South Africa - Policy, Legal and Regulatory Framework in the Energy Sector

Introduction

“This article is part of the “The South African Power Sector - Country Report” written by *****, Hlologelo Kekana, Lanrewaju Fajimi, Mpho Mataboge, Noreen Kidunduhu, Penny Mathumba and Alvin Tepo Togba.”

A. STRUCTURE AND OWNERSHIP OF THE SOUTH AFRICAN POWER SECTOR

(i) The power sector and electricity market

The power sector is narrowly defined as “a sector engaging in the production, processing, distribution and sales of electric power in forms suitable for feeding industrial processes and household equipment, and involved in the processing, distribution and sale of electric power from sustainable sources [1]. The term “power sector” includes the production, transmission, and trade of not just electricity, but also gaseous fuels, steam-extracted heat energy, hot water, or wind. In relation to electricity – power sector refers to the production and trade of electricity (i.e. generation, transmission, and distribution), further subdivided into the professional and industrial segments. The professional industry/segment consists of companies whose primary activity is the production and distribution of power and the industrial segment generates power for their own use and surplus power may be delivered to the grid. A new area of the power sector that is gaining popularity and relevance is “presumption”. Thus, refers to entities that produce and consume their own electricity of smaller capacity than the industrial segment (e.g. households, small farms). Power/electricity is a commodity. Therefore, there exists an exchange that enables purchases through different mechanisms termed as an electricity market.

(ii) The case of South Africa (SA)

Note worthily, SA has started to recognize the importance of renewable power sources. Although IPP’s (independent power-producers), who mainly use renewable sources of energy, only provide 5%-10% of electricity generation. There is potential for the renewable energy IPP’s to play a bigger role, with SA’s Renewable Energy Independent Power Producer Programme (REIPPP) being lauded for its procurement design and private sector participation. The programme commenced in 2011 (known as “Round 1”) and in 2021 at “Round 5”. Furthermore, the president has relaxed licensing requirements for embedded generation, which is believed to induce more “prosumer” based renewable energy options.

The power sector is structured as a combination of a natural monopoly and an single buyer model – the latter means that IPP’s can generate electricity which is to be sold to Eskom’s grid and distributed as Eskom's supply [2]. Recent amendments to regulations involving embedded generation (discussed in section 5) show slight movements away from this model. Currently, 173 municipal-owned producers and 13 private distributors are licensed to distribute and sell power to consumers. From a market perspective, Eskom uses its monopolistic position to supply power to other utilities, large industrial customers, commercial and residential customers, and also exports to the Southern African Power Pool (SAPP).

B. THE REGULATORY ENVIRONMENT – ELECTRICITY ACT, POLICIES AND SECONDARY REGULATION

Three key pieces of regulation govern the planning around electricity delivery. These are: the National Electricity Act No 34 of 2008 (NEA); National Regulator Act No 40 of 2004 and Electricity Regulation Act No 4 of 2006. Some of these were detailed in the preceding section. This section discusses each act as part of the overall regulatory environment for the sector.

(i) The Electricity Regulation Act No 4 of 2006 (ERA)

The ERA has a primary objective of establishing a framework for the supply of electricity (shown in Tables 5.1 and 5.2). It also empowers National Energy Regulator of South Africa (NERSA) to be a custodian and enforcer of this framework. Additionally, it empowers the Minister of Minerals and Energy to, amongst other things, (1) determine the current amount of new energy to be generated as well as from which sources (2) state the requirement for new generation capacity, including procurement through a competitive and fair tender process and the extent of private sector involvement. From a NERSA perspective, the ERA defines the powers and the functions of the regulator, especially as it regards tariff setting and setting minimum technical standards for the process. Tariff setting and methodologies themselves are outlined in the Electricity Pricing Policy (2008).

| Document | Year | Provisions/function |

| NDP 2030 | 2012 | Sets goals for energy investing to ensure reliable, efficient, and affordable electricity delivery for economic growth and social equity.

Notes the need to reduce energy-related pollution and greenhouse gas emissions to mitigate climate change impacts, in line with Nationally Determined Contributions (NDC) to the United Nations Framework. Creates an independent transmission system operator, endowed with power planning, procurement, and contracting functions. |

| IRP 2010-2030 | 2011 | Detailed vision of the electricity sector, drafted through expert and public consultation, laying out a 20-year plan to allocate future power generation needs and priority sources.

