Policy and Regulatory Framework for Energy in Nigeria

This article is written by Charlotte Remteng, Muhammad Bello Suleiman, Chiamaka Maureen Asoegwu and Chysom Nnaemeka Emenyonu as part of the requirements for the Open Africa Power Fellowship Programme 2021. It is a sub-section of the publication, Country Project Nigeria.

Nigeria Energy Situation

- Introduction

- Evolution and present situation of power system (generation, transmission, distribution...)

- Clean cooking in Nigeria

- Specific regulation and business models for each electrification mode, cooking, and other energy access-related activities. Successes and shortcomings

- Existing major energy projects in Nigeria

- Key challenges in Nigeria's energy sector

Nigeria’s Energy Institutional Setup

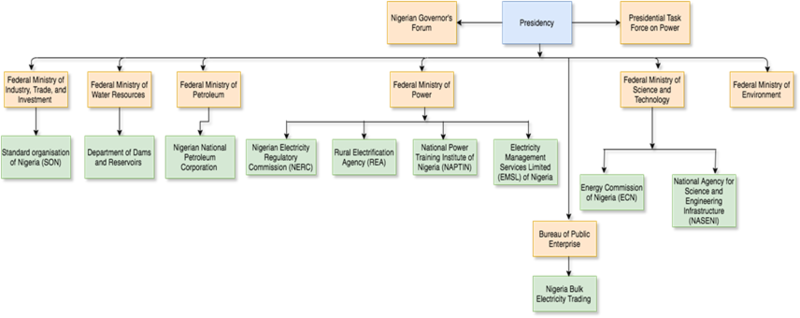

The energy sectors is overseen by the presidency of the republic and associated offices (Nigerian Governor’s Forum, presidential Task Force on power), below are ministries and departments, then commissions, programmes and other stakeholders. The figure 15 below shows the hierarchical Institutional setup of the Power sector in Nigeria.

Ministry of Energy

In Nigeria, there isn’t a single ministry that oversees all affairs relating to the country’s energy. Rather, the varied roles in the energy sector are undertaken by several ministries, departments, and agencies (MDAs). This includes federal ministries of power, water resources, petroleum, environment and science, and technology, etc.

The Federal Ministry of Power (FMP): The Federal Ministry of Power is the policy-making arm of the Federal Government with the responsibility for the provision of power in the country. The Ministry in discharging this mandate is guided by the provisions of the National Electric Power Policy (NEPP) of 2001, the Electric Power Sector Reform (EPSR) Act of 2005, and the Roadmap for Power Sector Reform of August 2010. The Rural Electrification Agency (REA), Electricity Management Services Limited (EMSL) of Nigeria, and National Power Training Institute of Nigeria (NAPTIN) are affiliated to the ministry, whereby activities of the independent regulator National Electricity Regulatory Commission (NERC) are overseen by the ministry. (https://www.power.gov.ng/) .

Federal Ministry of Environment (FMENV): FMENV has the statutory responsibility of protecting the environment against pollution and degradation and ensuring the conservation of natural resources for sustainable development in Nigeria. Under its Department Of Climate Change, the ministry coordinates all climate change matters. The Department's main objective is to foster renewable energy and energy efficiency, thus it focuses mainly on the sustainable use of biomass for cooking purposes and small-scale agricultural applications. The FMENV is also regulating the activities of the Environmental and Social Impact Assessment (ESIA). ESIA is mandatory for all development projects as per the Nigerian EIA Act No. 86 of 1992.

Federal Ministry of Industry, Trade and Investment (FMITI): the mission of the ministry is to create an economic environment in Nigeria that attracts investments, advances the industrialization process, and expands trade and export to strengthen the domestic economy. FMITI in collaboration with other MDAs supervises products, processes, and companies in the energy industry. It also supports and enacts renewable energy and energy efficiency measures. It oversees the production of parts of solar panels and is responsible for policies regarding the blending of biomass and provides industry incentives for renewable energy applications. Standard Organisation of Nigeria (SON) is affiliated with FMITI. The functions of SON include: preparing Nigerian Industrial Standards and ensuring the compliance of products and methods with such standards, establishing a quality assurance system including certification of factories, products, and laboratories, fostering interest in the formulation and adherence to standards by industry and the general public, and, assessing the conformity of imported products in the port of origin (pre-shipment verification).

