Click here to register!

Difference between revisions of "The Off-grid Appliance Market"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 86: | Line 86: | ||

{| border="1" cellspacing="0" cellpadding="5" style="width:100%;" | {| border="1" cellspacing="0" cellpadding="5" style="width:100%;" | ||

| − | |+ Table.2: Household Appliances with Highest Impact with Accordance to Gender<ref name="Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf">Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf</ref> | + | |+ Table.2: Household Appliances with Highest Impact with Accordance to Gender<ref name="Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf">Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf</ref><ref name="Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf">Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf</ref> |

|- | |- | ||

! scope="col" | From Female Perspective | ! scope="col" | From Female Perspective | ||

| Line 130: | Line 130: | ||

{| border="1" cellspacing="0" cellpadding="5" style="width:100%;" | {| border="1" cellspacing="0" cellpadding="5" style="width:100%;" | ||

| − | |+ Table.3: Household's Appliances' Demand and Impact Through Time<ref name="Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf">Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf</ref> | + | |+ Table.3: Household Appliances that Show the Highest Variation Between Males & Females |

| + | |- | ||

| + | ! scope="row" | Appliance | ||

| + | ! scope="col" | Rank from Male Perspective | ||

| + | ! scope="col" | Rank from Female Perspective | ||

| + | |- | ||

| + | ! scope="row" | Hand power tools | ||

| + | | 3rd highest | ||

| + | | 18th | ||

| + | |- | ||

| + | ! scope="row" | Clothes washer | ||

| + | | 17th | ||

| + | | 6th | ||

| + | |- | ||

| + | ! scope="row" | Sewing machines | ||

| + | | 14th | ||

| + | | 4th | ||

| + | |- | ||

| + | ! scope="row" | Electroc cookstoves | ||

| + | | 12th | ||

| + | | 3rd highest | ||

| + | |} | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | {| border="1" cellspacing="0" cellpadding="5" style="width:100%;" | ||

| + | |+ Table.4: Household's Appliances' Demand and Impact Through Time<ref name="Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf">Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf</ref> | ||

|- | |- | ||

! scope="row" | <br/> | ! scope="row" | <br/> | ||

Revision as of 10:23, 9 November 2018

Introduction

Around 1.2 billion people worldwide lack access to electricity and another 1 billion people have an unreliable grid connection (sometimes receiving as little as 2 hours of electricity per day). [1] [2] In 2014, 27 billion USD were spent in Africa and Asia on lighting and mobile phone charging with kerosene, candles, battery torches or other fossil-fuel powered technologies. [3] All of these technologies are outdated, costly and energy inefficient as well as causing negative health and environmental impacts.

According to a report from IRENA (2015) some 20 million households have access to electricity through solar home systems, 5 million households through renewables-based mini-grids and 0.8 million households through small wind turbines[4].

These numbers are likely to increase. The sum spent on off-grid appliances is expected to rise from around 500 million USD today to 4.7 billion USD in 2020. [5] Currently the most popular off-grid products are small appliances such as solar lanterns and solar lights. However, there is a growing market for other, significantly more energy intensive, appliances such as TVs, refrigerators, fans and solar pumps.

According to GOOGLA, 47 million households in Africa and Asia that are not connected to electricity enjoy an annual income of 3650 – 18250 USD. These households are capable of affording not only simply solar lanterns, but also other appliances such as Solar Home System (SHS)[6].

