Market for Solar Home Systems (SHS) in East Africa

Overview

East Africa is an market of the future when it comes to renewable energies: In Ethiopia, Kenya, Rwanda, Tanzania and Uganda was a great economical growth the recent years. A consequence of population and economic growth is an increasing need for energy.

Networks and power plants are outdated and lacking in efficiency. In many rural areas, people have no access at all to electricity.

In view of the acute energy crisis, demand for alternative and innovative supply options is growing. Enormous natural potentials exist for photovoltaics, wind, water and bioenergy as well as for solar and geothermal energy.

Almost all countries in the region have launched promotion programmes for renewable energies, and competitive bidding offers interesting business opportunities within ongoing development programmes. The private sector is also showing increasing interest in renewable alternatives, especially after the oil price shock in 2008.

With regard to this developing market, the following part presents potentials of East Africa:

Target Market Analysis for Ethiopia

Even if Ethiopia has abundant solar energy resources (national annual average irradiance is estimated to be 5.2 kWh/m2/day), the Ethiopian solar market is still at an early development stage with an estimated installed capacity of 5 MWp. Growth during the 1990s was under 5 % but has reached 15-20 % during the last few years, primarily driven by the telecom market that constitutes 70 % of installed capacity. Five or six companies supply 90 % of the market and some lack a specialist focus on solar PV.

SHS has the greatest annual growth rate of 20 % with few suppliers and driven by the extension of low-cost housing and real estate developments. Additionally, the political environment already turned into positive: Since 14th December 2009 the Ministry of Finance and Economic Development (MoFED) lifted the import duty fees on PV modules and balance of system (BOS).

Policies: The Government of Ethiopia (GoE) has adopted a twin-track strategy of rural electrification: The central focus of the strategy is accelerating grid expansion to rural towns on the one hand, while using gensets and mini-grids to bring electricity to off-grid consumers on the other. To realise this strategy of grid-based rural electrification, a programme known as “Universal Electricity Access Programme” (UEAP) was established in 2005. The UEAP envisages improving electricity access from 15 % to about 50 % over a five year horizon. The programme also aims at raising per capita electricity consumption from the level of 24 KWh per year in 2007 to 128 KWh by 2015.

As ambitious as it is, Ethiopian Electric Power Corporation’s grid-based rural electrification (implemented through UEAP) alone might not be able to meet the energy needs of the country any time soon. This is because, firstly, Ethiopia is a vast country with an estimated land area of 1.1 million km2; and secondly, the rate of electrification is one of the lowest (6 % direct connection) even compared with Sub Sahara Africa (SSA) standards. Challenged by those inconvenient realities mentioned above, the GoE has recognised the need for more innovative energy solutions and flexible technologies to complement its

Local Capacities

Availability of qualified solar technicians in Ethiopia is limited. Training is mainly given by companies to their technicians. Whenever there is a training session it is sporadic, non-modular and project specific. As a result a cadre of highly skilled technician with technical capacities to design, size and install larger and more complex PV systems is lacking. Including in-house technicians of local PV dealers, all of whom are based in Addis Ababa, a total of about 50 technicians are believed to exist nationwide.