Offers a legal basis for generation procurement for Eskom and the IPP Office, guiding investments across the power sector and defining the overall generation mix. Updates to the IRP often face uphill battles due to the politically-charged nature of the sector. |

| IRP 2019 | 2019 | Generation capacity additions of 39.7 GW from 2019 to 2030.

Ease the impact of decommissioning coal plants to protect the security and stability of the future power grid (recognizing promise of new generation). Prioritize private generation investments (except in nuclear power). Add 7.2 GW new coal sources, 1.9 GW of nuclear (extending life of Koeberg Power Station), and 3 GW of gas/diesel turbines. Add 25.4 GW from renewable generation, including 2.5 GW from hydropower (through interconnection with the Democratic Republic of Congo), 22.9 GW from wind, solar PV, and concentrated solar power. Add 2 GW of storage capacity and 500 MW/year other capacity additions, e.g., distributed generation (from retail, commercial, and industrial customers), co-generation, biomass, and landfill (waste-to- energy). |

| RERESI, DPE | 2019 | Sets out steps for long-term sector sustainability, including restructuring Eskom.

Sets out an incremental process to separate Eskom’s core functions of generation, transmission, and distribution into distinct subsidiary entities. Created a separate transmission operator in March 2020 to fulfil the role of purchasing, system operation, and grid management. Legally separated generation, transmission, and distribution entities by 2021. Offers a much-needed package of fiscal injections amounting to 105 billion South African Rand (ZAR) (US$ conversion) to service debt obligations, determined by National Treasury and DPE and according to Eskom’s performance, restructuring, and cost reduction. |

| Electricity Regulation Act | 2006 | Defines NERSA’s powers and functions of tariff-setting, licensing, and setting technical standards.

Empowers ministers responsible for energy to determine how much energy may be procured in a certain timeframe, and the authorized parties to the transaction. Electricity Pricing Policy (2008) outlines tariff-setting and pricing methodologies. Only awards generation licenses to new plants according to the capacity allocation defined by the IRP’s planned generation mix. SSEGs of up to 1 MW are exempt from licensing requirements, reducing obstacles for third parties to connect small renewable generation facilities to the grid. |

Source[2]

| Institution | Role/mandate in the electricity sector |

| Policy-setting and planning bodies | |

| National Treasury | Manages public spending and approves departmental budgets. |

| Department of Mineral Resources and Energy | Drafts power sector legislation, policies, and plans, including pricing policy for National Energy Regulator of South Africa (NERSA) to regulate tariffs, to secure sustainable energy and mineral resources. |

| Oversees: IPP Office | Conducts competitive procurement for new generation from IPPs. |

| Department of Public Enterprises (DPE) | Sole shareholder of Eskom; oversees efficiency and financial sustainability of all state-owned enterprises. |

| Dept. of Cooperative Governance and Traditional Affairs | Supports municipalities to deliver core services of electricity supply. |

| Department of Environmental Affairs | Drafts legislation on air quality standards, and promotes clean, efficient energy in line with international obligations. |

| Department of Trade and Industry | Drafts commercial and industrial policy to promote inclusive and equitable economic development. |

| National Planning Commission | Expert advisory body to draft, promote, and monitor implementation of the NDP.

Consults public on pathways for a just transition in line with the NDP. |

| State-owned enterprise | |

| Eskom | Vertically-integrated state-owned electricity generation, transmission, distribution, and retail company. |

| Statutory regulatory agencies | |

| NERSA | Regulates and determines electricity tariffs following Electricity Pricing Policy.

Grants licences for generation, transmission and distribution operators according to the IRP. Sets and monitors technical supply and service standards. |

| Private sector, civil society, unions | |

| Renewable energy industry and IPP associations | Various IPP associations advocate for IPPs’ interests in the country, e.g. to improve the policy environment for private participation, run transparent auctions, and increase renewable energy share in the IRP. |

| Energy-Intensive Users Group | Represents large industrial and mining customers of Eskom, which collectively make up 40% of Eskom sales.

Lobbies for favourable prices for large industrial customers, and now backs regulatory reforms for competition from IPPs. |

| Trade unions | Advocate for electricity sector workers’ interests and on the affordability of power.

