Difference between revisions of "Enabling PV in the MENA Region"

***** (***** | *****) |

***** (***** | *****) |

||

| (21 intermediate revisions by 4 users not shown) | |||

| Line 1: | Line 1: | ||

| + | = Overview = | ||

| + | *[[Enabling_PV_in_the_MENA_Region#The_Emerging_Photovoltaic_.28PV.29_Market_in_Jordan|The Emerging PV Market in Jordan]]<br/> | ||

| + | *[[Enabling_PV_in_the_MENA_Region#The_Emerging_Photovoltaic_.28PV.29_Market_in_Tunisia|The Emerging PV Market Tunisia]]<br/> | ||

| + | *[[Enabling_PV_in_the_MENA_Region#The_.22Enabling_PV.22_Approach|The "Enabling PV" Approach]]<br/> | ||

| − | + | <br/> | |

| − | |||

| − | The analysis focuses in more detail on | + | = The Emerging Photovoltaic (PV) Market in Jordan<br/> = |

| + | |||

| + | In [[Jordan Energy Situation|Jordan]] the '''Renewable Energy and Efficiency Law 13 (REEL)''' of 2012 as well as bylaws enable [[Independent Power Producers (IPPs)|Independent Power Producers (IPP)]] to provide electricity from renewable sources to NEPCO within long-term [[Power_Purchase_Agreement_(PPA)_-_Wind_Energy#Overview|Power Purchase Agreements (PPA)]]. Private investors may also invest in their own [[Photovoltaic (PV)|Photovoltaic (PV)]] system up to 5 MWp to directly consume the electricity produced and offset it against their entire demand within a net-metering scheme. The REEL even allows the generation of electricity at a different site than where the actual consumer is located – so-called energy wheeling.<br/> | ||

| + | |||

| + | <br/> | ||

| + | |||

| + | <u>As a result, there are two promising business cases that enable investments in PV:</u> | ||

| + | *Direct Proposals for PPAs under consecutive rounds of "expressions of interest" and | ||

| + | *"net-metering". | ||

| + | |||

| + | Apart from off-grid installations, around 3 to 4 MWp of solar PV systems under the net-metering scheme had been realized by April 2014, with another 4 to 5 MWp pending within the application process waiting list. | ||

| + | |||

| + | The analysis focuses in more detail on [[Net Metering|net-metering]] with PV, its sub-option of energy wheeling, as well as on Power Purchasing Agreements with the '''Ministry for Energy and Mining Resources (MEMR)''' and its state-owned company NEPCO as contract partner. And although tender-based projects exist on government lands, they are not the focus of the study. | ||

<br/> | <br/> | ||

| Line 15: | Line 30: | ||

The study describes in detail the legal and administrative processes for net-metering, wheeling as well as the direct proposal scheme. For each process step involved actors and delays are mentioned. In case that barriers have been identified proposals are made to clarify or speed up the process. | The study describes in detail the legal and administrative processes for net-metering, wheeling as well as the direct proposal scheme. For each process step involved actors and delays are mentioned. In case that barriers have been identified proposals are made to clarify or speed up the process. | ||

| − | [[File:Net-Metering Process.jpg|412px|alt=Net-Metering Process.jpg]] | + | [[File:Net-Metering Process.jpg|thumb|center|412px|Net-Metering Process|alt=Net-Metering Process.jpg]] |

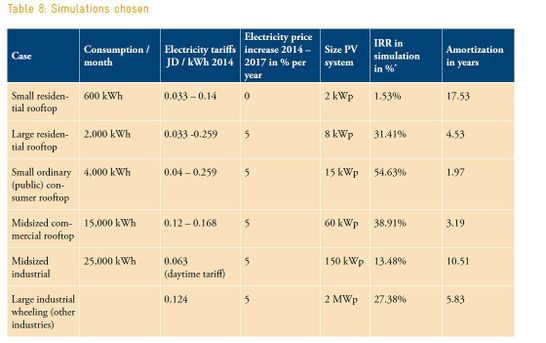

The study simulates PV business cases for different types of PV installations (residential and commercial roof-top, midsize to large industrial) and provides an overview of the most attractive categories. | The study simulates PV business cases for different types of PV installations (residential and commercial roof-top, midsize to large industrial) and provides an overview of the most attractive categories. | ||

| − | [[File:Business case simulation.jpg|546px|alt=Business case simulation.jpg]] | + | [[File:Business case simulation.jpg|thumb|center|546px|Business case simulation|alt=Business case simulation.jpg]] |

