Difference between revisions of "Financing Opportunities for Energy Access Companies in Mozambique"

***** (***** | *****) m |

***** (***** | *****) m Tag: 2017 source edit |

||

| (40 intermediate revisions by 3 users not shown) | |||

| Line 1: | Line 1: | ||

| + | {{Back to Mozambique Portal}} | ||

| + | {{Portuguese Version|Oportunidades_de_Financiamento_para_Empresas_de_Acesso_à_Energia_em_Moçambique}} | ||

| + | |||

== Access to Financial Services and Products == | == Access to Financial Services and Products == | ||

Access to finance is difficult for renewable energy companies in Mozambique due to sectoral and legal framework conditions, high interest rates, required collateral and lack of information. | Access to finance is difficult for renewable energy companies in Mozambique due to sectoral and legal framework conditions, high interest rates, required collateral and lack of information. | ||

| − | According to World Bank’s Doing Business report, Mozambique scores 25 with regard to getting credit (with 0 being the lowest and 100 the highest score). The degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders, and thus facilitate lending, is especially low with an index of 1 (out of 12). Furthermore, only 7.6% of individuals and firms are listed in a credit registry.<ref>World Bank (2020): Ease of Doing Business in Mozambique | + | According to World Bank’s Doing Business report, Mozambique scores 25 with regard to getting credit (with 0 being the lowest and 100 the highest score). The degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders, and thus facilitate lending, is especially low with an index of 1 (out of 12). Furthermore, only 7.6% of individuals and firms are listed in a credit registry.<ref>World Bank (2020): Ease of Doing Business in Mozambique https://www.doingbusiness.org/en/data/exploreeconomies/mozambique#. </ref> |

| − | Commercial banks have high lending rates<ref>U.S. International Trade Administration, “Mozambique -Country Commercial Guide.”</ref>, making it difficult for small retailers and micro- or medium entrepreneurs to get access to working capital, e.g. for stocking products. According to the findings of the FinScope MSME Survey Mozambique 2012, about 75% of micro enterprises and 50% of small enterprises lack access to financial services and products in the country.<ref>Republic of Mozambique (2016): National Financial Inclusion Strategy 2016-2022 | + | Commercial banks have high lending rates<ref>U.S. International Trade Administration, “Mozambique -Country Commercial Guide.”</ref>, making it difficult for small retailers and micro- or medium entrepreneurs to get access to working capital, e.g. for stocking products. According to the findings of the FinScope MSME Survey Mozambique 2012, about 75% of micro enterprises and 50% of small enterprises lack access to financial services and products in the country.<ref>Republic of Mozambique (2016): National Financial Inclusion Strategy 2016-2022 https://thedocs.worldbank.org/en/doc/469371468274738363-0010022016/original/MozambiqueNationalFinancialInclusionStrategy20162022.pdf. </ref> |

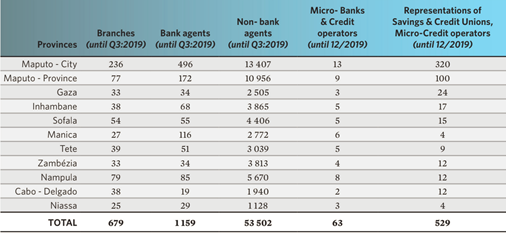

However, the lack of access to finance is not only hampered by high interest and required collateral, but also due to the mere fact that banking institutions are not easy to reach in rural areas nor do all provinces have the same coverage of bank branches. | However, the lack of access to finance is not only hampered by high interest and required collateral, but also due to the mere fact that banking institutions are not easy to reach in rural areas nor do all provinces have the same coverage of bank branches. | ||

| − | For an overview about the accessibility of financial services for individuals, read the article about end-user finance. | + | For an overview about the accessibility of financial services for individuals, read the article about '''''[[End-User Finance in Mozambique|end-user finance]]'''''. |

Mozambique’s financial sector is comprised by the following Credit institutions and financial companies: | Mozambique’s financial sector is comprised by the following Credit institutions and financial companies: | ||

