Impact of Tariff Structures on the Economic Viability of Mini-Grids

Background

Mini-Grids

Mini-Grids vary significantly in terms of their design and structure, depending on their location, available natural resources in the area, the local policy framework and the demographic being served by the grid. Therefore, many different tariff structures are being implemented and tested in mini-grids throughout the world.

For more information on mini and micro-grids in general have a look at the energypedia articles: Mini-Grids and Mini-grid Policy Toolkit.

Economic Viability

A project is economically viable when it is able to secure initial funding to cover the capital cost and when the revenues are able to cover the operation and maintenance (O&M) costs throughout the entire lifetime of the project while still generating an acceptable rate of return on the initial investment. In order to achieve this, the project should have a set operation plan which is flexible enough that it can adapt to future changes including political and regulatory changes, ownership hand over or economic fluctuations. Long term economic viability can be achieved through careful planning and economic modelling, taking into consideration external costs.[1] In a mini-grid the expected sale of electricity can be used to calculate financial indicators such as project return, equity return expectations and payback periods. These values provide the bases on which investment decisions can be made.[2]

Economic Viability of Mini-grids

“A financially viable micro-grid balances financial incentives/subsidies and revenue streams from tariffs with debt, equity, and operational expenses obligations both in the short and long run."[3] This does not necessarily mean that the funds needed must all come for consumer tariff payments. Some mini-grid are dependent on support from local or national governments to supply the funds needed to cover the operation and maintenance costs of the mini-grids. A mini-grid dependent on external funding can be just as financially viable as one in which all the costs are met through tariff collection, as long as it follows the set-out operation schedule and delivers the expected amount of power and energy, allowing the customers of the mini-grid to benefit from improved energy access. However, the operation plan for mini-grids which are dependent on government funding should consider the risk of political shifts which might affect the future availability of subsidies for the mini-grids.[4]

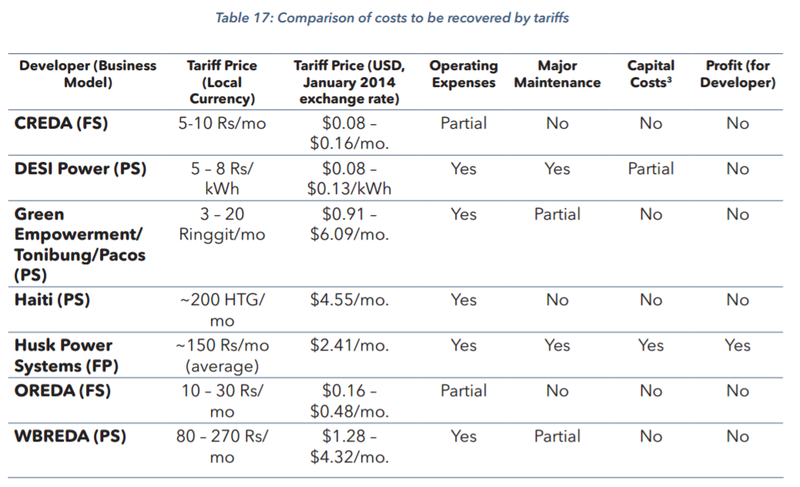

According to the Micro-grids for Rural Electrification study, “it is impossible to compare tariff design without first looking at the elements of the micro-grid that tariffs are expected to cover”.[4] Figure 1 below shows a comparison of different Mini-Grid projects around the world and the costs which the consumer tariffs charged in that mini-grids are expected to recover.

For-profit mini-grid companies will want to recover all the costs as well as to make a profit on their investment. Therefore, tariffs in a mini-grids installed by a for-profit company are likely to be quite high. If tariff levels are too low, then even high rates of tariff collection will be insufficient to retrieve the necessary fund. However, if tariffs are too high, customers might be unwilling to pay for the electricity and collection rates will be lowered.

