Difference between revisions of "Ethiopia Energy Situation"

***** (***** | *****) |

***** (***** | *****) |

||

| Line 334: | Line 334: | ||

[[Ethiopia Energy Situation#toc|►Go to Top]] | [[Ethiopia Energy Situation#toc|►Go to Top]] | ||

| + | |||

| Line 348: | Line 349: | ||

<br/> | <br/> | ||

| − | + | #'''Ministry of Water, Irrigation and Electricity (MoWIE) '''- Regulatory policy and decision making, energy operations, implementation and supervising other governmental agencies and enterprises. | |

| − | #'''Ministry of Water, Irrigation and Electricity (MoWIE) '''Regulatory policy and decision making, energy operations, implementation and supervising other governmental agencies and enterprises. | + | #'''Ministry of Environment, Forest and Climate Change (MoEFCC) - '''Regulatory policy and decision making, environmental, climate related operations and implementing ICS and climate change mitigation. |

| − | # | + | #'''Ethiopia Energy Authority (EEA) - '''Regulating energy efficiency and conservation, Regulate the electricity sector, Issue technical codes standards and directives, commission programs and projects on Energy Efficiency, Delegate its mandates to state governments to better deliver regulatory services to and to promote energy efficiency and conservation services in the economy. Other preparation works such as: organizational structure of the Authority, various directives and codes are under development. |

| − | '''Ministry of Environment, Forest and Climate Change (MoEFCC) - ''' | + | #'''Ethiopian Electric Utility (EEU) - '''Engage in the construct, maintain electric distribution networks, Purchase of bulk electric power , selling electrical energy to customers, Initiate electric tariff amendments approval and implement and Carry out any other related activities that would enable it achieve its purpose in accordance with economic and social development policies and priorities of the government. |

| − | + | #'''Ethiopian Electric Power (EEP) - ''' | |

| − | # | ||

| − | '''Ethiopia Energy Authority (EEA) - '''Regulating energy efficiency and conservation, Regulate the electricity sector, Issue technical codes standards and directives, commission programs and projects on Energy Efficiency, Delegate its mandates to state governments to better deliver regulatory services to and to promote energy efficiency and conservation services in the economy. Other preparation works such as: organizational structure of the Authority, various directives and codes are under development. | ||

| − | |||

| − | # | ||

| − | '''Ethiopian Electric Utility (EEU) - ''' | ||

| − | |||

| − | # | ||

| − | '''Ethiopian Electric Power (EEP) - ''' | ||

| − | |||

#'''Ethiopian Rural Energy Development and Promotion Centre (EREDPC)''' – with the mandate to carry out national energy resources studies, data collection and analysis, rural energy policy formulation, technology research and development and to promote appropriate renewable energy technologies in rural areas; the Centre also serves as the Executive arm of the '''Rural Electrification Fund (REF)'''. To assess and implement projects under the REF the EREDPC has established a core team as the '''Rural Electrification Executive Secretariat REES'''. The REES being responsible for project appraisal shall also provide advisory services, capacity building, and training to Regional Energy Bureaus and cooperatives. | #'''Ethiopian Rural Energy Development and Promotion Centre (EREDPC)''' – with the mandate to carry out national energy resources studies, data collection and analysis, rural energy policy formulation, technology research and development and to promote appropriate renewable energy technologies in rural areas; the Centre also serves as the Executive arm of the '''Rural Electrification Fund (REF)'''. To assess and implement projects under the REF the EREDPC has established a core team as the '''Rural Electrification Executive Secretariat REES'''. The REES being responsible for project appraisal shall also provide advisory services, capacity building, and training to Regional Energy Bureaus and cooperatives. | ||

#'''Rural Electrification Fund (REF)''' - to enable the private and cooperative engagement in rural electrification activities through loan based finance and technical support. Among other REF shall also prepare an off-grid rural electrification master plan which shall be updated annually and conduct feasibility studies to identify suitable RE projects, which will be implemented by the private sector (which includes NGOs, CBOs, co-operatives, municipalities/local governments and other entities).The REF received US$ 15 million in funding from the World Bank and GEF under the Energy Access Program. This allowed the granting of loans and the promotion of energy projects in rural areas in collaboration with private actors and local authorities. In formal terms it is administered by the '''Rural Electrification Board (REB)''' and the '''Rural Electrification Executive Secretariat (REES)'''. The REB determines the criteria for project promotion and coordinates cooperation with other programmes. The Board also decides on whether to proceed with the submitted project proposals. The REB’s members are employees of the Ministry of Water Resources, the Ministry of Mines and Energy, the EEA and the EREDPC and representatives of the private sector. The resources available to the REF are used to subsidise 85 % of the cost of rural electrification projects. Renewable energy sources are entitled to a higher subsidy of 95 %. Most of the projects that receive assistance, however, are based on electricity generation with diesel generators. | #'''Rural Electrification Fund (REF)''' - to enable the private and cooperative engagement in rural electrification activities through loan based finance and technical support. Among other REF shall also prepare an off-grid rural electrification master plan which shall be updated annually and conduct feasibility studies to identify suitable RE projects, which will be implemented by the private sector (which includes NGOs, CBOs, co-operatives, municipalities/local governments and other entities).The REF received US$ 15 million in funding from the World Bank and GEF under the Energy Access Program. This allowed the granting of loans and the promotion of energy projects in rural areas in collaboration with private actors and local authorities. In formal terms it is administered by the '''Rural Electrification Board (REB)''' and the '''Rural Electrification Executive Secretariat (REES)'''. The REB determines the criteria for project promotion and coordinates cooperation with other programmes. The Board also decides on whether to proceed with the submitted project proposals. The REB’s members are employees of the Ministry of Water Resources, the Ministry of Mines and Energy, the EEA and the EREDPC and representatives of the private sector. The resources available to the REF are used to subsidise 85 % of the cost of rural electrification projects. Renewable energy sources are entitled to a higher subsidy of 95 %. Most of the projects that receive assistance, however, are based on electricity generation with diesel generators. | ||

| Line 368: | Line 360: | ||

<br/> | <br/> | ||

| − | MoWIE is working closely with two public enterprises: the '''Ethiopian Electric Utility (EEU) '''and the '''Ethiopian Electric Power (EEP)''' for the electricity sub-sector, and the '''Ethiopian Petroleum Enterprise (EPE) '''for the petroleum sub-sector. EPE is an operational wing of government entrusted with the responsibility of exclusively importing petroleum products in to the country. The petroleum products market, with the exception of LPG, is still regulated in Ethiopia and importation is the monopoly of EPE<ref name="GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy.">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>. Based on the decision of the parlament in December 2013 EEPCo restructured into two companies: a) the '''Ethiopian Electric Utility (EEU) '''and the '''Ethiopian Electric Power (EEP)''' and they are mandated to generate, transmit, distribute, and sell electricity. The corporation disseminates electricity through two different power supply systems: the '''Interconnected System (ICS)''' and the '''Self-Contained System (SCS)'''. The ICS, which is largely generated by hydropower plants, is the major source of electric power generation. The SCS is mainly based on diesel generators and to a minor portion on small and medium hydropower plants. EEPCo’s financial situation is considered to be weak. In 2006, electricity tariffs were increased by 22 percent across the board, except for the life-line tariff (consumption up to 50kWh/month) which remained unchanged. The weighted average tariff is estimated at 0.06US$/kWh. The overall billing collection rate at present is estimated at around 98 percent. Electricity revenue increased to US$150 million. Operating profit after depreciation was US$35.2 million. Operating profit per kWh sales to end-use customers was at 0.014US$/kWh. According to the World Bank,11 EEPCo has a strong technical and stable management team, and is operating profitably with an internal cash generation of about US$50 million per year. Its operating costs are low since generation is predominantly hydro, which also reduces exposure to oil price volatility. | + | MoWIE is working closely with two public enterprises: the '''Ethiopian Electric Utility (EEU) '''and the '''Ethiopian Electric Power (EEP)''' for the electricity sub-sector, and the '''Ethiopian Petroleum Enterprise (EPE) '''for the petroleum sub-sector. EPE is an operational wing of government entrusted with the responsibility of exclusively importing petroleum products in to the country. The petroleum products market, with the exception of LPG, is still regulated in Ethiopia and importation is the monopoly of EPE<ref name="GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy.">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>. Based on the decision of the parlament in December 2013 EEPCo restructured into two companies: a) the '''Ethiopian Electric Utility (EEU) '''and the '''Ethiopian Electric Power (EEP)''' and they are mandated to generate, transmit, distribute, and sell electricity. The corporation disseminates electricity through two different power supply systems: the '''Interconnected System (ICS)''' and the '''Self-Contained System (SCS)'''. The ICS, which is largely generated by hydropower plants, is the major source of electric power generation. The SCS is mainly based on diesel generators and to a minor portion on small and medium hydropower plants. EEPCo’s financial situation is considered to be weak. In 2006, electricity tariffs were increased by 22 percent across the board, except for the life-line tariff (consumption up to 50kWh/month) which remained unchanged. The weighted average tariff is estimated at 0.06US$/kWh. The overall billing collection rate at present is estimated at around 98 percent. Electricity revenue increased to US$150 million. Operating profit after depreciation was US$35.2 million. Operating profit per kWh sales to end-use customers was at 0.014US$/kWh. According to the World Bank,11 EEPCo has a strong technical and stable management team, and is operating profitably with an internal cash generation of about US$50 million per year. Its operating costs are low since generation is predominantly hydro, which also reduces exposure to oil price volatility.<br/><u>Further operation and implementation organs are<ref name="GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy.">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>:</u> |