{| class="wikitable" | {| class="wikitable" | ||

| | | | ||

| − | |'''2019'''<ref>FinScope Report Mozambique 2019 | + | |'''2019'''<ref>FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view. </ref> |

|- | |- | ||

|Commercial banks | |Commercial banks | ||

| Line 33: | Line 36: | ||

|529 | |529 | ||

|} | |} | ||

| − | Provincial distribution of bank branches as of 2019<ref>FinScope Report Mozambique 2019 | + | Provincial distribution of bank branches as of 2019<ref>FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view. </ref> |

| − | [[File: | + | |

| + | [[File:Provincial_distribution_of_bank_branches_in_Mozambique_2019.png|alt=|506x506px]]<br /> | ||

| + | |||

| + | |||

| + | |||

| + | === Micro Finance === | ||

| + | The '''microfinance sector''' is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. | ||

| + | Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.<ref name=":0">ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf. </ref> | ||

| + | |||

| + | The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.<ref name=":0" /> | ||

| + | |||

| + | |||

| + | === Credit Lines in Place === | ||

| + | State-owned Banco Nacional de Investimento (BNI) is Mozambique’s development and investment bank. It offers a range of credit products to projects that contribute to the sustainable development of Mozambique. BNI finances infrastructures with inter-sector links, such as energy, agriculture or transportation, for example. As of September 2021, there was no online information available about interest rates or specific credit lines.<ref>https://www.bni.co.mz/en/development-banking/. Visited September 2021</ref> | ||

| + | |||

| + | In 2018, Banco Comercial e de Investimentos (BCI) launched a credit line “Eco Ambiental” for renewable energy production projects. This credit line will be available until 20 December 2024 and has in total 3 million Euros available.<ref>https://www.aler-renovaveis.org/pt/comunicacao/noticias/bci-lanca-linha-de-credito-eco-ambiental/</ref> The credit line also finances energy efficient equipment, if CO2 emissions are reduced for at least 15%, or if renewable energy use is involved. Beneficiaries include private customers, micro and small and medium enterprises (SMEs), single entrepreneurs as wells as large corporations. While individuals can get from MZN 5.000 to 5 million Meticais, companies can get up to 20 million Meticais, at a fixed rate of 15%.<ref>https://www.bci.co.mz/bci-exclusivo-pme/#1619531279903-c3fa3f7c-4114. Accessed in September 2021 </ref> | ||

| + | |||

| + | In March 2020, the TSE4ALLM project collaborated with BCI to offer a USD 1,000,000 credit line for productive uses in agriculture in Mozambique.<ref>TSE4ALLM (2022). UNIDO partners with BCI to finance renewable energy systems for productive uses in rural Mozambique. https://www.tse4allm.org.mz/index.php/en/midia/a-unido-em-parceria-com-o-bci-financia-sistemas-de-energia-renovavel-para-usos-produtivos-na-zona-rural-de-mocambique | ||

| + | |||

| + | </ref> The credit line has a 3 years duration. The clients can get a loan up to USD 50,000 but have to put up 25% upfront investment. The loan can be paid back in 1-3 years with a 7.5% interest rate.<ref>Practica Foundation (2022). [[Solar Powered Irrigation in Mozambique : Barriers#cite%20ref-4|Solar Powered Irrigation in Mozambique : Barriers]]</ref> | ||

| + | |||

| + | '''See also [[End-User Finance in Mozambique|credit lines in place for end-users in Mozambique]].''' | ||

| + | |||

| + | |||

| + | == Financing Opportunities on a National Level == | ||

| + | There are a number of public funding opportunities, tendering or offering catalytic grants and results-based financing (RBF). RBF is an approach that rewards companies for delivering previously-agreed results. Unlike traditional grant schemes, RBF schemes disburse grant incentives only against achieved results that have been verified. Read more about RBF '''''here'''''. | ||