On the other hand, NGO developers will often design tariffs so that the mini-grid remains self-sufficient once installed, meaning that the tariff is expected to cover everything except for the initial capital cost and occasional rare maintenance costs (sometimes referred to as break-even tariffs). In government owned mini-grids, tariffs are usually designed to cover only the basic O&M. This usually results in relatively low tariffs.[4]

Tariff Building for Mini-Grids – Different Options

Tariff designs can be very varied and should always be adapted to the specific circumstances of each individual mini-grids. Usually tariffs have two basic components, a connection fee and a usage/service fee (often paid monthly).[5]

Connection fees are used to cover the connection costs incurred by the mini-grid operator. Furthermore, they can be used as a measure to ensure a high level of commitment from the electricity consumers. In this way, connection fees can help increase the economic viability of the mini-grid, by covering a part of the capital cost, as well as by making sure that all the costumers of the mini-grid have a vested interest in the project. Consumers who have paid an initial connection fee are likely to be willing to ensure that the mini-grid remains operational for a long period. Therefore, they might be more willing to pay usage/service fees which cover the operation and maintenance costs for the grid.[6]

Usage/service fees are collected in the form of consumer tariffs. Tariffs can be structured in many ways, depending on the mini-grid in question. Most tariffs can be divided into the following categories:

- Energy Based Tariffs: Depend on the actual electricity consumption and require that the consumer’s kWh usage is measured

- Power Based Tariffs: Based on the maximum power available to the consumer. The tariff is calculated based on capacity cap put in place, which is given in Watts. The consumer pays a fixed amount of money each month for this capacity.

- Fee-for Service Tariffs: Based on the services provided rather than the energy consumed. For example, to tariff could set a fixed price for 1 hour of TV usage or 5 hours of lighting.

These tariffs can either be pre-paid or post-paid. Pre-paid tariffs result in more planning security for both the consumers and the mini-grid operators. More detailed types of tariff structures include:

- Customer Class Tariff Regime: sets diverse tariffs according to consumer group, e.g. residents, institutions and businesses. It is mostly used to cross-subsidise residents.

- Stepped Tariff Regime: includes different tariffs depending on consumption level of the consumers.

- With progressive tariffs, consumers pay low tariffs for the first kilowatt-hours (or Watts) and higher tariffs for further consumption (cross-subsidisation). It may also include a lifeline tariff, which is a subsidised tariff providing basic electricity needs.

- With regressive tariffs, larger consumers pay a lower unit price.

- Flat-Rate Tariffs: fixed tariffs that do not depend on electricity consumption, and only need a load limiter as a metering technology.

- Time Based Tariffs: variable tariffs based on the time of day. They are mostly applied for commercial and industrial consumers and are also used for load scheduling (Demand Side Management).

- Flexible Tariff Structure: includes tariffs that change according to electricity demand or power demand, providing incentives for electricity usage when surplus energy is available. Here advanced metering systems are needed.

The Article: Effects of Different Tariff Systems on Social Cohesion of Villages offers further information on the different tariff structures and their respective impacts.

Consumers usually do not like high fixed costs and prefer tariffs based on their actual energy usage, since this allows them to be more financially flexible. Therefore, the economic viability of the mini-grid depends on selling a certain minimum amount of electricity (kWh) every year. More electricity sold results in higher profits for the mini-grid operator.[6] The financial risk for the mini-grid operator is lowest if the tariff is composed of a fixed basic tariff element, which is high enough to cover the O&M, and an electricity consumption tariff element, which is slightly higher than the variable costs incurred by the operator. The disadvantage of fixed tariffs, however, is that they provide no incentive for the consumer to use electricity efficiently. This can be problematic, since, due to the limited power generation and distribution capacity available, the efficient use of electricity is particularly important in mini-grids. Therefore, flat rate tariffs can lead to problems in mini-grids. The highest risk for mini-grid operators occurs when the tariff structure contains only energy consumption based tariff elements, such as pay-as-you-go systems.[6]

