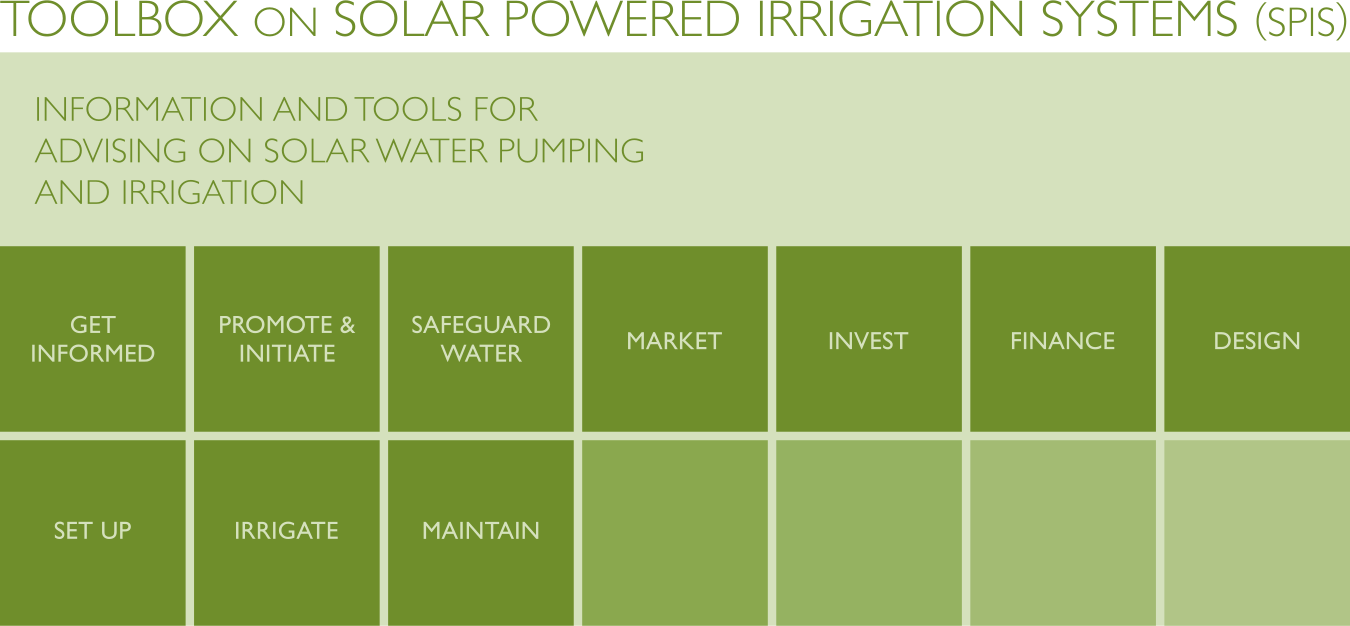

Difference between revisions of "SPIS Toolbox - Finance - Glossary"

From energypedia

***** (***** | *****) m (Protected "SPIS Toolbox - Finance - Glossary" ([edit=sysop] (indefinite) [move=sysop] (indefinite))) |

***** (***** | *****) m |

||

| (10 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | {{SPIS | + | {{SPIS Banner2}}{{Back to SPIS Toolbox}} |

== '''<span style="color:#879637">Glossary</span>'''<br/> == | == '''<span style="color:#879637">Glossary</span>'''<br/> == | ||

| − | {| style="width: 100%" cellspacing="1" cellpadding=" | + | {| style="width: 100%" cellspacing="1" cellpadding="3" border="0" |

|- | |- | ||

| style="width: 251px" | '''Assets'''<br/> | | style="width: 251px" | '''Assets'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Position in balance sheet which represents what a company owns.<br/> |

|- | |- | ||

| style="width: 251px" | '''Capital expenditures (CAPEX)'''<br/> | | style="width: 251px" | '''Capital expenditures (CAPEX)'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Are one-time expenses. Normally they are long-term investments in non-consumable parts of the business, for example money that is spent on pump, panels, machines, etc.<br/> |

|- | |- | ||

| style="width: 251px" | '''Cash Inflows'''<br/> | | style="width: 251px" | '''Cash Inflows'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | All cash receipts realized within a given period (e.g. from sales).<br/> |

| + | |- | ||

| + | | style="width: 251px" | '''Cash Flow''' | ||

| + | | style="width: 497px" | The incoming and outgoing cash of a business. Cash outflows are considered as negative cash flows and cash inflows as positive ones.<br/> | ||

|- | |- | ||

| style="width: 251px" | '''Cash Outflow'''<br/> | | style="width: 251px" | '''Cash Outflow'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Outgoing cash, all cash payments realized during a given period (e.g. for buying production inputs, loan installments, buying equipment).<br/> |

|- | |- | ||

| style="width: 251px" | '''Creditors'''<br/> | | style="width: 251px" | '''Creditors'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Payable occurring from past credit (money owed to suppliers for expenses).<br/> |