| + | |||

| + | === Fundo de Acesso Sustentável às Energias Renováveis (FASER) === | ||

| + | Faser (Fund for Sustainable Access to Renewable Energy) is a results-based financing fund, which finances the dissemination of modern, renewable energy technologies (e.g. PV systems, solar irrigation pumps, improved cookstoves) in peri-urban and rural off-grid areas. It furthermore aims at assisting vulnerable populations to have access to reliable and modern energy. FASER has been set up by '''Green People’s Energy,''' EnDev Mozambique and the '''Foundation for Community Development''' (FDC). | ||

| + | |||

| + | Find more information [https://www.faser.co.mz/ here]. | ||

| + | |||

| + | === Market Development Fund - BRILHO === | ||

| + | Businesses can apply for BRILHO’s Market Development Fund financial support ranging from £50,000 up to £1,500,000. Two grants-based mechanisms are offered: catalytic grants and results-based financing (RBF). | ||

| + | |||

| + | Find more information about this program [https://brilhomoz.com/ here]. | ||

| + | |||

| + | === Energising Development (EnDev) === | ||

| + | EnDev Mozambique supports SHS and picoPV companies along the value chain, strengthens the market development of improved cookstoves, and enables grid densification. Along with the financial support via results-based financing approaches, EnDev also supports private companies by providing trainings related to business development services. Check their homepage [https://endev.info/countries/mozambique/ here] for more details. | ||

| + | |||

| + | === ProEnergia – Energy for All === | ||

| + | This program of the Government of Mozambique is financed by the World Bank and implemented by Fundo de Energia (FUNAE) and Electricidade de Moçambique (EDM). | ||

| + | |||

| + | It has 3 components: | ||

| + | |||

| + | * connecting households to the grid; | ||

| + | * off-grid electrification with subcomponents for mini-grids and results-based financing; and | ||

| + | * technical assistance and implementation support to FUNAE and EDM. | ||

| + | |||

| + | Invitation for bids, requests for expressions of interest etc. are available on the World Bank’s project page, at the [https://projects.worldbank.org/en/projects-operations/project-procurement/P165453 procurement] section. | ||

| + | |||

| + | Find more general information '''[[Policy Framework and Energy Access Strategies in Mozambique|here]]''' . | ||

| + | |||

| + | === PROLER (Promoçao de Leilões de Energias Renovaveis) === | ||

| + | The PROLER program supports the Mozambican government in tendering renewable energy power generation projects connected to the national grid. It aims at building three 40 MW solar plants in the districts of Dondo, Manje and Lichinga, respectively, and a 40 MW wind project in Inhambane. The total cost of the four projects of the Initiative is of approximately 200 M€, from which 37 M€ will be co-funded by the European Union (EU), and the remaining will come from selected Private Investors. | ||

| + | A first tender was carried out in 2020. Further tenders for solar PV advisors and consultants to conduct a one-year wind measurement campaign and feasibility studies are expected to be opened in 2021.<ref>http://proler.gov.mz/. Accessed in June 2021. </ref> | ||

| + | For more information, read [http://proler.gov.mz/ accessed in June 2021 here]. | ||

| + | == Financing Opportunities on the International Level == | ||

| + | There are a couple of international funding opportunities available to Mozambican energy access enterprises and programs, ranging from grants and results-based finance to equity and debt. This chapter presents a few selected international funding opportunities and further helpful databases and links. | ||

| + | ===[https://www.get-invest.eu/funding-database/ GET.invest funding database]=== | ||

| + | GET.invest is a European program that mobilizes investment in renewable energy in developing countries. Check its comprehensive database of financing instruments available to project developers and companies in the renewable energy sector. You can i.e. filter for different funding sources, market segments, geographic regions, and countries according to your needs and interest. | ||

| − | + | === [https://beyondthegrid.africa/. Beyond the Grid Fund for Africa (BGFA)] === | |

| + | The Beyond the Grid Fund for Africa (BGFA) program focuses on Burkina Faso, Liberia, Mozambique, Uganda and Zambia. BGFA is a EUR 77 million multi-donor program, which supports the use of solar home systems (SHS) and mini- and micro grids in rural and peri-urban areas in these five countries. BGFA offers results-based financing to incentivize off-grid energy companies to expand, grow and scale-up access to energy for customers living in rural and peri-urban areas.<ref>https://beyondthegrid.africa/. Accessed in May 2021.</ref> | ||

