed and well maintained can they be used productively and contribute to income generation, increasing users’ ability to (re)pay loans and instalments.

Additional assurance to lenders can be provided by requiring supplier guarantees and aligning repayment periods with the duration of the guarantee so the solar PUE will function properly and contribute to income generation at least until loans have been repaid in full. This is another measure implemented in the GBE project in Côte d’Ivoire. It can be applied by analogy with PAYGO schemes, which can be designed so that all end-user instalment payments fall within the warranty period.

Supplier guarantees can be complemented by training end-users on how to make their investments profitable and how to carry out simple maintenance tasks, which proved to be successful in the GBE project in Senegal, for instance. Such training is important to ensure sustainable operation in the long term (beyond the warranty period). This aspect is further explored in the Knowledge Product on PUE.

7. Guarantee funds are another effective way to reduce default risks

Although working with VSLAs in Côte d’Ivoire helped reduce default risks, the lending MFI needed additional security. GBE deposited guarantee funds with the MFI, giving it the assurance it would get its money back. The guarantee fund covers any defaults, thereby reducing the MFI's risk, which in turn is reflected in lower interest rates, making the financing offer more affordable for the target group.

Moreover, a guarantee fund can continue to be used to secure further loans for similar projects, as long as it is not used to cover loan defaults. It can therefore be considered an instrument for maintaining (and scaling up) preferential financing offers over time.

8. Reusable funds can increase medium-term sustainability of financing schemes

Similarly, the RBF incentive used in the GBE intervention in Senegal is designed in such a way that it can be reused to continue financing other users. The mechanism works as follows: Together with an MFI, the RE supplier selects clients who wish to install PUE equipment (fridges or pumps). The clients pay a 10% deposit. The RE supplier installs the equipment and receives 50% of the equipment costs as an incentive payment from GBE, with the remaining 40% offered as a supplier credit to the clients. The clients, in turn, pay 90% of the equipment cost in instalment payments. The 50% already paid to the RE supplier through the GBE incentive, are used to facilitate the same financial mechanism for other clients. At the end of the GBE project, Senegal’s National Agency for Renewable Energies (ANER) will supervise the management of the fund and the replication process.

Reusable funds are a suitable instrument for maintaining a financing scheme over time, thereby contributing to replicating and up-scaling project results.

Conclusions

All five GBE interventions analysed for this Knowledge Product introduced either preferential loans offered by MFIs (or the Ministry of Mines and Energy in Namibia) or instalment plans offered by solar companies. These instruments let end-users purchase solar PUE appliances, despite their high costs and without having to make large upfront payments, which are often unavailable, at least in the short term.

For such financing mechanisms to be successful, it is important that borrowers are able to make their loan repayments, including interest, and that buyers using instalment payments can actually pay their instalments. This requires careful assessment of the specific financial situation of the target groups, as well as the potential impact of PUE appliances on the revenue and income of their respective businesses. Based on such an analysis, financing products need to be tailored to end-users’ needs and financial capabilities to ensure they do not impact their financial situation by taking on debt they cannot afford to repay. Other mechanisms and measures that help reduce the risk of default have been discussed. These include, for example, facilitating credits to user groups, ensuring proper use and functioning of solar PUE appliances, and providing guarantee funds to financial institutions.

Promoting partnerships between PUE suppliers and MFIs to jointly develop financing models for PUE appliances has proven to be particularly effective when providing financing to end-users, leveraging the individual expertise and strengths of both sides. Through their large network of agents and experience in providing financial services to rural communities, working with MFIs has great potential for scaling up and replicating such partnerships. However, MFIs need capacity building and further support to improve their financial service offerings in the long run.

Finally, it is important to underline that barriers to PUE financing are often multi-dimensional. Tackling individual obstacles while ignoring the bigger picture can leave cooperation projects aiming to improve end-user financing ineffective. For this reason, four of the five GBE interventions analysed for this Knowledge Product combined different financing approaches to address various barriers in parallel.

The GBE intervention in Côte d’Ivoire, for example, not only worked with MFIs to design loans tailored to users' production cycles, but also combined this with support for user groups to access these financing opportunities. GBE also provided guarantee funds to reduce the risk of default for the MFIs. Without this combination of measures, the MFIs would have been reluctant to provide the loans to the users and the users would hardly have been able to apply for them.

