Mozambique Renewable Energy Potential

Introduction

Large scale renewable projects are becoming a point of interest for investment in Mozambique, specifically solar and hydro. By the end of 2020, there was a total of 582 MW potential capacity derived from independent power producers (IPP). In 2021, 41 MW are in operation and additional 41 MW are under construction. 275 MW projects are in pre-feasibility phase and tenders amounting to 160 MW was launched by the PROLER program (which assists Mozambique’s national utility, EDM, with calls for tenders). The remaining 65 MW correspond to power purchase agreements already signed. Mozambique’s main body to promote renewable energy access, FUNAE, expects a total on-grid installed capacity for solar and wind energy of 306 MW in 2031[1].

Solar

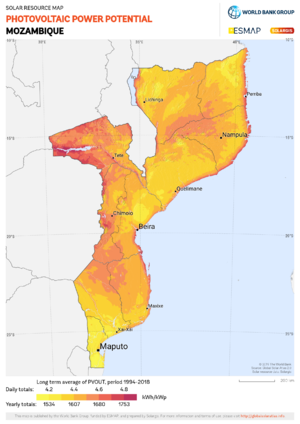

Mozambique has an abundant and unexploited solar resource which could be harnessed for utility scale as well as residential PV for both on/off grid electrification. The following map shows the global horizontal irradiation profile of Mozambique which varies between 1,785 and 2,206 kWh/m2/year. The potential for harnessing solar energy is limited both by the on-going re-establishment of the energy policy in Mozambique and the dispersion of rural population throughout the country. From the total potential of 23,000 GW, only about 2.7 GW would be realistically suitable for solar projects compatible with the present electrification and grid expansion plans. However, the fact that rural population is highly scattered means that instead of extending on-grid electrification, off-grid Solar Home Systems and mini-grids could be a more cost-effective alternative to provide access to electricity in remote and scattered communities[2].

The PV power potential map developed by the World Bank shows the potential for PV power projects in Mozambique on a scale of a yearly total specific PV power output[3] of 1,534 to 1,753 kWh/kWp. The zones marked in the darkest shade show the highest potential[4]

There is already a large-scale PV facility in operation, owed by EDM and two Norwegian Independent Power Producers: Scatec Solar and KLP Norfund Investments. It is located close to Mocuba (40 MW) and has been in operation since 2019. French IPP Neoen is responsible for the construction of a second 41 MW plant in Metoro, Cabo Delgado. Construction has already started in October 2020 and is planned to be operational by 2022[5]. However, internal conflicts in the province of Cabo Delgado could delay the start of operations[6]. By the end of 2020, international IPPs have planned the construction of twelve more PV plants for the near future with installed capacities between 15 and 40 MW. From those planned plants, three already went through an approved Power Purchase Agreement (PPA), three others are in the process of launching tenders through PROLER, and the rest are in pre-feasibility stage[7].

Hydropower

As of 2020, Mozambique has one of the highest hydropower potential in Africa, estimated at more than 12,000 MW[8], especially in the Tete province, at the Zambezi River, where the large-scale plant Cahora Bassa is located (more than 80% of the potential). The other 12 major river basins are Maputo, Umbeluzi, Incomati, Limpopo, Save, Buszi, Pungwe, Licungo, Ligonha, Lúrio, Messalo, and Rovuma and have potential for all types of hydropower from pico, mini to large-scale hydropower[9]. Exportation of electricity generated in Cahora Bassa is already a regular business, which makes Mozambique a critical supplier of electricity to neighbouring countries and an area of interest for further electricity commerce[8].

However, the grid connection of large-scale hydropower plants is not a solution to electrify rural off-grid population. The construction of strategically localised micro-hydro plants could improve the electrification rate for this section of the population. The current feed-in-tariff approved in 2014, supports PPA for small hydropower projects from 10 kW to 10 MW[10]. This incentive is expected to improve investments in small projects in order to increase job opportunities, electrify rural households and public buildings, as well as drive economic development of local rural villages. There are currently studies to evaluate the benefits and possibility of replication or expansion of existing small scale hydropower, such as the plant located in Manica[11].

| Plant | Installed Capacity (MW) | Location | Operator |

| Cahora Bassa | 2075 | Tete | Hidroeléctrica de Cahora Bassa |

| Mavuzi | 52 | Manica | EDM |

| Chicamba | 44 | Manica | EDM |

| Corumana | 16.6 | Maputo | EDM |

| Cuamba | 1.09 | Niassa | EDM |

| Lichinga | 0.73 | Niassa | EDM |

Source: Cahora Bassa Data from 2016[12]