<br/> | <br/> | ||

| − | + | == Power Purchase Agreements via Tenders or Direct Proposals == | |

| + | |||

| + | Another attractive option to install PV systems in Jordan is to become an independent power producer (IPP) through the installation of renewable energy plants. Power purchase agreements (PPA) are not new to Jordan however; there have been two IPPs producing and selling electricity with combined cycle plants since 2009. By June 2014, no renewable energy plants had been constructed under the first round of the tender scheme and the following two rounds of direct proposals. In the first round, initiated in 2011, PPAs covering 170 MWp of solar PV were initially signed between 12 IPP companies or consortia and the '''Ministry for Energy and Mining Resources (MEMR)'''. Until April 2014, these were in the process of financial negotiations between investors and the potential IPPs. In the following two rounds of direct proposals, another 400 MWp of solar PV systems had been tendered for direct proposals, including four 50 MW plants and two 100 MW plants. | ||

| − | + | With the 3rd Round for expression of interest (EOI), one can note that a standard procedure exists for the Direct Proposal Scheme, though none of the rounds have so far resulted in the construction of PV plants. | |

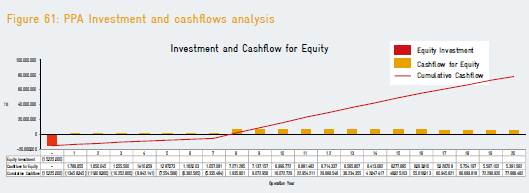

| − | + | The study provides a financial analysis of a Large PV System of 50 MWp for a PPA contract in Round 2 of the Direct Proposal scheme. | |

| − | + | [[File:PPA cash flow.jpg|thumb|center|529px|Power Purchase Agreement Cash Flow|alt=PPA cash flow.jpg]] | |

| − | + | <br/> | |

| + | |||

| + | == Download == | ||

| − | [[File: | + | <font size="2">[[File:Enabling PV in the MENA Region - Jordan.pdf|thumb|left|180px|Enabling PV in the MENA region - The emerging PV market in Jordan]]</font><br/> |

| − | + | <br/> | |

| − | |||

| − | + | = The Emerging Photovoltaic (PV) Market in Tunisia = | |

| − | + | [[Tunisia Energy Situation|Tunisia]] is a rapidly expanding photovoltaic market in the MENA region. The country’s economic conditions are relatively favourable, while its natural solar exposure conditions are ideal for photovoltaics, enabling installations to produce more than 1,700 kWh/kWp annually. Regarding public support, the PROSOL thermal programme, introduced in 2005, promotes solar thermal system investments. The PROSOL ELEC programme, designed for photovoltaic installations, has been in existence since 2010. So far, this support mechanism has contributed to the installation of a total PV capacity of 6 MWp. Nearly 150 Tunisian installers are certified by the Tunisian National Agency for Energy Management (ANME). These installers mainly perform installations of small photovoltaic systems, in particular in the private sector. | |

| − | < | + | <br/> |

| − | + | == Photovoltaics Not Connected to the Grid<br/> == | |

| − | + | The solar PV sector in Tunisia started in the ‘80s in order to meet the electricity needs of a population that could not access the national electricity grid. Photovoltaic installations were intended for low-income populations in order to reduce precarious energy situations, hence an important financial involvement from the state. Until 2013, photovoltaic installations that were not connected to the electricity grid were enabling the electrification of 13,500 households and 200 rural schools<ref name="DER 2014">DER 2014</ref>.<br/>Today, farms are the main target for photovoltaic installations that are not connected to the electricity grid. Indeed, beyond water pumping, they face the need to improve their energy performance in order to reduce the water needed for irrigation. | |

