Virtual Power Plants and the Role of Regulation

Introduction to Virtual Power Plants

Definitions

Distributed Energy Resources (DER) – small and medium-sized power resources that are connected to the distribution network.

They include:[1]

- distributed generation (such as solar panels and other variable renewable resources, but also non-renewable generation such as diesel generators)

- energy storage (such as small scale batteries, hot water systems or electric vehicle batteries)

- technology enabling demand response, such as smart thermostats, appliances or electric vehicle supply equipment

DERs are usually “behind the meter”. This means that many DERs are not visible to distribution grid operators and are not separately metered. However, larger DERs can be distribution connected and sub-metering of DERs may exist behind the meter. To work within a VPP, the DER must have a certain possibility to be remotely controlled.[1]

Consumer Energy Resources (CER) – distributed energy resources owned by the consumer.[2]

Aggregators – new market players who bundle DERs to engage as a single entity (a virtual power plant) in power or service markets.[3] They can optimise the use of DERs. Aggregators can then sell electricity or ancillary services via an electricity exchange, in the wholesale market, or through procurement by the system operator.[4]

Aggregators use a centralised IT system to remotely control the DERs and optimise their operation. They can provide:

- Load shifting

- Balancing services to TSOs

- Local flexibility to DSOs

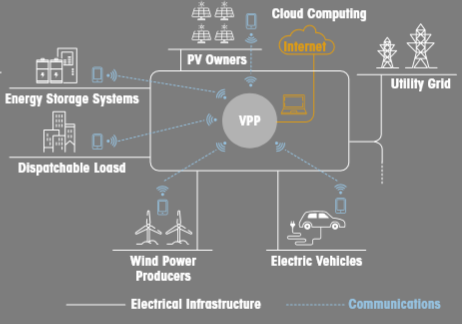

Virtual Power Plant (VPP) - VPPs aggregate dispersed DERs/CERs to enable these small energy sources to support the grid.[4] VPP behave similar to a traditional power plant, with standard attributes, including minimum and maximum capacity, and ramp up and ramp down capabilities.[1]

A central IT system controls the VPP, processing data like weather forecasts, electricity prices, and power trends to optimize dispatchable DER operations.[4]

VPPs offer both demand-side flexibility by aggregating demand-response and storage resources to act to grid requirements. Supply-side flexibility is provided by optimizing power generation from flexible resources like combined heat and power (CHP) plants, biogas plants, and using storage units. Operation optimization is based on historical and forecasted data on demand, generation, and prices.[4]

Benefits of Virtual Power Plants

Benefits For Decarbonisation

VPPs can combine renewable generation, like solar, and energy storage to address the variability of renewable resources. By grouping different DERs and operating them as a VPP, this variability is managed more effectively. Aggregating DERs and enabling market participation can boost their return on investment and speed up deployment. If they reduce fossil fuel use, VPPs can help accelerate decarbonisation.[1]

Benefits to the System

VPPs increase flexibility in electricity generation, improve energy efficiency, and boost grid stability through real-time monitoring and control. By aggregating renewable resources like solar and wind, along with storage and demand response, VPPs strengthen grid reliability and resilience.[5]

They also help balance energy systems by addressing gaps in renewable generation. When renewables can't meet peak demand, dispatchable generation, such as gas plants, fills the gap. Conversely, surplus renewable energy can be wasted due to network congestion or curtailment. VPPs address this by storing excess energy for later use, and when combined with demand response, they improve the balance between supply and demand.[1]

VPPs can also provide ancillary services to the grid, such as frequency regulation, voltage support and black start services.[1]

VPPs reduce the need for distribution and transmission infrastructure. By their nature, DERs are close to demand. Much of the electricity generated by a solar panel will be used by the household or business under that roof. This is a significant advantage given that the IEA estimates that more than 80 million km of grid infrastructure will need to be added globally between 2021 and 2050 to meet climate targets.[1]

VPPs enhance energy system resilience by reducing reliance on a few large generators and preventing single points of failure. Composed of geographically diverse DERs using various renewable sources, VPPs increase resilience since individual failures have minimal impact. Electric vehicle batteries further boost resilience by being mobile across the grid.[1]

Benefits to Consumers

VPPs help consumers maximize the value of their DERs by lowering energy costs and offering financial benefits. For example, electric hot water systems can heat water when cheap renewable energy is available, and EV batteries can charge during surplus renewable generation and, with vehicle-to-grid capability, feed power back to the grid when needed.[1]

