Serbia Energy Situation

Capital:

Belgrade

Region:

Coordinates:

44.016521° N, 21.005859° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Serbia is a landlocked country located in the Balkans. It is bordered by Hungary to the north, Romania to the northeast, Bulgaria to the southeast, North Macedonia to the south, Croatia and Bosnia and Herzegovina to the west, and Montenegro to the southwest. Serbia claims a border with Albania through the disputed territory of Kosovo.[1]

Serbia has been in the process of joining the European Union since 2014.[1]

Energy Situation

In the year 2022, the primary source of energy in Serbia, as reflected in the country's total energy supply, was coal, accounting for 43% of the total. This was followed by oil, which constituted 27% of the total energy supply. Coal accounted for 66% of electricity generation, followed by hydropower with 26% and natural gas (4%).[2]

In Serbia, the proportion of modern renewable energy sources in final energy consumption was around 27% in 2021. In terms of electricity generation, 28% of the electricity is generated from renewables, predominantly from hydropower (91%).[2]

Serbia has been making efforts to increase its share of renewable energy in its energy mix. The country has set targets for the development of renewable energy sources, particularly in the areas of wind and solar power.

Serbia has been investing in wind energy projects, and several wind farms have been under development or already operational. The government has shown support for wind energy as a means to diversify the energy mix and reduce dependence on conventional sources.

Solar power projects have also gained attention, with the government implementing policies to encourage solar energy development. Solar farms and rooftop solar installations have been part of the renewable energy expansion plans.

Serbia has a long history of utilizing hydropower, and it continues to be an important part of the country's energy mix. Existing hydropower plants have been upgraded, and there have been discussions about the potential for new hydropower projects.

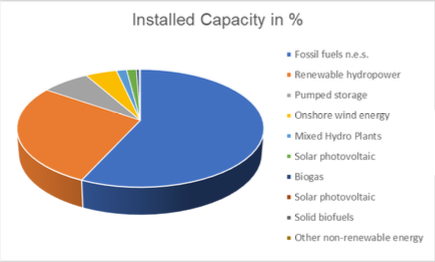

| Technology | Grid Connection | Year | Capacity (MW) |

|---|---|---|---|

| Solar photovoltaic | On-grid | 2022 | 11.94 |

| Solar photovoltaic | Off-grid | 2022 | 125.06 |

| Onshore wind energy | On-grid | 2022 | 398.00 |

| Renewable hydropower | On-grid | 2022 | 2353.99 |

| Mixed Hydro Plants | On-grid | 2022 | 129.00 |

| Pumped storage | On-grid | 2022 | 614.00 |

| Solid biofuels | On-grid | 2022 | 2.40 |

| Biogas | On-grid | 2022 | 33.70 |

| Fossil fuels n.e.s. | On-grid | 2022 | 4842.12 |

| Other non-renewable energy | On-grid | 2022 | 1.00 |

Energy Generation and Consumption

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity production [GWh] | 35.626 | 35.804 |

| Gross electricity consumption [GWh] | 32.318 | 36.43 |

| Consumption structure [GWh] / industrial, transport, services and other | 15.321 | 16.581 |

| Consumption structure [GWh] / households (residential customers) | 13.718 | 13.877 |

Net Import & Net Export

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Net imports [GWh] | 5.07 | 6.984 |

| Net exports [GWh] | 5.675 | 6.333 |

Energy Losses

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Losses in transmission [%] | 2,47% | 2.54% |

| Losses in distribution [%] | 11,10% | 10% |

Transmission Network

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Horizontal transmission network [km] | 9861,8 | 9.622 |

| Horizontal transmission network [km] / substation capacity [MVA] | 31.958 | 30.846 |

No of Consumers

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Electricity customers / total | 3.690.708 | 3.725.580 |

| Electricity customers / non-households | 409.183 | 419.407 |

| Eligible customers under national legislation | 3.690.708 | 3.725.580 |

Internal Market

| Description of data [unit] | 2020 | 2021 |

|---|---|---|

| Internal market / electricity supplied to active eligible customers [MWh] | 14.267.000 | 15,231,000 |

| Horizontal transmission network [km] / substation capacity [MVA] | 49% | 50% |

Renewable Energy Potential

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Total installed power generation capacity | MW | 8,472.00 | 12,588.00 |