Federal Ministry of Water Resources (FMWR): The mission of the ministry is to provide sustainable access to safe and sufficient water to meet the socio-economic needs of all Nigerians through efficient water resources management for basic human needs, irrigated agriculture, hydropower generation, and the promotion of a healthy population while maintaining the integrity of freshwater bodies. The ministry through its Department of Dams and Reservoir Operations is involved in numerous hydropower projects. FMWR handles the civil works and issuing water licenses in the hydropower project.

Federal Ministry of Petroleum Resources (FMPR): The ministry directs petroleum resources and their activities in Nigeria. It is tasked with the initiation and formulation of the board policies and programs on the development of the Petroleum sector (Oil and Gas) in general, formulation of policies to stimulate private industry investment and participation in the oil and gas sectors, licensing of all Petroleum and gas operations and activities, and coordination and supervision of all bilateral and multilateral relations affecting the energy (Oil and Gas) Sector among other functions. The activities of the Nigerian National Petroleum Corporation (NNPC), in addition to other parastatal, are coordinated by the ministry. NNPC has sole responsibility for upstream and downstream developments in the oil industry and is also responsible for regulating and supervising the sector on be- half of the Nigerian government.

Federal Ministry of Science and Technology (FMST): The ministry develops and implements strategies for science and technology development in Nigeria. The ministry consists of technical departments, each specializing in a certain field of science and technology. The Renewable and Conventional Energy Technology Department is responsible for energy issues in the FMST. The main focus of the department is on nuclear, renewable, and alternative energy sources as well as energy efficiency and R&D activities addressing energy-related problems associated with environmental degradation, pollution, and climate change. The Energy Commission of Nigeria (ECN) is affiliated with the ministry. The Energy Commission of Nigeria (ECN) was established by Act No. 62 of 1979, as amended by Act No. 32 of 1988 and Act No. 19 of 1989, with the statutory mandate for the strategic planning and coordination of national policies in the field of Energy in all its ramifications. By the Mandate, the ECN is the apex government organ empowered to carry out overall energy sector planning and policy implementation, promote the diversification of the energy resources. National Agency for Science and Engineering Infrastructure (NASENI) is also a parastatal of FMST and is active in the energy sector. NASENI promotes local manufacturing of renewable energy technologies such as solar modules, small hydro turbines, pole-mounted transformers, and wind turbine blades.

Bureau of Public Enterprise (BPE): The bureau is task formulating new policy, establishing a new legal and regulatory framework, Structural changes to the sector, and the institutional operatives. Its core mission is to be the key driver of the Government's economic reform program. The bureau is the major stockholder of the Nigerian Bulk Electricity Trading Plc (NBET). NBET was established in 2010 in line with provisions of the Electric Power Sector Reform Act (EPSRA). It is a trading licensee holding a bulk purchase and resale license. Its mandate is to engage in the purchase and resale of electricity and ancillary services from independent power producers and the successor generation companies.

Power Sector Regulatory bodies

The power sector regulatory bodies in Nigeria are:

- Nigerian Electricity Regulatory Commission (NERC)

- Federal Ministry of Power and

- Energy Commission of Nigeria

The Nigerian Electricity Regulatory Commission is the independent regulatory agency with authority for regulation of the electric power industry in Nigeria and ensures compliance with market rules and operating guidelines. In addition to its role of protecting consumers through the development of customer service standards and fair pricing rules and provide effective dispute resolution mechanisms, NERC is also responsible for tariff regulation (Multi-Year Tariff Order) and fair pricing, stimulating competition and private sector participation, establishing or approving appropriate operating codes and standards regulation, licensing and regulating entities engaged in generation (>1MW), transmission, distribution, and trading, monitoring activities of the electricity market and overseeing any amendment in the market.

