Renewable Energy Promotion in Rural Uganda

Renewable Energy Promotion in Rural Uganda

Project Approach

Despite significant improvements in recent years, Uganda still has a relatively low electrification rate of around 45 % in 2021. The rural electrification rate is even lower at only 36 %, in addition to grid electricity being expensive and often unreliable, particularly in rural areas. Many businesses use their own diesel generators, which are not only expensive but also contribute to air and noise pollution. The project aims to improve this situation by pro moting clean, affordable, reliable, and environmentally friendly solar technology solutions in rural and semiurban areas.The Green People’s Energy (Grüne Bürgerenergie, GBE) Project of the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) together with its project partners, the Uganda Manufacturers Association (UMA) and the contracted engineering firm, Solar Now, offered a free energy advisory package to 50 selected companies, cooperatives, and social institutions. This package, called “Solar Design and Advisory Support” (SDAS), includes information on the suitability and the design of Decentralised Renewable Energy (DRE) solutions, based on an onsite power supply assessment. This includes information on variation of the energy needs over a typical working day, and an economic analysis of the payback time and amortization period of a corresponding solar system. It also delivers technical advice on Renewable Energy (RE) and energy efficiency measures.The project activities also include trainings as well as webinars through UMA to disseminate the information to a broader audience.

In order to facilitate the implementation of the proposed energy investments, one component of the project is devoted to match making between the project beneficiaries (cooperatives, enterprises, farmers and social institutions) and potential sources of financing. In this component, project beneficiaries were put in contact with renewable energy financing institutions. The objective of the matchmaking sessions is to bridge the critical information gap between the beneficiaries as project developers and energy financiers and inform them about energy funding opportunities as well as renewable energy support programs. To that end, the project creates a pool of energy finance and investment companies and financial institutions with a short description of their respective profiles, for example minimum and maximum ticket sizes, financial models, interest rates and source of funding. Then the project matches the energy financiers with beneficiaries that fit their investment criteria and arranges for physical or virtual meetings for a first discussion about their mutual objectives and an agreement on a way forward.

Methodology of Data Collection

The data for this case study report was collected through a project document review, eight qualitative interviews with two representatives of GIZ, three representatives of the implementing partner organisations, two solar supplier companies and two agricultural businesses, and the political counterpart, as well as a quantitative survey among the consulted beneficiaries of which 27 responded. The case study was conducted between April and June 2023.

Key Findings

Project Achievements

The project shows the great interest of the Ugandan industry in lowering energy costs, specifically with agribusiness operations, such as cotton harvesting, cocoa production, other crops and vegetables, juicing, chilling, and fish farming. Interviewees mentioned that the number of interested SMEs was twice as high as could be accepted by the project. The selected 50 beneficiaries are mainly located in northern Uganda. In addition to various factories, cooperatives and social institutions, seven commercial farms including coffee plantations, cassava growers as well as meat producers with meat and milk processing, took part in the project.

The beneficiaries received customized alternative energy recommendations such as offgrid solar solutions, hybrid solutions e.g. gridtied systems and diesel hybrid solutions. The systems were compared to already existing energy sources for each company, with the comparison taking into consideration the total investment, costs per kilowatthour, system size, total solar generation, annual savings, expected payback period, and other parameters. The assessment reports illustrate how the use of renewable energy can be competitive.

The beneficiaries obtained an overview of their energy profile, including(1) how to save energy,

(2) where to invest in energy management,

(3) how to manage energy sources and finally

(4) an indication on investment necessary for satisfying the current energy needs with solar energy.

For example, the analysis for the Gulu Community Dairy Farmers Cooperative Society Ltd. used their annual costs for grid electricity of 12 million Ugandan Shilling (UGX) as a starting point and juxtaposed it with two solar options. A grid tied solar system would cost them 17 million UGX, translating into energy savings of 3 million UGX per year and a payback period of 5 years. A hybrid solar system with battery storage would save them 4.2 million UGX and pay for itself within 9 years. Generally, the commercial farms and the meat processing facility are facing investments between 10,000 EUR – 400,000 EUR, based on the energy assess ments provided by the project.

One of the companies benefitting in the project stated they are currently participating in a Ugandan Green Financial Accelerator (UGEFA) programme, which is funded by the European Union. The blended financial package that they put together with the help of UGEFA comprises a concessional loan (free of interest) for investment in green finance and a grant, triggered by the audit carried out by the project. The company is convinced that they will continue to work with solar power and mention the cross cutting benefits in cost control, as well as noise and pollution reduction. This aligns with their consumers’ interest in greener processing and healthier food. The approach comprised of a combination of awareness raising, outreach and webinars with direct onsite assessments and advice on possible investments and their advantages. The organizations behind the project – GIZ and Solar Now – serve as credible advisors to the beneficiaries. Specifically, it was mentioned in the interviews that there is a view pervasive in the Ugandan commerce and industry community that solar power is not very useful in industrial applications. The project was able to partially counteract these opinions.

