Difference between revisions of "Independent Power Producers (IPPs)"

***** (***** | *****) m |

***** (***** | *****) m |

||

| (17 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| + | = Overview = | ||

| + | |||

| + | '''Independent Power Producers (IPPs)''' or '''non-utility generator (NUG)''' are private entities (under unbundled market), which own and or operate facilities to generate electricity and then sell it to a utility, central government buyer and end users. IPPs may be privately-held facilities, cooperatives or non -energy industrial concerns capable of feeding excess energy into the system.<ref>South African Independent Power Producers Association,2011.Available at:http://www.saippa.org.za/main.html</ref> <ref>Wikipedia, 2014. Available at :http://en.wikipedia.org/wiki/Independent_Power_Producer</ref> | ||

| + | |||

| + | IPPs invest in generation technologies and recover their cost from the sale of the electricity. They can be great help to country's energy sector (especially when the public sectore do not have the required financial capacity for investment). | ||

| + | |||

| + | <u>There are different goals for integrating IPPs into the nationals, but USAID has summarized the following three goals:</u><ref>Gardiner, M.& Montpelier, V., Best Practices Guide: Implementing Power Sector Reform.Available at:http://pdf.usaid.gov/pdf_docs/PNACQ956.pdf</ref> | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

*''"Attract outside capital to meet rapidly growing electricity needs without imposing large strains on the nations internal financial capabilities;'' | *''"Attract outside capital to meet rapidly growing electricity needs without imposing large strains on the nations internal financial capabilities;'' | ||

*''Reduce electricity costs though competitive pressures; and,'' | *''Reduce electricity costs though competitive pressures; and,'' | ||

*''Assign risks in a more efficient or desirable manner''." | *''Assign risks in a more efficient or desirable manner''." | ||

| + | |||

| + | <br/>Integrating IPPs into the Grid | ||

| + | |||

| + | The criteria for integrating IPPs into the electricity market depends on the specific country. However, there are generally four models used to describe the integration of IPPs into the grid. The picture below summarizes the four different models.<ref>Eberhard, A.Independent Power Producers and Power Purchase Agreements:Frontiers of International Experience. Available at:http://www.naruc.org/international/Documents/S17%20-%20Eberhard.pdf</ref> | ||

| + | |||

| + | [[File:Integrating IPPs into the grid.JPG|border|center|600px|Integrating IPPs into the grids|alt=Integrating IPPs into the grid]] | ||

| + | |||

| + | Source:[http://bit.ly/1pKLE33| Independent Power Producers and Power Purchase Agreements: Frontiers of International Experience]<br/> | ||

| + | |||

<br/> | <br/> | ||

| − | + | ||

| − | + | = <br/>Risk for <span dir="auto">Independent Power Producers (IPPs)</span> = | |

| − | + | ||

| − | Before investing in electricity generation, IPPs need to consider various factors like revenue security, market demand, and contract procurement. The following table from ''Best Practices Manual from USAID'' summarizes the risks of IPPs.<ref>Gardiner, M.& Montpelier, V., Best Practices Guide: Implementing Power Sector Reform.Available at:http://pdf.usaid.gov/pdf_docs/PNACQ956.pdf</ref> | + | Before investing in electricity generation, IPPs need to consider various factors like revenue security, market demand, and contract procurement. The following table from ''Best Practices Manual from USAID'' summarizes the risks of IPPs.<ref>Gardiner, M.& Montpelier, V., Best Practices Guide: Implementing Power Sector Reform.Available at:http://pdf.usaid.gov/pdf_docs/PNACQ956.pdf</ref> |

| − | + | ||

| − | To understand the tendering process for IPPs, see | + | [[File:Risk of IPPs.JPG|frame|center|528px|Risk of IPPs|alt=Risk of IPPs.JPG]] Source: [http://1.usa.gov/1oDvAMA Best Practices Guide:Implementing Power Sector Reform] |

| + | |||

| + | <br/> | ||

| + | |||

| + | However, there are different mechanism to curb these risks namely,[[Power Purchase Agreement (PPA) - Wind Energy|Power Purchase Agreement (PPA)]],sovereign guarantees or feed in tariffs. <ref> Clark Energy. Available at: http://www.clarke-energy.com/2013/gas-engines-for-ipps/</ref> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | Tendering Process for IPPs | ||

| + | |||

| + | To understand the tendering process for IPPs, see | ||

| + | |||

*[[Wind Energy Country Analyses Pakistan#Licensing and Permitting Procedure|Tendering in Pakistan]] | *[[Wind Energy Country Analyses Pakistan#Licensing and Permitting Procedure|Tendering in Pakistan]] | ||