| − | <br/> | ||

| − | <u>Further operation and implementation organs are<ref name="GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy.">GTZ (2007): Eastern Africa Resource Base: GTZ Online Regional Energy Resource Base: Regional and Country Specific Energy Resource Database: IV - Energy Policy. </ref>:</u> | ||

*'''Ministry of Trade (MoT)''': The MoTI sets retail prices and regulates the distribution of petroleum products by oil distribution companies. | *'''Ministry of Trade (MoT)''': The MoTI sets retail prices and regulates the distribution of petroleum products by oil distribution companies. | ||

| Line 444: | Line 434: | ||

<br/> | <br/> | ||

| − | {| cellspacing="0" cellpadding="0" border="1" style="width: 100% | + | {| cellspacing="0" cellpadding="0" border="1" class="wikitable sortable" style="width: 100%" |

|- | |- | ||

! style="width: 25px" | '''#''' | ! style="width: 25px" | '''#''' | ||

Revision as of 07:44, 13 April 2016

Capital:

Addis Ababa

Region:

Coordinates:

9.0167° N, 38.7500° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

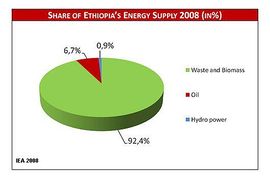

Ethiopia is one of the least developed countries in the world. With an average annual income of 120 US$ per capita, approximately 40% of its 85 million inhabitants live below the poverty line[1][2]. Ethiopia has one of the lowest rates of access to modern energy services, its energy supply is primarily based on biomass. With a share of 92.4% (88% according to SREP investment plan) of Ethiopia’s energy supply, waste and biomass are the country’s primary energy sources, followed by oil (6.7%) and hydropower (0.9%)[3] (see Fig. 1).

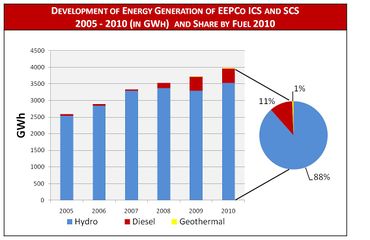

Energy Situation

99% of households, 70% of industries and 94% of service enterprises use biomass as energy source. Households account for 88% of total energy consumption, industry 4%, transport 3% and services and others 5%. The installed electricity generating capacity in Ethiopia is about 2060 MW (88% hydro, 11% diesel and 1% thermal) and production covers only about 10% of national energy demand.The country is completely reliant on imports to meet its petroleum requirements.

According to the World Bank only an estimated 12% of the Ethiopian population has access to electricity[4][5]. With almost 85% of the Ethiopians living in rural areas, there is a significant bias between the power supply of urban and rural population: only 2% of the rural but 86% of the urban residents has access to electricity[6][7][8]. The overloading of the network frequently disrupts the power supply of large commercial and industrial customers. There is a need for substantial investments in the power system.

The policy framework for household energy is set by the Ethiopian Energy Policy, the Environmental Policy of Ethiopia and the Conservation Strategy of Ethiopia, which address energy conservation and energy efficiency in order to reduce the consumption of fuelwood.

Ethiopia is well endowed with renewable energy sources. These include first of all hydro, but also wind, geothermal, solar as well as biomass. As of August 2009, only 7% of the estimated 54 GW economically exploitable power generation resources was either developed or committed to be developed[9].

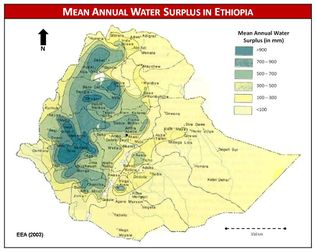

Hydropower

Ethiopia's hydropower potential is estimated up to 45,000 MW and is the 2nd highest in Africa (only DR. Congo has a higher potential). Approximately 30,000 MW is estimated to be economically feasible which is equivalent to an electricity generation of 162 TWh[10][11]. The current production of 3.98 TWh thus equals to an exploitation of only 2.5%. In general, Ethiopia’s terrain is advantageous for hydropower projects. With 10 river basins (of which the Blue Nile, Omo and Wabi Shebelle, and Genale-Dawa are international rivers), hundreds of streams flowing into the major rivers dissecting the mountainous landscape in every direction; and each river basin covering massive catchment areas with adequate rainfall, Ethiopia is said to be the “Water Tower of Eastern Africa”. This is no exaggeration given the fact that Ethiopia alone contributes to about 86% of the waters in the Blue Nile. Moreover, studies conducted by the Ministry of Water Resources (MoWR) estimated that the annual run-off from the major river basins is in the order of 122 billion cubic meters[12].

Besides, the mountainous landscape in the western half and some southern parts of the country makes many of the nation’s hydro resources suitable for hydro-electricity generation of varying sizes, i.e., ranging from pico hydro to small and large hydropower plants. Small-scale hydro schemes are particularly suitable in remote areas, which are not connected to the national grid. The total theoretical potential for micro hydropower schemes is 100 MW[13].

Like all other natural resources, Ethiopia’s hydro resources are unevenly distributed over its land mass. Generally speaking, the amount of rainfall and topographic conditions suitable to hydro-electricity generation, i.e., head decrease as one moves away from west to east until it gets totally arid, flat desert-type in the Ogaden lowlands. While rainfall is in relative abundance in the western and southern parts of the country, it gets moderate in the northern highlands and central plateau (see fig. 6). Thus, it could be argued that the distribution of Ethiopia’s hydro resource is in contrast with that of its wind energy resource, since the former decreases while the latter increases as we descend to the eastern lowlands. And the opposite is true in the western, central and south western highlands[12].

Ethiopia’s hydropower potential has an important contribution to make to its immediate neighbours. Sudan, Kenya, Djibouti, Somalia and Eritrea, as they constitute a readily available market for hydro-electric power within the region. Some of these countries are already facing power shortages and hence are in dire need of electricity to power their economies. As of 2007, EEPCo was undertaking small projects aimed at exporting hydro-electric power to neighbouring Sudan and Djibouti[12].

Since Ethiopia uses a classification of hydropower systems which differs from other countries, the Ethiopian definitions are shown in fig. 5 [8].