Oppose Eskom restructuring and decommissioning of coal generation due to expected job losses. |

| Community, social & environmental groups | Various community groups and non-governmental organizations voice civil society concerns, including for social and environmental justice in realizing a just transition, e.g., the Centre for Environmental Rights, Earthlife Africa, Greenpeace, Project 90 by 2030. |

Source[2]

C. ELECTRIFICATION PLANS

According to the University of Cape Town’s Energy Research Centre, SA’s electrification programme was largely successful between 1990 and 2011. Access to electricity increased from 35% in 1990 to 84% in 2011 [3]. After a political transition, the electrification programme achieved success due to a number of key enablers: (1) Eskom had access to capital, infrastructure and skills and capacity- the economy at the time was also very energy intensive. This helped it fund the electrification programme from 1991. For example, Eskom paid R300 000 as a grant to local authorities, in support of their electrification programme (2) The fiscus was also in a position to fund this transition with the formation of the Integrated electrification Programme (INEP), which was vested in the DMRE. In addition, Free Basic Electricity (FBE) was introduced in 2004 for poor households (who were given the first 50kWh to use for free) (3) the electrification plan had supportive policies.

The electrification rate and progress were threatened by lack of power infrastructure maintenance, Eskom’s deteriorating financial state, corruption indecisive policy action (detailed in section 2) The country’s electrification aspirations were set out in Chapter 5 of the National Development Plan [4]. The plan aimed to achieve at least 90% grid connection by 2030 (with off-grid connections an option where grid connection is impractical). This, after the electrification rates became half of those a decade ago, which highlighted the infeasibility of universal access by 2014 [4]. The solution to this included, at a high level, the diversification of power sources and ownership of the electricity sectors while balancing affordability, security, and climate change obligations. Central to this was widening participation and accelerating investments in the private sector, which spoke to procurement processes for IPP’s and removing uncertainties around whether the IPP’s can sell electricity directly to customers or through Eskom.

(i) Capacity Plan

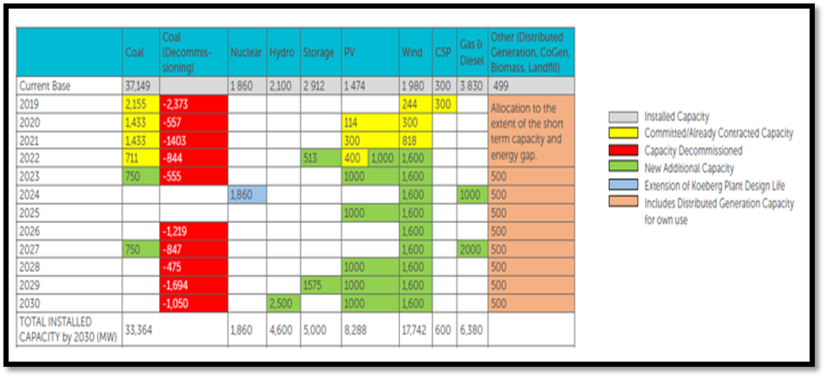

In 2019, the long-awaited Integrated Resource Plan (IRP) was released. The IRP is “an electricity capacity plan which aims to provide an indication of the country’s electricity demand, how this demand will be supplied and what it will cost” [5]. Much of this detailed what was included in the NDP – i.e.: an increased focus on renewable energy sources and gradual decommissioning of some of Eskom’s coal fired power plants. Table 5.3 provides a snapshot of this plan.

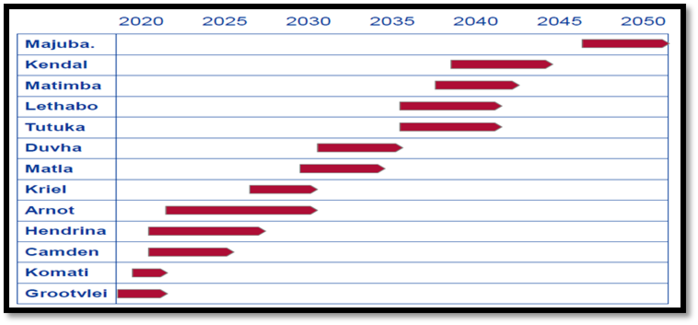

Eskom’s exact plan to decommission coal fired plants is detailed in the Just Energy Transition (JET) Plan (shown figure 5.3). The formation of the JET office was announced in late 2020, and the resulting plan confirmed in the second half of 2021. The plan is estimated to cost approximately USD10 Billion, and aims to see the majority of the coal fired plants shut down by 2050. During this period of transition, Eskom aims to move towards cleaner energy sources, while creating job opportunities for those displaced by the replacement of coal. This is also done so that Eskom is also a “direct” supplier of renewable energy, ensuring that renewable energy is not a private sector monopoly.