Benefits to Utilities

Setting up and running a VPP is a cost-effective way to build capacity compared to large-scale renewable generation and storage. In some markets, individual DERs may not meet minimum bid size requirements, so aggregating them through a VPP makes them more attractive for investment.[1]

Challenges and Barriers

Traditional power systems were designed for a one-way flow of electricity; DERs and VPPs mean that distribution systems need to manage the two-way flow of electricity and information about that flow. VPPs often rely on telecommunications to operate, and when telecommunications networks fail, so do VPPs.[1]

As more households and businesses take advantage of DERs, there is a risk that utilities will see declining returns on generation and grid infrastructure investments due to increased behind-the-meter consumption. This is a wider risk for businesses and consumers who may end up paying for stranded assets, an issue that regulators may need to consider managing.[1]

Furthermore, challenges such as cyber security threats and the need for standardised communication protocols for interoperability are hindering wider adoption. In addition, regulatory barriers prevent effective support for distributed energy management. Market structures that incentivise the participation of small energy producers are often lacking. To realise the full potential of VPPs it is essential to overcome these challenges.[5][6]

Key Enabling Factors

Key enabling factors for VPPs are:[4]

Smart meters & Communication Infrastructure

The creation and operation of a VPP requires real-time data collection from DERs. This requires smart meters, broadband communication infrastructure, network remote control and automation systems (network digitalisation).

Real-time communication between VPP operators and the connected DERs is also needed. Network remote control and digitalisation help to improve grid efficiency, as the data collected can be used to better predict demand. Two-way communication network devices are essential.

Accurate data (weather forecast, load projections, wholesale prices)

Advanced forecasting tools and techniques are critical for forecasting renewable generation and load on the grid to provide an optimised schedule for deployable DERs. Forecasts for distributed generation can be integrated with load forecasts to produce net load forecasts, increasing the visibility of demand-side variations.

Regulatory framework allowing participation of new market players

A liberalised wholesale electricity market without price caps (especially with spot markets in place) is essential for the establishment of VPPs. The main incentives to create a VPP are provided by the difference between peak/off-peak prices in wholesale markets or by signals from transmission system operators to provide control reserve or other ancillary services. The regulatory framework needs to allow aggregators to participate in both the wholesale electricity market and the market for ancillary services.

Supportive Regulatory Framework for VPP Market Participation

VPPs will only develop where supportive market conditions for DERs have been put in place. Therefore, regulatory authorities should support the establishment of VPPs with the following measures: [4]

Wholesale Market

- Enabling aggregators to participate in electricity wholesale markets and ancillary services markets

- Introducing regulations that allow decentralised sources to provide services to the central/local grid

- Setting clear price signals to guide the aggregators’ operations

- Regulations on the introduction of smart meters and smart grid infrastructure

Distribution

- Establishment of local markets for DSOs to procure services to avoid grid congestion and ensure grid stability

- Introducing rules for the collection, management and sharing of data by DSOs to protect the privacy of consumers

Retail Market

- Defining a standardised methodology for calculating dynamic prices that can be adopted by retailers.

- Functioning retail markets could provide innovative products and pricing models for different customer needs.

- Define clear roles and responsibilities for market participants.

- Long-term predictable regulation is needed.

- Liberalised markets, as opposed to regulated markets, could facilitate market entry.

System Operation

- Defining rules for coordination between distribution and transmission system operators / DSOs and TSOs.

Regulatory Options to Support VPP – Detailed List

Several regulatory conditions can facilitate the market integration of DERs and VPPs at large scale. There are a wide range of actions regulators could take to support VPPs. A detailed list is provided below.

