Tunisia Energy Situation

Capital:

Tunis

Region:

Coordinates:

34.0000° N, 9.0000° E

Total Area (km²): It includes a country's total area, including areas under inland bodies of water and some coastal waterways.

XML error: Mismatched tag at line 6.

Population: It is based on the de facto definition of population, which counts all residents regardless of legal status or citizenship--except for refugees not permanently settled in the country of asylum, who are generally considered part of the population of their country of origin.

XML error: Mismatched tag at line 6. ()

Rural Population (% of total population): It refers to people living in rural areas as defined by national statistical offices. It is calculated as the difference between total population and urban population.

XML error: Mismatched tag at line 6. ()

GDP (current US$): It is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. It is calculated without making deductions for depreciation of fabricated assets or for depletion and degradation of natural resources.

XML error: Mismatched tag at line 6.2 ()

GDP Per Capita (current US$): It is gross domestic product divided by midyear population

XML error: Mismatched tag at line 6. ()

Access to Electricity (% of population): It is the percentage of population with access to electricity.

XML error: Mismatched tag at line 6.no data

Energy Imports Net (% of energy use): It is estimated as energy use less production, both measured in oil equivalents. A negative value indicates that the country is a net exporter. Energy use refers to use of primary energy before transformation to other end-use fuels, which is equal to indigenous production plus imports and stock changes, minus exports and fuels supplied to ships and aircraft engaged in international transport.

XML error: Mismatched tag at line 6.no data

Fossil Fuel Energy Consumption (% of total): It comprises coal, oil, petroleum, and natural gas products.

XML error: Mismatched tag at line 6.no data

Introduction

Tunisia is a small country located in Northern Africa sharing borders with Algeria and Libya. The country entails the Northern reaches of the Sahara desert and the Eastern end of the Atlas Mountains and has a Mediterranean coast. Therefore, the country has a bright diversity on climate and biosphere.

Energy Situation

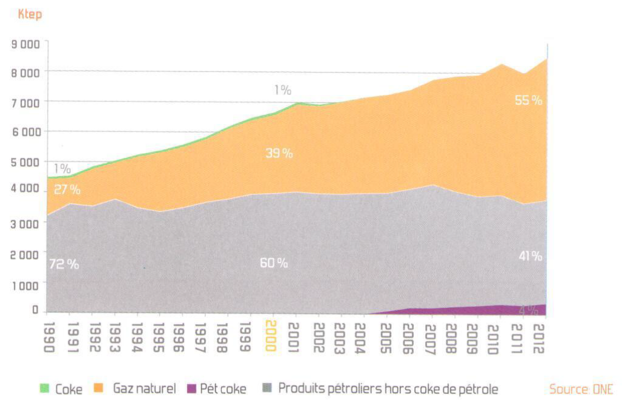

Since 1990, the Tunisian primary energy consumption has increased in a roughly linear way, with approximately 4500 ktoe in 1990, 6700 ktoe in 2000 and 8300 ktoe in 2010 (without biomass). As shown in Figure 1, the sharpest increase is to be noticed in the gas sector, which represented 55 % of the primary energy supply in 2012. As a result of this, the share of oil, including crude oil and petroleum products, has slightly decreased. The share of coal and peat has always been minimal and by now reached zero. The amount of biofuel and waste slightly increased (58 PJ in 2011), and currently represents 15 % of the primary energy supply. In 2014, primary energy consumption was about 9200 ktoe[1] (i.e. 107 000 GWh or 385 PJ), without biomass.

Figure 1: Primary Energy Consumption since 1990[2]

Energy Data

Primary Energy Consumption

|

Total Primary Energy Consumption in 2014[3]* (without biomass, PV, SWH, process heat, self-consumption of oil fields, consumption of natural gas pipeline compressor stations) |

|

|

|

|

|

Energy Source |

in ktoe |

in GWh |

in PJ |

in % |

|

Crude Oil and Oil Products (2014)* |

4232 |

49218 |

177185 |

46% |

|

Natural Gas (2014)* |

4876 |

56708 |

204148 |

53% |

|

Electricity from Renewables (2014)* |

92 |

3852 |

1070 |

1% |

|

SUBTOTAL (2014)* |

9200 |

106996 |

385186 |

100% |

|

|

|

|

|

|

|

Biomass (2011) |

1,390 |

|

58 |

|

|

Geothermal, Solar etc. (2011) |

9 |

|

0.38 |

|

(*) Data not yet officially published

Energy balance, import and export

|

Tunisia's energy production, consumption and import/export balance in 2012[4] | |||