Outlook: Market Potentials

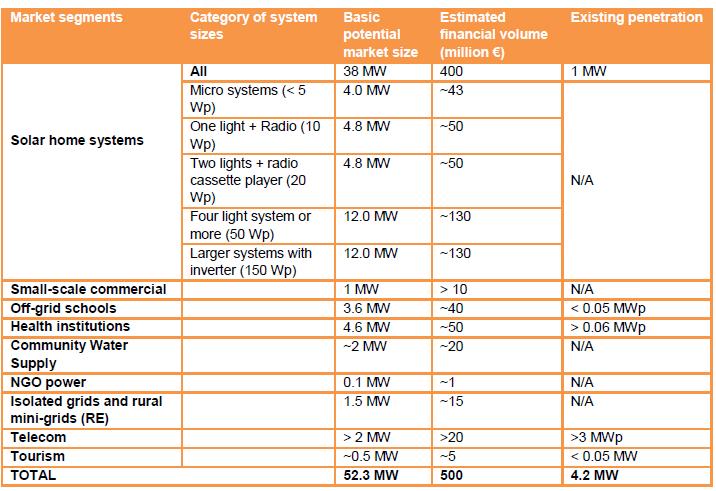

The market potential is estimated at 52 MW, the majority within the solar home systems (SHS) market and continued expansion in telecom sector. Table below shows the Solar PV Off-Grid Market Potential in Ethiopia[1].

Important conclusions:

- The total potential market for solar PV in Ethiopia is estimated to be about 52 MW. Currently, the estimated market penetration rate is about 8 % of the potential.

- Over three-quarters of the total demand comes from the household sector distantly followed by the health institutions, rural schools and the telecom industry.

- At present, institutional PV markets (health institutions and schools) are financed almost entirely by donors. Out of an estimated potential market of about 10 MW in community and institutional PV market, only a small fraction (about 1 %) is currently served. Since the bulk of the market is yet to be tapped and financing is most likely to come from donors, demand in these sectors will continue to provide much needed incentives to the commercial PV market growth.

►For futher information about market analysis for Solar PV in Ethiopia see the full report.

Target Market Analysis for Kenya

Policies:With the exception of the removal of duties and Value Added Tax for solar energy equipment and the use of solar PV in remote electrification activities, the Kenyan Government has not developed a policy support regime for solar energy which has specific targets or allocations. Although government documents mention solar energy in a “positive light” there have been few incentives, and no specific targets or legislation designed to increase the uptake of solar energy.

However, government policy is beginning to put in place some legislation that will help the solar market develop in response to electricity shortages, fuel price rises and consumer demand. This includes feed-in tariffs for other renewables than solar PV13, and the wider use of solar energy in rural electrification.

Local Capacities

Outside of the solar companies themselves, Kenya has no organised solar energy training programmes for artisans or engineers. It does have some University-level courses in alternative energy, but these are fairly basic and do not prepare “solar engineers” per se. When it comes to design and installation of more complex systems (above 1 kWp), there is a lack of significant engineering capacity at all levels. Installation of small systems is accomplished by agents or specialist installers (who often market systems on their behalf) or systems are simply self-installed (>30 %). Concerning installation or design of large systems, international supply companies are often called to bring in expertise. For the size of the market, there is a sufficient pool (> 50) of experienced solar technicians in Kenya who can handle the installation of “medium” sized systems. Even improvements in training programmes are necessary, a base of capacity in Kenya for the installation of SHS, institutional systems, inverter-battery backup and pumping systems exists - even though most installers do not have formal training.

Outlook: Market Potentials

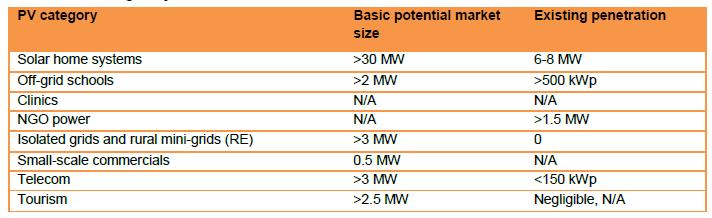

As the table below shows, market potentials for Kenya are promising.

- PV sales have been growing at a sustained rate of over 10 % per year for the last ten years.

- Furthermore, costs for off-grid solutions increased rapidly in 2008. In addition, 70 % of the country is far from the grid, and this means that commercial, NGO and households that had previously relied on generator power are reconsidering use of generators and switching to hybrid solar.[2]

► For further information see the full report.

Target Market Analysis for Rwanda

Rwanda has a net deficit of power with a national electrification rate of 8 % and a rural electrification rate of 1 %. The current installed capacity of Rwanda’s energy sector amounts more than 85 MW, however, the country needs a total of at least 100 MW to meet present demand and sustain its economic growth.

