Difference between revisions of "Solar Powered Irrigation in Mozambique : Barriers"

***** (***** | *****) (Created page with "=== Introduction === This article is part of the publication on '''Solar irrigation market analysis in Mozambique''' which looks at the feasibility of introducing individual s...") |

***** (***** | *****) m Tag: 2017 source edit |

||

| Line 1: | Line 1: | ||

| + | {{Back to Moz PUE Hub}} | ||

| + | |||

=== Introduction === | === Introduction === | ||

This article is part of the publication on '''Solar irrigation market analysis in Mozambique''' which looks at the feasibility of introducing individual solar-powered irrigation packages at small scale enterprise level in Mozambique. | This article is part of the publication on '''Solar irrigation market analysis in Mozambique''' which looks at the feasibility of introducing individual solar-powered irrigation packages at small scale enterprise level in Mozambique. | ||

Revision as of 14:37, 13 December 2021

Introduction

This article is part of the publication on Solar irrigation market analysis in Mozambique which looks at the feasibility of introducing individual solar-powered irrigation packages at small scale enterprise level in Mozambique.

Barriers for Upscaling

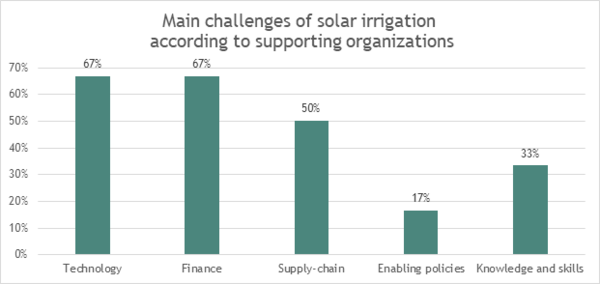

The organizations that have worked on solar irrigation projects in Mozambique indicate that the main challenges are related to the technology, supply chain (commercial) and financing of solar pumps. This chapter is based on the survey responses as well as in-depth interviews with two key experts from the Mozambican private sector to elaborate and reflect on the different barriers.

Technical barriers

The technical implications of using solar pumps instead of fuel powered pumps are ample. Respondents of the organization survey indicate correctly that the pumps have a smaller capacity, some types are less mobile or cannot function in every type of water source, panels can be stolen, repairs can be challenging and conventional irrigation technologies are not always compatible.

To start with the water source, chapter 2.2 has shown that the majority of the solar pumps is used in deep boreholes and rivers. Due to the very high cost of deep boreholes, and the limited number of farmers who have access to land along perennial river streams, the scope of solar irrigation is severely reduced if not more water sources can be used. One respondent of the supplier survey therefore suggests to improve the availability of hydrological data. This could help to identify the zones where water is most accessible. A provincial government official indicated that it is the technology that should be adapted, in order to allow for a much larger pumping head and discharge. A key supplier stressed that technically there is no limit to solar irrigation, and mentioned examples in Malawi where one solar pump provides 1000 m3 of water per day, and a solar irrigation system in Chimoio province with a planned yield of 500 m3/day. Unfortunately, there is a direct relation between the capacity and output of a solar pump, the required energy and the cost of the system. This implies that systems with a larger capacity exist, but at a higher cost.

The lack of optimal irrigation technologies for solar systems is another important aspect. Irrigation by furrows or flooding is very time consuming and leads to high water losses, which compromises the available water volume for the plants and thereby the size of the irrigated field. Since the capacity of solar pumps is smaller and less flexible compared to fuel-powered pumps, there is a need to optimize the application system. Optimal application systems for solar pump are featured by a high water efficiency and low pressure, as both aspects directly impact on the water volume available for the crops, for a given solar pump. Optimal irrigation technologies for solar pumps include spray tubes, drip systems, rainmakers, large diameter hosepipes and basins with spray cans. Only drip systems are widely available in Mozambique, yet its cost is prohibitive for most small-scale farmers.

The surveys as well as various reports[1] indicate that the risk of theft is an important constraint related to solar powered pumps in Mozambique. The issue of stolen panels links to mobility of the pump and panels. Most solar submersible pumps are featured by a relatively large number of panels that are fixed on a panel mount and therefore prone to theft. The available suction pumps come with the benefit that panels can be taken home.

Another observation from the surveys is that repairs of SPIS are challenging. This results from a number of factors. First of all, solar pumps are relatively new and therefore there is limited knowledge and experience amongst farmer communities and technicians. Secondly, the technology is often installed by the supplier and, depending on the brand, submersible solar pumps are either difficult to access or even impossible to repair locally. Thirdly, spare parts are not widely available and need to be requested from the supplier. Most of this is a supply chain problem, resulting from the limited market development of solar irrigation in Mozambique. Another issue is that not all users receive training. The private sector survey indicated that only 40% of the suppliers provide training to the users (see chapter 2.1). For one of the largest SPIS projects the question on how the maintenance is arranged was answered by N/A.