|- | |- | ||

| style="width: 251px" | '''Collateral'''<br/> | | style="width: 251px" | '''Collateral'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Property or other assets that a borrower offers a lender to secure a loan.<br/> |

|- | |- | ||

| style="width: 251px" | '''Credit Sales'''<br/> | | style="width: 251px" | '''Credit Sales'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Sales made without receiving cash.<br/> |

|- | |- | ||

| style="width: 251px" | '''Current Assets'''<br/> | | style="width: 251px" | '''Current Assets'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Cash and other assets which are expected to be converted into cash or consumed during the normal operating cycle of a business.<br/> |

|- | |- | ||

| style="width: 251px" | '''Debtors'''<br/> | | style="width: 251px" | '''Debtors'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Receivables occurring from past credit sales.<br/> |

|- | |- | ||

| style="width: 251px" | '''Depreciation'''<br/> | | style="width: 251px" | '''Depreciation'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | A cost charged against fixed assets for their replacement.<br/> Note: “depreciation” is one of the few expenses for which there is no associated outgoing cash flow. |

|- | |- | ||

| style="width: 251px" | '''Expenses / expenditure'''<br/> | | style="width: 251px" | '''Expenses / expenditure'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Payment of cash or cash equivalent for good or services received. Cost of resources used up or consumed by the activities of the business.<br/> |

|- | |- | ||

| style="width: 251px" | '''Finished Good Stock'''<br/> | | style="width: 251px" | '''Finished Good Stock'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | An inventory of final products ready for sale.<br/> |

|- | |- | ||

| style="width: 251px" | '''Financial Viability'''<br/> | | style="width: 251px" | '''Financial Viability'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Ability to generate sufficient income to meet operating expenditure, financing needs and, ideally, to allow profit generation. Financial viability is usually assessed using the Net Present Value (NPV) and Internal Rate of Return (IRR) approaches together with estimating the sensitivity of the cost and revenue elements. Both NPV and IRR are the most commonly used decision criteria of a cost-benefit analysis.<br/> |

|- | |- | ||

| style="width: 251px" | '''Fixed Assets'''<br/> | | style="width: 251px" | '''Fixed Assets'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Assets required for long-term use and for physical use in the business (machinery, buildings, office equipment, cars, etc.).<br/> |

|- | |- | ||

| style="width: 251px" | '''Fixed Cost'''<br/> | | style="width: 251px" | '''Fixed Cost'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Costs that do not vary with the level of production.<br/> |

|- | |- | ||

| − | | style="width: 251px" | '''Fixed Investment | + | | style="width: 251px" | '''Fixed Investment'''<br/> |

| − | | style="width: 497px" | | + | | style="width: 497px" | Investment made in fixed assets (e.g. machinery).<br/> |

|- | |- | ||

| style="width: 251px" | '''Gross Margin'''<br/> | | style="width: 251px" | '''Gross Margin'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Gross income minus gross expenses.<br/> |

|- | |- | ||

| style="width: 251px" | '''Income'''<br/> | | style="width: 251px" | '''Income'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Income is money generated from the activities of the business.<br/> |

|- | |- | ||

| style="width: 251px" | '''Inflation'''<br/> | | style="width: 251px" | '''Inflation'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | The rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.<br/> |

|- | |- | ||

| style="width: 251px" | '''Internal Rate of Return'''<br/> | | style="width: 251px" | '''Internal Rate of Return'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Gives the discount rate over the life-span of a capital investment; i.e. the profit rate generated by a certain investment (amount) over its life-span. By calculating IRR of a project you can answer the question whether the money is well spent or if less risky investment alternatives might be more profitable in the long run, e.g. putting the money on a bank account to get interest on it.<br/> |

|- | |- | ||

| style="width: 251px" | '''Liabilities'''<br/> | | style="width: 251px" | '''Liabilities'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Claims by creditors against the assets of a business.<br/> |

|- | |- | ||

| style="width: 251px" | '''Life Cycle Costing'''<br/> | | style="width: 251px" | '''Life Cycle Costing'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | A technique for evaluating total cost of ownership to compare different alternatives.<br/> |

|- | |- | ||

| style="width: 251px" | '''Material Stocks'''<br/> | | style="width: 251px" | '''Material Stocks'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | An inventory of all raw materials not yet used in production.<br/> |

|- | |- | ||

| style="width: 251px" | '''Net Present Value'''<br/> | | style="width: 251px" | '''Net Present Value'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Determines the present worth of an investment by discounting the cash inflows and cash outflows generated by this investment over its life-span. For the determination of the NPV you need to define the expected life span of the investment as well as a discount factor, which might be near to the interest rate on deposits. You could also use the NPV for comparison of alternative investment options.<br/> |

|- | |- | ||

| style="width: 251px" | '''Net Working Capital''' | | style="width: 251px" | '''Net Working Capital''' | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Current Assets minus Current Liabilities. |

|- | |- | ||

| style="width: 251px" | '''Operating expenses (OPEX)'''<br/> | | style="width: 251px" | '''Operating expenses (OPEX)'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Are the ongoing costs for running a business that are related with the operation and maintenance. They are the expenses related to the production activity of the business and they are divided into fixed and variable costs.<br/> |