Data for EDM plants from 2018[13]

Planned large-scale hydropower projects include a 1,245 MW north bank expansion of the Cahora Bassa in 2021 and a new power plant with an installed capacity of 1,500 MW (Mphanda Nkuwa) 60 km downstream from Cahora Bassa to be commissioned in 2028[14].

| Project name | Location | Size | Status (as of 2021) |

| Cahora Bassa North Bank | Tete | 1245 MW | Sustainability Assessment |

| Mphanda Nkuwa | Tete | 1500 MW | Commercial agreement signed between Mozambican government and the operating company in 2017[16] |

| Lupata | Sofala | 600-650 MW | Feasibility |

| Boroma | Tete | 200-400 MW | Feasibility |

| Lurio | Cabo Delgado | 120 MW | Feasibility |

| Mavuzi 2&3 | Manica | 60 MW | Conceptual |

| Malema | Nampula | 60 MW | Pre-Feasibility |

| Massingir | Gaza | 25-40 MW | Pre-Feasibility |

Wind

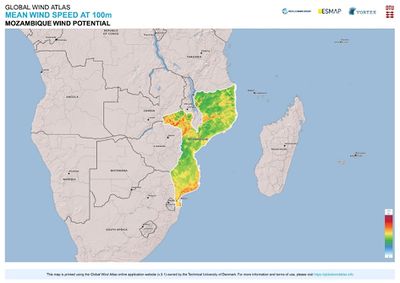

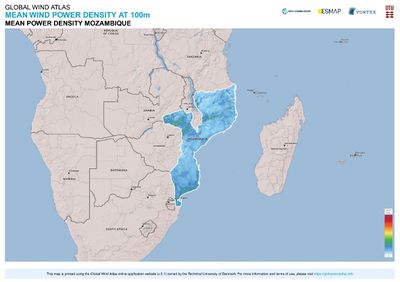

Mozambique has a potential wind capacity of 4.5 GW, of which about 25% has potential for immediate connection to the existing grid. The provinces with the most potential are Tete, Maputo, Sofala, Gaza, and Inhambane. This potential is determined by the sites with the highest average wind speed at 80 m (more than 7 m/s in Maputo and Gaza), and having more than 3,000 hours equivalent to the nominal power[17].

The following maps show the mean wind speed at 100 m above sea level, and the estimated mean power density available from the wind resource. The southern region of Maputo shows a high mean wind speed at 100 m, however the power density is low. The areas with the best wind resource and higher mean power density are located in the central part of Tete and at the border between the Nampula and Zambezia provinces[17]

There are three wind projects planned for a total of 160 MW of installed capacity. One of the wind projects, a 40 MW plant to be located in the Inhambane province, will start the pre-qualification tender in 2023. Two more 60 MW plants are currently in the feasibility analysis phase[7].

Biomass

Overall, Mozambique has a rich biomass potential of over 2 GW[4]. Charcoal and firewood are important fuels for cooking energy purposes in Mozambique, as well as in other countries in southern Africa. Mozambique’s dry tropical woodland allows the growth of tree species, such as Colophospermum mopane, which provides a high-quality, slow-burning product[18]. However, the use of charcoal as fuel has serious implications for health, environment, gender and finances and is discussed in this chapter. Sustainable exploitation of biomass resources can prevent land conflicts, abuse of community rights, and environmental impacts such as deforestation, land degradation and greenhouse gas emissions[19]. In order to ensure sustainable biomass production, the National Directorate of New and Renewable Energy in Mozambique, with cooperation from the European Union partners, developed the Biomass Energy Strategy in 2012. This strategy identified the highest potential for biomass from productive forests to be 26.9 million ha. The provinces with the largest potential area are Niassa, Zambezia, Tete and Cabo Delgado[19]. Wood for fuel production is obtained from plantations located mainly in the provinces of Niassa, Zambezia, and Manica[19].

Other biomass fuels with high calorific value are solid wastes, deriving from different productive industries. The following table from GET.invest shows the potential of biomass derived from waste by sector (data from 2014)[4].

| Forestry | 1006 MW |

| Agro-industry | n/a |

| Pulp Industry | 280 MW |

| Sugar Industry | 831 MW |

| Municipal Solid Waste | 63 MW |

| Other (livestock holdings, vegetable oils for coconut or jatropha) | n/a |

For a breakdown of livelihood zones where sale of biomass is one of the main income sources, see this chapter.