Fig. 5[11]:

| Terminology | Capacity limits | Unit |

| Large | >30 | MW |

| Medium | 10 - 30 | MW |

| Small | 1 - 10 | MW |

| Mini | 501 - 1,000 | kW |

| Micro | 11 - 500 | kW |

| Pico | ≤10 | kW |

The costs to explore hydropower potential are relatively low. In fact, hydro installation in Ethiopia costs about US$1,200 per installed kW, or about half the cost of most other plants being built in eastern Africa. Thus, unit generation costs of planned hydropower plants are calculated to be below USD 0.05 per kWh. The levelized cost for transmission is estimated to be 0.007 USD per kWh. This figure for the distribution system is estimated to be 0.014 USD per kWh. Therefore, the levelized cost of power supply for planed power plants is estimated at 0.067 USD per kWh, one of the lowest in the World. The additional power shall serve both the domestic and export demands, since most of Ethiopia’s neighbors will use mainly conventional thermal generations having average generation costs ranging between USD 0.15 and USD 0.24 per kWh. However, power export is expected to be limited by the limited capacity of the interconnector lines. (SREP 4 Investment Plan).

The largest project in the pipeline is the controversial dam and hydropower plant Gilgel Gibe III (MW 1870), which recently came close to financial closure with an agreement between Ethiopia and China. Another big hydro project is the renaissance Dam, formerly known as Great Millenium Dam. This Hydro project shall have a maximum capacity of 5.25 GW, starting with 700 MW in 2015.

- For information on challenges and issues affecting the exploitation of hydropower in Ethiopia, click here.

Pico and Micro Hydropower

As mentioned above, the Ethiopian definition of hydropower schemes differ from the ones of other countries. Typically pico hydropower (PHP) plants have a capacity of up to 3 kW. They are characterized by the absence of a distribution grid and supply to one or two households. Nonetheless the pico hydropower range in Ethiopia is extended up to 10 kW which makes sense considering that widely-used injera cookers with capacities of up to 5 kW need to be supplied. Thus two households with one injera cooker each fully absorb the plant’s capacity, without requiring a distribution network. While defining micro hydropower schemes from a range between 11 – 500 kW, it makes sense to distinguish between a lower range (≤30 kW), supplying individual villages without high voltage (HV) transmission and an upper range (31 – 500 kW) for small towns or several villages which are interconnected by HV lines and a low voltage (LV) distribution grid[14]. According to EEA, the specific yield of Ethiopian highlands with a moisture surplus of at least 300 mm/a is 500 W/km² (Given that average pressure heads for potential pico and micro hydro power sites are 45 m, using a 60% system efficiency and a specific minimum flow of 2 l/s/km²).

Since the maximum of micro hydropower (MHP) schemes is defined with 500 kW, the largest catchment area for MHP development is thus 1000 km². Subtracting the catchments >1000 km² from the total of 315,000 km² with perennial flows and a respective moisture surplus, that leaves a land area of 200,000 km² suitable for MHP development. As mentioned above, Ethiopia has thus a theoretical MHP potential of 100 MW[14][11]. Most promising sites can be found in the western part of the country, since suitable topographic conditions and constant flows are prevailing (see fig. 6) [15]. Taken the same data set as a basis for PHP development, a PHP catchment must at least have an area of 15 km². Since a catchment of that size is rarely available to individual farmers, PHP potential is rather limited and allows respective plants only in sparsely populated areas[11]. Apart from the large EEPCo hydropower schemes, small scale hydropower potential has hardly been exploited so far. In the period between 1950 and 1970, EEPCo installed several MHP schemes with a total capacity of 1.5 MW. All of them are not operational anymore: once the areas were connected to ICS, the MHP plants were shut down. Nonetheless, some of the plants are still in good condition and it would be technically feasible to rehabilitate them[11]. The same holds true for the Yaye MHP. The 170 kW off-grid plant was commissioned in 2002 by the Irish Development Aid and the Sidama Development Program but already suffered from low river flow during the 2002/2003 dry season. After only having operated for two years, EEPCo connected Yaye to its ICS and the MHP plant was shut down completely[15].

The GIZ Energy Coordination Office (ECO) is planning to rehabilitate the Yaye plant and to feed the generated power into the national grid, once the scheme is operational again. Furthermore, GIZ ECO is currently implementing four pilot MHP sites in the Sidama Zone/SNNPR with a capacity of 7 kW (Gobecho I), 30 kW (Gobecho II), 33 kW (Ererte) and 55 kW (Hagara Sodicha) respectively and supports the upgrading of a watermill in Jimma and 10 kW MHP plant in Kersa. Other than that, several pico hydro schemes as well as 32 cross flow turbines exist, which power flour mills with outputs ranging between 5 and 22 kW. The latter were commissioned by Ethiopian Evangelical Church Mekane Yesus (EECMY). Nonetheless 35-40% of those plants are not operational anymore due to a lack of water during dry season and management as well as technical problems[16]. EECMY and REF are planning the installation of further MHP plants such as a 55 kW scheme on the Bege River and a 5.5 kW scheme in Sire[11]. In 1994 the Ethiopian NGO Ethiopian Rural Self-Help Association (ERSHA) implemented another hydro powered grain mill near Ambo, which is said to be still operational[16]. Additionally, the current GTP (2010 – 2015) includes the installation of 65 MHP plants[17]. No further details regarding capacity and location of latter are available at the time[8].

Solar Energy

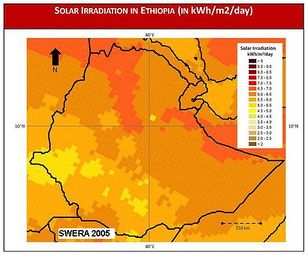

Ethiopia receives a solar irradiation of 5000 – 7000 Wh/m² according to region and season and thus has great potential for the use of solar energy[11]. The average solar radiation is more or less uniform, around 5.2 kWh/m2/day. The values vary seasonally, from 4.55-5.55 kWh/m2/day and with location from 4.25 kWh/m2/day in the extreme western lowlands to 6.25 kWh/m2/day in Adigrat area, Northern Ethiopia[12]is still at its early stage.

Until recent times use of PV for meeting off-grid power needs was confined to projects funded by donors. UN organizations such as UNICEF and WHO are few examples that had supported projects that use PV based technologies (distance-education radios and vaccine fridges) in remote rural areas. Moreover, the Government of Ethiopia (GoE) with technical as well as financial assistance from Italian government had executed a PV-based rural electrification project in the mid 1980s. The rural electrification project was later abandoned and looted, during change of government in 1991, by the very people it was intended to serve. Such donor-driven projects proved unsuccessful or at least unsustainable primarily because the requisite commercial infrastructure (awareness, skilled technicians, financing mechanism, market linkages, and supportive policies) was lacking.

Outside project-based donor-assisted initiatives of the past, Ethiopian Telecommunications Corporation (ETC) is the major user of PV solar in the country. ETC uses PV solar to power its remote rural telecom installations and this application has grown several times in recent years. As of 2007, there were about a dozen PV dealers in the capital. Almost all of them do PV as a side business; and the majority of them do everything from import down to installation. Efforts made under the EU financed IGAD PV project, GEF-supported off-grid rural electrification project and UNEP/GEF PV Commercialization project proved useful in removing some of the key barriers (awareness, skills training, finance) that had hindered the development of the commercial PV market in the country[12].

With an installed capacity of approximately 5 MW and an estimated PV market potential of 52 MW, with a majority in the solar home system (SHS) market and a further expansion of the telecommunication sector, not even 10% of the potential is exploited. Costs for SHS are relatively high and unlike costs for MHP systems, cannot be reduced by connecting more costumers. In the near future, larger and particularly grid-connected solar energy systems will thus compete with small-scale hydropower systems . Next to the PV SHSs, there is also a market for solar water heating (SWH) systems that use solar irradiation to heat up water, which can significantly reduce fuel wood and electricity consumption. Solar thermal is another application with considerable potential in Ethiopia. Although of more recent, phenomenon compared to PV, SWH is an application that is growing steadily in Addis in recent years. There are both imported locally manufactured models of SWHs in the market. Currently, however, cheap Chinese models are likely to drive other models out of market[12]. Unlike PV systems, SWH systems have not been monitored in the past and thus accurate data is missing. Nevertheless it is estimated that 5,000 units are installed, which is equivalent to an area of 10,000 m² [18][11]. The 2010 – 2015 GTP of the Ethiopian government furthermore includes the dissemination of 153,000 SHSs and 3 million solar lanterns[19][8].