Utility Cost Recovery

- Approve investment plans in generation and networks that allow the entry of new participants or technologies and monitoring power markets.[1]

- As DERs can reduce electricity sales from utilities, traditional business models will not deliver DER integration. To remedy this, regulators can use performance-based regulation, performance incentive mechanisms, and/or multi-year rate plans to encourage utilities to reach the wider goals that DERs and VPPs are crucial in achieving.[7][1]

- Allow utilities to include DERs and VPP foundational infrastructure (e.g., DERMS) in rate base.[7]

System Planning

For those regulators that require utilities to carry out integrated resource planning and/ or integrated distribution system planning, the integration of DERs should be part of that process, i.e.: [7]

- Require VPPs to be considered in current planning processes (e.g., IRPs, resource adequacy assessments, asset replacement, distribution system planning) so that VPPs are considered as viable options alongside conventional assets

- Require integrated grid system planning (e.g., integrated distribution system plan, integrated transmission & distribution plan, grid modernization plans)

- Require open-source and/or distributed capacity procurement so that VPPs can compete against conventional assets during capacity procurement process

- Require a minimum proportion of resource adequacy procurement to be from VPPs

- Clarify benefit-cost assessment frameworks for DERs and VPPs to ensure VPP benefits are comprehensively valued

- To monitor progress on this point, regulators need to collect data on the success of utilities in integrating DERs.[1]

Market Participation

- Aggregated DERs need to be able to participate in wholesale, ancillary services, demand response and other markets or procurement. This involves changes to market or procurement rules and the development of new VPP-specific technical requirements.[1]

See also chapter above on supportive regulatory framework – overview.

DER Deployment

To support DER deployment, regulators can, i.e.:[7]

- Provide financial incentives for DER installation (especially for low-income customers)

- Allow utilities to subsidize DERs (especially for low-income customers)

- Streamline DER permitting and interconnection processes (e.g., provide incentives, set maximum review timelines)

- Publish distribution system hosting capacity maps with clear data standards and regular update requirements

- Modify energy codes and standards to support DER deployments where current standards are a barrier

- Require distribution utilities to deploy a grid orchestration platform to better manage the distribution grid and DERs

DER Aggregation

- Regulation can facilitate the aggregation of DER by the following actions:[7]

- Authorize default VPP-opt in enrolment models

- Allow all DER types to participate in VPPs (e.g., solar, storage, demand response, heat pumps, etc.)

- Ensure open participation for multiple aggregators and OEMs

- Align VPP aggregation standards across IOUs (e.g., data access rules)

- Establish interoperability standards and communications protocols

- Provide clear methods for VPP capacity accreditation

- Limit DER incentives to smart, connected DERs (e.g., smart thermostats instead of standard thermostats that cannot be controlled)

- Flexible export and import limits (Static export limits on DERs prevent overloading the grid in the middle of a sunny day. This means, however, the full potential of DERs to contribute to a VPP is reduced. Flexible export limits, also called Dynamic Operating Envelopes, can be enabled by regulation to support greater DER exports at times when there is capacity available on the distribution network.)[1]

VPP Tariffs and Compensation Models

Retail price levels and tariff structures play a crucial role in supporting the uptake of Distributed Energy Resources (DERs). To enhance this, several key approaches can be adopted:

- Implement compensation models that reward Virtual Power Plants (VPPs) for the full range of grid benefits they deliver, such as capacity benefits, deferred infrastructure costs, and environmental advantages.[7]

- Design appropriate tariffs and compensation models for VPPs.

Possible tariff structures include feed-in tariffs, net energy metering, net billing, or buy-all-sell-all models. Regulators should also consider time-of-use tariffs, which can help shift demand by implementing simple structures like peak pricing during the day and off-peak pricing at night. However, DERs and VPPs can be more responsive to dynamic pricing, when real-time data is used. To support this, regulatory changes such as half-hourly or five-minute settlement periods would be beneficial. Additionally, widespread deployment of smart meters and smart inverters is essential to enable such dynamic pricing.[1]

- Compensating consumers for the use of their DERs as part of a VPP provides an added incentive for consumers to invest in DERs, benefiting both them and the overall grid.[1]

A Body to Set Technical Standards

- A single body setting DER integration standards centralizes decision-making on technical requirements and compliance. Properly designed standards ensure consistent DER performance and support consumer and system needs, enabling communication between DERs and compliance with distribution network requirements.[1]

Case Studies

Ofgem, Great Britain

This case study was published by RETA (2024), Virtual Power Plants: An Introductory Guide for Energy Regulators [1]. A few more details have been added, links are provided.

Introduction

Ofgem is Great Britain’s independent energy regulator. It has taken various measures to integrate DERs and VPPs into the British electricity market.

What steps did the regulator take to enable VPPs and DER integration?