Federal Ministry of Power on the other hand is tasked with initiating, formulating, coordinating, and implementing broad policies and programs promoting the development of electricity generation from all sources of energy in Nigeria. The ministry generally provides direction to other ministries, agencies, and departments (MDAs) involved in the power sector in the country.

Energy Commission of Nigeria is “charged with the responsibility for the strategic planning and coordination of national policies in the field of energy in all its ramifications” (ECN Act). This is achieved through inquiring into and advising the government of the federation or the state on adequate funding of the energy sector, including research and development, production, and distribution, and also monitoring the performance of the energy sector in the execution of government policies on energy. ECN also serves as a center for gathering and disseminating information relating to national policy in the field of energy..

Rural Electrification bodies

Nigeria’s Rural Electrification Programme, launched in 1981, aims at the national grid connection of all local government headquarters and selected neighboring towns and villages. When it was enacted, the Federal Ministry of Power and Steel in collaboration with the Power Holding Company of Nigeria (PHCN) handled the rural electrification activities which centered on grid expansion. In 2006, the Rural Electrification Agency (REA) was created, as part of the Electric Power Sector Reform Act (EPSRA). The agency is the Implementing agency of the Federal Government of Nigeria tasked with the electrification of rural and unserved communities. Its mission is to provide access to reliable electric power supply for rural dwellers irrespective of where they live and what they do, in a way that would allow for a reasonable return on investment through an appropriate tariff that is economically responsive and supportive of the average rural customer. This is achieved through promoting rural electrification in the country, coordinating rural electrification programs, administering the Rural Electrification Fund (REF) to promote, support, and provides rural electrification through Public and Private Sector Participation.

Policy, Legal, and Regulatory Framework

Policies relating to the energy sector in Nigeria center around all the development and regulation of the petroleum and electricity industry as these two sectors form the bulk of the energy sector in Nigeria. The two relevant energy markets in Nigeria are petroleum and electricity markets. The major drivers of the reforms and changes in these markets are privatization and liberalization to attract private investments.

The petroleum market is heavily subsidized to keep the prices on the low side. In 2012 there was partial removal of the fuel subsidy on Premium Motor Spirit (PMS) by the federal government to conserve and maximize Nigeria’s oil wealth. The “Draft Petroleum Industry Bill” was submitted for approval by Parliament in 2012. This bill defines all aspects governing the exploitation, administration, and organization of the petroleum sector in Nigeria. Its core objective is to promote the establishment of new private-sector refining capacities in-country. The foundation of new refineries would serve to ease the regular market bottlenecks experienced in petroleum products.

For the electricity market, the policy was the basis for the formulation of the Electric Power Sector Reform Act (2005), which constitutes the legal foundation for the process. The transfer of NEPA to PHCN and the subsequent splitting up of its assets into 18 separate successor companies responsible for generation, transmission, and distribution as well as the establishment of the regulatory authority NERC are the central pillars of the reform.

Structure and ownership of the Power Sector

The power market in Nigeria is one of the few energy markets in Africa which has seen some form of transformation from the traditional vertical market model: where a single utility company (Nigerian Electricity Power Authority, NEPA) runs the generation, transmission, and distribution subsystems; to an unbundled market: where the generation is partly run by the government and partly by Independent Power Producers (IPPs), the transmission run by the government-owned Transmission Company of Nigeria (TCN) and the distribution run completely by private companies. This is a move towards a market economy, and this creates a favorable atmosphere for a competition that grows the market and in turn, means better service delivery to customers.

In post-independent Nigeria, the need for large-scale investment in power infrastructure resulted in the creation of a government-owned utility company, the Nigerian Electricity Power Authority (NEPA). NEPA was responsible for the generation, transmission, and distribution of electricity throughout the country.

The dilapidated and deplorable state of the transmission and distribution infrastructure due to lack of maintenance and funding made the government turn NEPA into a public limited company where shares were sold and traded to the public, NEPA Plc in the 2000s. A successor company was later created to Power Holding Company of Nigeria (PHCN).