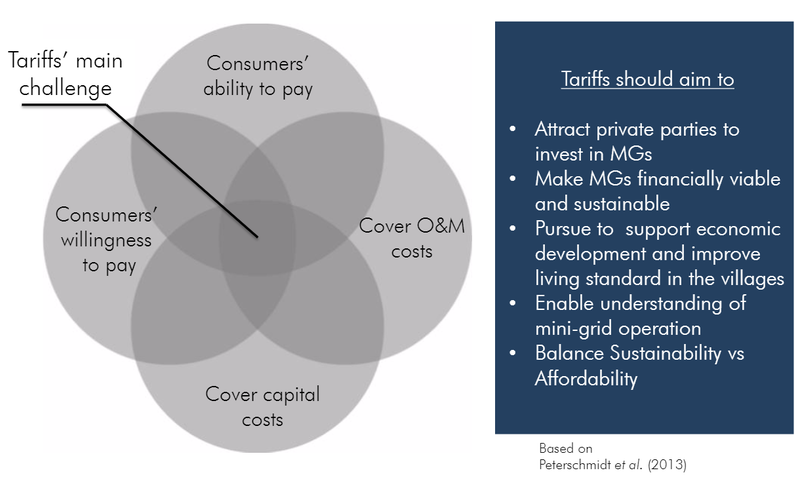

Figure 2 below summarises the main challenges which a tariff structure must overcome as well as listing the main points which a tariff structure should aim to achieve.

Table 1 below gives an overview of different tariff structures that can be implemented as well as the advantages and disadvantages that are associated with each of these structures.

|

Tariff Mechanism |

Explanation |

Example |

Advantages |

Disadvantges |

Metering and Billing |

|

Capacity-based tariff |

Consumers pay per energy consumption |

PVDH Mini-Grid in Bangladesh

|

|

|

Post-paid:

Pre-paid:

|

|

Consumption-based tariff |

Flat-rate or subscription tariff where the customer pays for a certain amount of power, which is then made available to them. |

Hydro-power mini-grid in Nepal

|

|

|

Pre-paid:

|

|

Seasonal tariff |

The price of energy is defined by seasonal variation effecting renewable energy availability |

Hydro power plant in Brazil

|

|

|

Post-paid: Cash or mobile phone Pre-Paid: Customer buys blocks Cash payment, mobile phone payment or scratch cards. |

|

Binomial tariff |

Tariff varies by time of day (peak / non-peak) and depending on the need for a battery/diesel generator |

PV distributed power generation in Brazil

|

|

|

Post-paid:

|

|

Lifeline and inverted block tariff |

Customer charge increases with consumption. Cross-subsidy from high to low consumption customer |

Mwengo Hydro Limited project in Tanzania

|

Easy adaption for low consumers Fair system for low income customers Wide number of new technologies focusing on this method |

? |

Post-paid:

Pre-paid:

|

|

Per-device tariff |

Consumer pays per number of devices. |

Biomass gasifier in India using husks

|

|

|

Pre-paid:

|

|

Energy as a service tariff |

Energy not soled per unit of energy but for service provided |

Solar PV based MUSB in Odisha

|

|

|

Pre or post-paid:

|

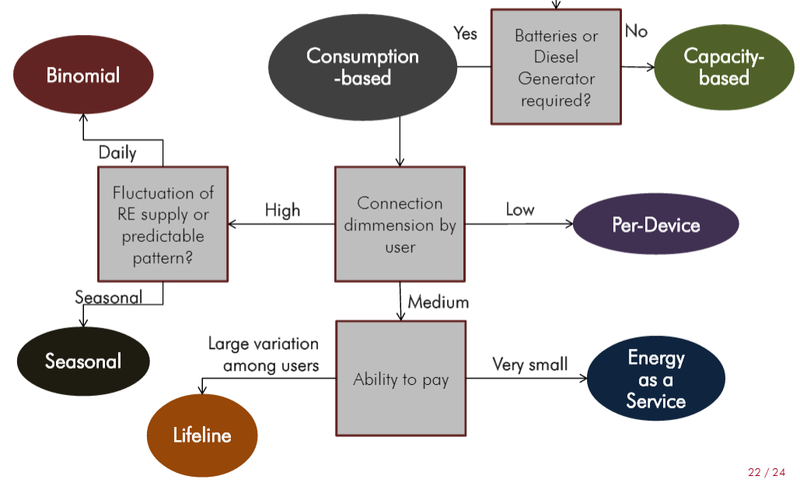

Figure 3 below shows how different tariff structures should be selected depending on given circumstance for the specific mini-grid in question.

More information on this topic, as well as a few real-world examples of tariff structure designs, can be found in the article Costs and Tariff Setting - Examples.

Who Pays Different Tariffs?

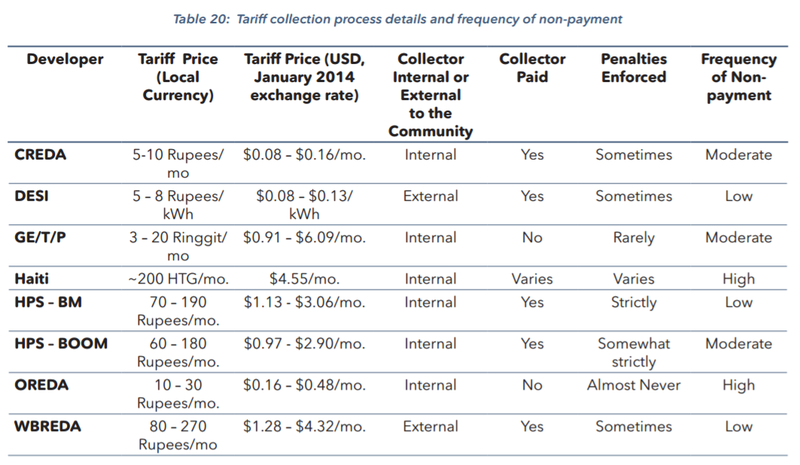

Tariff structures are often designed based on the prevailing financial structures within the local population. In most cases mini-grid tariffs will be higher than those payed by customers with a central grid connection. Tariff collection intervals can be designed to match the income streams of the consumers. However, studies have found that regular tariff collection was overall more successful in terms of retrieving payments. Furthermore, it was found that strict penalties (such as financial fines or disconnecting users) helped to ensure the success of tariff collections.[4]

Figure 4 below shows how different tariff collection patterns can affect the customers’ payments, based on a few examples from mini-grids around the world.

A further study suggested that an “electrification scheme managed by an operator requires a tariff structure common to all users”.[5] In order to overcome the high costs of certain technologies as well as the lower purchasing power of some communities, inter technology cross subsidies could be implemented. This way the high costs of rural electrification could be spread out between all users.[5] For example, in many countries the government regulates and even subsidises the national electricity tariffs. When new mini-grid projects are planned in these countries the government might require that consumers in the new mini-grid are charged the same tariffs as those consumers which are connected to the main utility grid (this is politically more favourable). However, because utility scale electricity is cheaper to produce, the tariffs which consumers on the main utility grid are charges are often not high enough to ensure a financially viable operation for the mini-grid. In this case the government could subsidise the mini-grid tariff, or the tariffs for consumers in the utility grid could be raised slightly to cross subsidies the mini-grid tariff. This would ensure more universal energy access conditions for all electricity consumers in the country, both those connected to the main utility grid and those connected to a mini-grid.[8]

The Forum of Regulators in India is currently considering a tariff structure like this, where the tariff in mini-grids will be regulated and kept at the same level as the central grid tariff. Mini-grid project developers will receive a subsidy to ensure that they keep a viable profit margin. This type of regulation does have the disadvantage that it limits the tariff structure to energy based tariffs. Under this regulation electricity could not be sold in terms of ‘electricity services’ since would not allow for an easily comparable regional cross-subsidisation.[3]