- For information on challenges and issues affecting the exploitation of solar energy in Ethiopia, click here.

Photovoltaic: Best Practice Case Study[20]

In 1988, the Ethiopian Ministry of Agriculture had installed PV-powered community water supply scheme. The scheme, in addition to reducing the drudgery of women who are solely responsible for fetching water, had also improved community’s health at large by providing access to clean drinking water. After nearly two decades of almost un-interrupted service to the community, however, the water supply scheme broke down due to aging in 2002.

MEKETA, a local not-for-profit environmental organization, visited Sirba-gudeti village in 2004 to consult the community members on how they can collaborate in the reinstatement of water supply service and introduction of PV Solar Home Systems (PV SHS) for powering entertainment electronic appliance and for lighting. Strategically, MEKETA intended to use the village as a Rural Sustainable Energy Demonstration site, therefore, the overall objectives of the project was to rehabilitate the community water supply unit and to pilot and promote the adoption of 12VDC battery based systems (BBS), to meet small power requirements of rural consumers.

- To learn more about the project, click here.

Biomass

Biomass resources include wood, agro-industrial residue, municipal waste and bio fuels. Wood and agricultural as well as livestock residue are used beyond sustainable yield with negative environmental impacts.

According to estimates made by a recent study, at the national level, there appears to be a surplus of woody biomass supply. However, the same study revealed that there is a severe deficit of supply when the data is disaggregated to lower local levels. According to this same study, 307 Woredas (districts) out of the total number of 500 Woredas are consuming woody biomass in excess of sustainable yield.

Among the key issues that characterize the Ethiopian energy sector, the following are some that stand out:

- The energy sector relies heavily on biomass energy resources,

- The household sector is the major consumer of energy (which comes almost entirely from biomass) and,

- Biomass energy supplies are coming mainly from unsustainable resource base (which has catastrophic environmental implications).

- For more information, also see section problem situation at the top of this page.

Ethiopia’s biomass energy resource potential is considerable. According to estimates by Woody Biomass Inventory and Strategic Planning Project (WBISPP), national woody biomass stock was 1,149 million tons with annual yield of 50 million tons in the year 2000. These figures exclude biomass fuels such as branches/leaves/twigs (BLT), dead wood and homestead tree yields. Owing to rapidly growing population, however, the nation’s limited biomass energy resource is believed to have been depleting at an increasingly faster rate. Regarding the regional distribution of biomass energy resources, the northern highlands and eastern lowlands have lower woody biomass cover. The spatial distribution of the "deficit" indicated that areas with severe woody biomass deficit are located in eastern Tigray, East and West Harerghe, East Shewa and East Wellega Zones of Oromiya and Jigjiga Zone of Somali Region. Most of Amhara Region has a moderate deficit but a small number of Woredas along the crest of the Eastern Escarpment have a severe deficit[12].

There is however an energy production potential from agro-processing industries (processing sugar cane bagasse, cotton stalk, coffee hull and oil seed shells)[9]. Up to date, no grid-connected biomass power plants exist. Several sugar factories have however been using sugar cane bagasse for station supply since the 1950s. A total of 30 MW of capacity surplus could be fed in the grid by sugar factories[21]. Municipal waste and bio fuels on the other hand are barely used as energy resources. No estimation of municipal waste power production potential is available at the time, power production potential of landfill gas is estimated to be 24 MW [9]. The current GTP plans to disseminate 25,000 domestic biogas plants, 10,000 vegetable oil stoves and 9.4 million improved stoves by 2015[19][8].

- For information on challenges and issues affecting the exploitation of biomass in Ethiopia, click here.

Biomass Stoves: Best Practice Case Study[20]

Various energy sector studies conducted in the mid 1980s identified the rising cost of domestic energy supplies on household consumers, unsustainable consumption of fuel wood, increasing deforestation and soil erosion as major environmental and economic problems facing Ethiopia. Demand side management was one among various strategies adopted by the Government of Ethiopia to address the issue and was aimed at reducing households demand for biomass and hence relieving the pressure on the remaining woody biomass resources. This was done through the Ethiopian improved stoves programme, whose objective was to reduce cost and improve the supply of household (biomass) fuels for domestic consumers.

Innovative approaches adopted by the project were:

- A limited and gradually declining subsidy to cover costs including design, testing and development, technical training to private sector artisans, and market support and promotion,

- Use of revolving loan funds to provide newly trained artisans with badly needed working capital and some basic hand tools,

- Training many producers to encourage competition while keeping an eye on quality of products,

- Creating linkages between metal clad producers and potters who produce ceramic liners in the outskirts of Addis,

- Close supervision, monitoring and follow up of production and sales,

- Placing consumer needs and preferences at the centre of all operations.

- To learn more about the project, click here.

Wind Energy

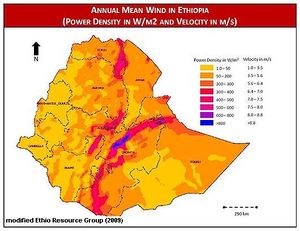

Ethiopia has good wind resources with velocities ranging from 7 to 9 m/s[22]. Its wind energy potential is estimated to be 10,000 MW[21] (see fig. 8). The Ethiopian National Meteorological Services Agency (NMSA) began work on wind data collection in 1971 using some 39 recording stations located in selected locations. Ever since the establishment of these stations, wind velocity is measured and data made available to consumers. However, the number of stations established, quality of data (in terms of comprehensiveness) and the distribution of the stations leaves much to be desired.

On the basis of data obtained from existing wind measurement stations two important conclusions can be drawn:

- First and foremost, Ethiopia’s wind energy potential is considerable.

- Secondly, wind energy is highly variable over the terrain mainly as a function of topography of the country. Pockets of areas with high wind velocities of up to 10 m/s are distributed throughout the Eastern half of the country, including the western escarpment of the Rift Valley.

Seasonal and daily variation in wind velocity is also considerable; wind velocity is higher between early morning and mid-day and in terms of seasonal variation, in the highland plateau zone there are two peak seasons – March to May and September to November; and in the eastern lowlands wind velocity reaches its maximum between May and August. In most of these places, maximum wind velocities are 3 to 4 times greater than the minimum. Medium to high wind speed of 3.5 to 6 m/s exists in most Eastern parts and central Rift Valley areas of the country. Perhaps due to their mountainous terrain and land use/land-cover type, most western and north-western parts of the country have generally low wind velocity (see fig. 8)[12].

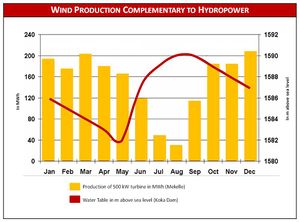

Up till now, no commercial wind energy power plants exist, nevertheless EEPCo is planning to develop seven wind sites that are in close proximity to the ICS by 2015, ranging between 50 and 300 MW. In sum, the installed wind power capacity would be approximately 720 MW [23]. Wind energy is considered a promising complementation to hydropower, since the two resources unfold their potential anti-cyclic: in rainy seasons the hydropower potential is high whereas low winds prevail. Vice versa hydropower potential is low in the dry season whereas the wind potential is high (see fig. 9). Unlike large hydropower plants, wind energy plants do not have any negative environmental impacts[22][8]. More about the planned wind farm can be seen here.

- For information on challenges and issues affecting the exploitation of wind energy in Ethiopia, click here.

Geothermal Energy

Ethiopia’s geothermal resources are estimated to be 5 GW of which 700 MW are suitable for electric power generation[9][21]. Geothermal resources are primarily located in the Rift Valley area, where temperatures of 50 – 300°C prevail in a depth of 1,300 – 2,500 m. Only one 7.3 MW geothermal power plant has been commissioned so far, which started operating in 1998/1999 but was shut down due to lacking technical maintenance in 2002 [24][9][21]. Operation was taken up again, but only at a much reduced generation rate. Exploration of geothermal resources is still ongoing[8].