Low tariffs compared to the cost of generating the power ($0.06/kWh paid and cost of generating the power is $0.21/kWh), power outages, and unreliable services led to the government increasing the tariffs to get foreign investment and also unbundling the national grid. This gave rise to 11 distribution companies, one government-owned transmission, and 6 generation companies. In 2013, PHCN was completely dissolved and in its place, Nigerian Electricity Regulatory Commission (NERC) was created as a regulatory authority. The commission monitors and controls all activities of the power sector.

Unbundling the generation improves revenue collection and financial losses in due power supplied but never billed. It also reduces the amounts spent by the government on subsidies annually. Several dispatchable stations have seen an increase in number since the unbundling of the sector. This increase in dispatchable stations still fails to match the growing population in the country.

Electricity Act, Energy Policies, Secondary Regulations

National Electric Power Policy (NEPP), 2001 is the first policy toward the realization of a market economy on the power market. It outlines three phases in the realization of an adequate and reliable supply of electricity. The first phase is the privatization of the state-own utility NEPA and the introduction of the Independent Power Producers (IPPs). The second phase centers around increasing the competition between market participants, partial removal of subsidies, and sale of excess power to distribution companies (DISCOs). The last part outlines the freedom to select suppliers by large consumers and the creation of a fully liberalized and competitive market. National Energy Policy (NEP), 2003 is a document designed to serve as the framework for the development of the energy sector and how contributes to the country’s economy. The document covers the development, exploitation, and supply of all energy resources, their utilization by different sectors, and other related topics such as the environment, energy efficiency, and energy financing as well as energy policy implementation.

National Economic Empowerment and Development Strategy (NEEDS), 2004 was developed in 2004 to address the challenges of infrastructure development in the country. This policy promotes the privatization of infrastructure which is regarded as a key instrument for achieving improved service delivery. The government will still be a player and invest in areas that are regarded capital expensive or unattractive to investors. The document also set a target for shares of renewable sources in the country’s energy mix. The National Power Sector Reform Act (EPSRA) fully liberalized the power sector in 2005. It provides an avenue for the vertical and horizontal unbundling of the electricity company into separate and competitive entities; development of competitive electricity markets; setting out of a legal and regulatory framework for the sector; a framework for rural electrification; a framework for the enforcement of consumer rights and obligations: establishment of performance standards. Also, the transfer of the public institution, NEPA to a successor company Power Holding Company of Nigeria (PHCN) resulted from this Act.

Electrification Plans

Nigeria’s electrification plan is well in the Nigeria Electrification Program (NEP) and The Masterplan by the Rural Electrification Agency (REA). NEP is a Federal Government initiative that is private sector driven and seeks to provide electricity access to households, micro, small and medium enterprises in off-grid communities across the country through renewable power sources. NEP is being implemented by the Rural Electrification Agency (REA) in collaboration with the World Bank, AfDB, and other partners. The objectives of the Nigeria Electrification Project are to increase electricity access to households and micro small and medium enterprises (MSMEs); provide clean, safe, reliable, and affordable electricity through renewable power sources to unserved and underserved rural communities; develop a data-driven off-grid model for Nigeria that will become an exemplar for Sub-Saharan Africa; provide reliable power supply for 250,000 (MSMEs) and 1 million households. The Masterplan on the other hand has an ambitious target of powering 19888 numbers of homes by the year 2020. Supplying 9388 amount of solar panels to 5342 amount of communities will affect 153,188 families. This will be achieved through mandating the Discos to meet their grid extension obligations; encouraging the development of mini-grids by communities and private investors; waivers on mini-grids with less than 10kW capacity; promoting the roll-out of stand-alone systems to help provide critical service for hardest-to-reach customers.

Other documents that provide paths, regulations, and incentives for electrification plans in Nigeria include:

- Nigeria Electrification Roadmap, 2019;

- Regulation on National Content Development for the Power Sector, 2014;

- Roadmap for Power Sector Reform;

- Power Sector Policy Directives & Timelines – June 19;

- NATIONAL ENERGY EFFICIENCY ACTION PLANS (NEEAP) (2015 – 2030);

- Economic Recovery & Growth Plan: 2017-2020;

- Power Sector Recovery Programme (PSRP), 2018.