|

Crude Oil (ktoe) |

Natural Gas (ktoe) | ||

|

Total Production |

3522 |

2563 | |

|

Imports |

1139 |

2480 | |

|

Exports |

-2741 |

-0 | |

|

Total consumption |

1946 |

5043 | |

|

% of net imported resources in the total consumption |

69 |

49 | |

Oil production decreased between 1980 and 2012 from 120,000 to 67,000 barrels per day. Gas production, however, increased from 20 billion cubic feet in the early 1980s to 68 billion cubic feet in 2012. An overall increase in domestic primary energy production from 5400 ktoe in 1900 to 7000 ktoe in 2012 could not follow the sharp rise in demand.

As a result of the consumption/production unbalanced illustrated in Figure 2, Tunisia, a net energy exporter until 2000, became a net importer. In 2014, 49% of natural gas consumption (2300 ktoe) was covered by domestic production. The remaining 51% (2400 ktoe) was imported from Algeria[7].

Figure 2: From a Net-Exporter to a Net-Importer[8]

Becoming a net importer is coupled with rising energy prices since the mid-2000s (natural gas is today 8 times more expensive than it was in 2000) and a weak national currency (Dinar, TND) (2010: 1.8 TND=1.0 €; 2012: 2.0 TND=1.0 €; 2015:2.2 TND=1.0 €). Thus expenses for energy represented 13.7% of GDP in 2012 − with expenses on energy import representing 16.8% of the global imports[9].

Subsidies

The energy sector is heavily subsidised in Tunisia. Subsidies for natural gas as well as electricity started a sharp increase in the early 2000s. In 2012, energy subsidies represented 20% of the government budget. In 2012, energy subsidies amounted to 5600 million TND (3100 million EUR), i.e. 20% of public budget or 9% of GDP. Whereas energy subsidies only represented 3% of GDP in 2005. This rise in subsidies is not sustainable for the state and has several negative effects on public spending such as a decreased budget for public investments[10]. Subsidizing procedures remain non-transparent. The subsidy system is composed of indirect and direct subsidies. Indirect subsidies are to the difference between supply costs of crude oil and gas for the State, and the selling prices to the two public operators STIR for oil and STEG for natural gas. Direct subsidies are subsidies made directly by the State to STIR and STEG in order to offset their deficits[11].

As for electricity, average retail prices (0.14 TND/kWh in 2012) are significantly lower than average production costs for the State (0.26 TND/kWh in 2012). The discrepancies between average production cost and average retail price are even larger for natural gas[12].

Renewable Energy

Currently, renewable energy plays a minor role in the energy supply.The use of solar energy for thermal purposes is widespread in Tunisia and can be regarded as a success story. Since its launch in 2005, the ANME program “PROSOL THERMIQUE”, meant to promote the installation of solar water heaters, has led to an installed capacity of 487853 m^2 in 2012[13].

Regarding grid-connected renewables, the total installed capacity of renewable energy was an estimated of 312 MW in 2014 (245 MW of wind energy, 62 MW of hydropower and 15 MW of PV), that was 6% of the total capacity[14]. In terms of electricity production this meant in 2013 3% of this an annual production: 2.6% (357.8 GWh) from wind turbines and 0.4% (60.1 GWh) from hydropower[15].

There are two large wind parks in Tunisia, both operated by state utility STEG, one in the region of Bizerte in Metline and Kechabta with a capacity of 190 MW operational since 2012; and one in the region of Sidi Daoud, with a capacity of 55 MW, built in 3 phases between 2000and 2009[16].

As for photovoltaics, there was a total capacity of 15 MW as of early 2015, mostly small-scale private installations most of whose capacity ranges between 1 kW and 10 kW. In low voltage, in the residential sector the capacities range from 1 kW to 17 kW and in the commercial sector capacities are between 10 and 30 kW. In medium voltage, capacities in commercial sector range between 25 and 100 kW[17]. As of early 2015, there were only three operational PV installations with a capacity of at least 100 kW: a 149 kWp installation in Sfax[18], a 211 kWp installation operated by the Tunisian potable water supply company SONEDE and a 100 kWp installation in the region of Korba[19], both connected to the medium voltage, and realized by Tunisian installer companies.