| + | |||

| + | ===[https://www.aecfafrica.org/ Africa Enterprise Challenge Fund (AECF)]=== | ||

| + | The AECF supports businesses in Africa, with special focus on agriculture and agribusiness, and renewable energy and adaptations to climate change. In addition, it supports rural financial services and communications systems that support the two sectors. The AECF has different funding lines, the ones relevant for Mozambique are described below. | ||

| + | |||

| + | <u>REACT SSA</u> | ||

| + | |||

| + | The Renewable Energy and Adaptation to Climate Technologies (REACT) window is demonstrating how renewable energy technologies and businesses have the potential to reach Africa’s rural communities. Under the REACT SSA program, the following technologies are funded:<ref>https://www.aecfafrica.org/index.php/portfolio/renewable_energy/react_ssa. Accessed in June 2021.</ref> | ||

| + | |||

| + | * Hydro-power, solar energy, biomass and wind energy technologies | ||

| + | * Solar home systems | ||

| + | * Large solar power stand-alone systems for productive use | ||

| + | * Larger solar power systems that meet the full range of household needs and are still affordable for low income individuals | ||

| + | * Mini-grids/ micro grids/ utility models | ||

| + | * Production and/or distribution of cleaner fuels (e.g. ethanol) and energy efficient cookstoves | ||

| + | * Distribution models that support local entrepreneurship and growth of SMEs within a renewable energy product demand and supply chain | ||

| + | * Innovative ideas that stimulate “next generation” approaches in renewable energy sector | ||

| + | |||

| + | Find more information [https://www.aecfafrica.org/index.php/portfolio/renewable_energy/react_ssa here]. | ||

| + | |||

| + | <u>Innovation Fund</u> | ||

| + | |||

| + | The Innovation Fund is an AECF initiative aimed at innovations in clean cooking and productive use of energy technologies and services. The fund provides technical and financial support to enterprises that are sufficiently developed to address affordability and accessibility of clean cooking, and productive use energy technologies. Eligible companies need to have market ready innovations past a prototyping phase. <ref>https://www.aecfafrica.org/index.php/the-AECF-innovation-fund. Accessed in June 2021.</ref> | ||

| + | The fund invests in the following products and services: | ||

| + | |||

| + | * Scalable supply chain models for clean cooking solutions (especially in rural areas). | ||

| + | * Alternative clean cooking technologies (stoves and fuels) e.g. mini-grid and solar PV powered electric cooking. | ||

| + | * Business models and technological innovations for stand-alone systems and Productive Use Energy (PUE) appliances. | ||

| + | |||

| + | For more information, see [https://www.aecfafrica.org/index.php/the-AECF-innovation-fund here]. | ||

| + | |||

| + | ===[https://eepafrica.org/ EEP Africa]=== | ||

| + | The [https://eepafrica.org/ Energy and Environment Partnership Trust Fund (EEP Africa)] is a clean energy financing facility hosted and managed by the Nordic Development Fund (NDF). EEP Africa provides early stage grant and catalytic financing to innovative clean energy projects, technologies and business models in 15 countries across Southern and East Africa (with Mozambique being part of it). | ||

| + | |||

| + | The EEP Innovation window offers grants to companies (including start-ups), NGOs, and social enterprises, which focus on one of the following technologies: Biofuels Liquid, Biogas, Cookstoves, Energy Efficiency, Geothermal, Hydropower, Solar PV, Solar Thermal, Solid Biomass, Waste-to-Energy, Wind Power, other RE/EE technology or a combination of technologies. In recent calls, grants and repayable grants between EUR 200,000 and EUR 1 million have been awarded, with a minimum co-financing requirement of 30%.<ref>https://eepafrica.org/. Accessed in June 2021.</ref> | ||