Recommendations for Renewable Sector

In looking at the possible future uses of these sources, three potential types of applications can be considered: in conventional rural electrification; in complementary rural electrification; and in the provision of non-electrical energy. One of the most important weaknesses in the work carried out to date is an almost complete lack of analysis of the economic viability of renewable energy applications and their competitiveness relative to their conventional alternatives. Nor has there been any significant amount of investigation into whether potential markets exist for the technologies or how such markets might be developed. Hence it is very important to consider facilitating for proper and sustained mechanisms for data collection, analysis and knowledge management to establish the feasibility and market potentials of different RE applications.

Fossil Fuels

Ethiopia is not an oil producing country as yet. Nevertheless, prospecting and exploration studies conducted since 1960s indicate that there are proven reserves of oil and gas that can be exploited at a commercial scale. The energy resource potential of the country includes several hundred million tons of coal and oil shale, and over 70 billion cubic meters of natural gas[12].More fossil fuels prospecting and exploration studies are currently underway by certain international petroleum companies in some parts of the country.

Based on study findings thus far, the eastern lowlands of Ogaden desert, has the highest potential for oil and natural gas development in Ethiopia. These included Kalub gas and Hilala oil fields. In fact, currently, development and infrastructural works are thoroughly underway in some of these fields, heralding the-much-awaited-news that Ethiopia’s long dream of exploiting some of its fossil fuel resources is going to become a ‘reality’ sooner than later.

Extreme west of the country, more specifically the Gambella region, is another area where potential for fossil fuel reserves are often said to be significant. Unlike the Ogaden region where exploration started some four decades ago, the Gambella region is a more recent entry (less tan 10 years) to the list of potential sites to be studied in detail. The official stand of the government and the exploration companies regarding the outcomes of their exploration works is that the wells that have been dug up thus far turned out to be dry. However, despite some political disturbances that persisted in the area; and causing several hick-ups to the initiative, the exploration work has continued in localities adjacent to the Sudanese border. For issues and chalenges affecting the fossil fuel sector in Ethiopia click here.

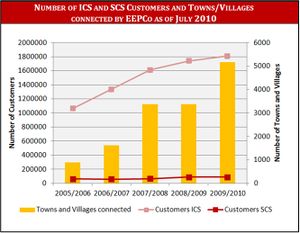

Electricity Sector

According to the Ethiopian Electric Power Corporation (EEPCo), Ethiopia’s total electricity generation in 2010 was 3,981.07 GWh. Although hydropower contributes only 0.9% to the total energy supply, it generates 88% of electricity and is thus the country’s dominating electricity resource, followed by Diesel (11%) and geothermal (1%) electricity generation (see fig. 2). In the ICS (interconnected system) EEPCo currently operates 11, primarily large, hydropower-, one geothermal- and 15 diesel grid-connected power plants with a total capacity of 1842.6 MW, 7.3 MW and 172.3 MW respectively. Another three hydropower- and several diesel off-grid power plants with a capacity of 6.15 MW and 31.34 MW respectively operate as self-contained systems (SCS). The ICS is expanding whereas the SCS is shrinking due to the interconnection of previously SCS served towns to the ICS. As of July 2010, a total of 5163 towns and villages and a total of 1,896,265 customers were connected to the ICS and SCS by EEPCo (see fig. 3).

System losses are calculated to be 23%. This figure represents both technical and non-technical losses and the major share is attributable to the distribution network poor design.

Approx. 87% of costumers are domestic consuming roughly 40% of the electricity, 12% commercial and 1.1% industrial whereas only 0.1% is used for street lightning[25]. Average consumption per connected household is rather low (kWh/a 747) or roughly 50 kWh/year per capita compared to 510 kWh for Subsaharan Africa, leaving a lot of potential for further growth by deepening the current network and by increasing the level of power consumption.

EEPCo charges a connection fee of at least 500 ETB (36,6 €). The fee can go up to 100 US$. The amount is sometimes

recovered through the customer’s bill over a 24 month or an even longer period. The fee includes wiring to the house and the instalation of an electric meter. It is assumed that poor household have difficulties to pay the connection costs, so that a lot of them are not connected to the grid in electrified villages. The tariffs for electricity depend on the energy consumption. Customers with a monthly consumption up to 50 kWh pay a flat rate of 0,273 ETB per month (0,02 €) plus a service charge of either 1,4 ETB/month (0,10 €) for 0-25 kWh or 3,4 ETB/month (0,24 €) for 26-50 kWh). As such, the average estimated monthly electricity bill is expected to be in the order of ETB 7 - 16 per month (0,51 – 1,17 €). This represents less than two percent of average monthly expenditure of an average rural household, as the price paid by those households to buy kerosene for lighting is much higher than the relevant EEPCo tariff. It is estimated that a rural household spents around 1,6 US$ per month for kerosene. Consequently, the risk is low that household cannot pay the bill and are disconnected once they are electrified through grid densification.

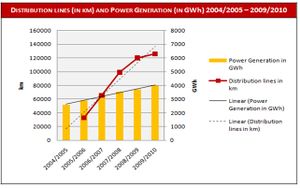

In 2005 EEPCo launched the Universal Electrification Access Program (UEAP), with the goal to connect a total of 6878 towns and villages to the grid and to increase the energy generation capability to 6386 GWh by 2010. Although the aspired target was not fully met, electricity generation increased 53% from 2,587.2 GWh in 2005 to 3,981.07 GWh in 2010[24][25]. However, the production increase does not keep pace with the grid extension activities. Transmission lines increased from a total length of 8,003.93 km in 2006 to 10,884.24 km in 2010, distribution lines’ total length even quadrupled from 33,000 km in 2005 to 126,038 km in 2010 (see fig.4)[8].

Although electricity generation is steadily increasing this creates a bias between the grid extension and the load of power generated, which results in a shortage of electricity and thus frequent power cuts. Furthermore, transmission and distribution losses of the ICS are high: 20% were lost in the period between 2001 and 2005. Most of the loss happens during distribution from the national grid to end users. Due to the hence limited electricity service, people’s willingness to pay might decrease significantly and makes more reliable power supply in isolated systems more attractive[25][11][9].

The current 5-year Growth and Transformation Plan (GTP), launched in 2010 and running until 2015, targets to increase Ethiopia’s total generating capacity to 8,000 to 10,000 MW by 2015[26]. This would quadruple or even quintuple the country’s current capacity of approximately 2000 MW. To this effect, the plan includes the installation of 8 large hydropower schemes (8737 MW total capacity), 7 wind plants (866 MW total capacity) and a 70 MW geothermal power plant[17]. The number of connected costumers is planned to be more than doubled: the target is to connect 4 million costumers by 2015[26]. This would represent an increase of the general access rate from 41% to 75% based on the ratio of the total households in electrified towns and villages to the total households in the country . Moreover the plan includes further development of the renewable energy sector[8].

Key Cross-cutting Issues in the Energy Sector

There are number of key cross-cutting issues in the Ethiopian energy sector. The most fundamental among these are[27]:

- Environment: Ethiopia’s national energy balance is dominated by traditional (biomass) fuels. The fact that the majority of biomass supplies are coming from an unsustainable resource base coupled with the use of very low efficiency household cooking appliances poses serious environmental concerns.

- In-door Air Pollution (IAP): Domestic cooking appliances in use in rural Ethiopia are not only inefficient but also produce large quantities of smoke due to incomplete combustion. In rural areas, where cooking places are poorly ventilated, this smoke is the main cause of IAP, which is a serious health problem among women and children.

- Gender: Women are not only energy users, but also major suppliers of traditional fuels in Ethiopia. More than two-thirds of traditional fuels are supplied by poor urban and rural women in Addis. Therefore, all interventions in the energy sector need to pay attention to the gender aspects as well.

- Sustainable Livelihoods: Traditional fuels sector, though extremely vulnerable, is a major employer, only next to agriculture, in Ethiopia. Recently, there are indications that jobs are being lost due to fuel-switching. Therefore, while fuel-switching should continue for environmental reasons, the issue of loss of sustainable livelihoods by traditional fuels suppliers should not be ignored.