Further Information

- Mozambique Electricity situation

- Energy Access situation

- Renewable Atlas from FUNAE: https://www.funae.co.mz/index.php/pt/recursos/recurso-eolico

References

- ↑ Aler_mar2021_resumo-Renovaveis-Em-Mocambique-2021.Pdf’, accessed 23 April 2021, https://www.lerenovaveis.org/contents/lerpublication/aler_mar2021_resumo-renovaveis-em-mocambique-2021.pdf.

- ↑ Pranab Baruah and Brendan Coleman, ‘Country Brief: Mozambique Off-Grid Solar Power in Mozambique: Opportunities for Universal Energy Access and Barriers to Private Sector Participation’, n.d., 26.

- ↑ “Yearly average values of PV electricity (AC) delivered by a PV system and normalized to 1kWp of installed capacity (© 2019 Solargis)” (https://globalsolaratlas.info/support/methodology)

- ↑ 4.0 4.1 4.2 GET.invest, ‘Renewable Energy Potential – GET.Invest’, accessed 21 April 2021, https://www.get-invest.eu/market-information/mozambique/renewable-energy-potential/

- ↑ PV Magazine, ‘Construction Begins on 41 MW Solar Project in Mozambique’, pv magazine International, 2020, https://www.pv-magazine.com/2020/10/30/construction-begins-on-41-mw-solar-project-in-mozambique/.

- ↑ Mozambique Conflict: What’s behind the Unrest?’, BBC News, 29 March 2021, sec. Africa, https://www.bbc.com/news/world-africa-56441499.

- ↑ 7.0 7.1 ALER, ‘Renováveis Em Moçambique’, 2021, https://www.lerenovaveis.org/contents/lerpublication/aler_mar2021_resumo-renovaveis-em-mocambique-2021.pdf.

- ↑ 8.0 8.1 Kameshnee Naidoo and Christiaan Loots, ‘Mozambique / Energy and the Poor – Unpacking the Investment Case for Clean Energy’, 2020, https://sun-connect-news.org/fileadmin/DATEIEN/Dateien/New/2021-01-29_UNDP-UNCDF-Mozambique-Energy-and-the-Poor.pdf.

- ↑ Miguel M. Uamusse et al., ‘Mini-Grid Hydropower for Rural Electrification in Mozambique: Meeting Local Needs with Supply in a Nexus Approach’, Water 11, no. 2 (February 2019): 305, https://doi.org/10.3390/w11020305.

- ↑ Energy Sector – GET.Invest’, accessed 4 May 2021, https://www.get-invest.eu/market-information/mozambique/energy-sector/

- ↑ Miguel Uamusse, Small Scale Hydropower as a Resources of Renewable Energy in Mozambique: Case of Chua River in Manica, 2018, https://doi.org/10.20944/preprints201805.0327.v1

- ↑ Iha_2016_may_hydropower-Status-Report-2016.Pdf’, accessed 3 May 2021, https://www.lerenovaveis.org/contents/lerpublication/iha_2016_may_hydropower-status-report-2016.pdf.

- ↑ EDM, ‘Generation | EDM - Electricidade de Moçambique’, accessed 19 May 2021, https://www.edm.co.mz/en/website/page/generation.

- ↑ IHA, ‘Hydropower Status Report’, 2016, https://www.lerenovaveis.org/contents/lerpublication/iha_2016_may_hydropower-status-report-2016.pdf

- ↑ Andrew Bullock and Stephan Hülsmann, ‘Strategic Opportunities For Hydropower Within The Water-Energy-Food Nexus In Mozambique’, n.d., 71.

- ↑ The Post, ‘Mozambique Energy: “HCB Must Expand Portfolio,” Says Chairperson’, 2018, https://mozambiqueminingpost.com/2018/08/29/mozambique-energy-hcb-must-expand-portfolio-says-chairperson/.

- ↑ 17.0 17.1 Recurso Eólico’, accessed 24 June 2021, https://www.funae.co.mz/index.php/pt/recursos/recurso-eolico

- ↑ Emily Woollen et al., ‘Charcoal Production in the Mopane Woodlands of Mozambique: What Are the Trade-Offs with Other Ecosystem Services?’, Philosophical Transactions of the Royal Society B: Biological Sciences 371, no. 1703 (19 September 2016): 20150315, https://doi.org/10.1098/rstb.2015.0315

- ↑ 19.0 19.1 19.2 ‘Mozambique Biomass Energy Strategy.Pdf’, accessed 24 June 2021, https://www.greengrowthknowledge.org/sites/default/files/downloads/policy-database/MOZAMBIQUE%29%20Mozambique%20Biomass%20Energy%20Strategy.pdf