Mini-grid can also make use of Life Line Tariffs, in which richer consumers cross subsidies the tariffs for poorer households which cannot pay as much. This type of tariff structure could improve the overall energy access rates achieved by a mini-grid. While consumers are very sensitive to changes in tariff structures and that tariffs which fully cover the costs of the mini-grid are often unaffordable for consumers in developing countries, there is evidence to suggest that the willingness/ability to pay for electricity services is often higher than previously thought.[9]

Examples of Different Tariffs

Adaptation of Feed-in Tariff for remote mini-grids: Tanzania as an Illustrative Case

“Following the successful Feed-in Tariffs (FiTs) system worldwide, few countries have implemented FiTs explicitly tailored for off-grid or mini-grid systems. This study takes an integrated approach to examine the feasibility of an off-grid Feed-in Tariff (off-FiT) for existing and new remote mini-grids in Tanzania, using a combination of geographical analysis, technical, economic and institutional assessments. Based on detailed modelling of two community off-grid cases, (i) PV-diesel and (ii) mini-hydro, we identify least-cost rural electrification options that make solar and mini-hydro energy competitive with diesel generators and potential effect of the support scheme on rural electrification plans. In the first case, we illustrate where the off-FiT complements diesel generation of an existing mini-grid (PV-diesel). In the second case (mini-hydro), we illustrate conditions where the off-FiT policy brings mini-hydro generation to non-electrified communities and sells renewable electricity directly to new customers.

Currently, Tanzania has Standardized Power Purchase (SPP) rates, which target generators connected to the national grid and distribution systems of mini-grids or isolated grids. We found for the off-FiT tariff the total amount needed to support the same number of customers by solar and hydro-mini grids versus diesel would be of 31.5 million US$, or a premium of 0.11 US$/kWh to the present current SPPs tariff of 0.24 US$/kWh for PV. We also found that a technology specific FiT tariff would be most suitable to attract national and international investors by providing a rate of return that compensates the risk of the investment. The overall support is comparable to the 36 million US$ that the government currently subsidizes and allocates to diesel mini-grids in country, and this shows the potential for a long-term renewable energy strategy for mini-grid areas.”[10]

Tariff Structures. A "Universal" PV-Based Rural Electrification Scheme

“In this paper tariff structures of real operating case studies in several countries are analysed, as well as its relationship with typical life cycle cost and user’s purchase power. Besides, reviews of the requirements of an ideal tariff structure for typical load profiles universal schemes based on autonomous electrification are reviewed … To cover for the tariff gap [between consumers supplied by a mini-grid and consumers supplied by the central grid], we propose the establishment of common tariff structures for grid-connected, micro-grids and autonomous systems, using inter-technological cross subsidies in determined concessions, with what we can cover the extra-costs of rural electrification without forcing the users to pay more. As for the price and cost structure of the tariffs, we would propose to introduce fixed “commercial” components of delivering energy for all customers, which will ensure it is more economically efficient for operators to attend various small users than to keep improving the service of one big individual user.”[5]

Conclusion

The economic viability of a mini-grid is directly linked to the tariff structure used in the mini-grid to collect revenues. Cost-recovering tariffs are often higher in a mini-grid than the national grid tariffs. Therefore, the mini-grid operator should carefully select a tariff structure which will keep the prices at an affordable level for the electricity consumer while at the same time generating sufficient revenue. Many different tariff structures have been developed and adapted to address this issue and to optimise the economic viability for each mini-grid, on a case by case basis. A well-designed tariff structure, which is appropriate to the respective mini-grid, will be able to generate a higher revenue by reducing the numbers of non-payments.