A combination of high electricity and fuel prices, and a growing economy, as well as export opportunities into the Democratic Republic of the Congo (DRC), should increase the overall demand for solar PV equipment in Rwanda. However, due to the small size of the country, the medium to long- term off-grid opportunities will gradually decrease as the grid network is enlarged and coverage made denser.

The Rwandan solar PV market is an early-stage market of small players that is poorly integrated into the global and regional solar energy industry. But the Rwandan Government is working with partners such as the European Union, the World Bank and the Belgium Government to install solar PV in public health centres, schools and government administration facilities in the rural areas. Their total installation target is approximately 200 kWp in solar PV installations commencing in 2009.

Only one company called Modern Technology Services (MTS) is aggressively exploiting this market at present.

Policies: Rwanda is well-known for being a leader in governance in the region since the genocide, and as such, it has attracted significant amounts of donor support during the last 15 years. Much of this support is targeted at the energy sector. As well, the government is aggressively pursuing rural electrification strategies which include Renewable Energy components. What is missing is a strong internal capacity to develop and build appropriate energy policy regimes. Given the urgency of the energy problems faced, the lack of skilled manpower and the lack of finances, it is not surprising that there is not a well- developed solar energy policy. For better or for worse, much of the policy development in Renewable Energy occurs on an “ad hoc” basis, often as a result of donor advice.

The government is focused on rural development, poverty alleviation and creation of business opportunities. As such, its energy policy is designed to support these overarching goals

Local Capacities

There are five to six players active in the Rwandan solar energy sector, and they are the primary repositories of solar energy skills (as well as a number of independent contractors). There is also some regional expertise in solar energy in smaller towns. Rwandan solar energy companies are just beginning to build up capacities. Their products are rather expensive (over USD 20/Wp), and there is limited capacity to design and deliver sophisticated PV systems and battery backups.

Capacity building services have been conducted sporadically by a variety of players in the past ten years. Unfortunately, there is no coordinated repository of trained PV technicians, and as yet there is no accepted code of practice or curriculum for PV in the country in university or among technician practitioners.

There is a task force in the Ministry of Infrastructure to establish some basic standards for solar PV equipment and installation.

An international NGO is set to start producing PV modules from second quality silicon wafers and to sell them in the local market at discounted prices.

Outlook: Market Potentials

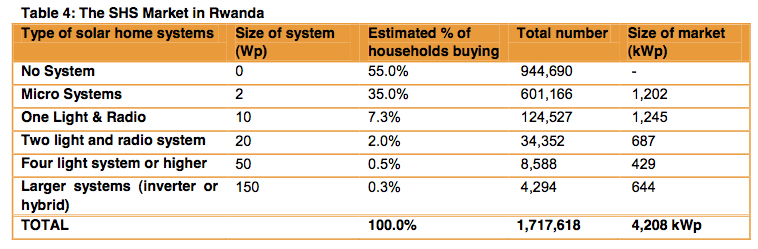

Government and donor projects will continue to dominate the market in the short and medium term. The government plans to increase grid connection to 16 % by 2012 at a cost of USD 400 million. This will require a combination of expanded grid extension and new power generation. By the year 2020, the grid coverage is projected to reach 35 %.

Demand by private sector for solar products remains limited, but may become an important niche market. Growth in the SHS sector is slow but encouraging with at least three companies actively marketing their products. The future outlook however seems promising: High electricity prices, combined with some favourable policy indicate future opportunities in the grid-connected solar PV market towards 2015. [3]

► An overview of key solar market players and the market analysis in detail can be read up here.

Target Market Analysis for Tanzania

Minimum installed capacity in Tanzania is estimated to be 2.5 MWp. Annual sales in solar PV in 2008 are likely to be over 300 kWp, and growing rapidly. The solar energy sector benefits from Tanzania’s political stability and steady economic growth.