In 2019, Ofgem approved a code modification (CMP295: Contractual Arrangements for Virtual Lead Parties), which provided access for independent aggregators to participate in the energy market and balancing mechanism. The modification was mainly driven by a European Union directive. The modification defined Virtual Lead Parties (VLPs) as market participants and created a new bilateral agreement between the Electricity System Operator (ESO) and the Virtual Lead Parties (VLPs), to become CUSC (Connection and Use of System Code) parties. The agreement reflects the unique nature of the relationship between VLPs and generation units.

Another modification, approved by Ofgem in 2023 (Balancing and Settlement Code (BSC) P415: Facilitating Access to Wholesale Markets for Flexibility Dispatched by VLPs), allows aggregators to access the wholesale market as 'virtual trading partners'. It also includes the introduction of compensation arrangements to take account of the impact that VLP actions may have on the market. The modification allows VLPs to trade Deviation Volumes on wholesale electricity markets on behalf of consumers.[8] However, a supplier will face financial consequences if a VLP reduces consumer demand, as the supplier will have purchased energy based on the consumer’s expected usage, without considering any VLP intervention. Consequently, the supplier cannot sell the energy it has already bought, since the consumer is no longer consuming it. Ofgem thus decided that suppliers who have been commercially affected as a result of VLP action will be compensated. The cost of compensation will be shared between the suppliers. Ofgem expects this modification to increase levels of flexibility in both the balancing and wholesale markets. They also expect the changes to promote greater levels of competition in the market.[9]

Flexibility first principle: encourages DSOs to resolve network constraints using flexibility services, including VPPs, rather than expensive infrastructure expansions, where this is economically advantageous.

Next steps

The Market-Wide Half-Hourly Settlement (MHHS) programme, to be fully implemented by the end of 2026, will see suppliers being charged based on close to real-time consumption of their domestic and small business customers (rather than a nominal profile), further incentivising the adoption of time-of-use tariffs and dynamic tariffs. This is expected to increase demand for flexibility services like VPPs.

Ofgem is exploring additional improvements to support VPP integration and to streamline rules across different markets (for example through creating a new Flexibility Market Facilitator role) to promote further flexibility and reduce barriers to flexibility including through lowering barriers to entry for VPPs.

The regulator is currently working closely with the government on a new regulatory system for ‘load control’. This system will include new standards for smart devices set by the government. Ofgem will be responsible for a new licensing system for companies that can remotely control electrical loads, such as VPPs, to ensure cyber security, grid stability and consumer protection.

A Digital Asset Register is under development to provide a comprehensive overview of distributed assets, which will help in coordination across various flexibility platforms. A consultation process took place from July to September 2024. Following this, decision was made in March 2025 that the Market Facilitator Elexon should also take on the role of Flexibility Market Asset Registration delivery body, responsible for the deployment, and operation of the new digital infrastructure. It will now develop the design of the digital infrastructure further. The register is expected to be launched between mid 2026 and mid 2027.[10]

Challenges faced by the regulator

One major challenge, according to Ofgem, is the need to coordinate across various market participants – suppliers, DSOS, aggregators, and consumers. Current market rules require changes to accommodate new players.

Further challenges include cybersecurity, maintaining grid stability, and developing product standards for low-carbon technologies like electric vehicle charge points, which must be remotely controlled and interoperable.

Australian Energy Market Commission (AEMC)

This case study was published by RETA (2024), Virtual Power Plants: An Introductory Guide for Energy Regulators.[1]

Introduction

In Australia’s energy transformation, VPPs, made up of consumer energy resources (CER) and distributed energy resources (DER), will play a critical role. Reducing overall system costs, improving reliability and achieving a secure low-emission energy supply for all will contribute to achieve a net zero system.

Since there is no agreed definition of a VPP or requirements to register under the regulatory framework, unless they are providing scheduled services, it is unclear how many VPPs operate in Australia. The main retailers, however, all state to have 100s of MWs in VPPs. It is generally agreed that VPPs will make up a significant share of Australia’s electricity generation by 2050.

What steps did the regulator take to enable VPPs and DER integration?

Early work to examine the regulatory frameworks started 10 years ago.

Important steps include:

Establishment of a CER taskforce that developed and published a CER roadmapin 2024, defining and driving the CER integration actions needed.

In 2016, ancillary services were unbundled from the provision of energy. This fundamental change opened up competitive opportunities for new providers to offer such services to the energy system and helped service providers to gain value from establishing and operating VPPs.