Access to energy not only improves the quality of life, but also aids in conducting various income generating activities. Therefore, there is a huge potential for manufactures to produce off-grid appliances based on clean energy, not only for daily use, but also for income generating purposes. [7]

With accordance to the 2018's off-grid appliances market survey, the off-grid solar market continues to grow rapildly[8]. This rapid rate of growth is driven by[8]:

- The increase in uptake of solar home systems, which are large enough to power household appliances

- The increasing awareness of the ability and potential of distributed renewable energy systems for powering productive use appliances

Off-Grid Appliances' Related Definitions

| Concept | Off-grid Appliances | Productive Use of Energy | Infrastructure (In the Context of Healthcare Appliances) | Medical Equipment (In the Context of Healthcare Appliances) |

|---|---|---|---|---|

| Definition |

|

|

|

|

Traditionally electrical appliances run off Alternative Current (AC), since they are designed to be connected to the grid. However, with the emergence of solar powered isolated grids and stand-alone systems, Direct Current (DC) appliances could become the better alternative. A solar system typically generates DC current which can easily be stored in batteries. Therefore, having appliances which run on DC system reduces the need to convert AC to DC, which in turn reduces costs as well as electricity losses[10].

Most Recent Findings

- The 2018's survey is based on pinpointing the most recent demand and impact's perceptions across different use categories, as well as across different regions[8].

- The main use categories/segments, upon which the appliances were surveyed are: Household Use Appliances - Business/Productive Use Appliances - Healthcare Appliances[8].

- It was found that differences in geneder and geography affect the consumers' demand for different appliances[9].

- Though consumer demands for off-grid appliances might remain broadly similar across regions, yet regional preferences differ and should be thoroughly studies and considered[8].

- 37% of respondents to the survey have confirmed that there exist differences in demand for appliances between male and female consumers[9] (i.e. Clothes washers and cookers were found to be much higher among women's demand[9]).

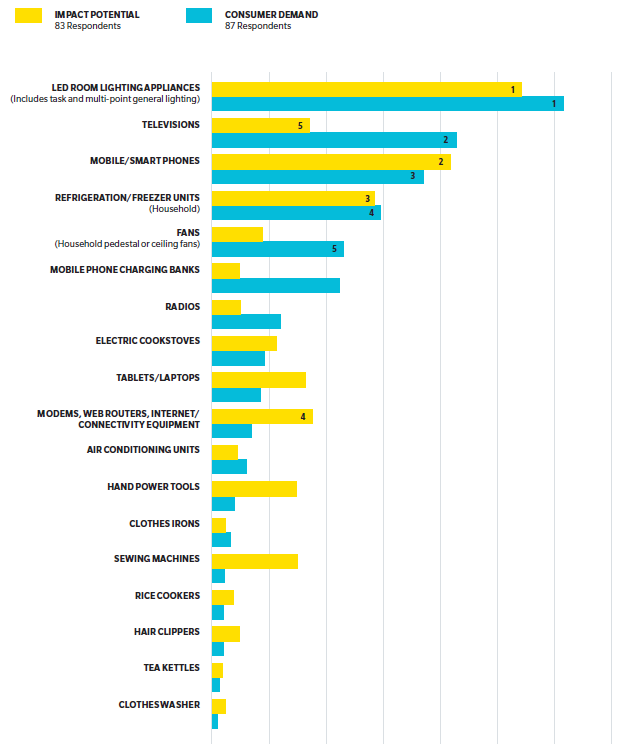

- With regard to the Household Use Appliances, LED room lighting remians -globally & for a 3rd time in a row- on top in terms of both: consumer demand & impact potential[8][9]. This is directly followed by Televisions and mobile/smart phones[8][9].

- For Productive Use/Income Generating Appliances, the demand is on the rise worldwide, and there is a trend towards larger appliances under that segment[8][9]. For a first time, solar water pumps jump up the list to top-rank LED lighting appliances[8][9].

- Higher prices of the appliance does not necessarily mean better quality, as many off-grid appliances' efficiency is improving while prices are decreasing[9].

- Remote communities with low energy access are an untapped market for off-grid appliance, which require more research work and data collection[9].

- The need for more researchal work and collection of data also applies for the segment Healthcare Appliances[8].

- There is a huge and critical difference between theoretical needs and market realities[8] (i.e. Though many of the highly ranked appliances such as: refrigerators and milk chilling, had so little to no reported sales[8]).