While combining the advantages of different approaches, it must also be noted that this type of project is more complex and difficult to implement, especially with the increased number of parties involved. This makes it necessary to invest sufficient time in the project preparation phase, involving all partners, to identify and address potential obstacles and challenges to reduce risk of delays or setbacks. While this applies to all development cooperation interventions, it is particularly relevant for the implementation of complex, multi-dimensional projects.

References

- ↑ IEA, IRENA, UNSD, World Bank, WHO, 2023. Tracking SDG 7: The Energy Progress Report. World Bank, Washington DC

- ↑ USAid, RMI, 2021. Microfinance loans for increasing access to off-grid solar products.

- ↑ IRENA, 2020b. Innovation landscape brief: Pay-as-you-go models. International Renewable Energy Agency, Abu Dhabi.

- ↑ 4.0 4.1 Sotiriou, A.G., et al., 2018. Strange Beasts: Making Sense of PAYGOo Solar Business Models. Consultative Group to Assist the Poor, Washington, DC.

- ↑ Waldron, Daniel, Holger Siek, Mattern, Max, Walter Tukahiirwa, 2021. Getting Repaid in Asset Finance: A Guide to Managing Credit Risk. Washington, DC.

- ↑ 6.0 6.1 Global Distributors Collective, 2022. Selling productive use of energy products to last mile consumers. Lessons learned. Global Distributors Collective.

- ↑ Engell, J., Tamer, C., 2020. Navigating the Complexities of End-User Financing with Futurepump: An Innovator Case Study. U.S. Agency for International Development (USAID).

- ↑ CGAP, 2020. Innovations in asset finance. Unlocking the potential for low-income customers.

- ↑ USAid, RMI, 2021. Microfinance loans for increasing access to off-grid solar products.

- ↑ 10.0 10.1 A2EI, 2021. Productive Use Report. Evaluation of Solar Powered Agricultural Technologies for Productive-Use Applications: A Modeling Approach.

- ↑ EL-Mesery, H.S., EL-Seesy, A.I., Hu, Z., Li, Y., 2022. Recent developments in solar drying technology of food and agricultural products: A review. Renewable and Sustainable Energy Reviews 157, 112070. https://doi.org/10.1016/j.rser.2021.112070

- ↑ Lighting Global, 2019. The Market Opportunity for Productive Use Leveraging Solar Energy (PULSE) in Sub-Saharan Africa. Report. World Bank Group, Washington, D.C.

- ↑ EnDev, 2020. Productive Use of Energy: Moving to scalable business cases. Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

- ↑ Water Energy for Food., 2022. Innovator Guidebook: Enduser Financing Models for Scaling Water-Energy-Food Innovations.

- ↑ Lighting Global, 2019. The Market Opportunity for Productive Use Leveraging Solar Energy (PULSE) in Sub-Saharan Africa. Report. World Bank Group, Washington, D.C.

- ↑ ARE, 2022. Understanding the Clean Energy Transition with Community-Driven Decentralised Renewable Energy projects in Germany and Sub-Saharan Africa.

- ↑ IRENA, 2020a. Innovation landscape brief: Community-ownership models. International Renewable Energy Agency, Abu Dhabi.

- ↑ Raymond, Anne and Abhishek Jain. 2018. Solar for Irrigation: A Comparative Assessment of Deployment Strategies. New Delhi: Council on Energy, Environment and Water.

- ↑ Africa Clean Energy, Gogla, et al., 2020. Design principles for demand side subsidies in the off grid solar sector. Briefing note.

- ↑ Gogla, 2021. Discussion Paper: How End-User Subsidies Can Help Achieve Universal Energy Access. GOGLA.

- ↑ SEforAll, Climate Policy Initiative, 2022. The role of end-user subsidies in closing the affordability gap.

- ↑ Tearfund, 2020. Designing sustainable subsidies to accelerate universal energy access. A briefing paper on key principles for the design of pro-poor subsidies to meet the goal of sustainable energy for all. Tearfund.

- ↑ ESMAP, 2022. Designing Public Funding Mechanisms in the Off-Grid Solar Sector. Energy Sector Management Assistance Program (ESMAP), World Bank, Washington, DC.

- ↑ Reiche, K., Teplitz, W., 2009. Energy subsidies: why, when and how? A think piece. Deutsche Gesellschaft für Technische Zusammenarbeit (GTZ) GmbH, Eschborn.