In December 2024, the AEMC released a final determination to help integrate VPPs into the wholesale energy market. It allows, but does not require, currently unscheduled VPPs (and other price-responsive resources) to be scheduled and dispatchable, either in aggregations or individually. It allows them to bid into the spot market, set prices, receive dispatch instructions and earn revenue in markets which require scheduling (e.g. regulation frequency control ancillary services), with the flexibility to opt out from being scheduled from time to time.

Another closely related rule change, allows ‘flexible’ CER (such as electric vehicles) to be separately metered from ‘passive’ consumer loads at the same site, such as lights and fridges. This is a first step in creating more options for consumers in households and businesses to be able to use and manage CER as they choose, and to have separate retail tariffs for their CER and their passive loads. It is a step toward consumers being able to use their CER in the energy market and being rewarded for that. The final rule was made in August 2024, and takes effect in 2026.

Next steps

Further work is being undertaken in Australia, including on these issues:

Distribution networks play a key role in facilitating the provision of services from distribution-connected resources to the wholesale market. The AEMC is leading the CER Task Force's examination of the potential future role of distribution system operators. As part of this task force, the AEMC will help develop a functional plan for the integration of CER into the energy system and market.

Consumer protection in the context of relationships between retailers, distributors and consumers with CER. There are various pieces of work examining consumer protection. The aim is to update the consumer protection framework to ensure that consumers can benefit from this type of innovation while being protected from negative impacts.

Case Studies from the US

Quick overview on VPP regulation examples from different US states:[7]

Further Information

Please find here a list of literature and links on VPPs, both on regulatory issues and on VPPs in general.

- The Virtual Power Plant Partnership’s Regulatory and Policy Strategy Working Group, VPP Policy Principles, Policy Brief 2024. (Policy principles to help energy regulators and policymakers leverage virtual power plants to promote affordability and reliability. This brief contains principles for policy and regulation that can support the fair and efficient growth, integration, valuation, compensation, and advancement of VPPs.)

- US Department of Energy (2025), Pathways to Commercial Liftoff: Virtual Power Plants 2025 Update. (This publication also entails a lot of examples/case studies from the US.)

- NECPUC Retail DR Working Group Presentation, 2024, Policy Principles for Enabling Virtual Power Plants (VPPs).

- The National Association of Regulatory Utility Commissioners (NARUC) Center for Partnership and Innovation (CPI) (2023), Regulators’ Financial Toolbox: Virtual Power Plants (Report based on a webinar)

- Integrate to Zero (I2Z), Blunomy (2025), Virtual Power Plant (VPP) Readiness Index.

- IRENA (2019), Innovation landscape brief: Aggregators

- gridX, VPP Leveraging flexibility to reduce cost of asset ownership

- The Virtual Power Plant Partnership’s Utilities Working Group, 2024, Virtual Power Plant Flipbook (The VPP Flipbook is a collection of VPP case studies highlighting key program design elements and takeaways to help utilities and other stakeholders implement efficient and impactful VPP programs.)

References

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 1.14 1.15 1.16 1.17 1.18 1.19 1.20 1.21 RETA (2024), Virtual Power Plants: an Introductory Guide for Energy Regulators.

- ↑ Integrate to Zero (I2Z), Blunomy (2025): Virtual Power Plant (VPP) Readiness Index.

- ↑ The term “aggregators” is often used synonymously with VPP.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 IRENA (2019), Innovation landscape brief: Aggregators.

- ↑ 5.0 5.1 Mahmood, Mou & Talukder, Khadiza & Hasan, Mahmudul & Chowdhury, Nahid-Ur-Rahman. (2024). A Comprehensive Study on Virtual Power Plants: Operations, Benefits, Challenges, and Future Trends.

- ↑ Mateus Kaiss et. al, Review on Virtual Power Plants/Virtual Aggregators: Concepts, applications, prospects and operation strategies, Renewable and Sustainable Energy Reviews, Volume 211, 2025.

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 7.6 US Department of Energy (2025), Pathways to Commercial Liftoff: Virtual Power Plants 2025 Update.

- ↑ Deviation Volumes represent the difference between what is forecast to be consumed or generated and what was actually consumed or generated.

- ↑ Ofgem, 2023, Balancing and Settlement Code (BSC) P415: Facilitating access to wholesale markets for flexibility dispatched by Virtual Lead Parties (P415).

- ↑ Ofgem, 2025, Flexibility Market Asset Registration Decision.