Nigeria Electrification Roadmap is a document created with a proposition of a development roadmap for future electrification in the country based on a collaboration between the Federal Government of Nigeria and Siemens. The Roadmap is structured in three phases, with Phase 1 focusing on essential and “quick-win” measures to increase the system’s end-to-end operational capacity to 7 GW, Phase 2 targeting remaining network bottlenecks to enable full use of existing generation and “last mile” distribution capacities, bringing the system’s operational capacity to 11 GW, and finally Phase 3 developing the system up to 25 GW capacity in the long term, with appropriate upgrades and expansions in both generations, transmission, and distribution.

Regulation on National Content Development for the Power Sector is a document that provides a simplified summary of the regulation primarily for off-grid energy stakeholders. It provides a context to the regulation, legal foundation, objectives, incentives, key provisions, strategy, stakeholders, implementation status, and related policy and regulatory documents.

Roadmap for Power Sector Reform is a roadmap by the Presidency, the Federal Republic of Nigeria, that outlines plans to accelerate the pace of activity concerning reforms already mandated under the EPSR Act and, at the same time and in support of this, a renewed drive to improve on short term service delivery. The roadmap has a vision of reaching a target of 40,000MW which will require investments in power generating capacity alone of at least US$ 3.5 billion per annum for the next 10 years (20:2020). Correspondingly large investments will also have to be made in the other parts of the supply chain (i.e. the fuel-to-power infrastructure and the power transmission and distribution networks).

Power Sector Policy Directives & Timelines is a document with directives from the FMP to its parastatals (NBET, TCN, NERC, and BPE) on requirements and expectations from the stakeholders towards the unbundling of the country’s government-owned monopoly that operated Nigeria’s entire power sector to meet the country’s developmental needs. These directives are companied with timelines need to comply with them.

National Energy Efficiency Action Plans (NEEAP) is a work that was initially designed by the ECOWAS Centre for Renewable Energy and Energy Efficiency (ECREEE) and adopted by the 15 ECOWAS members-states. This National Energy Efficiency Action Plan (NEEAP) includes baseline data and information on energy efficiency activities and programs in Nigeria, barriers to the development and promotion of energy efficiency in the country, and suggested achievable energy efficiency targets, incl. gender-disaggregated indicators, based on national potentials and socio-economic assessments.

The Economic Recovery and Growth Plan (ERGP), a Medium Term Plan for 2017 – 2020, builds on the SIP and has been developed to restore economic growth while leveraging the ingenuity and resilience of the Nigerian people – the nation’s most priceless assets. It is also articulated with the understanding that the role of government in the 21st century must evolve from that of being an omnibus provider of citizens’ needs into a force for eliminating the bottlenecks that impede innovation and market-based solutions. The Plan also recognizes the need to leverage Science, Technology, and Innovation (STI) and build a knowledge-based economy. The ERGP is also consistent with the aspirations of the Sustainable Development Goals (SDGs) given that the initiatives address its three dimensions of economic, social, and environmental sustainability issues. The Federal Government’s Economic Recovery and Growth Plan 2017-2020 (“ERGP”) sets out the medium-term structural reforms to diversify Nigeria’s economy, with a top priority of expanding power sector infrastructure. The ERGP recognizes the fundamental role of power in the development of all sectors of the economy. In the long term, the ERGP aims to increase power generation by improving operational capacity, encouraging small-scale renewable projects, and building additional generation capacity. Medium-term, the ERGP aims to ensure the delivery of at least 10,000 MW (on-grid and off-grid) of operational capacity by 2020 by optimizing the existing installed capacity available for generation, addressing gas supply issues including vandalism, and completing major gas infrastructure lines for power.