| + | <br/> | ||

| + | == Photovoltaics Connected to the Low and Medium Voltage Grid == | ||

| − | + | PV connected to the grid was initiated by the PROSOL ELEC programme. A preliminary experimental phase to prepare the sector and various players was launched in 2010-2011. The aim of this experimental phase was to reach an installed capacity of 1.5 MW. Following the success of this experimental phase, the Tunisian government decided to extend the PROSOL ELEC programme. At the end of 2013, the PROSOL ELEC programme had equipped next to 1,650 households for an installed capacity totalling approximately 4 MWp<ref name="ANME 2013">ANME 2013</ref>. | |

| − | + | Self-generation mechanisms for the installations that are connected to medium voltage, intended for industrial and service industries, have experienced a slow start since the enactment of the Law of 9 February 2009. Indeed, at the end of 2013, only two installations had been carried out. Over the same period, a dozen grid connection requests were officially forwarded to the Technical Advisory Committee, totalling a capacity of around 900 kWp<ref name="DER 2014">DER 2014</ref>. | |

| − | + | <br/> | |

| − | + | == Profitability of PV Business Cases == | |

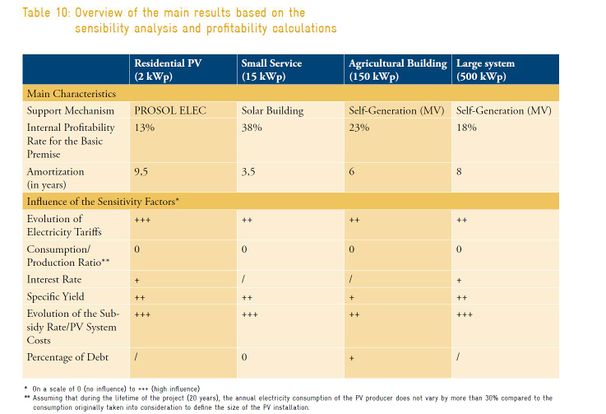

The four cases analysed above show us that any photovoltaic system installed in Tunisia is amortised during their 20-year project duration, and this no matter what market segment is concerned. In theory, implemented photovoltaic projects are therefore economically profitable. Several market segments offer an amortization period shorter than 10 years and therefore represent a true investment opportunity. The table below summarises, for the four types of photovoltaic projects, the main results based on the sensitivity analysis and profitability calculations carried out: | The four cases analysed above show us that any photovoltaic system installed in Tunisia is amortised during their 20-year project duration, and this no matter what market segment is concerned. In theory, implemented photovoltaic projects are therefore economically profitable. Several market segments offer an amortization period shorter than 10 years and therefore represent a true investment opportunity. The table below summarises, for the four types of photovoltaic projects, the main results based on the sensitivity analysis and profitability calculations carried out: | ||

| + | |||

| + | [[File:Profitability overview TUN.jpg|thumb|center|606px|Profitability overview Tunisia|alt=Profitability overview TUN.jpg]] | ||

As illustrated in the table above, the case of the commercial PV installation of a capacity of 15 kWp and eligible to the “Solar Buildings” programme benefits from the lowest amortization period. The case of the agricultural building of a 150 kWp capacity is the second most profitable case, with an internal rate of return of 23% and an amortization period of 6 years. | As illustrated in the table above, the case of the commercial PV installation of a capacity of 15 kWp and eligible to the “Solar Buildings” programme benefits from the lowest amortization period. The case of the agricultural building of a 150 kWp capacity is the second most profitable case, with an internal rate of return of 23% and an amortization period of 6 years. | ||

| + | <br/> | ||

| + | == <br/>Download == | ||

| + | |||

| + | {| style="width: 100%;" border="0" cellspacing="1" cellpadding="5" | ||

| + | |- | ||

| + | | Study in English<br/> | ||

| + | | Study in French<br/> | ||

| + | |- | ||

| + | | | ||

| + | [[File:ENABLING PV Tunisia en web.pdf|thumb|left|180px|Enabling PV in the MENA region - The emerging PV market in Tunisia]]<br/> | ||