The first large scale solar power plant of a 10MW capacity, co-financed by KfW and NIF (Neighbourhood Investment Facility) and implemented by STEG, is due 2018 in Tozeur.[20]

Regarding the off-grid use of renewable energies, 11,000 decentralised PV systems have been installed[21].A new law on renewable energies currently discussed at the Parliament, might help for a stronger intake on the market, if the indispensable guidelines on regulation and on project financing are met.

[13] GIZ, Le marché solaire thermique en Tunisie. Situation actuelle et perspectives (2013). Christopher Gross.

[14] Bureau des statistiques, Ministère de l‘Industrie

[17] GIZ – RE-ACTIVATE

[18] GIZ, Enabling PV

[20] Secretariat of the German-Tunisian Energy Partnership

[21] GIZ, Enabling PV

Electricity

Installed Capacity and Generation

The installed capacity was of 4,799 MW in 2014[22] ‒ with the biggest share (4,492 MW/94%) provided by natural gas fired thermal power stations. The 6% left are divided between hydroelectric power (62 MW as of 2014) and wind generating plants (245 MW as of 2014[23]). Electricity is generated almost exclusively from combustible fossil fuels: 93 % natural gas, 7 % heavy fuel and a tiny share left to renewables (3% in 2013[24]).

In 2014, the state-owned company, STEG, remained the major electricity producer, supplying 86% of the demand, followed by an IPP, CPC (Carthage Power Company) which produced 10% of the consumed electricity. The last 4% are produced by small scale producers for their own needs (e.g. industries).

Installed power plant capacity in MW (excluding small scale PV)[25]

|

Type of Power Plant |

2013 |

2014* |

Share 2014 (%) |

|

Thermal (steam) power plant |

1.040 |

1.040 |

24 |

|

Combined-cycle gas turbine |

789 |

1.209 |

28 |

|

Gas turbine |

1.772 |

1.779 |

41 |

|

Hydropower |

62 |

62 |

1 |

|

Wind power |

245 |

245 |

6 |

|

STEG total |

3.908 |

4.335 |

100 |

|

IPPs |

471 |

471 |

- |

|

Total capacity, national |

4.379 |

4.806 |

- |

(*)Data not yet officially published

Consumption

In Tunisia the industrial sector is the largest energy consumer (see beneath).

|

Electricity consumption of individual sectors in 2013[26] |

||

|

GWh |

% | |

|

Industry |

4,909 |

63 |

|

Transport & communication |

311 |

4 |

|

Tourism |

567 |

7 |

|

Service |

891 |

11 |

|

Agricultural pump sets |

556 |

7 |

|

Pumping stations (water, sanitation service) |

563 |

7 |

|

'Total'1 |

7,797 |

100 |

1Total may not add up due to rounding.

The gas consumption has marked a steep increase (5,344 Ktep in 2013) and 72.5% of its production is used for electricity consumption, 7.1% for the industry sector and 20% for the residential and tertiary sectors.

Grid

STEG controls the Tunisian grid and holds a monopoly on electricity transportation and distribution. The grid has three voltages: high (225 kV), medium (150 kV) and low (90 kV). 99.5% of the households have had an access to electricity since 2006.

The transmission grid is connected to the Algerian grid and, on its Eastern end, to Libya. Regional grid synchronization tests with the participation of Morocco, Algeria, Tunisia, Libya and Egypt have been carried out but failed so far due to frequent synchronization issues with the Egyptian grid. Furthermore, a 400 kV high voltage sea cable with a capacity of 1,000 MW binding North Africa to Europe via Tunisia and Italy is currently discussed[27].

Grid losses are primarily due to maintenance or other incidents. Along with the prolonging of the transmission grid, losses have risen in 2012 it represented 2,735 GWh[28]. The growing economy of Tunisia and rise of living standards contributed to a significant increase in the electricity consumption leading to ever more often grid saturation. In addition, some power plants and facilities are out-dated and can no longer cope with the actual load of the network; hence, overload, losses and high voltage drops occur on a regular basis. To address these issues, the »Electricity Distribution Network Rehabilitation and Restructuring Project« has been launched, this should improve the reliability and safety of electricity distribution.