Household Appliances

| From Female Perspective | From Male Perspective |

|---|---|

|

|

|

|

|

|

|

|

|

|

| Appliance | Rank from Male Perspective | Rank from Female Perspective |

|---|---|---|

| Hand power tools | 3rd highest | 18th |

| Clothes washer | 17th | 6th |

| Sewing machines | 14th | 4th |

| Electroc cookstoves | 12th | 3rd highest |

| # | 2014 Survey Results | 2016 Survey Results | 2018 Survey Results | |

|---|---|---|---|---|

| Anticipated Consumer Demand | 1 | LED lighting | LED lighting | LED lighting |

| 2 | Mobile charging banks | Televisions | Televisions | |

| 3 | Television | Mobile/Smart phones | Mobile/Smart phones | |

| 4 | Radios | Mobile phone charging banks | Refrigeration/Freezer units | |

| 5 | Refrigeration | Refrigeratiom | Fans | |

| 6 | Fans | Fans | Mobile phone charging banks | |

| 7 | Laptops | Radios | Radios | |

| 8 | Tablets | Laptops | Electric cookstoves | |

| 9 | Rice cookers | Hand power tools | Tablets/Laptops | |

| 10 | Clothes irons | Small speaker systems | Modems, web routers, internet/connectivity equipment | |

| Development Impact Potential | 1 | LED lighting | LED lighting | LED lighting |

| 2 | Refrigeration | Mobile/Smart phones | Mobile/Smart phones | |

| 3 | Mobile charging banks | Mobile charging banks |

Refrigeration/Freezer units | |

| 4 | Televisions | Televisions |

Modems, web routers, internet/connectivity equipment | |

| 5 | Laptops | Refrigeration | Televisions | |

| 6 | Radios | Hand power tools | Tablets/Laptops | |

| 7 | Fans | Sewing machines | Sewing machines | |

| 8 | Rice cookers | Radio | Hand power tools | |

| 9 | Grinders | Laptops | Electric cookstoves | |

| 10 | Hand power tools | Fans | Fans |

Business/Productive Use Appliances

Healthcare Appliances

Off-grid Appliances for Productive Use

The term ‘off-grid appliances for productive use’ refers to appliances used in economic activities like agriculture or commercial and industrial companies, for socio-economic development. [11]

Agriculture

Agriculture is the main source of income in many developing countries and energy is required along the value chain. To read in detail about the role of energy efficient appliances along the value chain, click here.

Examples of some off-grid appliances in agriculture are:

For more information about off-grid appliances in agriculture, please see: Photovoltaics for Productive Use and the PoweringAg portal on energypedia.

Off-Grid Appliance Value Chain

The off-grid appliance value chain has the following components: manufacturing and assembly, transport and last-mile distribution and after-sales support.

The major players in off-grid appliances manufacturing are generic companies in Asia (mostly in China), niche companies in western markets, and some multinationals with new off-grid ventures. Manufacturers may also partner with regional companies to assemble parts in-country since often there are lower import duties on individual parts than on the complete system.

For the off-grid market, there are four major distribution channels: (i) institutional partners; (ii) integrated distribution; (iii) traditional dealer–distributor networks; and (iv) franchising. Among these channels, institutional partnerships are the most popular as they unlock extensive rural networks and community-level understanding of different terrains. However, as the market grows, manufactures might be able to tap into traditional distributor-retailer markets.

Challenges

Major challenges for the off-grid appliances market: [13] [14]

High upfront costs: The target customers of off grip appliances live in rural areas and might not be able to afford high upfront costs. Innovative financial schemes such as PAYG would help to penetrate the market. However, there is also a need for other institutions like banks and microfinance to provide credits to the rural customers.

Lack of consumer awareness: Customers may not be aware of the potential benefits gained through off-grid appliances. Manufactures could expand their consumer base by educating potential customers about the usefulness of off-grid appliances.