*[[Wind Energy Country Analysis Vietnam#Permission procedures|Tendering in Vietnam]] | *[[Wind Energy Country Analysis Vietnam#Permission procedures|Tendering in Vietnam]] | ||

| + | |||

<br/> | <br/> | ||

| − | + | ||

| − | Normally, the involvement of private parties in contract procurement is expected to reduce corruption and increase transparency, <u>but IPPs contract procurement can be corrupted due to the following reasons:</u><ref>Deterring Corruption and Improving Governance in the Electricity Sector: A Sourcebook. Available at: http://siteresources.worldbank.org/INTENERGY2/Resources/electricitysourcebookch7.pdf </ref> | + | Corruption during IPPs Contract Procurement |

| + | |||

| + | Normally, the involvement of private parties in contract procurement is expected to reduce corruption and increase transparency, <u>but IPPs contract procurement can be corrupted due to the following reasons:</u><ref>Deterring Corruption and Improving Governance in the Electricity Sector: A Sourcebook. Available at: http://siteresources.worldbank.org/INTENERGY2/Resources/electricitysourcebookch7.pdf </ref> | ||

| + | |||

*IPPs contract are of a high value and thus attract embezzlement from public and private entities. | *IPPs contract are of a high value and thus attract embezzlement from public and private entities. | ||

*IPPs contract are generally drafted under the crisis situation and are flexible. Thus, the involved parties can justify the deviation from least-cost method and can embezzle the funds. | *IPPs contract are generally drafted under the crisis situation and are flexible. Thus, the involved parties can justify the deviation from least-cost method and can embezzle the funds. | ||

*IPPs are fairly new to the electricity market and thus there is no clear guidelines on how to handle its contract procurement. | *IPPs are fairly new to the electricity market and thus there is no clear guidelines on how to handle its contract procurement. | ||

*IPPs procurement is usually handled between high ranking officials (as compared to other power sector procurement).This situation can provide extra level of protection for corrupt behavior. | *IPPs procurement is usually handled between high ranking officials (as compared to other power sector procurement).This situation can provide extra level of protection for corrupt behavior. | ||

| − | <br/> | + | |

| + | <br/> | ||

| + | |||

= Further Information = | = Further Information = | ||

| Line 33: | Line 59: | ||

*[[Role of Independent Power Producers (IPPs) in Electricity Generation in Nepal|Role of Independent Power Producers (IPPs) in Electricity Generation in Nepal]] | *[[Role of Independent Power Producers (IPPs) in Electricity Generation in Nepal|Role of Independent Power Producers (IPPs) in Electricity Generation in Nepal]] | ||

*[[Operation Models (IPP, BOT) - Wind Energy|Operation Models (IPP, BOT) - Wind Energy]] | *[[Operation Models (IPP, BOT) - Wind Energy|Operation Models (IPP, BOT) - Wind Energy]] | ||

| − | <br/> | + | |

| + | <br/> | ||

| + | |||

= References = | = References = | ||

| + | |||

<references /><br/> | <references /><br/> | ||

| + | [[Category:Grid]] | ||

| + | [[Category:Mini-grid]] | ||

| + | [[Category:Financing_and_Funding]] | ||

[[Category:Electricity]] | [[Category:Electricity]] | ||

| − | |||

Latest revision as of 15:15, 11 July 2018

Overview

Independent Power Producers (IPPs) or non-utility generator (NUG) are private entities (under unbundled market), which own and or operate facilities to generate electricity and then sell it to a utility, central government buyer and end users. IPPs may be privately-held facilities, cooperatives or non -energy industrial concerns capable of feeding excess energy into the system.[1] [2]

IPPs invest in generation technologies and recover their cost from the sale of the electricity. They can be great help to country's energy sector (especially when the public sectore do not have the required financial capacity for investment).

There are different goals for integrating IPPs into the nationals, but USAID has summarized the following three goals:[3]

- "Attract outside capital to meet rapidly growing electricity needs without imposing large strains on the nations internal financial capabilities;

- Reduce electricity costs though competitive pressures; and,

- Assign risks in a more efficient or desirable manner."