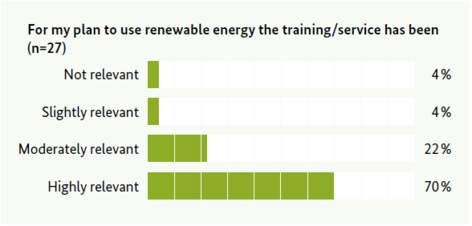

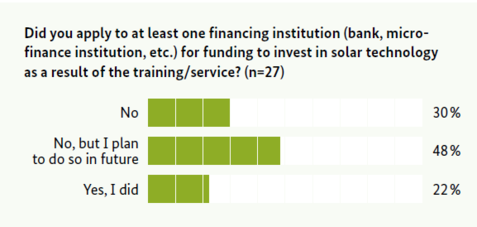

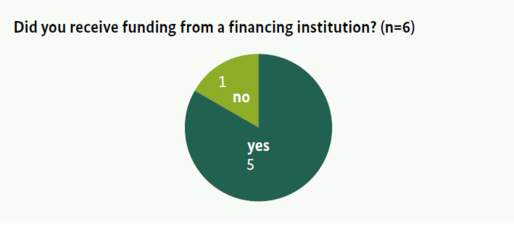

The survey among the 50 selected beneficiaries indicates that the capacity building was well received. 70 % of the participants consider the training/advisory service “highly relevant” for their plans to use renewable energy, another 22 % “moderately relevant”(see figure 1). 6 of the 27 surveyed companies had applied for financing at the point of the survey (see figure 2).At the time of the survey, one of them was in advanced stages of negotiations for funding. An 8.8 kWp solar system demonstration site has been installed by the project to showcase renewable energy usage and its impact towards energy cost reduction. UMA has a membership of over 1500 companies/businesses across various sectors, including agri-businesses, manufacturers, industrialists, service companies and cooperatives. The system’s location at the UMA head office there fore offers MSMEs and large enterprises from all sectors, a direct perspective on solar energy. The display system at the UMA head office showcases solar power generation and thus demonstrates the relevance of solar energy and energy efficiency to the project’s private business target group.The project also engaged successfully with the Government of Uganda. One officer of the Ministry of Energy and Mineral Development (MEMD), was designated to support the project and subsequently, for example, joined project staff on field trips, gaining firsthand insights and a better understanding of the impacts of rules and regulations on companies’ competitiveness. A representative of the MEMD notes that the project was managing the processes around energy assessments and recognizing opportunities through the discussion of the assessment reports. The Ministry also supports the engagement by taking part in meetings with the potential finance partners.

Intermediate Impact

The sum of the different activities implemented has resulted in the promotion of RE. This bears the potential of stimulating local demand and attracting funding and more donor engagement. For example, in the demonstration facility, a display visualizes the savings and thus the benefits of solar energy: While its target was set to reach 800,000 UGX per month, it is typically saving about 1 million UGX of energy costs for the facility. The project has been able to bridge a critical gap between MSMEs and energy financiers, this is especially the case where beneficiaries present their assessment reports to banks, energy companies and other energy financing as a credible basis for investment. Further impacts of project activities could occur if the advised beneficiaries actually make investment decisions, which may not be the case until some time after the project is completed.

Challenges in Project Implementation

Across the board, interviewees found a major challenge in the financing of the installations of the technologies suggested in the assessments. The sheer size of the investments was daunting to some of the companies. SMEs engaged in the project aim to substitute generators and grid energy, but as they are relatively small, the large investments are hard to manage. The match making activities of the project to facilitate financing (see project description) could not solve this problem. Local stakeholders suggested that a larger financing facility for these types of invest ments would be helpful, specifically given the extremely high interest rates on loans in Uganda.

The project faced various other challenges. Physically, the project was challenging from the start due to the long distances that had to be covered within Uganda, a common problem for rural energy projects, and factored into the project design. This was compounded by the COVID19 pandemic, which further hampered the implementation of the project. A late start required an extension of the project for an additional year. Two other challenges identified were the lack of energy literacy on the part of SMEs and the fact that the format of the energy assessment reports did not fully meet the needs of the beneficiaries. Project counterparts noted that the various project steps, from the application process, through the consultation and decision making process, to the actual investment decisions, can take one to two years. From the perspective of the companies, this is very long, particularly in the economic turmoil of the pan demic period, when some companies were restructured between assessment and investment.