Policy Framework, Laws and Regulations

The government’s declared aim is a huge expansion of the infrastructure in the energy sector. Based on the national Universal Electricity Access Program (UEAP) the Goverment owned utility "EEPCo" has started to extend the national electricity grid to towns and villages preferably with minimum of 5000 households. Villages and towns with less households are often only considered for grid extension if the central or provincial governments cover the costs. The grid extension is carried out by the construction of 33 kV transmission lines. Local departments of EEPCo are in charge of the grid connection and operation within the towns and villages. The costs for the UEAP are estimated at one billion US$. Twenty percent of that sum will be financed by EEPCo via credits, another 80% by the government or international donors. The high contribution of the government is due to the fact that the extension of the grid to villages with less than 5,000 inhabitants is economically not feasible for EEPCo. The first two years of the program are partly financed by World Bank, which covers about US$ 100 Mio of the initial US$ 180 Mio budget.

Once a town is having access to the grid, the connection of households, social institutions and enterprises is within their own responsibility. The connection of the individual customers to the grid is generally not subsidized and 100% covered by the respective customer. The connection fee ranges from US$50 to US$100 (average 75 US$) including the cost for the electricity meter. There are different figures about the share of households connected to the grid. In some documents a rate of 30-40% is mentioned. Another document from the World Bank says that up to 70% are reached due to instalment payment of the connection fee. The connection rate may drop if EEPCo will try to meet the ambitious political goal of 50% coverage via fast rollout to many villages without taking to much care of household connections.

The current average electricity tariff is about US$0.056 (0,04 €) per kWh, equivalent to about 62% of the long-run marginal cost of supply. Thus, the current electricity tariffs are not cost covering.

The improvement of efficiency of the existing energy resources is another target. The energy loss is to be reduced from 20% (2005) to the international average, 13%, during the same period of time. In the last years, the government tried to pave the way for more private investors to generate electricity and feed it into the grid. Proclamation 37/1997 opens domestic investors the possibility to invest in plant capacities of up to 25MW. Only foreign organisations are permitted to invest in power stations with a capacity of over 25 MW. Council of Ministers Regulations No. 7/1996 and No. 36/1998 introduced additional tax relief and improved import regulations as incentives for private investment. Nonetheless, the electricity sector is still controlled by the state.

In November 2013 the Ethiopian parlament approved the Energy Proclamation to liberize the energy sector. An Ethiopian Energy Athority (EEA) will be founded, where foreign companies can register and obtain licences to produce electricity and get a fixed feed-in tariff for the generated power. The feed-in tariffs will be fixed by the board of directors of EEA and approved by the Ministry of Energy.

EEPCo presented end of 2013 a new energy masterplan for the next 25 years. 28 projects with total investments of 156 billion USD shall be realized by 2038 assuming an electricity demand of 37.000 kW. By 2016 EEPCo plans to increase the power production by 2000 MW to 10000 MW.Also the transmission and distribution grid shall be extended significantly. It is planned to install 13.560 km of 250kV lines with 114 transformer stations and 9.257 km of 400kV line with 41 transformer stations by 2020.

Policy and Strategy

Following are some of the major highlights from the policies and strategies of the country.

Energy Development

- Fuel wood plantation: encouragement of the private sector and different communities to be involved in plantation schemes,

- Conversion of biomass in different forms of energy purposes: enhancing conversion efficiency in charcoal making, encourage and promote the modern use of agricultural residues and dung (Biogas etc.),

- Hydro power development: utilization of the vast hydropower potentials (of which only about 2 % is currently utilized),

- Other Energy sources: the policy states that whenever the economic potential is realized geothermal, coal, solar, wind and other sources of energy shall be used to generate electricity or other energy services,

- Oil exploration and development of the natural gas potential.

Energy Conservation and Efficiency

- Improving the energy efficiency in the transport sector, the agriculture sector, the industry and at household level is to be enhanced,

- Regarding the household sector, enhancing the supply of fuel wood, encouraging fuel wood substitution and taking other measures to narrow the gap between energy demand and supply, such as the promotion of fuel efficient stoves.

Encouragement of Private Sector to be Involved in Energy Sector

The Energy policy also dedicates a special section for the encouragement of the private sector to be involved in the development of the Energy resources of the country specially by being involved in the construction of energy structures, a field that has been and still is seen to be mainly the responsibility of the government.

Environmental Policy of Ethiopia

The policies are:

- To adopt an inter-sectoral process of planning and development which integrates energy development with energy conservation, environmental protection and sustainable utilization of renewable resources,

- To promote the development of renewable energy sources and reduce the use of fossil energy resources both for ensuring sustainability and for protecting the environment, as well as for their continuation into the future.

Forest, Woodland and Tree Resources

The policies are:

- To ensure that forestry development strategies integrate the development, management and conservation of forest resources with those of land and water resources, energy resources, ecosystems and genetic resources, as well as with crop and livestock production,

- To find substitutes for construction and fuel wood whenever capabilities and other conditions allow, in order to reduce pressure on forests.

Conservation Strategy of Ethiopia

- Boost technical and social research on the design of improved cooking stoves,

- Promote local manufacture and distribution of improved charcoal and biomass stoves,and

- Locate, develop, adopt or adapt energy sources and technologies to replace biomass fuels.

Development of Alternative Energy Resources and their utilization are to: Acquire, develop, test and disseminate appropriate and improved energy use technologies (e.g. improved stoves, charcoal kilns, solar powered cookers and heaters).

Capacity Building and Institutional Strengthening are to:

- Strengthen research, planning and project implementation capability of the federal and regional energy agencies,

- Establish a centre for testing alternative and efficient energy sources, technologies and appliances,

- Promote and assist the private sector to assemble and manufacture energy development facilities and end-use appliances.

Institutional Set-up in the Energy Sector, Activities of Other Donors

Until a change of government in 1991, there were neither energy sector policies nor institutional arrangements that separated policy making organs from those of operations. Ever since the mid 1990s, in a bid to enhance efficiency and harmonize operations in the energy sector, policy making organs were separated from operation organs[28].

At the Federal Government level, there exists a number of institutions involved in the energy sector in the Country. The Ministry of Water Irrigation and Electricity (MoWIE) is responsible for the overall development of the energy sector in the country. The the MoWIE also is responsible for the protection and utilisation of the nation’s water resources.

Current institutional setup of the energy sector in Ethiopia Ministries and main agencies and departments that deal with energy issues:

- Ministry of Water, Irrigation and Electricity (MoWIE) - Regulatory policy and decision making, energy operations, implementation and supervising other governmental agencies and enterprises.

- Ministry of Environment, Forest and Climate Change (MoEFCC) - Regulatory policy and decision making, environmental, climate related operations and implementing ICS and climate change mitigation.

- Ethiopia Energy Authority (EEA) - Regulating energy efficiency and conservation, Regulate the electricity sector, Issue technical codes standards and directives, commission programs and projects on Energy Efficiency, Delegate its mandates to state governments to better deliver regulatory services to and to promote energy efficiency and conservation services in the economy. Other preparation works such as: organizational structure of the Authority, various directives and codes are under development.

- Ethiopian Electric Utility (EEU) - Engage in the construct, maintain electric distribution networks, Purchase of bulk electric power , selling electrical energy to customers, Initiate electric tariff amendments approval and implement and Carry out any other related activities that would enable it achieve its purpose in accordance with economic and social development policies and priorities of the government.

- Ethiopian Electric Power (EEP) -

- Ethiopian Rural Energy Development and Promotion Centre (EREDPC) – with the mandate to carry out national energy resources studies, data collection and analysis, rural energy policy formulation, technology research and development and to promote appropriate renewable energy technologies in rural areas; the Centre also serves as the Executive arm of the Rural Electrification Fund (REF). To assess and implement projects under the REF the EREDPC has established a core team as the Rural Electrification Executive Secretariat REES. The REES being responsible for project appraisal shall also provide advisory services, capacity building, and training to Regional Energy Bureaus and cooperatives.