| + | |||

| + | Currently (2021), there are two ongoing projects in Mozambique that received funding from EEP Africa: a [https://eepafrica.org/wp-content/uploads/2021/04/MOZ16372_Gommyr-Power.pdf feasibility study for productive solar microgrid hubs], and a project that promotes a [https://eepafrica.org/wp-content/uploads/2020/09/MOZ14529_Pamoja.pdf smart cookstove fueled with cashew shells]. | ||

| + | |||

| + | The EEP Catalyst offers flexible follow-on debt financing to successful companies from the EEP Innovation grant portfolio, with the purpose of closing financing gaps and crowding in new investors. | ||

| + | |||

| + | For further information and current calls visit their [https://eepafrica.org/ homepage]. | ||

| + | |||

| + | === [https://www.edp.com/en/edp/social-responsibility/access-energy-fund-program#4th-edition Energy Access Fund (A2E)] === | ||

| + | This fund supports renewable energy projects focusing on community, education, health, business, water & health in different Sub-Saharan African countries including Mozambique. It regularly opens different funding windows. The 4th funding window was opened in April 2022, with funding ranging from 25 000 euros to 150 000 euros. | ||

| + | |||

| + | For further information and current calls visit their [https://www.edp.com/en/edp/social-responsibility/access-energy-fund-program#4th-edition homepage]. | ||

| + | |||

| + | ===[https://opecfund.org Opec Fund for International Development (OFID)]=== | ||

| + | The Opec Fund for International Development (OFID) offers grants, public lending, private/trade finance, and some special initiatives such as scholarships in the areas of energy, agriculture, water and sanitation, health, and much more. For further information visit their [https://opecfund.org/what-we-offer/overview homepage]. | ||

| + | |||

| + | === [https://www.nefco.int/fund-mobilisation/funds-managed-by-nefco/modern-cooking-facility-for-africa/ Modern Cooking Facility for Africa] === | ||

| + | This programme offers grants to companies offering high-tier clean cooking solutions using a RBF mechanism. The first funding round is opened until 21 June 2022 and aims to distribute 420,000-840,000 electric, biogas and bioethanol cookstoves and associated fuels in six Sub-Saharan African countries including Mozambique. | ||

| + | |||

| + | Find the latest call for proposals, [https://www.nefco.int/fund-mobilisation/funds-managed-by-nefco/modern-cooking-facility-for-africa/ here]. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | == Further Information == | |

| + | * [[Portal:Financing and Funding|Financing and Funding Portal]] on energypedia | ||

| + | * [[End-User Finance in Mozambique|End-user Finance in Mozambique]] | ||

| + | * https://www.get-invest.eu/funding-database/ | ||

| + | * | ||

| − | |||

| − | |||

| − | |||

== References == | == References == | ||

<references /> | <references /> | ||

| + | [[Category:Mozambique]] | ||

| + | [[Category:Financing and Funding]] | ||

| + | [[Category:Microfinance]] | ||

Latest revision as of 08:21, 3 November 2022

Access to Financial Services and Products

Access to finance is difficult for renewable energy companies in Mozambique due to sectoral and legal framework conditions, high interest rates, required collateral and lack of information.

According to World Bank’s Doing Business report, Mozambique scores 25 with regard to getting credit (with 0 being the lowest and 100 the highest score). The degree to which collateral and bankruptcy laws protect the rights of borrowers and lenders, and thus facilitate lending, is especially low with an index of 1 (out of 12). Furthermore, only 7.6% of individuals and firms are listed in a credit registry.[1]

Commercial banks have high lending rates[2], making it difficult for small retailers and micro- or medium entrepreneurs to get access to working capital, e.g. for stocking products. According to the findings of the FinScope MSME Survey Mozambique 2012, about 75% of micro enterprises and 50% of small enterprises lack access to financial services and products in the country.[3]

However, the lack of access to finance is not only hampered by high interest and required collateral, but also due to the mere fact that banking institutions are not easy to reach in rural areas nor do all provinces have the same coverage of bank branches.

For an overview about the accessibility of financial services for individuals, read the article about end-user finance.