One key expert stressed that training is the key to success and sustainability. Especially large projects in which a lot of pumps are installed without investing in training usually lead to failure within a very short time.

1.1 Commercial barriers

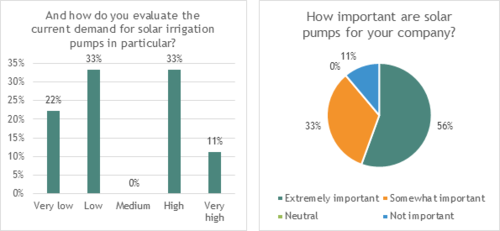

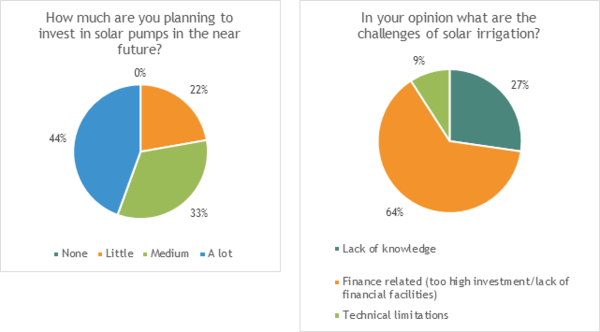

The absence of local supply chains, including services and spares, was mentioned as the third most important challenge by governments and NGOs. The government even noticed a limited willingness to invest in solar irrigation amongst the local private sector. As shown in the graph below, the private sector itself is divided on the status of the current demand for solar irrigation pumps. Yet, 56% considers solar pumps as extremely important for their company.

Another 44% of the suppliers is planning to invest a lot in solar pumps in the near future and only 22% plans to invest little. Hence, the interest and willingsness to invest in solar pumps expressed by the private sector is positive. The challenges they face however are mainly finance-related (64%) or resulting from a lack of knowledge (27%).

Unlike in some other countries, the private sector does not face major problems to import pumps. The procedures are manageble and with the new pre-warning system in the port of Maputo the customs and importation time has been reduced to only 2-3 days. Foreign currency and loans to order pumps from abroad can be obtained through the commercial banks in Mozambique without any major issues.

Tax Exemptions

The suppliers all indicate that there is no tax exemption on solar pumps. However, sometimes there are exceptions made to import pumps for particular projects. Generally, suppliers need to pay 17% VAT and 7.5% import tax on solar products[2]. The import tax applies to the CIF cost, hence including the value of the cost, insurance and freight of the pumps. As a comparison, hand pumps are VAT exempt and agricultural technologies are featured by an import tax of only 5%. However, solar irrigation pumps do not classify as such. Apart from the import tax, there are a lot of other charges during the importation process, linked to the obligatory services of the port companies assuring the logistics, operation, storage, clearance and administration. The total importation costs add up to 30-40% of the CIF cost, according to the key experts interviewed. As a result, the solar pump business in Mozambique is less competitive than in Zimbabwe, where solar products are free from import duties, or than South Africa.

The suppliers recommend the government to:

- Issue duty exemptions or reduction on import taxes (incl. on solar panels) (4/8)

- Provide financial resources to small communities to buy the equipment (1/8)

- Increase knowledge on solar/renewable energies (2/8)

- Create a legislation for selling solar pumps (1/8)

General recommendations by the private sector to scale solar irrigation in Mozambique includes a focus on:

- Information and training (44%)

- Investment (22%)

- Access to finance for farmers (22%)

- Reducing importation costs (11%)

Financial Barriers

The following two responses to the organizational survey explain why the main financial barrier related to solar powered irrigation systems is its high cost:

“The capital cost for the transition to solar is high for most rural farmers. They need financial instruments to support them. On the other hand the country needs more technology vendors strategically located to be able to supply and support rural communities across the country.”

“Many farmers and organizations don’t have access to technology to use solar irrigation and to purchase it is very expensive for the majority of farmers and small organizations.”

As shown in chapter 3.3, a price of 1000 EUR is not uncommon for a smallholder farmer solar irrigation system. It goes without saying that the vast majority of farmers in Mozambique cannot make such a high investment upfront. Yet, access to credit is a big problem in Mozambique. The interest charged by commercial banks is 19.3% and the eligibility criteria by banks and micro finance institutes do allow smallholder farmers to take a loan. A specific problem in Mozambique is the fact that land is owned by the state, which means that it cannot be used as collateral when applying for a loan.