In addition, as part of the ERGP, the FGN aims to improve the financial capacity of the Nigerian Bulk Electricity Trading Plc. (“NBET”) to support the electricity market, strengthen governance and institutional capacity of sector agencies, and improve the commercial viability of Generation Companies (“GenCos”) and Distribution Companies (“DisCos”). It is on the above premise that the Power Sector Recovery Programme (“PSRP”, or, the “Programme”) was designed to address challenges in power sector reform.

References

- Awogbemi, O. and Komolafe, C.A. 2011. Potential for sustainable renewable energy development in Nigeria. Pacific Journal of Science and Technology 10(1): 161-169

- Babatunde, M. A., Shauibu, M. I. (2011).The Demand for Residential Electricity in Nigeria,” Pakistan J. Appl. Econ., vol. 21, pp. 1–13, 2011

- Bello, M.A., Roslan, A.H., (2010). Has Poverty Reduced in Nigeria 20 Years After? Eur. J. Soc. Sci. 2010,15, 7–17.

- Bielecki, C., Wingenbach. G. (2014). Rethinking improved cookstove diffusion programs: A case study of social perceptions and cooking choices in rural Guatemala. Energy Policy 2014, 66, 350–358. [CrossRef]

- BioEnergy Consult, (2021).https://www.bioenergyconsult.com/biomass-energy-in-nigeria/

- Bonan. J., Pareglio. S., Tavoni, M. (2017). Access to modern energy: A review of barriers, drivers and impacts. Environ. Dev. Econ. 2017, 22, 491–516. [CrossRef]

- Buraimoh, E., Ejidokun., Temitayo. O., Ayamolowo, Oladimeji, J. (2017) Optimization of an Expanded Nigeria Electricity Grid System using Economic Load Dispatch. ABUAD Journal of Engineering Research and Development (AJERD), 1 (1). pp. 1-6.Iwayemi B. A., “Investment in Electricity Generation and Transmission in Nigeria, 2007; Issues and Options,” Int. Assoc. Energy Econ., 2007

- Bureau of Public Enterprises, (2019). https://bpe.gov.ng/fg-signs-agreement-with-siemens-for-implementation-of-the-road-map-to-resolve-challenges-in-nigerias-power-sector/

- Davidson, I. E., Okafor, F. N., Ojo,O., Jimoh, A. A. (2015). Power System Operation in Developing Economies – The Nigeria Experience,” in IFAC Conference on Technology Transfer in Developing Countries: Automation in Infrastructure Creation, 2001, no. May 2015, pp. 1–6.

- David-West, A. (2014). Nigerian power sector: Value investment opportunity or value trap? Lagos, Nigeria: CSL Stockbrokers Limited.

- Draft Rural Electricity Strategy and Implementation Plan 2015

- ECREEE (2016), op. cit.

- Edomah N., Chris. F., Aled J. (2016). Energy Transitions in Nigeria: The Evolution of Energy Infrastructure Provision (1800–2015). Energies 2016, 9, 484; doi:10.3390/en9070484

- Energy for Growth Hub, (2019) How Big Is Nigeria’s Power Demand? https://www.energyforgrowth.org/memo/how-big-is-nigerias-power-demand/

- Esi-africa, (2021). Katsina wind farm makes headway for Nigeria’s abandoned projects https://www.esi-africa.com/industry-sectors/renewable-energy/katsina-wind-farm-makes-headway-for-nigerias-abandoned-projects/

- Fatima. M.A. (2019). Nigeria: The NERC Mini-Grid Regulations And The Nigerian Mini_Grid Market: Opportunity For Investment

- GET.invest. Nigeria; Energy Sector. https://www.get-invest.eu/market-information/nigeria/energy-sector/

- Government of Nigeria, (2020); Nigeria Economic Sustainability Plan

- Henrich Boll Stiftung. (2017) Can Nigeria Meet its Electricity Goals by 2030? We found out. https://ng.boell.org/en/2019/10/11/can-nigeria-meet-its-electricity-goals-2030-we-found-out

- Henrich, V.S. (2021). Fostering an Enabling Policy Environment to Expand Clean-CookingAccess in Nigeria

- https://guardian.ng/news/nigeria-records-highest-power-transmission-of-5615-40mw/

- https://nerc.gov.ng/index.php/home/nesi/404-transmission

- Hydropower Status Report, (2018) https://www.hydropower.org/country-profiles/nigeria

- IEA (2020), SDG7: Data and Projections, IEA, Paris https://www.iea.org/reports/sdg7-data-and-projectionshttps://www.iea.org/reports/sdg7-data-and-projections/access-to-electricity

- IEA, (2019). Africa Energy Outlook

- IEA, (2019). Africa Energy Outlook.