Mozambique’s financial sector is comprised by the following Credit institutions and financial companies:

| 2019[4] | |

| Commercial banks | 19 |

| Micro-banks | 9 |

| Credit unions | 9 |

| Electronic money institutions | 3 |

| Savings and loan organisations | 12 |

| Representations of Savings and Credit Unions, Micro-credit operators | 529 |

Provincial distribution of bank branches as of 2019[5]

Micro Finance

The microfinance sector is still small and concentrates predominantly on Maputo city and Maputo province. High interest rates make credit from Micro Finance Institutions (MFI) very expensive. Given the difficulties in accessing local credit, most off-grid solar companies either depend on their own finances or are raising international capital.[6]

The lack of affordable loans limits the ability of energy access enterprises to manage their inventory levels, give credit to dealers, expand their distribution networks and invest in the marketing of their products. It also limits the ability of SMEs to import larger quantities of stock and thereby secure better price offers from their suppliers. This in turn leads to higher prices that are often unaffordable for low-income groups.[6]

Credit Lines in Place

State-owned Banco Nacional de Investimento (BNI) is Mozambique’s development and investment bank. It offers a range of credit products to projects that contribute to the sustainable development of Mozambique. BNI finances infrastructures with inter-sector links, such as energy, agriculture or transportation, for example. As of September 2021, there was no online information available about interest rates or specific credit lines.[7]

In 2018, Banco Comercial e de Investimentos (BCI) launched a credit line “Eco Ambiental” for renewable energy production projects. This credit line will be available until 20 December 2024 and has in total 3 million Euros available.[8] The credit line also finances energy efficient equipment, if CO2 emissions are reduced for at least 15%, or if renewable energy use is involved. Beneficiaries include private customers, micro and small and medium enterprises (SMEs), single entrepreneurs as wells as large corporations. While individuals can get from MZN 5.000 to 5 million Meticais, companies can get up to 20 million Meticais, at a fixed rate of 15%.[9]

In March 2020, the TSE4ALLM project collaborated with BCI to offer a USD 1,000,000 credit line for productive uses in agriculture in Mozambique.[10] The credit line has a 3 years duration. The clients can get a loan up to USD 50,000 but have to put up 25% upfront investment. The loan can be paid back in 1-3 years with a 7.5% interest rate.[11]

See also credit lines in place for end-users in Mozambique.

Financing Opportunities on a National Level

There are a number of public funding opportunities, tendering or offering catalytic grants and results-based financing (RBF). RBF is an approach that rewards companies for delivering previously-agreed results. Unlike traditional grant schemes, RBF schemes disburse grant incentives only against achieved results that have been verified. Read more about RBF here.

Fundo de Acesso Sustentável às Energias Renováveis (FASER)

Faser (Fund for Sustainable Access to Renewable Energy) is a results-based financing fund, which finances the dissemination of modern, renewable energy technologies (e.g. PV systems, solar irrigation pumps, improved cookstoves) in peri-urban and rural off-grid areas. It furthermore aims at assisting vulnerable populations to have access to reliable and modern energy. FASER has been set up by Green People’s Energy, EnDev Mozambique and the Foundation for Community Development (FDC).

Find more information here.

Market Development Fund - BRILHO

Businesses can apply for BRILHO’s Market Development Fund financial support ranging from £50,000 up to £1,500,000. Two grants-based mechanisms are offered: catalytic grants and results-based financing (RBF).

Find more information about this program here.

Energising Development (EnDev)

EnDev Mozambique supports SHS and picoPV companies along the value chain, strengthens the market development of improved cookstoves, and enables grid densification. Along with the financial support via results-based financing approaches, EnDev also supports private companies by providing trainings related to business development services. Check their homepage here for more details.

ProEnergia – Energy for All

This program of the Government of Mozambique is financed by the World Bank and implemented by Fundo de Energia (FUNAE) and Electricidade de Moçambique (EDM).

It has 3 components:

- connecting households to the grid;

- off-grid electrification with subcomponents for mini-grids and results-based financing; and

- technical assistance and implementation support to FUNAE and EDM.