- Rural Electrification Fund (REF) - to enable the private and cooperative engagement in rural electrification activities through loan based finance and technical support. Among other REF shall also prepare an off-grid rural electrification master plan which shall be updated annually and conduct feasibility studies to identify suitable RE projects, which will be implemented by the private sector (which includes NGOs, CBOs, co-operatives, municipalities/local governments and other entities).The REF received US$ 15 million in funding from the World Bank and GEF under the Energy Access Program. This allowed the granting of loans and the promotion of energy projects in rural areas in collaboration with private actors and local authorities. In formal terms it is administered by the Rural Electrification Board (REB) and the Rural Electrification Executive Secretariat (REES). The REB determines the criteria for project promotion and coordinates cooperation with other programmes. The Board also decides on whether to proceed with the submitted project proposals. The REB’s members are employees of the Ministry of Water Resources, the Ministry of Mines and Energy, the EEA and the EREDPC and representatives of the private sector. The resources available to the REF are used to subsidise 85 % of the cost of rural electrification projects. Renewable energy sources are entitled to a higher subsidy of 95 %. Most of the projects that receive assistance, however, are based on electricity generation with diesel generators.

- Petroleum Operation Department – for petroleum exploration and development, licensing, and project coordination;

MoWIE is working closely with two public enterprises: the Ethiopian Electric Utility (EEU) and the Ethiopian Electric Power (EEP) for the electricity sub-sector, and the Ethiopian Petroleum Enterprise (EPE) for the petroleum sub-sector. EPE is an operational wing of government entrusted with the responsibility of exclusively importing petroleum products in to the country. The petroleum products market, with the exception of LPG, is still regulated in Ethiopia and importation is the monopoly of EPE[28]. Based on the decision of the parlament in December 2013 EEPCo restructured into two companies: a) the Ethiopian Electric Utility (EEU) and the Ethiopian Electric Power (EEP) and they are mandated to generate, transmit, distribute, and sell electricity. The corporation disseminates electricity through two different power supply systems: the Interconnected System (ICS) and the Self-Contained System (SCS). The ICS, which is largely generated by hydropower plants, is the major source of electric power generation. The SCS is mainly based on diesel generators and to a minor portion on small and medium hydropower plants. EEPCo’s financial situation is considered to be weak. In 2006, electricity tariffs were increased by 22 percent across the board, except for the life-line tariff (consumption up to 50kWh/month) which remained unchanged. The weighted average tariff is estimated at 0.06US$/kWh. The overall billing collection rate at present is estimated at around 98 percent. Electricity revenue increased to US$150 million. Operating profit after depreciation was US$35.2 million. Operating profit per kWh sales to end-use customers was at 0.014US$/kWh. According to the World Bank,11 EEPCo has a strong technical and stable management team, and is operating profitably with an internal cash generation of about US$50 million per year. Its operating costs are low since generation is predominantly hydro, which also reduces exposure to oil price volatility.

Further operation and implementation organs are[28]:

- Ministry of Trade (MoT): The MoTI sets retail prices and regulates the distribution of petroleum products by oil distribution companies.

- National Strategic Petroleum Reserve Administration: This is an arm of government that manages and administers strategic reserve depots located throughout the country to ensure sustained supply at times of sudden shocks.

At a regional level, energy activities are mainly supported by regional energy bureaus, which are part of regional governments, and by regional energy institutions, such as the Oromia Mines & Energy Agency and the Regional Rural Electrification Executive Secretariat Offices with support and advice from the EREDPC. There are only few private companies active in the energy sector.

Activities of Other Donors

World Bank

For years the World Bank was the main international donor in the energy sector working closely with GoE and EEPCo to rationalize the power sector investment program, and to assist in the funding of new projects. Currently the World Bank is financing several programmes under the titles: Energy Access and Electricity Access (Rural) Expansion. The programmes are mainly financed through loans of several hundred million US $ and a GEF grant of 5 Mio US $.

The objective of the Energy Access Project is to establish a sustainable program for expanding the population's access to electricity, and improve the quality of electricity supply. The project components are: 1) support institutional, and capacity building, through the preparation of a long-term power sector strategy, of an indicative rural electrification master plan and of specific studies, to stimulate private sector investments, and, of an integrated rural energy strategy, comprising both the biomass sector, and modern forms of energy. 2) support capacity building for enterprises investing in small-scale renewable energy and, for key agencies, 3) expand, and rehabilitate the urban distribution system, and load dispatch, by promoting investments to improve, and extend services, primarily in Addis Ababa, Nazareth, Dire Dawa, and Bahir Dar. The component finances studies, and feasibility reports, recommending appropriate reinforcement of the telecommunications systems, and energy management systems; 4) support rural electrification, through grid-based electrification connections in rural areas and off-grid systems; 5) plan, and manage activities based on supply and demand, to reduce environmental degradation, and improve biomass energy end-use efficiency; and market improved stoves and , 6) finance the Environmental Management Plan, including capacity building (training and advisory services), and the compensation plan for crop losses. Technical assistance should ensure the safe disposal of transformers containing polychlorinated biphenyls.

The Electricity Access Expansion Project is geared to help expand electricity access to rural populations in Ethiopia.The project aims to bring grid, mini-grid and off-grid electricity access to more than 250 towns and villages and provide such services as lighting for schools and clinics, benefiting a total population of about 1.8 million. It shall help to install public street lighting and also connect 286,000 new or indirect household customers to the grid distribution system. To ensure affordability, poor customers shall be offered 5 year-loans to defray the costs of connection, and shall receive energy efficient bulbs to reduce the monthly payments.

In addition to the grid extension the World Bank programmes also supports:

- The decentralization of EEPCO's accounting system;

- The decentralization of part of EEPCO's billing system;

- Manpower development to support EEPCO's restructuring;

- Construction of the Gilgel Gibe hydroelectric plant;

- Completion of the Woody Biomass inventory in the North of the country;

- Studies including sector restructuring study, a generation expansion study, a tariff study, and a valuation of fixed assets;

On October 30, 2008 the World Bank, acting as administrator for the Global Partnership on Output-Based Aid (GPOBA), signed a grant agreement for US$8 million with EEPCo to support increased access to electricity in rural towns and villages with grid access. Up to 228,571 low-income households will benefit from the scheme. GPOBA will provide a subsidy of US$35 for each new eligible rural household. GPOBA pays the subsidy to EEPCo only after independent verification of pre-agreed “outputs”:

- a working metered connection to a household,

- a five-year loan from EEPCo to help repay the connection cost, and

- two energy- efficient compact fluorescent lamps (CFLs), which will reduce the electricity consumption by 55%.

The loan to be granted by EEPCo will be 80 percent of the estimated cost of connection. Customers will pay a 20 percent upfront fee when applying for the connection. The balance of the loan will be divided into 60 equal monthly installments of US$1. Repayment of the loan will be rolled into the electricity bill. In the absence of reliable means-based poverty tests, all customers would be eligible to receive the loan. However, to provide some form of targeting, it was agreed that the connection with concessional financing would only be available one year after the village had been electrified. The assumption is that customers who could afford to connect would have requested the connection in the first 12 months, before concessional funding was made available. GPOBA is drawing on funds from the UK’s Department for International Development (DFID) and a Multi-Donor Trust Fund funded by the Swedish International Development Cooperation Agency (SIDA) and the Australian Agency for International Development (AusAID). The project became effective in May 2009.

In recent years, after the GoE publicly blamed the World Bank for powershedding and World Banks reluctance to participate in the financing of Gibe III the relations have cooled down considerably. The African Development Bank is still an important partner, not only for generation projects, but as well for the financing of the international interconnectors. China has become a strategic partner of Ethiopia in the energy sector. The extent of Chinese cooperation in the Ethiopian market was underlined not only by the recent signing for Gibe III, but a series of new major contracts for financing hydro plants and substations. Chinese companies led by Sinohydro Corporation are working on a number of hydroelectric power (HEP) projects – successfully challenging the traditional big players in Ethiopia. Chinese firms can offer low prices and financing – with The Export-Import Bank of China (China Eximbank).