| + | |||

| + | | [[File:ENABLING PV Tunisie fr web.pdf|thumb|left|180px|Enabling PV dans la région MENA - Analyse du marché solaire photovoltaïque en Tunisie]] | ||

| + | |} | ||

<br/> | <br/> | ||

| − | |||

| − | = The | + | = The "Enabling PV" Approach = |

| + | |||

| + | Electricity from '''photovoltaics (PV)''' is about to reach grid parity in many countries of the MENA region, as well as generation parity in some countries of the region. More and more governments are promoting large or small decentralized forms of PV projects, which are coupled with the conventional electricity grids. Within this context, the overall goal of the project "Enabling PV" is to contribute to the sustainable use of PV in the MENA region. As the first show case, the project focuses on the emerging solar markets of [[Enabling_PV_in_the_MENA_Region#The_Emerging_Photovoltaic_.28PV.29_Market_in_Tunisia|Tunisia]] and [[Enabling_PV_in_the_MENA_Region#The_Emerging_Photovoltaic_.28PV.29_Market_in_Jordan|Jordan]]. | ||

| − | + | "Enabling PV" as a project is coordinated by [http://www.giz.de/en/ Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ)] within the framework of the regional project "Mediterranean Solar Plan (MSP) – Technology Cooperation". It has been financed in the framework of the '''International Climate Initiative (IKI)''' of the German Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB). The German Solar Industry Association (BSW-Solar) and the consulting company eclareon GmbH are responsible for executing the "Enabling PV" in Tunisia and Jordan.<br/> | |

| − | + | The project also aims at supporting local renewable energy associations in MENA countries.<u>"ENABLING PV" focuses on the following activities in Tunisia and Jordan:</u><br/> | |

| + | *Identifying viable business models for solar PV in Jordan and Tunisia on the basis of real-life experiences of local and foreign project developers and investors.<br/> | ||

*Analyzing the legal and administrative process flows for each identified business model and making the results available to local and international investors. | *Analyzing the legal and administrative process flows for each identified business model and making the results available to local and international investors. | ||

*Detecting existing barriers to the implementation of business models. | *Detecting existing barriers to the implementation of business models. | ||

| Line 80: | Line 117: | ||

*Strengthening cooperation and transferring knowledge between relevant stakeholders, in particular from the private sector in Jordan, Tunisia and Germany. | *Strengthening cooperation and transferring knowledge between relevant stakeholders, in particular from the private sector in Jordan, Tunisia and Germany. | ||

| − | + | <br/> | |

| Line 86: | Line 123: | ||

*[[Jordan Energy Situation|Jordan Energy Situation]] | *[[Jordan Energy Situation|Jordan Energy Situation]] | ||

| + | *[[Tunisia Energy Situation|Tunisia Energy Situation]] | ||

*[[Photovoltaic (PV)|Photovoltaic (PV)]] | *[[Photovoltaic (PV)|Photovoltaic (PV)]] | ||

| − | *[[Portal:Solar|Solar Portal on energypedia]] | + | *[[Portal:Solar|Solar Portal on energypedia]]<br/> |

| + | *[[Financing_Solar_Energy_in_Tunisia|Financing Solar Energy in Tunisia]]<br/> | ||

| + | *[[Dynamic Cash Flow Analysis of Photovoltaic Projects in Tunisia|Dynamic Cash Flow Analysis of Photovoltaic Projects in Tunisia]]<br/> | ||

| + | |||

| + | <br/> | ||

| − | |||

| − | = | + | = References = |

| − | * | + | *[http://www.giz.de/en/ Deutsche Gesellschaft für Internationale Zusammenarbeit] |

| + | <references /> | ||

| + | |||

| + | [[Category:Jordan]] | ||

| + | [[Category:Tunisia]] | ||

| + | [[Category:Solar]] | ||

| + | [[Category:Financing_Solar]] | ||

[[Category:MENA_(Middle_East_and_North_Africa)]] | [[Category:MENA_(Middle_East_and_North_Africa)]] | ||