This is often achieved through the use of subsidies. These could be direct subsidies through government regulations, such as establishing a uniform price per unit of electricity, for all electricity consumers, both on and off the central grid. Another option is cross-subsidising amongst different electricity consumers in the mini-grid. For example, businesses might pay higher tariffs than private households, or better-off households, with a higher ability to pay, are charged higher tariffs to cover the costs for poorer households with a lower ability to pay. Such tariff structures could help make electricity prices more affordable for poor households. However, they also skew the electricity market which can become problematic. A further challenge is establishing fair criteria on which electricity consumers are assessed and sorted into different tariff categories. As discussed in (Moner-Girona, et al., 2016)[10] renewable energy FiT could also be adapted for Mini-Grids, however, this tariff mechanism is still relatively uncommon.

Further Information

- USAID: What types of tariffs are appropriate for mini-grids and how are tariffs set?

- Costs and Tariff Setting - Examples

- Demand Assessment: A Critical Factor in Ensuring Economic Viability of Mini grids in India

- How it Works: Mini-grid Business Models

- Effects of Different Tariff Systems on Social Cohesion of Villages

- Retail Tariff Tool - SADC RERA Mini-Grids

- Feed-in-Tariff (FiT) Tool - SADC RERA Mini-Grids

- Standardized Power Purchase Agreement for Purchase of Capacity and Associated Electric Energy to the Isolated Mini-Grid – Based on Tanzania/Kenya Examples

- Standardized Power Purchase Agreement for Purchase of Capacity and Associated Electric Energy to the Isolated Mini-Grid – Based on Zimbabwean Practice

- Standardized Small Power Purchase Agreements (PPAs) for Isolated Mini Grid Connection

- Mini-Grid Implementation Experience as a EPC Contractor Jochem

- Operating a Mini-Grid Profitably, Sanchez (2013)

- Impacts of Rural Electrification in Uganda 2011-2019

References

- ↑ LafargeHolcim Foundation, n.d. Economic viability and compatibility – Prosperity. [Online] Available at: https://www.lafargeholcim-foundation.org/TargetIssues/economic-viability-and-compatibility-prosperity [Accessed 16 May 2017].fckLR

- ↑ Al-Hammad, H. et al., 2015. Renewable Energy In Hybrid Mini-Grids and Isolated Grids: Economic Benefits and Business Cases, Frankfurt: Frankfurt School – UNEP Collaborating Centre for Climate and Sustainable Energy Finance.

- ↑ 3.0 3.1 Deshmukh , R., Carvallo, J. P. & Gambhir, A., 2013. Sustainable Development of Renewable Energy Mini‐grids for Energy Access: A Framework for Policy Design, s.l.: Lawrence Berkeley National Laboratory .

- ↑ 4.0 4.1 4.2 4.3 Schnitzer, D. et al., 2014. Micro-grids for Rural Electrification: A critical review of best practices based on seven case studies, s.l.: United Nations Foundation.

- ↑ 5.0 5.1 5.2 5.3 Gavaldà, O., Vallvé, X. & Vosseler, I., n.d. Tariff Structures. A "Universal" PV-Based Rural Electrification Scheme, Barcelona: Trama Tecnoambiental S.L..

- ↑ 6.0 6.1 6.2 Franz, M., Peterschmidt , N., Rohrer, M. & Konde, B., 2014. Mini-Grid Policy Toolkit, Eschborn: European Union Energy Initiative Partnership Dialogue Facility.

- ↑ Philipp, D., 2014. Billing Models for Energy Services in Mini-Grids, s.l.: Micro Energy International.

- ↑ EnDev Mini-Grid Expert, H., 2017. Smart Mini-Grids in West Africa [Interview] (24 4 2017)

- ↑ Khennas, S. & Barnett, A., 2000. Best Practices for Sustainable Development of Micro Hydro Power in Developing Countries, London: Department of International Development, UK.

- ↑ 10.0 10.1 Moner-Girona, M. et al., 2016. Adaptation of Feed-in Tariff for remote mini-grids: Tanzania as an illustrative case. Renewable and Sustainable Energy Reviews, Volume 53, pp. 306-318.