|- | |- | ||

| style="width: 251px" | '''Payback Period (PP)'''<br/> | | style="width: 251px" | '''Payback Period (PP)'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | The length of time required to recover the cost of an investment''.''<br/> |

|- | |- | ||

| style="width: 251px" | '''Profitability'''<br/> | | style="width: 251px" | '''Profitability'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Income minus expenses. It is stated in the income statement (or Profit and Loss Statement), which reports a company's revenue, expenses, and net income over a period of time.<br/> |

|- | |- | ||

| style="width: 251px" | '''Raw Material Purchases'''<br/> | | style="width: 251px" | '''Raw Material Purchases'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Cost incurred on purchase of raw material<br/> |

|- | |- | ||

| style="width: 251px" | '''Revenue'''<br/> | | style="width: 251px" | '''Revenue'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Is the income earned by a business typically through selling goods/products or services.<br/> |

|- | |- | ||

| style="width: 251px" | '''Variable Cost'''<br/> | | style="width: 251px" | '''Variable Cost'''<br/> | ||

| − | | style="width: 497px" | | + | | style="width: 497px" | Cost that varies directly with the level of production delivered.<br/> |

|} | |} | ||

| − | |||

{{SPIS Reference}} | {{SPIS Reference}} | ||

Latest revision as of 14:41, 22 November 2018

Glossary

| Assets |

Position in balance sheet which represents what a company owns. |

| Capital expenditures (CAPEX) |

Are one-time expenses. Normally they are long-term investments in non-consumable parts of the business, for example money that is spent on pump, panels, machines, etc. |

| Cash Inflows |

All cash receipts realized within a given period (e.g. from sales). |

| Cash Flow | The incoming and outgoing cash of a business. Cash outflows are considered as negative cash flows and cash inflows as positive ones. |

| Cash Outflow |

Outgoing cash, all cash payments realized during a given period (e.g. for buying production inputs, loan installments, buying equipment). |

| Creditors |

Payable occurring from past credit (money owed to suppliers for expenses). |

| Collateral |

Property or other assets that a borrower offers a lender to secure a loan. |

| Credit Sales |

Sales made without receiving cash. |

| Current Assets |

Cash and other assets which are expected to be converted into cash or consumed during the normal operating cycle of a business. |

| Debtors |

Receivables occurring from past credit sales. |

| Depreciation |

A cost charged against fixed assets for their replacement. Note: “depreciation” is one of the few expenses for which there is no associated outgoing cash flow. |

| Expenses / expenditure |

Payment of cash or cash equivalent for good or services received. Cost of resources used up or consumed by the activities of the business. |

| Finished Good Stock |

An inventory of final products ready for sale. |

| Financial Viability |

Ability to generate sufficient income to meet operating expenditure, financing needs and, ideally, to allow profit generation. Financial viability is usually assessed using the Net Present Value (NPV) and Internal Rate of Return (IRR) approaches together with estimating the sensitivity of the cost and revenue elements. Both NPV and IRR are the most commonly used decision criteria of a cost-benefit analysis. |

| Fixed Assets |

Assets required for long-term use and for physical use in the business (machinery, buildings, office equipment, cars, etc.). |

| Fixed Cost |

Costs that do not vary with the level of production. |

| Fixed Investment |

Investment made in fixed assets (e.g. machinery). |

| Gross Margin |

Gross income minus gross expenses. |

| Income |

Income is money generated from the activities of the business. |

| Inflation |

The rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. |

| Internal Rate of Return |

Gives the discount rate over the life-span of a capital investment; i.e. the profit rate generated by a certain investment (amount) over its life-span. By calculating IRR of a project you can answer the question whether the money is well spent or if less risky investment alternatives might be more profitable in the long run, e.g. putting the money on a bank account to get interest on it. |

| Liabilities |

Claims by creditors against the assets of a business. |

| Life Cycle Costing |

A technique for evaluating total cost of ownership to compare different alternatives. |

| Material Stocks |

An inventory of all raw materials not yet used in production. |

| Net Present Value |

Determines the present worth of an investment by discounting the cash inflows and cash outflows generated by this investment over its life-span. For the determination of the NPV you need to define the expected life span of the investment as well as a discount factor, which might be near to the interest rate on deposits. You could also use the NPV for comparison of alternative investment options. |

| Net Working Capital | Current Assets minus Current Liabilities. |

| Operating expenses (OPEX) |

Are the ongoing costs for running a business that are related with the operation and maintenance. They are the expenses related to the production activity of the business and they are divided into fixed and variable costs. |

| Payback Period (PP) |

The length of time required to recover the cost of an investment. |

| Profitability |

Income minus expenses. It is stated in the income statement (or Profit and Loss Statement), which reports a company's revenue, expenses, and net income over a period of time. |

| Raw Material Purchases |

Cost incurred on purchase of raw material |

| Revenue |

Is the income earned by a business typically through selling goods/products or services. |

| Variable Cost |

Cost that varies directly with the level of production delivered. |