| − | |||

| − | |||

| − | |||

Latest revision as of 10:37, 15 May 2015

Overview

The Emerging Photovoltaic (PV) Market in Jordan

In Jordan the Renewable Energy and Efficiency Law 13 (REEL) of 2012 as well as bylaws enable Independent Power Producers (IPP) to provide electricity from renewable sources to NEPCO within long-term Power Purchase Agreements (PPA). Private investors may also invest in their own Photovoltaic (PV) system up to 5 MWp to directly consume the electricity produced and offset it against their entire demand within a net-metering scheme. The REEL even allows the generation of electricity at a different site than where the actual consumer is located – so-called energy wheeling.

As a result, there are two promising business cases that enable investments in PV:

- Direct Proposals for PPAs under consecutive rounds of "expressions of interest" and

- "net-metering".

Apart from off-grid installations, around 3 to 4 MWp of solar PV systems under the net-metering scheme had been realized by April 2014, with another 4 to 5 MWp pending within the application process waiting list.

The analysis focuses in more detail on net-metering with PV, its sub-option of energy wheeling, as well as on Power Purchasing Agreements with the Ministry for Energy and Mining Resources (MEMR) and its state-owned company NEPCO as contract partner. And although tender-based projects exist on government lands, they are not the focus of the study.

Net-Metering and Wheeling

At the time of the interviews for the study in late April 2014, the most common way to employ PV systems in Jordan was net-metering at the site of a consumer. Around 3 to 4 MWp had been installed under the scheme, with 4 to 5 MWp under review by the relevant DSOs. According to the directive concerning net-metering, the overall limit for net-metering is fixed at 1% of the gross capacity of the low voltage distribution grid, or approximately 28 MWp, and 1.5% of gross capacity of the medium voltage distribution grid, approximately 42 MWp. This limit was described as purely regulative and to be reviewed if necessary.

The study describes in detail the legal and administrative processes for net-metering, wheeling as well as the direct proposal scheme. For each process step involved actors and delays are mentioned. In case that barriers have been identified proposals are made to clarify or speed up the process.

The study simulates PV business cases for different types of PV installations (residential and commercial roof-top, midsize to large industrial) and provides an overview of the most attractive categories.

Power Purchase Agreements via Tenders or Direct Proposals

Another attractive option to install PV systems in Jordan is to become an independent power producer (IPP) through the installation of renewable energy plants. Power purchase agreements (PPA) are not new to Jordan however; there have been two IPPs producing and selling electricity with combined cycle plants since 2009. By June 2014, no renewable energy plants had been constructed under the first round of the tender scheme and the following two rounds of direct proposals. In the first round, initiated in 2011, PPAs covering 170 MWp of solar PV were initially signed between 12 IPP companies or consortia and the Ministry for Energy and Mining Resources (MEMR). Until April 2014, these were in the process of financial negotiations between investors and the potential IPPs. In the following two rounds of direct proposals, another 400 MWp of solar PV systems had been tendered for direct proposals, including four 50 MW plants and two 100 MW plants.

With the 3rd Round for expression of interest (EOI), one can note that a standard procedure exists for the Direct Proposal Scheme, though none of the rounds have so far resulted in the construction of PV plants.

The study provides a financial analysis of a Large PV System of 50 MWp for a PPA contract in Round 2 of the Direct Proposal scheme.

Download

The Emerging Photovoltaic (PV) Market in Tunisia

Tunisia is a rapidly expanding photovoltaic market in the MENA region. The country’s economic conditions are relatively favourable, while its natural solar exposure conditions are ideal for photovoltaics, enabling installations to produce more than 1,700 kWh/kWp annually. Regarding public support, the PROSOL thermal programme, introduced in 2005, promotes solar thermal system investments. The PROSOL ELEC programme, designed for photovoltaic installations, has been in existence since 2010. So far, this support mechanism has contributed to the installation of a total PV capacity of 6 MWp. Nearly 150 Tunisian installers are certified by the Tunisian National Agency for Energy Management (ANME). These installers mainly perform installations of small photovoltaic systems, in particular in the private sector.