Invitation for bids, requests for expressions of interest etc. are available on the World Bank’s project page, at the procurement section.

Find more general information here .

PROLER (Promoçao de Leilões de Energias Renovaveis)

The PROLER program supports the Mozambican government in tendering renewable energy power generation projects connected to the national grid. It aims at building three 40 MW solar plants in the districts of Dondo, Manje and Lichinga, respectively, and a 40 MW wind project in Inhambane. The total cost of the four projects of the Initiative is of approximately 200 M€, from which 37 M€ will be co-funded by the European Union (EU), and the remaining will come from selected Private Investors.

A first tender was carried out in 2020. Further tenders for solar PV advisors and consultants to conduct a one-year wind measurement campaign and feasibility studies are expected to be opened in 2021.[12]

For more information, read here.

Financing Opportunities on the International Level

There are a couple of international funding opportunities available to Mozambican energy access enterprises and programs, ranging from grants and results-based finance to equity and debt. This chapter presents a few selected international funding opportunities and further helpful databases and links.

GET.invest funding database

GET.invest is a European program that mobilizes investment in renewable energy in developing countries. Check its comprehensive database of financing instruments available to project developers and companies in the renewable energy sector. You can i.e. filter for different funding sources, market segments, geographic regions, and countries according to your needs and interest.

Beyond the Grid Fund for Africa (BGFA)

The Beyond the Grid Fund for Africa (BGFA) program focuses on Burkina Faso, Liberia, Mozambique, Uganda and Zambia. BGFA is a EUR 77 million multi-donor program, which supports the use of solar home systems (SHS) and mini- and micro grids in rural and peri-urban areas in these five countries. BGFA offers results-based financing to incentivize off-grid energy companies to expand, grow and scale-up access to energy for customers living in rural and peri-urban areas.[13]

Africa Enterprise Challenge Fund (AECF)

The AECF supports businesses in Africa, with special focus on agriculture and agribusiness, and renewable energy and adaptations to climate change. In addition, it supports rural financial services and communications systems that support the two sectors. The AECF has different funding lines, the ones relevant for Mozambique are described below.

REACT SSA

The Renewable Energy and Adaptation to Climate Technologies (REACT) window is demonstrating how renewable energy technologies and businesses have the potential to reach Africa’s rural communities. Under the REACT SSA program, the following technologies are funded:[14]

- Hydro-power, solar energy, biomass and wind energy technologies

- Solar home systems

- Large solar power stand-alone systems for productive use

- Larger solar power systems that meet the full range of household needs and are still affordable for low income individuals

- Mini-grids/ micro grids/ utility models

- Production and/or distribution of cleaner fuels (e.g. ethanol) and energy efficient cookstoves

- Distribution models that support local entrepreneurship and growth of SMEs within a renewable energy product demand and supply chain

- Innovative ideas that stimulate “next generation” approaches in renewable energy sector

Find more information here.

Innovation Fund

The Innovation Fund is an AECF initiative aimed at innovations in clean cooking and productive use of energy technologies and services. The fund provides technical and financial support to enterprises that are sufficiently developed to address affordability and accessibility of clean cooking, and productive use energy technologies. Eligible companies need to have market ready innovations past a prototyping phase. [15] The fund invests in the following products and services:

- Scalable supply chain models for clean cooking solutions (especially in rural areas).

- Alternative clean cooking technologies (stoves and fuels) e.g. mini-grid and solar PV powered electric cooking.

- Business models and technological innovations for stand-alone systems and Productive Use Energy (PUE) appliances.

For more information, see here.

EEP Africa

The Energy and Environment Partnership Trust Fund (EEP Africa) is a clean energy financing facility hosted and managed by the Nordic Development Fund (NDF). EEP Africa provides early stage grant and catalytic financing to innovative clean energy projects, technologies and business models in 15 countries across Southern and East Africa (with Mozambique being part of it).