Electricity Prices

Low voltage (Tarifs as of March 2015)

The Tunisian electricity tariff system is complex, subsidized and cross-subsidized. On the general low voltage, tariffs depend on the sector of the consumer (residential or non-residential) and the consumption per month in kWh. Tariffs are most heavily subsidized for households whose monthly consumption is below 50, 100 and 200 kWh. These households pay 0.075 TND [0.034 EUR], 0.108 TND [0.049 EUR] and 0.140 TND [0.064 EUR] for each kWh consumed. Households whose consumption surpasses 200 kWh per month have to pay 0.151 TND (0.069 €)/kWh for the first 200 kWh, 0.184 TND (0.084 €)/kWh for the following 100 kWh, 0.280 TND (0.13 €)/kWh for the following 200 kWh, and 0.350 TND (0.16 €) for each kWh above 500 kWh/month. Production costs are thus more than covered in the tranches 301-500

Medium voltage (Tarifs as of March 2015)

There are three to four tariff slots depending on the sector and on the day time. Prices range from 0.088 TND/kWh (0.040 €) to 0.238 TND/kWh (0.109 €). The subsidies no longer apply to cement producers which have paid electricity to its real cost since 2014 (cheapest slot: 0.129 TND (0.059 €)/kWh, most expensive slot 0.311 TND (0.142€)/kWh).

High voltage (Tarifs as of March 2015)

This represents a tiny share of the market, with only a handsome of subscribers. There are four tariff slots and prices range between 0.111 TND (0.051€)/kWh and 0.233 TND (0.106€)/kWh).

[22] Bureau des statistiques, Ministère de l’Industrie

[25] Bureau des statistiques, Ministère de l‘Industrie

[26] STEG, Rapport annuel 2013

</div>

Energy Policy

General Information

National energy policies are divided into four fundamental axes: (1) energy efficiency; (2) development of renewable energies; (3) exploration of conventional and unconventional resources; (4) and diversification of energy sources.

The results of the National Energy Debate that was carried out between June 2013 and June 2014 by the Ministry of Industry and Energy, reflect the countries energy strategy.

Exploration and exploitation of conventional and unconventional fossil resources are carried on in order to address the demand and limit importations. Generally speaking, diversity should help protecting Tunisia from the international prices volatility and reduce its import dependency.

As for unconventional resources, exploring shale gas potentials is an intensively discussed subject in Tunisia. Shale gas is seen as a potential solution to solve out the current energy deficit, a study carried out in 2011 highlighted the strong Tunisian potential for shale gas. Technical, ecological and economic feasibility must be deeper analysed: therefore, a feasibility study and a profitability analysis must be carried out in the foreseeable future. A first step was taken early 2015 with the launching of a large-scale Strategic Environment Assessment for unconventional fossil resources.

Nuclear power was regarded as possibly implementable in Tunisia, yet more and more cons have shown up along the way i.e. high investment costs, incompatibility with the current electric park and safety issues. The idea of developing nuclear in Tunisia was thus put aside.

The potential of coal as a mean of diversification is currently under investigation. At first, it seems to have some hard-hitting pros (e.g. low and stable cost, easy to import and widespread on earth). A feasibly study is still to be carried out, given the needed know-how and technology, coal may only be an option after 2024.

In order to reduce its dependency from Algerian gas, Tunisia needs to diversify its electric mix and extend its interconnections. A gas interconnection with Italy already exists (“Gazoduc”), currently being used to transport Algerian gas to Europe. However this interconnection may be used for imports in future. An electric interconnection with Italy with a 400 kV submarine cable is currently being considered. It may be used for import and export in the future: complementary daily and annual production and consumption profiles of North Africa and Europe can create synergies.

Furthermore, there is a strong need for institutional and budget reforms in the energy sector since the current situation drastically differs from the one 20 years ago. Some of its aspects such as subsidies have become a burden hindering a further development of the whole sector. In November 2014, the Industry Minister M. Ben Naceur called for a drastic reduction for the year 2015. Subsidies should decrease from 1.3 billion Euros (2.7 billion TND) to 0.9 billion Euros (1.96 billion TND) in order to use the saved money in investment projects[29]. In 2014, energy prices were raised by approximately 10% in total in order to reduce subsidies. By June 2014, electricity price subsidies for cement producers’ were completely phased out.