Japan

The Government of Japan is willing to develop the geothermal resource base of Ethiopia. The Japan External Trade Organization (JETRO) recently financed a surface survey of Aluto Langano geothermal site which indicated a potential geothermal resource base to support at least 35 MW power plant. The World Bank, the Government of Japan and the Government of Ethiopia will co-finance the appraisal and well testing to determine the level of geothermal resource available at that site. The OFID (OPEC Fund for International Development)agreed to co-finance the Urban Distribution Component to support rehabilitation and access of new consumers in EEPCo system. Italy has supported several hydropower plants and the development of the sector – and their own supplier – with considerable financial packages. France finances grid extension projects. In May 2009 Ethiopia has signed a financing agreement with France amounting to 210 million Euros for the implementation of the Ashegoda Wind Power Project in Tigray State. Coordination with EnDev Activities It has been agreed with the MoME to promote the current and planned joint interventions to the level of national programmes, namely a national Pico to Small Hydropower as well as a national solar energy programme in order to harness the momentum created by the EnDev intervention and utilize the synergy with other interventions. The planned development of a national biomass development strategy is also a similar undertaking.

SREP

Srep is supporting the following activities:

- Development of Aluto Langano Geothermal field

- Assela Wind Farm Project

- Clean Energy SMEs Capacity Building and Investment Facility

In the case of the Clean Energy SMEs Capacity Building and Investment Facility it is intended to support market development for clean, renewable energy-based products and services in the household and commercial segments, by providing targeted capacity building and financing to SMEs selling improved cook stoves, lighting devices, solar home systems, solar water heaters, rooftop solar systems, and modern fuels. The project will also provide commercial financing that allow companies to develop new, professionalize existing and, ultimately, grow businesses. The Project will be divided in two phases: Phase I: Capacity building of market players and Phase II: Financing of Market Players (SMEs).

The following table is giving an overview about main programmes of other donors (correct as of February 2012) [29]:

| # | Project/Initiatives | Description | Partner |

|---|---|---|---|

| 1 | Industries Energy Efficiency Program | Replacement of energy inefficient technologies | WB |

| 2 | Energy Efficiency Program | Replacement of inefficient electrical bulbs with CFLs. | WB |

| 3 | Nationwide Wind and Solar Energy Grid Based Master Plan Project | Wind and solar resource assessment and preparation of development master plan. The assessment will include a number of pre-feasibility studies | Government of China |

| 4 | Universal Electricity Access Programme | To extend the national electricity grid to supply electricity to rural towns and villages and improve the national electricity access rate in order to promote socioeconomic development of rural areas. | WB/AfDB/ BADEA/OPEC FID |

| 5 | Energy Access Project | In addition to supporting expansion of electricity access through extension of the grid by EEPCo, the project provides energy access to locations remote from the grid by independent suppliers and communities. A further component involved the implementation phase of the Biomass components in increasing fuel wood supply by bringing about 302,000 hectares of natural forests under participatory community management and implementing about 384,000 hectares of agro-forestry schemes. A further sub-component willprovide training in the production of 320.000 efficient cook-stoves. It is also supporting the rehabilitation and reinforcement of the distribution networks in most of the urban areas, including Addis Ababa, in order to improve the quality and reliability of supply. | WB/ EIB/ GEF |

| 6 | Adama I Wind Power Project | Development of 51 MW wind farm at Adama site. | China |

| 7 | Ashegoda Wind Power Project | Development of 120 MW wind farm at Ashegoda site | AFD |

| 9 | Bamboo as sustainable biomass energy: A suitable alternative for firewood and charcoal production in Africa. | Increase the use of bamboo as a source of energy thereby providing a more sustainable, environmentally friendly and economical option to firewood and wood charcoal | INBAR |

| 10 | National Household level Biogas Programme | Promote the production of biogas and its use for cooking and lighting in rural and peri-urban areas in 4 regional states in Ethiopia, among livestock rearing households with access to water. Promote the use of the slurry from the digesters as fertilizer in horticulture. Use a comprehensive approach, involving the private sector in construction and maintenance and ensuring proper quality control systems with government backing as well as access to credit | SNV |

| 11 | Community Managed Renewable Energy Programme | The project aims to improve access to essential services including quality health care, education and potable water in rural communities through increased access to solar energy services by promoting the use of Fuel Saving Stoves (FSS), solar power for local schools and health posts and solar powered water pumps. | EC /Plan UK |

| 12 | Support to Efficient Utilization of Alternative Energy Sources to Improve the Livelihood of Pastoral and Agro pastoral Communities in Southern Ethiopia. | To contribute to increase the access to affordable and sustainable energy through increased production, supply and efficient use of renewable energies in order to improve basic social services and livelihood in un-served rural areas of southern Ethiopia | EC /COOPI |

| 13 | Integrated Approach to Meet Rural Household Energy Needs of Ethiopia | To contribute to economic prosperity, social well-being, environmental sustainability and climate change issues (and hence to contribute to MDGs) through increasing the use of RE and EETs solutions for improved access to sustainable and efficient energy in the rural and peri-urban areas | EC /HoA – REC/N |

BMZ

In the focal areas of bilateral development cooperation in Ethiopia, the following programmes are implemented: Urban Governance and Decentralization Programme (UGDP), Engineering Capacity Building Programme (ECBP), Sustainable Land Management Programme (SLM).

DGIS

SNV is implementing a National Biogas Programme in Ethiopia in partnership with the Ethiopian Rural Energy Promotion & Development Centre (EREDPC). Implementation started in May 2008 with the construction of 100 demonstration biogas plants in 4 regions (Tigray, Oromia, Southern region and Amhara). In an initial phase (2008-2013), constructing a total of 14.000 biogas plants is targeted.

The Netherlands Embassy (DGIS) temporarily finances the Horn of Africa Regional Environmental Centre (Addis Ababa University initiative) that is involved in stimulating carbon financing in some of its own developed energy projects and as part of a small platform pushing on carbon/CDM problem solving. Other partners of the platform are the Min. M&E, UNDP, EPA, GIZ.

Further Information

- Ethiopian Energy Authority (1994): National Energy Policy, Addis Ababa, March 1994.

- Environmental Protection Authority (1998): Environmental Policy of Ethiopia, Addis Ababa, 1998.

- Mengistu Tefera (2004): AFREPREN, Power Sector Reform in Ethiopia, Implications for Rural Electrification, Addis Ababa, August 2004.

- Ethiopian Rural Energy Development and Promotion Center, Solar and Wind Energy Resources Assessment (SWERA) Project (2006): Country Background Information, Solar and Wind Energy Utilization and Project Development Scenarios, Interim Report, Addis Ababa, July, 2006.

- ENEC/CESEN (1986): Cooperation Agreement in the Energy Sector, Main Report, Addis Ababa, September 1986

- ENEC/CESEN (1986): Cooperation Agreement in the Energy Sector, Technical Report 4, Wind Energy Resources, Addis Ababa, May 1986.

- Woody Biomass Inventory and Strategic Planning Project (2004): The Main Features and Issues Related to the Ethiopian Domestic Biomass Energy Sector, Executive Summary, Addis Ababa, December 2004.

- Woody Biomass Inventory and Strategic Planning Project (2005): A National Strategic Plan For The Biomass Energy Sector, Addis Ababa, March 2005.

- IGAD, Regional Household Energy Project (2000): PV Solar Home Systems Market Study, Addis Ababa, October 2000.

- UNEP/GEF PV Project, Building Sustainable Commercial Network for PV Solar Home Systems Commercialization in Eastern Africa (2005): Market Assessment for PV Solar Home Systems Commercialization in Jima, Ethiopia, Draft Final Report, 2006.

- Addis Ababa University, Faculty of Technology, Electrical Engineering Department (2001): Study of Feasible Options for Rural Electrification in Ethiopia, Progress Report I and II, January 2001.

- Ethiopian Electric Agency, Energy Access Project (2004): The Ethiopian PV Commercialization Project, A Strategy for Solar Commercialization and Capacity Building, Draft Final Report, Addis Ababa, July 2004.

- Federal Democratic Republic of Ethiopia, Ministry of Water Resources (2002): Water Sector Development Program 2002 – 2016, Main Report, Addis Ababa, 2002.