- International Energy Agency. (2016). World Energy Outlook. Paris, France, 2016.

- KPMG (2016). Nigerian Power Sector Guide

- KPMG. (2016). A guide to the Nigerian power sector.

- Lim, J., Schwarz, S., Schwarz. D.,Maru, R (2013). A rights-based approach to indoor air pollution. Health Hum. Rights 2013, 15, 160–167. [PubMed]

- Market Insights, (2021). Connecting Australian Business to the World: Nigeria Market Insights 2021

- Medium,(2016).Conversation with Kunle Odebunmi of Anergy (https://medium.com/@GridlessAfrica/conversation-with-kunle-odebunmi-ofarnergy-payg-solar-home-systems-671d06deb3fc) Accessed 30 August 2017

- Mini-Grids in Nigeria, (2017). A Case Study of a Promising Market, November 2017, the World Bank Group. Source: file:///F:/Nigeria%20Mini%20Grids%20by%20World%20Bank.pdf

- Mohapatra. S., Simon. L. (2017). Intra-household bargaining over household technology adoption. Rev. Econ. Househ. 2017, 15, 1263–1290. [CrossRef]

- Multi Year Tariff Order (MYTO), (2015). Transmission Tariff. https://nerc.gov.ng/index.php/home/myto/407-transmission-tariff

- Nigeria Living Standards Survey, 2018-19. Note: The estimates exclude Borno state.Source: Data from the World Development Indicators database: Country: Nigeria. Last Updated:05/25/2021

- Omorogiuwa,E., Eseosa,O., Ogujor, E.O. (2012). Determination Of Bus Voltages, Power Losses And Flows in the Nigeria 330kv Integrated Power System,” 2012.

- Onuoha, K. (2016). The Electricity Industry in Nigeria : What are the Challenges and Options Available to Improve the Sector ? SSRN Electron. J., no. May 2010, 2016.

- Owolabi, A., Nsafon, B.,Huh, Jeung-Soo. (2019). Validating the techno-economic and environmental sustainability of solar PV technology in Nigeria using RETScreen Experts to assess its viability. Sustainable Energy Technologies and Assessments. 36. 100542. 10.1016/j.seta.2019.100542. https://www.researchgate.net/figure/Solar-radiation-map-of-Nigeria-1-Yobe-State-is-considered-as-the-best-site-for-the_fig1_337665203

- Precious, A.(2019). How Big is Nigeria’s Power Demand? https://www.energyforgrowth.org/memo/how-big-is-nigerias-power-demand/

- REA, (2019). Opportunities in the Off-Grid Sector in Nigeria: Focus on the Nigeria Electrification Project (NEP)

- Rural Electrification Agency, (2017).Nigerian Mini-Grid Investment Brief, December 2017,.

- Rural Electrification Agency, (2019). How off-grid devt ‘ll rescue Nigeria power sector. https://rea.gov.ng/off-grid-devt-ll-rescue-nigeria-power-sector/

- Rural Electrification Agency, Energizing Economies Initiative (REA,EEI). http://rea.gov.ng/energizing-economies/

- Sambo, A., Garba, B., Zarma, I., Gaji, M. (2010). Electricity Generation and the Present Challenges in the Nigerian Power Sector. J Energy Power Eng. 6.