Forecasts from the ANME expected the consumption to double by 2030 without implementation of a comprehensive action, therefore energy efficiency should be further strengthened. Measures since 2000 have brought results: Tunisia has reduced its energy intensity by 20%[30].

[29] http://directinfo.webmanagercenter.com/2014/11/30/tunisie-une-augmentation-attendue-de-7-des-prix-de-lelectricite-et-du-gaz-en-2015/

[30] Brochure 30/30. Stratégie Nationale de maîtrise de l‘énergie. Objectifs, moyens et enjeux. GIZ, juin 2014.

Renewable energy & energy efficiency policies

Strategies and Objectives for Renewable Energies

Energy efficiency and renewable energies have been important topics in major publication over the last decade. The law No. 2004-72 on the rational use of energy defines wise use of energy as a national priority and as the most important element of a sustainable development policy. It states three principal goals: energy saving, renewable energy promotion and creation of new forms of energy, that favour costs’ reduction as well as the National economy and the environment.

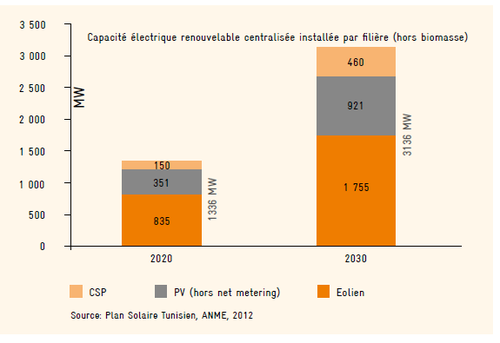

The Tunisian Solar Plan, a renewable energy development plan elaborated by the ANME but not officially adopted by parliament or government, foresees a 30% share of renewables in the electricity mix by 2030. This corresponds to an additional totally capacity of 3 GW and an overall investment of 4.75 billion euro.[33] Figure 3 shows the development goals by technology.

The Tunisian Solar Plan was updated in 2014, and a new update is planned for 2015.

The National Energy Conservation Action Plan[34] consists of three phases: (1) awareness raising, first concrete and grass-root actions were taken under two programs, (2000-2013) that contributed to an annual decrease of 2% in energy intensity; (2) continued implementation and voluntary investment via the mobilization of industry, construction and transport (audits, cogeneration, lighting, household appliances, buildings, transport); (3) implementation of large scale projects in order to reach the 30-30 goals ‒ 30% of electricity shall be produced by renewable sources by 2030 ‒ (2020-2030).

The Action Plan also foresees an independent regulator in the electricity market.

Legal Conditions and Support Schemes for Renewable Energies

For more info, see Analysis of the Regulatory Framework for Renewable Energy in Tunisia

Support schemes that promote the implementation of renewable energies and energy efficiency measures available in Tunisia are twofold: direct financial incentives and tax incentives. Capital subsidies and grants (allocated by the Energy Transition Fund FTE or the national utility STEG) are available. Support is also available for energy audits and implementation of energy efficiency measures. Tax incentives for energy conservation and renewable energy projects include customs tariff concessions for renewable energy and energy efficiency equipment, and VAT exemptions and concessions for locally manufactured products for energy efficiency or renewable energies[35]. However, regulatory conditions may change in 2015 since a new law on renewable energies is expected to be adopted by parliament before the summer 2015. It is meant to open the energy market to competition, including investors. This law entails three key aspects:

- A national Energy plan shall be designed within the next 5 years.

- 11 implementing rules shall be written within 6 months following the vote. They are mean to precise the following aspect of the law: procedures, creation and implementation of an independent regulator (structure and dutties).

The “feed-in tariffs” shall be determined by the Minister of Industry.

As of today electricity generation condition remain unchanged and are the following: STEG holds a monopoly in various areas of the electricity sector including transmission, distribution, marketing and the purchase and sale of electricity.

In terms of electricity generation, on the other hand, the regulatory and institutional framework governing electricity production has been opened up to the private sector. STEG no longer holds a monopoly in the strict sense of the term because the market is now open to:

1. Independent Power Producers (IPP)

Since it does not exclude any particular energy source, the IPP scheme (Law No. 96-27) can theoretically be transferred to renewable energies. In reality, however, only two (non-renewable) IPPs have been realized in Tunisia between 1996 (the adoption of the IPP scheme) and 2015[36]: Carthage Power Company (480 MW), Société d’El Bibane (SEEB, 27 MW).