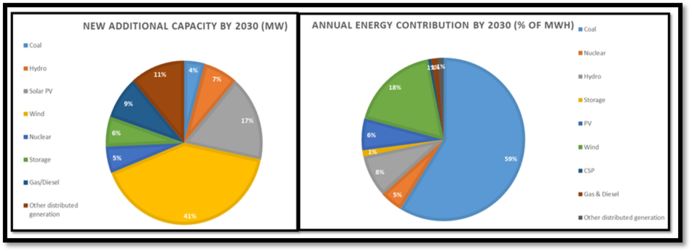

The IRP 2019 also noted plans to extend the life of the Koeberg nuclear plant beyond its design life by a further 20 years, even though it will revert to its installed capacity of 1926 MW. In total, additional generated capacity of 18 000MW has been committed to since IRP 2010, and the coal’s contribution to the energy mix will be significantly reduced as shown in figure 5.4. This shows very clearly the commitment to increase the role of solar PV and wind technology sources by 2030. The immediate, short-term priority though, was the filling of the 2000MW capacity gap.

The economic impact of the COVID-19 pandemic acted as an accelerant to implementing the IRP2019, specifically with regards to closing the 2000MW gap. What with Eskom’s power cuts already putting strain on the economy, lockdowns imposed by efforts to reduce COVID-19 infections, securing electricity supply was seen as much needed infrastructure to kick start the ailing economy[8]. Therefore, in August 2020, the Minister of MRE issued a request for proposals to bridge this gap, with power procured under the Risk Mitigation Independent Power Procurement Program (RMIPPP) to be operational by the end of June 2020. Additionally, early 2021 saw the announcement to procure 2600MW of renewable energy being fast tracked (under REIPPPP round 5). Furthermore, the President amended Schedule 2 of the ERA – this sought to exempt generation projects up to 100MW from licensing requirements from NERSA, irrespective of whether are connected to the grid[8]. However, a grid connection permit and environmental impact assessments would still need to be done to ensure compliance and reduce the possibility of compromising the integrity of the energy system. What stands out in all these efforts to secure capacity, is that renewable energy sources are playing a much bigger role in the energy mix.

(ii) Implementation plans

South Africa acted decisively in determining where generation capacity will come from – most of which is currently done by Eskom. Eskom currently also carries the bulk of the transmission load. Currently, Eskom has electrification plans, but so do municipalities. None of this is coordinated and there is very little predictability about what will or won’t happen – if and where the plans are “visible” [9]. Municipalities responsible for electricity reticulation. Although IPP’s have a bit more regulatory certainty than a decade ago, it is not advisable to construct for example, a mini-grid, without knowing whether this clashes with Eskom’s or municipality’s electrification plan.

References

- ↑ Baryla, B., Dukala, K., Gorniak, J., Jasko, K., Kossowska, M., Prokopowicz, P., . . . Zmuda, G. (2013). Study of Competencies: Power Sector. Krakow: Center for Eavulaition and Analysis of Public Policies

- ↑ 2.0 2.1 2.2 Dyson, G. (2020). The South African Power Sector. EEG Energy Insight, 1-11.

- ↑ Prasad, G. (2014). South African Electrification Programme. Cape Town: Energy Research Centre: University of Cape Town

- ↑ 4.0 4.1 National Planning Commission. (2012). National Development Plan 2030: Our future - make it work. Tshwane: The Presidency

- ↑ 5.0 5.1 Dempster, E. (2019, October 22). The Integrated Resource Plan 2019: A promising future roadmap for generation capacity in South Africa. Energy Alert, DEMR. (n.d). About DEMR. Retrieved July 3 2021 from https://www.dmr.gov.za/about-dmr/overview

- ↑ Integrated Resource Plan (IRP) 2019 of South Africa

- ↑ Eskom, 2021. Coal Power. [Online]

- ↑ 8.0 8.1 Presidency, T. (2021, June 10). President Cyril Ramaphosa on amendment to Schedule Two of the Electricity Regulation Act.

- ↑ Truter, W. F., Rethman, N. F. G., Kruger, R. A., Reynolds, K. A., & de Jager, P. C. (2021). Sustainable Pasture Production on Reclaimed Coal Mine Soils.