Photovoltaics Not Connected to the Grid

The solar PV sector in Tunisia started in the ‘80s in order to meet the electricity needs of a population that could not access the national electricity grid. Photovoltaic installations were intended for low-income populations in order to reduce precarious energy situations, hence an important financial involvement from the state. Until 2013, photovoltaic installations that were not connected to the electricity grid were enabling the electrification of 13,500 households and 200 rural schools[1].

Today, farms are the main target for photovoltaic installations that are not connected to the electricity grid. Indeed, beyond water pumping, they face the need to improve their energy performance in order to reduce the water needed for irrigation.

Photovoltaics Connected to the Low and Medium Voltage Grid

PV connected to the grid was initiated by the PROSOL ELEC programme. A preliminary experimental phase to prepare the sector and various players was launched in 2010-2011. The aim of this experimental phase was to reach an installed capacity of 1.5 MW. Following the success of this experimental phase, the Tunisian government decided to extend the PROSOL ELEC programme. At the end of 2013, the PROSOL ELEC programme had equipped next to 1,650 households for an installed capacity totalling approximately 4 MWp[2].

Self-generation mechanisms for the installations that are connected to medium voltage, intended for industrial and service industries, have experienced a slow start since the enactment of the Law of 9 February 2009. Indeed, at the end of 2013, only two installations had been carried out. Over the same period, a dozen grid connection requests were officially forwarded to the Technical Advisory Committee, totalling a capacity of around 900 kWp[1].

Profitability of PV Business Cases

The four cases analysed above show us that any photovoltaic system installed in Tunisia is amortised during their 20-year project duration, and this no matter what market segment is concerned. In theory, implemented photovoltaic projects are therefore economically profitable. Several market segments offer an amortization period shorter than 10 years and therefore represent a true investment opportunity. The table below summarises, for the four types of photovoltaic projects, the main results based on the sensitivity analysis and profitability calculations carried out:

As illustrated in the table above, the case of the commercial PV installation of a capacity of 15 kWp and eligible to the “Solar Buildings” programme benefits from the lowest amortization period. The case of the agricultural building of a 150 kWp capacity is the second most profitable case, with an internal rate of return of 23% and an amortization period of 6 years.

Download

| Study in English |

Study in French |

|

|

The "Enabling PV" Approach

Electricity from photovoltaics (PV) is about to reach grid parity in many countries of the MENA region, as well as generation parity in some countries of the region. More and more governments are promoting large or small decentralized forms of PV projects, which are coupled with the conventional electricity grids. Within this context, the overall goal of the project "Enabling PV" is to contribute to the sustainable use of PV in the MENA region. As the first show case, the project focuses on the emerging solar markets of Tunisia and Jordan.

"Enabling PV" as a project is coordinated by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) within the framework of the regional project "Mediterranean Solar Plan (MSP) – Technology Cooperation". It has been financed in the framework of the International Climate Initiative (IKI) of the German Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB). The German Solar Industry Association (BSW-Solar) and the consulting company eclareon GmbH are responsible for executing the "Enabling PV" in Tunisia and Jordan.

The project also aims at supporting local renewable energy associations in MENA countries."ENABLING PV" focuses on the following activities in Tunisia and Jordan:

- Identifying viable business models for solar PV in Jordan and Tunisia on the basis of real-life experiences of local and foreign project developers and investors.

- Analyzing the legal and administrative process flows for each identified business model and making the results available to local and international investors.

- Detecting existing barriers to the implementation of business models.

- Formulating concrete recommendations for removing these barriers and discussing them with decision-makers.

- Strengthening cooperation and transferring knowledge between relevant stakeholders, in particular from the private sector in Jordan, Tunisia and Germany.

Further Information

- Jordan Energy Situation

- Tunisia Energy Situation

- Photovoltaic (PV)

- Solar Portal on energypedia

- Financing Solar Energy in Tunisia

- Dynamic Cash Flow Analysis of Photovoltaic Projects in Tunisia