| Renewable capacity | MW | 4,195.00 | 9,222.00 |

| Hydropower | MW | 2,941.00 | 2,941.00 |

| Wind - onshoore | MW | 1,026.00 | 1,796.00 |

| Biofuels solid, liqluid, gaseous) | MW | 0.00 | 0.00 |

| Solar PV | MW | 54.00 | 898.00 |

| Geothermal | MW | 170.00 | 3,582.00 |

| Non-renewable capacity | MW | 0.00 | 0.00 |

| Coal | MW | 5.00 | 5.00 |

| Gas | MW | 198.00 | 198.00 |

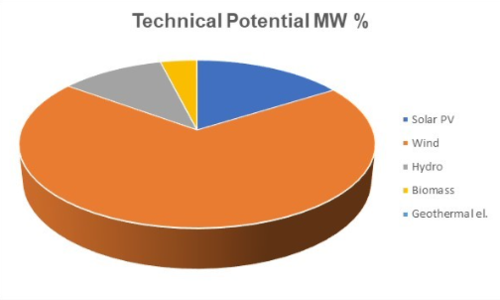

| Technologies | Technical Potential MW |

|---|---|

| Solar PV | 6,901.7 |

| Wind | 29,670.0 |

| Hydro | 4,736.0 |

| ≤ 10 MW | 500.0 |

| > 10 MW | 4,236.0 |

| Pumping | 0.0 |

| Biomass | 1,671.0 |

| Biogas | 674.0 |

| Solid Biomass | 997.0 |

| Biowaste | 109.0 |

| Geothermal el. | 10.0 |

| Total | 42,988.7 |

As we can see, if Serbia would use its entire technical potential,ti would increase the generating power by 405%, and would be more than autoefficent of the WB6.

Fossil Fuels

Greenhouse gas emissions

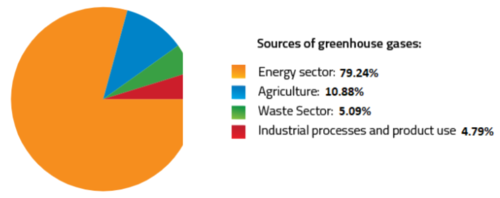

Greenhouse gas emissions in Serbia are around 65,5M tons of CO2 equivalent.

| Unit | Reference Case 2030 | Remap 2030 | |

|---|---|---|---|

| Energy-related CO2 emissions | [Mt CO2 /yr] | 46.7 | 39.2 |

Key Problems of the Energy Sector

Serbia faces several challenges in increasing the share of renewable energy in its energy mix. Addressing these challenges requires a comprehensive and coordinated effort involving government, industry, and the public to facilitate a successful transition to a more sustainable and renewable energy future.

| Dependence on Coal | Serbia has traditionally relied heavily on coal for its energy needs. Transitioning away from coal to renewables involves significant economic and political challenges. |

| Investment and Funding | The initial costs of establishing renewable energy infrastructure can be high. Securing sufficient investment and funding for renewable projects may pose a challenge. |

| Grid Integration | Adapting the existing energy grid to accommodate the intermittent nature of renewable sources, such as solar and wind, can be complex and expensive. |

| Policy Framework | The development of a supportive policy framework for renewable energy is crucial. Challenges may arise in creating and implementing effective policies to encourage investment and development. |

| Public Awareness and Acceptance | There may be a lack of awareness or acceptance among the general public regarding the benefits and necessity of transitioning to renewable energy sources. |

| Land Use Issues | Identifying suitable land for renewable energy projects, such as solar farms or wind parks, and addressing potential conflicts with existing land uses can be challenging. |

| Technological Innovation | Keeping up with advancements in renewable energy technologies and ensuring their efficient integration into the energy system can be a hurdle. |

| Regulatory Barriers | Existing regulations may not be conducive to the development of renewable energy projects. Addressing regulatory barriers and streamlining the permitting process is essential. |

| Energy Storage | The integration of energy storage solutions is critical for managing the variability of renewable energy sources. Developing cost-effective and efficient energy storage technologies can be a challenge. |

| Workforce Skills | Building a skilled workforce capable of designing, installing, and maintaining renewable energy systems may require training and education programs. |

| Political Will | Political commitment to the transition to renewable energy is essential. Changes in political leadership or shifts in policy priorities can impact the progress of renewable energy initiatives. |

| Interconnection with Neighbors | Collaborating with neighboring countries for regional energy integration and the development of cross-border renewable energy projects may face geopolitical and technical challenges. |

| Economic Considerations | Balancing the economic interests of different stakeholders, including traditional energy sectors, and ensuring a fair and sustainable economic transition can be challenging. |

| Environmental Impact | Careful consideration of the environmental impact of renewable energy projects is necessary to avoid unintended consequences and ensure long-term sustainability. |

| Global Market Dynamics | International market dynamics, including the availability and cost of renewable energy technologies, can influence the feasibility and competitiveness of renewable projects in Serbia. |

Policy Framework, Laws and Regulations

In the Republic of Serbia, the production of electricity from renewable energy sources is mainly promoted through a feed-in tariff.