There are three to five major suppliers of solar equipment in Tanzania. Availability of PV modules, batteries, inverters, charge regulators and appliances is limited to major towns. Many suppliers complain about reduced quality of equipment from Asia as demand increases.

Tanzania’s market has followed a similar pattern to that of Kenya, but is still considerably smaller at about 300 kWp/annum with steady growth (>20 % per year since 2000). PV SHS in Tanzania are mostly purchased by high-end consumers (prosperous farmers, urban-based consumers with families in rural areas), whilst rural incomes in Tanzania still lag behind neighbouring Kenya. Linkage between national level wholesalers and local level retailers are not well established, meaning that there are many mark-ups along the chain that greatly increase end- consumer prices.

Policies: Government policy in general is supportive of solar power. A solar feed-in tariff is not established yet. Marketplace standards are established for equipment and installations but without the clear capacity for enforcement. Government papers include solar energy and seek to increase its usage wherever possible. However, government policy requires funding to achieve implementation and this relies primarily on donor support.

Local Capacities

Tanzanian market can be divided into two general categories, the consumer SHS market and the larger system institutional market.

Consumer solar home system market

There is a poorly developed and inconsistent offering across sales and installation. However, there is a sufficient pool of experienced small system solar technicians in Tanzania who can handle the installation of SHS. But the intense competition for sales means that dealers who make unsound claims about capabilities of equipment frequently mislead consumers.

Institutional and large system market

Among the major companies participating in this market there is sufficient capacity to meet current modest demands. For systems below 3-5 kWp, the leading companies are able to complete jobs to high standards.

The players in the larger institution market invest in overseas training but there remains a lack of recognised accreditation and guarantee of quality installation.

Outlook: Market Potentials

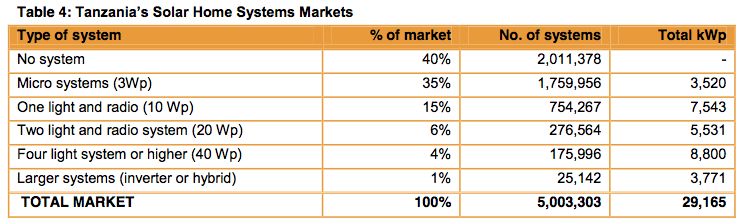

In comparison with other East African countries, the overall outlook for the solar sector in Tanzania is good:

- Tanzania is the most politically stable East African country with a liberalised economy that has seen steady economic growth over the past ten years.

- Much of the country is off-grid. The country’s large geographic size combined with the limited reach and capacity of the grid ensure that off-grid solutions will be the only plausible source of power.

- A number of economically active sectors are located off-grid and will purchase PV systems provided that they are convinced they work. As well, households and small businesses in agricultural areas (cashew, tea, coffee, cotton, sisal and sugar) have cash and will pay for PV systems to electrify their homes and premises.

- PV sales have been growing at a sustained rate of over 15 % per year for the last five years.

- Off-grid, the costs of running generators sky-rocketed in 2008. PV and battery back-ups are increasingly viewed as viable alternatives to gen-sets.

- Within planned rural electrification programmes the Rural Energy Agency will make procurements for solar PV systems. These procurements will increase steadily over the next five years.

- It is only a matter of time before grid connected opportunities become a reality. Cost is not the only factor in middle class and business consumer interest, energy independence, capability to survive power cuts, “green” marketing and a desire to be “modern” all play a role.

For qualifying companies, the government will be offering USD 2/Wp per sold system for systems below 100 Wp. But the cost of developing market networks in Tanzania is expensive, and this adds considerably to the marginal costs of sales. Therefore, even though the absolute turnover of the SHS market is large, the actual profit per sale is relatively low.[4]

► For further information see the full report.

Target Market Analysis for Uganda

The solar PV market in Uganda has steadily grown over the last 15 years with new players entering the market that include foreign investors. While ten years ago there were a handful of solar companies mainly engaged in institutional solar PV installations, there are now over thirty companies involved in the solar business (both PV and solar thermal). The market is in a state of transition where different players are yet to find their optimum servicing levels within the market.