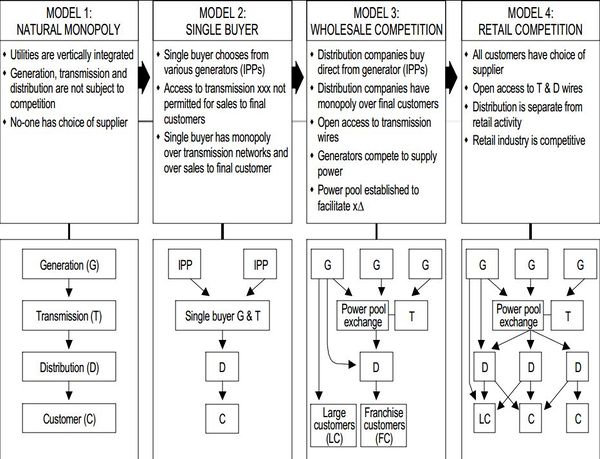

Integrating IPPs into the Grid

The criteria for integrating IPPs into the electricity market depends on the specific country. However, there are generally four models used to describe the integration of IPPs into the grid. The picture below summarizes the four different models.[4]

Source:Independent Power Producers and Power Purchase Agreements: Frontiers of International Experience

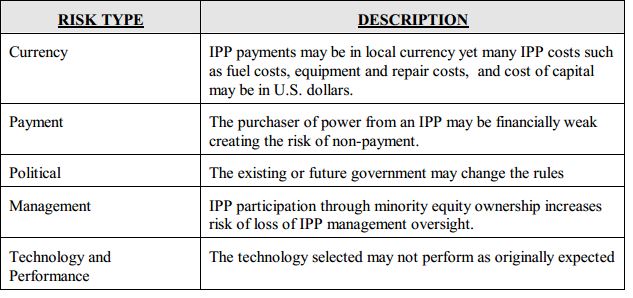

Risk for Independent Power Producers (IPPs)

Before investing in electricity generation, IPPs need to consider various factors like revenue security, market demand, and contract procurement. The following table from Best Practices Manual from USAID summarizes the risks of IPPs.[5]

Source: Best Practices Guide:Implementing Power Sector Reform

However, there are different mechanism to curb these risks namely,Power Purchase Agreement (PPA),sovereign guarantees or feed in tariffs. [6]

Tendering Process for IPPs

To understand the tendering process for IPPs, see

Corruption during IPPs Contract Procurement

Normally, the involvement of private parties in contract procurement is expected to reduce corruption and increase transparency, but IPPs contract procurement can be corrupted due to the following reasons:[7]

- IPPs contract are of a high value and thus attract embezzlement from public and private entities.

- IPPs contract are generally drafted under the crisis situation and are flexible. Thus, the involved parties can justify the deviation from least-cost method and can embezzle the funds.

- IPPs are fairly new to the electricity market and thus there is no clear guidelines on how to handle its contract procurement.

- IPPs procurement is usually handled between high ranking officials (as compared to other power sector procurement).This situation can provide extra level of protection for corrupt behavior.

Further Information

- Grid Portal on energypedia

- Best Practices Guide: Implementing Power Sector Reform , Chapter 2

- Role of Independent Power Producers (IPPs) in Electricity Generation in Nepal

- Operation Models (IPP, BOT) - Wind Energy

References

- ↑ South African Independent Power Producers Association,2011.Available at:http://www.saippa.org.za/main.html

- ↑ Wikipedia, 2014. Available at :http://en.wikipedia.org/wiki/Independent_Power_Producer

- ↑ Gardiner, M.& Montpelier, V., Best Practices Guide: Implementing Power Sector Reform.Available at:http://pdf.usaid.gov/pdf_docs/PNACQ956.pdf

- ↑ Eberhard, A.Independent Power Producers and Power Purchase Agreements:Frontiers of International Experience. Available at:http://www.naruc.org/international/Documents/S17%20-%20Eberhard.pdf

- ↑ Gardiner, M.& Montpelier, V., Best Practices Guide: Implementing Power Sector Reform.Available at:http://pdf.usaid.gov/pdf_docs/PNACQ956.pdf

- ↑ Clark Energy. Available at: http://www.clarke-energy.com/2013/gas-engines-for-ipps/

- ↑ Deterring Corruption and Improving Governance in the Electricity Sector: A Sourcebook. Available at: http://siteresources.worldbank.org/INTENERGY2/Resources/electricitysourcebookch7.pdf