2. Autoproduction/ Net Metering

This scheme is currently open only to producers whose principal activity is related to an existing industrial, agricultural or tertiary business. As such, it does not provide development opportunities for a third party developer with no link to the producer.

3. PROSOL Thermique

The PROSOL programme of 1995 realized 300 m2 solar water heaters (SWH) thanks to GEF (Global Environment Fund) funding. In 2004 the PROSOL programme was relaunched with the help of the Italian government and UNEP. It combines a tax incentive mechanism, an investment subsidy and a credit via STEG. The residential sector has seen very rapid growth in the installation of SWH installations (increasing from 12m²/10,000 inhabitants in 2004 to 40m²/10,000 inhabitants in 2010).[37]

4. PROSOL-ELEC[38]

PROSOL-ELEC is a promotion scheme for small-scale (1 or 2 kWp) photovoltaic installations inspired by the PROSOL programme.

PROSOL ELEC, which was launched in 2010, contributed to the installation of a total PV capacity of 6 MWp until 2014.[39]

[36] Cécile Cessac, Analyse du cadre réglementaire de l’accès au réseau des producteurs d’électricité à partir des énergies renouvelables en Tunisie.

[37] Ibid.

Key actors in the Energy Sector

Governmental Bodies and Agencies

DGE (Direction Générale de l’Energie, Directorate-General for Energy) is a sub-department of the Ministry of Industry, Energy and Mines. It is designed to conceive, coordinate and implement the national energy policy and to draft energy action plans and energy management programs.

STEG (Société Tunisienne de l’Electricité et du Gaz, Tunisian Company for Electricity and Gas) is the national energy producer, TSO and supplier. The STEG was created by law 62-8 in 1962[1].

ETAP (Entreprise Tunisienne des Activités Pétrolières, Tunisian Refining Industry Company). Created in 1972, this stated-owned company plans oil and gas explorations and manage this national gas and petroleum wealth[2].

ANME (Agence Nationale de la Maîtrise de l’Energie, National Agency for Energy Management). Created in 1985, this agency specialised in energy management supports the Industry Ministry along the energy transition[3].

AGIL (Société Nationale de Distribution des Pétroles, National Company of Oil Distribution) shares the oil distribution market with some private companies (s.a. Total, Shell, BP, etc.)[4].

Fond de Tranisition Energétique (Energy Transition Fund, FTE), until 2014 Fond National de Maîtrise de l’Energie (National Fund for Energy Management), created in 2005, it helps ANME to provide renewable projects with a financial support (among other subsidies)

STEG Energies Renouvelables, created in 2010, this is a branch of the Tunisian Company for Electricity and Gas fully devoted to renewable energies[5].

Utilities

STEG is the national utility, monopoly.

Others

Currently only two IPP generate electricity:

- Carthage Power Company (CPC): Radès II Power Station (natural gas fired plant, total capacity 480 MW) started operation in 2002 under the terms of a build own operate (BOO) agreement and by 2010 was responsible for 21% of national production.[6]

- Societe d’Electricite d’El Bibane (SEEB): Tunisia’s second IPP, two 13.5 MW gas turbines that went online in 2003.[7]

Energy Cooperation

Bilateral Energy Cooperation with Germany

See also: German-Tunisian Energy Partnership and DMS

Further Information

References

- ↑ Bureau des statistiques, Ministère de l’Industrie

- ↑ ANME Maîtrise de l'Energie en Tunisie - Chiffres Clés, p19

- ↑ Bureau des statistiques, Ministère de l‘Industrie

- ↑ http://www.iea.org/statistics/statisticssearch/report/?year=2012&country=TUNISIA&product=Balances

- ↑ http://www.iisd.org/gsi/sites/default/files/fossil-fuel-subsidies-renewable-energy-middle-east-north-african-countri%20%20%20.pdf

- ↑ Bureau des statistiques, Ministère de l‘Industrie

- ↑ Ibid.

- ↑ ANME, Maîtrise de l'Energie en Tunisie - Chiffres Clés, p18.

- ↑ http://www.leaders.com.tn/article/11353-la-tunisie-sera-t-elle-capable-d-arreter-l-hemorragie-des-subventions

- ↑ Présentation Déjeuner-Débat du 24 Mars 2014, Rafik Missaoui.

- ↑ Ibid.

- ↑ Ibid.