The historical growth in the market is accounted for by five key components:

- Conducive regulatory policies that encourage investment and trade in the solar sector

- Government projects that specifically promote the use of solar in rural electrification

- The demand for reliable electricity and modern energy services by an expanding middle- income society

- The growth in the telecommunication sector 5. National awareness programmes that are facilitated through donor support.

Policies: No feed-in tariff regulation exists for solar PV. The overall objective of the Renewable Energy Policy is to diversify the energy supply sources and technologies in the country. In particular, the policy goal is to increase the use of modern renewable energy from the current 4 % to 61 % of the total energy consumption by the year 2017. Solar shall be a component but a target is not specified yet. The greatest potential is identified in the segment of solar home systems.

The Rural Electrification Agency publishes subsidies and targeted approaches to encourage PV implementation, and has worked with the private sector, in cooperation with the World Bank, through the Energy for Rural Transformation Initiative for cost-sharing and market development.

Local Capacities

The solar market is generally characterised by relatively small solar firms with annual turnovers ranging from USD 100,000 to USD 3 million. Potential consumers are not well educated or informed about the products. Basic installation and maintenance of PV systems is ensured, but there are limited experience in larger solar PV installations. Craftsmen and contractors are poorly equipped and have limited knowledge. On the other hand, they offer their services in rural areas and are good at individual marketing. Regarding Capacity building programmes, a few good training curriculums are developed, but there are limited qualified trainers and since they are project driven not affordable for individual private companies.

Outlook: Market Potentials

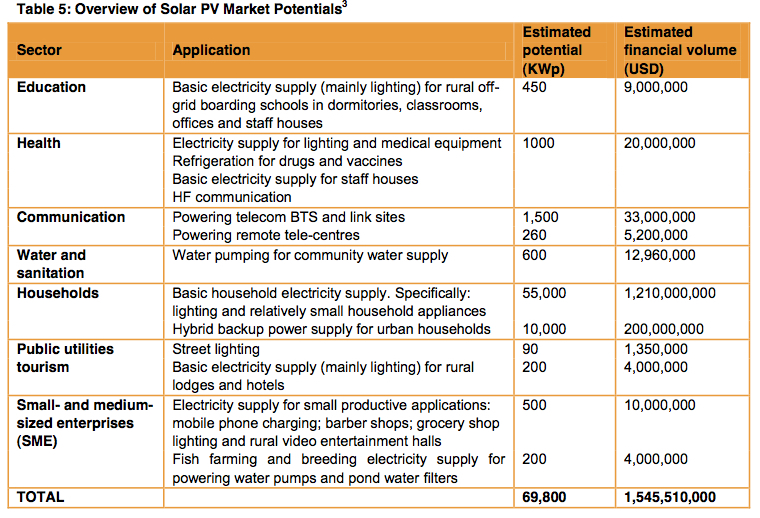

Uganda’s potential market for solar PV is estimated at almost 70 MWp (see Table). Over the long term, the commercial SHS market is seen to have the largest potential. Creating partnerships with local enterprises can ease the cost of market entry and further ease access to the market.[5]

►For further information see the full report.

Further Information

- Market for Solar Home Systems

- Financing Solar home system

- Solar portal on energypedia

- Examples of Legal Texts and Regulations to Lift Import Duties for PV Products

References

- ↑ GTZ. 2009. Target Market Analysis Ethiopia’s Solar Energy Market

- ↑ GTZ. 2009. Kenya’s Solar Energy Market- Target Market Analysis

- ↑ GTZ. 2009. Rwanda’s Solar Energy MarketfckLRTarget Market Analysis

- ↑ GTZ. 2009. Tanzania’s Solar Energy MarketfckLRTarget Market Analysis

- ↑ GTZ. 2009. Uganda’s Solar Energy MarketfckLRTarget Market Analysis