The EEP Innovation window offers grants to companies (including start-ups), NGOs, and social enterprises, which focus on one of the following technologies: Biofuels Liquid, Biogas, Cookstoves, Energy Efficiency, Geothermal, Hydropower, Solar PV, Solar Thermal, Solid Biomass, Waste-to-Energy, Wind Power, other RE/EE technology or a combination of technologies. In recent calls, grants and repayable grants between EUR 200,000 and EUR 1 million have been awarded, with a minimum co-financing requirement of 30%.[16]

Currently (2021), there are two ongoing projects in Mozambique that received funding from EEP Africa: a feasibility study for productive solar microgrid hubs, and a project that promotes a smart cookstove fueled with cashew shells.

The EEP Catalyst offers flexible follow-on debt financing to successful companies from the EEP Innovation grant portfolio, with the purpose of closing financing gaps and crowding in new investors.

For further information and current calls visit their homepage.

Energy Access Fund (A2E)

This fund supports renewable energy projects focusing on community, education, health, business, water & health in different Sub-Saharan African countries including Mozambique. It regularly opens different funding windows. The 4th funding window was opened in April 2022, with funding ranging from 25 000 euros to 150 000 euros.

For further information and current calls visit their homepage.

Opec Fund for International Development (OFID)

The Opec Fund for International Development (OFID) offers grants, public lending, private/trade finance, and some special initiatives such as scholarships in the areas of energy, agriculture, water and sanitation, health, and much more. For further information visit their homepage.

Modern Cooking Facility for Africa

This programme offers grants to companies offering high-tier clean cooking solutions using a RBF mechanism. The first funding round is opened until 21 June 2022 and aims to distribute 420,000-840,000 electric, biogas and bioethanol cookstoves and associated fuels in six Sub-Saharan African countries including Mozambique.

Find the latest call for proposals, here.

Further Information

- Financing and Funding Portal on energypedia

- End-user Finance in Mozambique

- https://www.get-invest.eu/funding-database/

References

- ↑ World Bank (2020): Ease of Doing Business in Mozambique https://www.doingbusiness.org/en/data/exploreeconomies/mozambique#.

- ↑ U.S. International Trade Administration, “Mozambique -Country Commercial Guide.”

- ↑ Republic of Mozambique (2016): National Financial Inclusion Strategy 2016-2022 https://thedocs.worldbank.org/en/doc/469371468274738363-0010022016/original/MozambiqueNationalFinancialInclusionStrategy20162022.pdf.

- ↑ FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view.

- ↑ FinScope Report Mozambique (2019): https://drive.google.com/file/d/1TYp_gAuemR2rUVUNWeYyA2N9hG5U7qUS/view.

- ↑ 6.0 6.1 ECA/Green Light (2018): Off-Grid Solar Market Assessment in Mozambique https://www.lightingafrica.org/wp-content/uploads/2019/07/Mozambique_off-grid-assessment.pdf.

- ↑ https://www.bni.co.mz/en/development-banking/. Visited September 2021

- ↑ https://www.aler-renovaveis.org/pt/comunicacao/noticias/bci-lanca-linha-de-credito-eco-ambiental/

- ↑ https://www.bci.co.mz/bci-exclusivo-pme/#1619531279903-c3fa3f7c-4114. Accessed in September 2021

- ↑ TSE4ALLM (2022). UNIDO partners with BCI to finance renewable energy systems for productive uses in rural Mozambique. https://www.tse4allm.org.mz/index.php/en/midia/a-unido-em-parceria-com-o-bci-financia-sistemas-de-energia-renovavel-para-usos-produtivos-na-zona-rural-de-mocambique

- ↑ Practica Foundation (2022). Solar Powered Irrigation in Mozambique : Barriers

- ↑ http://proler.gov.mz/. Accessed in June 2021.

- ↑ https://beyondthegrid.africa/. Accessed in May 2021.

- ↑ https://www.aecfafrica.org/index.php/portfolio/renewable_energy/react_ssa. Accessed in June 2021.

- ↑ https://www.aecfafrica.org/index.php/the-AECF-innovation-fund. Accessed in June 2021.

- ↑ https://eepafrica.org/. Accessed in June 2021.