In the Republic of Serbia, the main support scheme for the production of electricity from renewable energy sources is a feed-in tariff, regulated by the Energy Law and special Decrees.

The plant operators need to obtain the status of a „privileged power producer“ („povlašćeni proizvođač električne energije“) in order to acquire the right to a price support for the generated electricity under the legal requirements. After having concluded a power purchase agreement with the plant operator, the guaranteed supplier Elektroprivreda Srbije is legally obliged to buy the specified amount of electric energy from privileged producers at an incentive price .

The amount of the feed-in tariff is determined in the Decree on Incentive Measures for Electricity Generation from Renewable Energy Sources and High-Efficiency Cogeneration of Electricity and Heat and it mainly depends on the type of RES technology.

Support schemes

The guaranteed supplier is statutorily obliged to purchase electricity from renewable energy sources at an incentive price.

| Feed-in tariff | The electricity market operator is obliged to pay a regulated tariff for the electricity generated from renewable energy sources. |

Institutional Set up and Key Actors in the Energy Sector

The following key actors work together within the regulatory framework to ensure the efficient functioning, sustainability, and development of the energy market in Serbia. Collaboration among these stakeholders is essential for achieving energy security, promoting renewable energy, and meeting the country's energy goals.

| 1. Ministry of Mining and Energy: | The Ministry of Mining and Energy is responsible for formulating and implementing energy policies in Serbia. It plays a key role in shaping the regulatory framework, energy development plans, and strategies for the energy sector. |

| 2. Energy Agency of the Republic of Serbia (AERS): | The Energy Agency is an independent regulatory body overseeing the energy sector in Serbia. AERS is responsible for regulating and overseeing electricity and natural gas markets, ensuring fair competition, and protecting the interests of consumers. |

| 3. Electric Power Industry of Serbia (EPS): | EPS is a state-owned power utility in Serbia. It is involved in electricity generation, transmission, and distribution. EPS plays a significant role in the country's energy landscape. |

| 4. Serbian Transmission System Operator (EMS): | EMS is the Transmission System Operator responsible for managing the high-voltage electricity transmission system in Serbia. It operates, maintains, and develops the transmission infrastructure. |

| 5. Distribution System Operators (EPS Distribution and other regional operators): | EPS Distribution and other regional operators are responsible for managing the low and medium-voltage electricity distribution networks in Serbia. They distribute electricity to end-users, maintain the distribution infrastructure, and ensure the continuity of electricity supply. |

| 6. Independent Power Producers (IPPs): | Independent Power Producers are private entities involved in electricity generation. They contribute to the diversification of the generation mix and may operate renewable or conventional power plants. |

| 7. Investors and Financing Institutions: | Investors, both domestic and foreign, play a crucial role in funding and developing energy projects in Serbia. Financing institutions, such as banks and international financial organizations, provide funding and support for energy infrastructure projects. |

| 8. Consumers and Industrial Users: | End-users, including residential, commercial, and industrial consumers, are essential actors in the energy market. Their energy consumption patterns and demand influence market dynamics. |

| 9. Government Agencies and Local Authorities: | Various government agencies and local authorities are involved in permitting, land-use planning, and environmental assessments for energy projects. They also play a role in setting policies that impact the energy sector. |

| 10. International Organizations and Donors: | International organizations and donor agencies may provide support, technical assistance, and funding for energy sector development projects in Serbia, especially those focused on sustainability, renewable energy, and regulatory reforms. |

| 11. Environmental Agencies: | Environmental agencies, such as the Ministry of Environmental Protection, play a role in ensuring that energy projects adhere to environmental regulations and standards. |

| 12. Market Operator (EMS - Market Operator): | The Market Operator facilitates the electricity market by managing market transactions, ensuring fair competition, and promoting market efficiency. It operates in accordance with the regulatory framework and market rules. |

Further Information

References

Further sources:

- IRENA, Renewables Readiness Assessment: Serbia, 2021

- IRENA, Renewable Energy Prospects for Central and South-Eastern Europe Energy Connectivity (CESEC), 2020

- IRENA, Cost-competitive renewable power generation: Potential across South East Europe, 2017

- LEGAL SOURCES ON RENEWABLE ENERGY res-legal.eu

- Energy Community, Serbia