- Shell Foundation, (2018). Nigerian Off-Grid Market Acceleration Program: Mapping the Market

- Solomon. O., Philip O.B., Adeyinka M.A. Presentation on Environmental statistics: The Situation In The Situation in Federal Republic of Nigeria

- Sule, A.H. (2010). Major Factors Affecting Electricity Generation, Transmission and Distribution in Nigeria.

- Sweet Crude Reports, (2020).What you need to know about NERC’s Service Reflective Tariff https://sweetcrudereports.com/what-you-need-to-know-about-nercs-service-reflective-tariff/

- Techcabal, (2018). Hydropower-dominates-africas-renewables-but-over-80-of-its-potential-remains-untappedhttps://techcabal.com/2018/09/20/hydropower-dominates-africas-renewables-but-over-80-of-its-potential-remains-untapped/

- The Nation, (2019). BPE offers five GenCos to investors.https://thenationonlineng.net/bpe-offers-five-gencos-to-investors/

- The Nigerian Energy Report 2019

- The Solar Report Nigeria. Commissioned by the Netherlands Enterprise Agency. https://www.rvo.nl/sites/default/files/2021/06/Solar-Report-Nigeria.pdf

- The World Bank, (2018). Nigeria Electrification Project (P161885)

- Tracking SDG7: The Energy progress Report 2021 – World bank

- Ugochukwu, O.R., Chinyere, A.N., Jane, M., Uwazie. I., Nkechinyere.U.,Christian. O., Uwadoka., Jonathan. O. A. (2019). Improved Cook-stoves and Environmental and Health Outcomes: Lessons from Cross River State, Nigeria

- UNDP in Nigeria, Goal 5: Gender equality |https://www.ng.undp.org/content/nigeria/en/home/sustainable-development-goals/goal-5-gender-equality.html

- UNDP SDG Investor Platform, (2021).Nigeria https://sdginvestorplatform.undp.org/country/nigeria

- Urmee, T., Gyamfi. S. (2014). A review of improved Cookstove technologies and programs. Renew. Sustain. Energy Rev. 2014, 33, 625–635. [CrossRef]

- USAID Power Africa, (2020). Nigeria Energy Sector. https://www.usaid.gov/powerafrica/nigeria

- USAID, (2021). Nigeria Power Africa Fact Sheet. https://www.usaid.gov/powerafrica/nigeria

- World Bank. Country Brief: Nigeria. https://www.worldbank.org/en/country/nigeria

- https://www.ace-taf.org/wp-content/uploads/2021/03/Stand-Alone-Solar-Investment-Map-Nigeria.pdf)

- file:///F:/Nigeria%20Mini%20grid%20Investment%20Brief.pdf

- https://nerc.gov.ng/index.php/home/nesi/401-history

- https://www.cleancookingalliance.org/country-profiles/focus-countries/3-nigeria.html

- https://unfccc.int/climate-action/momentum-for-change/activity-database/momentum-for-change-towards-creating-low-carbon-green-urja-urban-poor-slums

- https://www.macrotrends.net/countries/NGA/nigeria/population

- https://www.statista.com/statistics/382311/nigeria-gdp-distribution-across-economic-sectors/

- https://www.ace-taf.org/wp-content/uploads/2021/03/Stand-Alone-Solar-Investment-Map-Nigeria.pdf

- https://guardian.ng/news/nigeria-records-highest-power-transmission-of-5615-40mw/

- https://www.sciencedirect.com/science/article/pii/S1364032116301605#:~:text=Nigeria%20has%20substantial%20biomass%20potential,to%20meet%20their%20energy%20needs.

- https://www.enerdata.net/estore/energy-market/nigeria/

- https://www.statista.com/statistics/617570/average-monthly-electricity-outage-africa-by-select-country/#:~:text=As%20of%202018%2C%20the%20average,Nigeria%20stood%20at%204%2C600%20hours.

- http://cseaafrica.org/challenges-and-interventions-needs-in-the-nigerian-electricity-supply-industry-nesi/

- https://www.sciencedirect.com/science/article/pii/S1364032116301605#:~:text=Nigeria%20has%20substantial%20biomass%20potential,to%20meet%20their%20energy%20needs.