Brainstorming about credit facilities for farmers, the interviewed key experts from the private sector indicated that bank loans are preferable, since it is not their expertise to manage loans, sign contracts with farmers or assess the credit risk of different applicants. It is preferred that a donor signs a contract with a bank to provide low interest loans to farmers. The bank should then pay the supplier. There are examples of such projects in which loans with only 5% interest have been made available to farmers.

The new BCI Super package that was launched in April 2021 in order to stimulate the use of renewable energy for productive use, is an example of a credit facility that specifically highlights solar-powered irrigation as one the activities to finance. This credit line is funded through a guarantee of 1 million USD provided by UNIDO, managed by FUNAE and implemented by the BCI bank[3]. The provided loans can be a maximum of 50,000 USD, to be paid back within 1-3 years, with a 7.5% interest rate. The clients need to bring in 25% of the investment as upfront payment. The target groups are companies, NGOs, cooperatives and associations, that need to have a BCI bank account, show salary slips for 2 months, provide a viable technical and financial business plan and submit the request online. As a result, this arrangement is not likely to be accessible by smallholder farmers.

As shown in this article, the alternative: to donate solar pumps to farmers is no one’s favourite option either, as the lack of ownership or genuine interest generally comprises the effective use and maintenance of a technology. Another recommendation is to provide subsidies to end users. One of the key experts therefore recommends to partly subsidize pumps and let farmers pay about 20% of the remaining cost. The other key expert mentioned the SolTrain project as an example of a partial subsidy approach. This arrangement has been established to promote and sell solar heating systems. The process is as follows:

1) Interested clients need to comply with a set of minimum requirements and submit a number of forms.

2) The submitted forms need to be approved by the Mozambican Technology Institute and by the donor. This takes on average two weeks.

3) After approval the client pays 50% of the total sum, after which installation begins.

4) The donor pays the remaining 50% to the company. There is no loan or interest involved.

According to the solar pump supplier this model is easy to copy and applicable to farmers, even though there are a lot of forms involved. He suggested that criteria could include: 3 clients in the same area, owning at least 1 hectare of land, and having their farm registered with an association or as a company. He also advices to adopt a flexible project plan and adjust the criteria if it does not work.

Though these ideas may stimulate the solar irrigation market, it is not very inclusive for small-scale farmers. A very different approach, which is not available yet in Mozambique, are Pay-As-You-Go (PAYGO) arrangements that are provided by a technology supplier without involvement of banks of micro finance institutes. This approach has grown mainly in the solar home sector and is now starting to be applied by some solar pump suppliers in a number of African countries. The advantage of PAYGO approaches is the reduction of paperwork and a much more accessible financial product that is linked to the cost and benefits of a solar irrigation system. The largest provider of solar irrigation pumps through PAYGO is the Kenyan company Sunculture, which has recently raised 25 million USD to expand their sales to Senegal, Togo and Ivory Coast. Their pumps are linked with mobile payment devices, offered by partner companies such as BBOXX. The Sunculture company as well as similar finance solutions for solar pumps are not available in Mozambique yet.

It should be noted that despite the general optimism regarding solar home kit suppliers providing PAYGO solutions, a stakeholder consultation meeting with Mozambican companies involved in solar productive use systems did point out some key challenges[4]. The main issues are related to payment collection (lack of mobile network), the duration of payback time (customers need over a year to pay back solar home systems), difficulties to assess credit profiles of customers, fiscal issues (high VAT and import taxes), the risk of market distortion by grant providing programmes (due to a lack of coordination) and the lack of start-up or incubation funding windows (since small early-stage companies are not eligible for most grants and other incentive mechanisms).

Further Information

- Mozambique Off-grid Knowledge Hub

- Solar Powered Irrigation in Mozambique : Market Landscape

- Solar Powered Irrigation in Mozambique : Market Share

- Solar Powered Irrigation in Mozambique : SPIS Support Initiatives

[1] https://amer.org.mz/wp-content/uploads/2019/04/aler_mz-report_oct2017_web.pdf

https://www.government.nl/documents/reports/2016/10/18/end-term-review-of-the-intervention-renewable-energy-for-rural-development

[2] This information provides by key experts corresponds to the findings by https://gggi.org/site/assets/uploads/2019/02/20190218_-Country-Brief_Mozambique.pdf

[3] https://www.tse4allm.org.mz/index.php/en/midia/a-unido-em-parceria-com-o-bci-financia-sistemas-de-energia-renovavel-para-usos-produtivos-na-zona-rural-de-mocambique

[4] https://beyondthegrid.africa/wp-content/uploads/MOZ-BGFA-Mozambique-Stakeholder-Workshop-Report.pdf