Availability of cheap generic products: A large availability of cheap generic products spoils the market and breaks the trust of the customers. Therefore, strict rules should be put in place to prevent cheap quality products from entering the market. Similarly, policies such as subsidies on kerosene (in India), free distribution of SHS (in Indonesia) distort the market and awareness should be raised to reform these policies.

Lack of Distribution Network: Most of the rural off-grid customer base does not have a distribution network in place. Therefore, the off-grid sector is often required to invest in distribution networks or partner with already available networks. Last mile distribution is one of the most challenging aspects of the off-grid appliances value chain.

Further Information

- LED Lights in Off-grid Applications

- Quality of PicoPV Systems

- Off-grid Lighting Transition from Kerosene to LED

- solar portal on energypedia

- Technical Aspects of Grid-Interconnection

- DC Mini-Grid

- PicoPV Market

- PicoPV Products

- PicoPV Systems

- PicoPV Systems' Recent Market

- Refrigerators - (PA) Technology

- Test Procedures, Measurements & Standards for Refrigerators & Freezers

- What Users Can Save with Energy-Efficient Refrigerators & Freezers

- The Overall Worldwide Saving Potential from Domestic Refrigerators & Freezers

References

- ↑ GIZ, “Photovoltaic for Productive Use Applications: A Catalogue of DC Appliances,” 15, accessed June 10, 2016, https://energypedia.info/wiki/File:GIZ_(2016)_Catalogue_PV_Appliances_for_Micro_Enterprises.pdf.

- ↑ LEAP. “The State of The Off-Grid Appliance Market,” 2016, 12. http://www.cleanenergyministerial.org/Portals/2/pdfs/Global_LEAP_The_State_of_the_Global_Off-Grid_Appliance_Market.pdf

- ↑ World Bank Group, “Off-Grid Solar Market : Trends Report 2016,” 2016, 2.

- ↑ IRENA, “Off-Grid Renewable Energy Systems: Status and Methodological Issues,” 2015, 1, www.irena.org/DocumentDownloads/Publications/IRENA_Off-grid_Renewable_Systems_WP_2015.pdf.

- ↑ LEAP, “The State of The Off-Grid Appliance Market,” 22. http://www.cleanenergyministerial.org/Portals/2/pdfs/Global_LEAP_The_State_of_the_Global_Off-Grid_Appliance_Market.pdf

- ↑ World Bank Group, “Off-Grid Solar Market : Trends Report 2016,” 6.

- ↑ World Bank Group, “Off-Grid Solar Market : Trends Report 2016,” 6.

- ↑ 8.00 8.01 8.02 8.03 8.04 8.05 8.06 8.07 8.08 8.09 8.10 8.11 8.12 8.13 8.14 8.15 Efficiency for Access. (2018). Off-Grid Appliance Market Survey: Perceived Demand and Impact Potential of Household, Productive Use and Healthcare Technologies. Retrieved From: https://assets.publishing.service.gov.uk/media/5bb77fc0ed915d23ad91fcb3/Market-Survey-2018.pdf

- ↑ 9.0 9.1 9.2 9.3 9.4 9.5 9.6 9.7 9.8 9.9 Shirley, R. (2018). Fact Sheet: Global Off-Grid Appliance Market. Retrieved From: https://www.powerforall.org/resources/fact-sheets/fact-sheet-global-grid-appliance-market

- ↑ GIZ, “Photovoltaics for Productive Use Applications: A Catalogue of DC Appliances,” 23.

- ↑ GIZ, “Photovoltaics for Productive Use Applications: A Catalogue of DC Appliances,” 21.

- ↑ LEAP, “The State of The Off-Grid Appliance Market.”

- ↑ International Finance Corporation, “Lighting Asia: Solar Off-Grid Lighting,” accessed June 13, 2016, http://www.ifc.org/wps/wcm/connect/311790804b5ca8d783fbc3bbd578891b/Lighting-Asia-offgrid-lighting-Report072512.pdf?MOD=AJPERES.

- ↑ LEAP, “The State of The Off-Grid Appliance Market.”