Lessons Learned

An important finding is that few companies have applied for fund ing at all, and of those that have applied, five were not successful (yet), as figure 3 shows. Four of them do not have the equity required by the financial institution, one is still in the application process. The reasons why the majority of companies have not (yet) applied for funding are manifold. Some companies are simply not ready for an investment because they are still in the planning stage or currently procuring new machinery. But most of those who have not yet applied anticipate challenges with financing. For example, they do not know how to apply, do not have the required documentation, and/or do not have access to, let alone trust in, financial institutions. Several survey responses relate to financing condi tions, including high interest rates, high collateral requirements or high payback rates which do not allow the companies to afford these loans. Reservations also remain on the part of financial institutions. They are reluctant to allocate funds for largescale RE investments due to a lack of information and/or confidence in the performance, returns and varying quality of RE in Uganda. RE investments are perceived to be high risk, resulting in high interest rates (see above). This highlights the need for further action on the financing aspect of similar projects. Future projects with this approach should plan for more extensive support in the accesstofinancing stage of the companies’ investment cycles.

Observers and beneficiaries furthermore emphasized that the physical engagement with the companies on site is key. After an initial engagement, companies need some time to digest the received information. After that, the details on the bankable proposals and the matchmaking with financiers should be imple mented with an intensified effort with those companies that show interest, taking into account that the financing process might take a long time. These points have to be considered for the necessary duration of similar projects. Stakeholders also suggest that GBE could have asked the beneficiaries to contribute cofinancing for the technical assessment. They speculate that the companies might have been more engaged and utilized the results of the assessment more decisively.

In fact, some stakeholders reported that companies are expecting more direct support including investment subsidies from GIZ. Asked for the reason why no implementation has happened, one company explicitly stated in the survey “Waiting for the people who trained us to bring us what they promised.” Sound management of expectations is often also a factor for success.The format of the energy assessment report is crucial for uptake. Beneficiaries had some suggestions to make the energy assessment reports more useful in the future. Specifically, they found that the prescribed scope did not fully address their information needs, e.g., where it came to their specific situation. On the other hand, some parts of the report also went into too much detail, indicating that the selection of priority areas of the report could be improved.

Businesses also noted that going off the grid and relying fully on solar is risky because it does not allow for spontaneous production expansion or load growth. The energy assessments only looked at the current energy consumption and its substitution by solar energy. Potentially a staggered approach could be tested that first provides a superficial orientation to the companies and then delves into more detail only on relevant options. Interviewees highlighted the commitment and credibility of the consultant team that was engaged with this project as an important factor. Another successful aspect was partnerships. UMA’s involvement in this project helped to gain access to the target group and enabled a larger impact, nationwide. The collaboration with the Export Initiative of the German Ministry for Economic Affairs and Climate Protection (BMWi) and UGEFA also enhanced replic ability and investment likelihoods.

Sustainability of the Intervention

UMA and Solar Now will continue to reach out and promote RE solutions, as they are sound options to enhance the competitiveness of the Ugandan production sectors, specifically in the agri-cultural areas. In addition, in the longterm, the demonstration system installed at UMA can raise awareness of the use of RE and its impact on reducing energy costs. Further sustainable effects of the project activities could occur if the advised beneficiaries would actually make investment decisions, which may not happen until some time after the end of the project.

Conclusion and Outlook

The project approach demonstrates that the potential and interest for solar power in the rural industries in Uganda is large and provides significant and costeffective opportunities to enhance their competitiveness and reduce their environmental burden. 50 rural and semirural MSMEs and large enterprises are now aware of the financial and environmental impacts that a shift to solar energy would bring to them. Now they need to take the next steps to find financiers for the proposed investments. While grid energy is very expensive and not very reliable in rural Uganda, solar systems are also not cheap. Specifically, to provide uninterrupted power supply, batteries are required with high investment costs. This means that financial assessments and the ability for the businesses to compare different energy system designs with respect to their economic viability as well as the affordability of the investments, and the specific energy requirements of the businesses are very important but also very complicated. Often, the inhouse capacity of the companies is insufficient to identify the best options from a financial and technical perspective. In addition to technical training, therefore, financial training based on a detailed needs assessment could be considered for future project activities.

Tailored future project activities could allow to differentiate the target group not only by size but also by sector, and pro vide bespoke solutions for specific groups. Such sector specific approaches might also enhance the bankability and access to investment funds, which proves to be a major barrier to the implementation of the RE solutions. The short project implementation period does not allow for all projects to be successful in raising the finances needed for the investments. There is the risk that many proposals can get stuck at or shortly before the stage of bankability, and ultimately are not implemented successfully. More sustainable impact might be possible with a larger and longer project and with a specialised financing facility as suggested by some local stakeholders.